WTI Rebounds On Big Crude Draw, Continued Demand Rebound

Tyler Durden

Wed, 07/15/2020 – 10:38

Oil prices surged overnight after API reported a big surprise crude draw, but erased all those gains as OPEC+ pushed to taper its record output curbs.

Prices of “$41 on WTI and $44 on Brent are huge numbers,” said Ole Hansen, head of commodities strategy at Saxo Bank.

“We need the EIA to confirm API’s stock draw before an attempt can be made” at breaking those levels, he said.

So here we go…

API

-

Crude -8.322mm (-2.1mm exp)

-

Cushing +548k

-

Gasoline -3.611mm (-2.0mm exp)

-

Distillates +3.03mm (+1.1mm exp)

DOE

-

Crude -7.493mm (-2.1mm exp)

-

Cushing +949k

-

Gasoline -3.147mm (-2.0mm exp)

-

Distillates -453k (+1.1mm exp)

After the prior week’s surprise crude build, expectations for last week were for a modest crude draw (which API crushed with the biggest draw since December) but the official data showed a notable crude draw and a surprise Distillates draw…

Source: Bloomberg

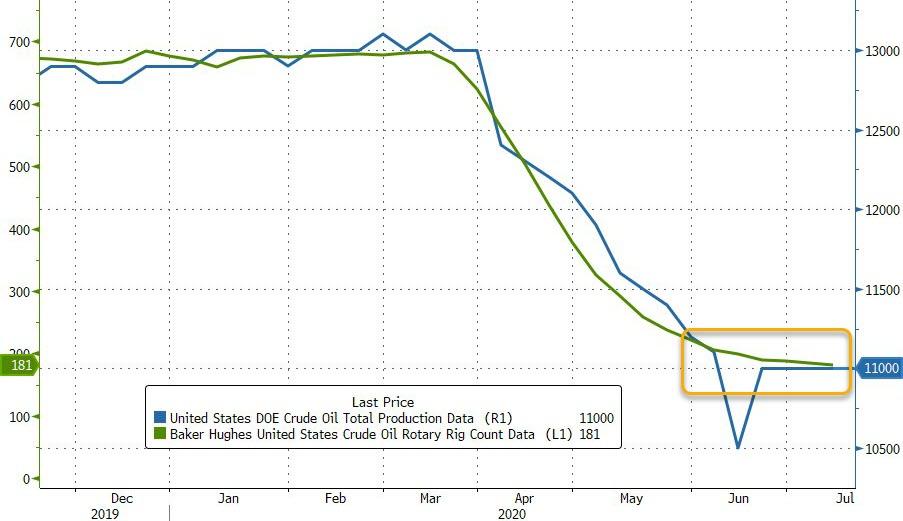

Crude oil production in the Lower 48 fell by ~100k b/d. That was partially offset by an increase in Alaska. Overall the number is still stuck at 11 million barrels a day…

Source: Bloomberg

Demand continues to be the even bigger question (with the caveat that the latest week is likely to drop versus the July 4th weekend’s seasonal demand spike). But the smoothed 4-week average shows continued demand rebound…

Source: Bloomberg

Crude imports fell a whopping 25% last week, the biggest weekly drop since 2016.

WTI was hovering back just above $40 (at pre-API) levels ahead of the EIA data, in the middle of its recent range…

But as the official inventory data hit WTI prices spiked…

Will this be the breakout? Even with OPEC+ tapering its production cuts?

via ZeroHedge News https://ift.tt/2Zy4Jz7 Tyler Durden