Executives Of Bankrupt Companies Made $131 Million In Bonuses This Year

Tyler Durden

Sun, 07/19/2020 – 09:55

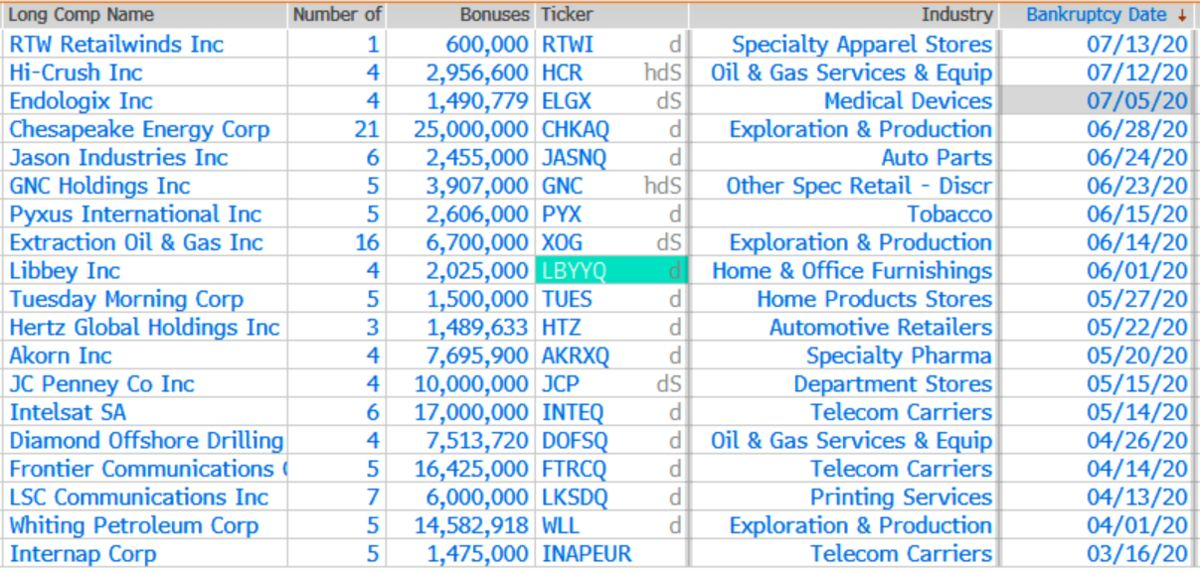

While a wave of bankruptcies continues to wash over the country as a result of the pandemic (and just poorly run businesses), that hasn’t stopped the executives of some of the biggest trainwrecks in recent business history from collecting fat bonus checks, despite driving their respective companies into the ground. Among the higher profile names are companies like J.C. Penney, Chesapeake Energy and Hertz, who have all filed for bankruptcy protection this year.

They have also all awarded their executives significant bonuses totaling $10 million, $25 million and $1.5 million respectively in the weeks – or sometimes days – leading up to their bankruptcies. And they’re not the only ones.

Out of the 100 companies that have filed for bankruptcy since the Covid lockdowns began, Bloomberg estimates that 19 of these companies have committed to paying a total of $131 million in retention and performance bonuses.

The companies claim the bonuses are to keep their management teams in order to lead their turnarounds. Yes, the very same management teams that led the companies to bankruptcy to begin with. And the bonuses are tough to claw back unless they are made after a company officially files for protection with the court.

At a place like J.C. Penney, where thousands will lose their job, the company’s CEO stands to make $4.5 million in bonuses. Hertz doled out $1.5 million to its top three executives as part of $16.2 million in retention bonuses three days before it filed for bankruptcy.

Frontier Communications issued bonuses in February, before filing for bankruptcy in April. Chesapeake said in May it intended to pay $25 million in bonuses to 21 executives while requiring others to take salary cuts. The CEO of Intelsat, who led the company to its bankruptcy and has been in charge since 2015, is lined up for a $6.9 million bonus.

Ian Keas, a principal at Pearl Meyer, an executive-compensation consulting firm, said:

“Board members want the people that know the business, know the assets of the company, know the nuances and facets of the business, and can leverage that understanding and knowledge to extract value going forward.”

Julie Farb, director of the Center for Strategic Research at AFL-CIO, a federation of 55 labor unions, had a slightly different take on the bonuses:

“We really find them offensive in light of the median worker pay, the reductions in benefits and layoffs due to store closings. It’s all made worse in the current Covid environment.”

In addition to the amount of the bonuses, the timing is also making them tough to swallow. Right now, tens of millions of Americans are unemployed while others risk their lives on a daily basis to help deal with the pandemic by going to work on a daily basis.

Nell Minow, vice chair of ValueEdge Advisors, a shareholder-advisory firm said:

“They’re going to say they’re doing it for stability and consistency. But when a company is heading toward bankruptcy, maybe stability and consistency should not be your priorities. Maybe it should be rethinking the company’s strategy.”

Creditors may have some recourse by filing an adversary claim to challenge these pre-bankruptcy bonuses. But fighting them can be costly, time consuming and difficult to win.

Peter Carr, a spokesperson for the U.S. Trustee, said:

“The only remedy is a claw-back. The U.S. Trustee program can’t seek that remedy, so we object to any debtor motions that would prevent the unsecured creditors’ committee from pursuing this remedy.”

We won’t hold our breath.

via ZeroHedge News https://ift.tt/3jmQapJ Tyler Durden