What’s Behind The Worst Kept Market Secret Of The Past Three Months: JPMorgan Explains

Tyler Durden

Sun, 07/19/2020 – 16:25

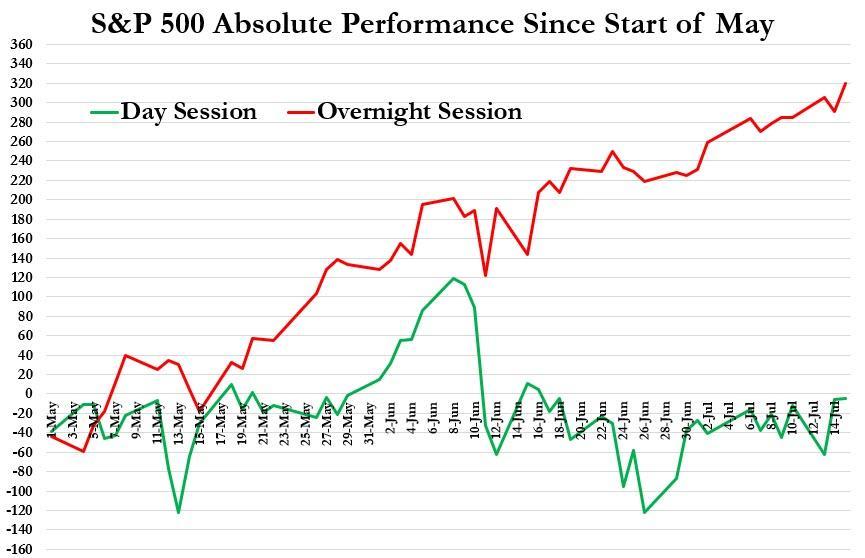

Over the past three months we have obsessed over a fascinating market timing phenomenon, one which during the last 10 weeks amounted to a “risk-free” trade: S&P500 returns during the day session have been flat as a pancake since the start of May, while over the same time period, gains during the overnight session have been a diagonal line, accounting for all of the market’s upside since May 1, a whopping 314 S&P points.

Indeed, this dramatic divergence between performance during the day and overnight sessions had become the market’s worst kept secret.

To be sure, the outperformance of the overnight session is hardly new – we first pointed this out back in 2015 in “Forget The 3:30pm Ramp, Stock Gains Are All About The Night Shift” – however, as the chart above shows, rarely has the divergence been as clear as it has been since the start of May.

And having pounded the table on this divergence repeatedly over the past few months, it appears that quite a few institutional accounts have figured out that buying the cash close, and selling the cash open is all one needs to generate a roughly 40% annualized return, while ignoring all that other anachronistic investing trivia such as news, data and fundamentals.

In fact, it has gotten to the point where none other than one of the Wall Street’s most respected quants was compelled to chime in on this divergence after what we showed on Friday was “The Craziest Chart You’ll See Today“, and in a note on Friday afternoon, the author of JPMorgan’s Flows and Liquidity report, Nikolaos Panigirtzoglou, addressed the “difference in performance between regular vs. extended trading”, months after we first brought attention to it.

While confirming that there is a clear upside bias to the overnight session, Panigirtzoglou explains it as follows: “the arrival of important news after US hours and during European trading hours, including both US and non-US economic data as well as better virus-related news in Asia and Europe, have been important in understanding the divergence in performance between regular and extended trading hours.” Which of course is far more politically correct than saying central banks and their various proxies only buy at night when most investors are sleeping.

In any case, here are JPM’s observations:

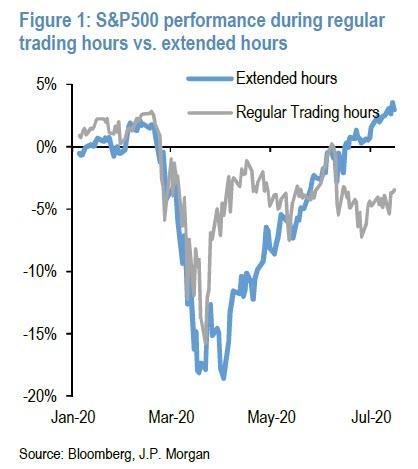

One of the characteristics of the US equity rally over the past four months has been the divergence between the erformance during regular market trading hours i.e. 09:30 to 16:00 EST vs. the performance during extended hours i.e. after-hours and pre-market trading. This divergence is shown in Figure 1. While up until the end of March, there was little divergence, since April all of the S&P500 up move appears to have happened during extended market hours, while regular trading hours have on average acted as a small drag.

As Panigirtzoglou then notes, that this divergence since April “is raising questions about whether non-US investors, perhaps trading more actively during Asian or European hours, have been mostly responsible for the S&P500 rally since April” although the JPM quant doubts this hypothesis for two main reasons:

- First, US investors can be active during US extended market hours also, e.g. via trading futures.

- Second, JPM believes that the arrival of news has been more important during after US hours or during European regular trading hours. This is not only because important economic data such as Chinese and European PMIs or the US payroll report and US retail sales are released during extended US hours, but also because virus news emanating from Asia and Europe, regions that have been ahead of the US on the virus curve, have been important market drivers in recent months. In addition, important US news about vaccines or therapeutics in recent months or US company earnings reports were released after US hours.

We find it amusing that JPM admits that US stock markets no longer respond to news flow during regular hours, which confirms what both BofA and another JPM strategist, Oksana Aronov, told Bloomberg namely that “Central Banks Have Created A Collective Hallucination Where Valuations Are Entirely Fabricated“, a world in which neither newsflow, nor fundamental data, nor frankly anything else, matters any more. Which however is bizarre since US stocks have not really moved higher for the past 3 months during the US day session, which in turn can be explained by the relentless selling of stocks by baby boomers to central banks and/or or their own Millennial and Gen Z kids.

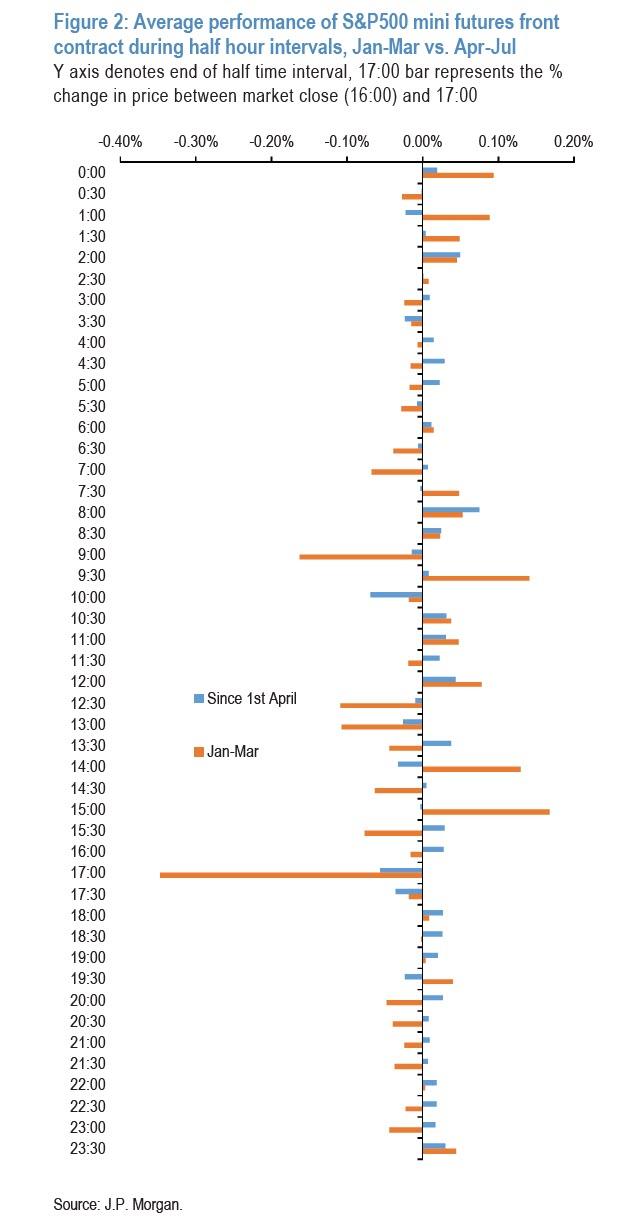

But we digress, so here is the rest of JPM’s analysis, which dissects US equity performance further in half-hour intervals JPM uses tick data on the S&P500 mini futures contract.

Figure 2 depicts this performance dissection for January-March vs. April-July periods. What is striking is how much less of a drag on US equity market performance was during April-July (vs. the January-March period) after hours trading, between 16:00-17:00 EST (just after NY close) and for all half-hour intervals between 19:30-23:00 EST.

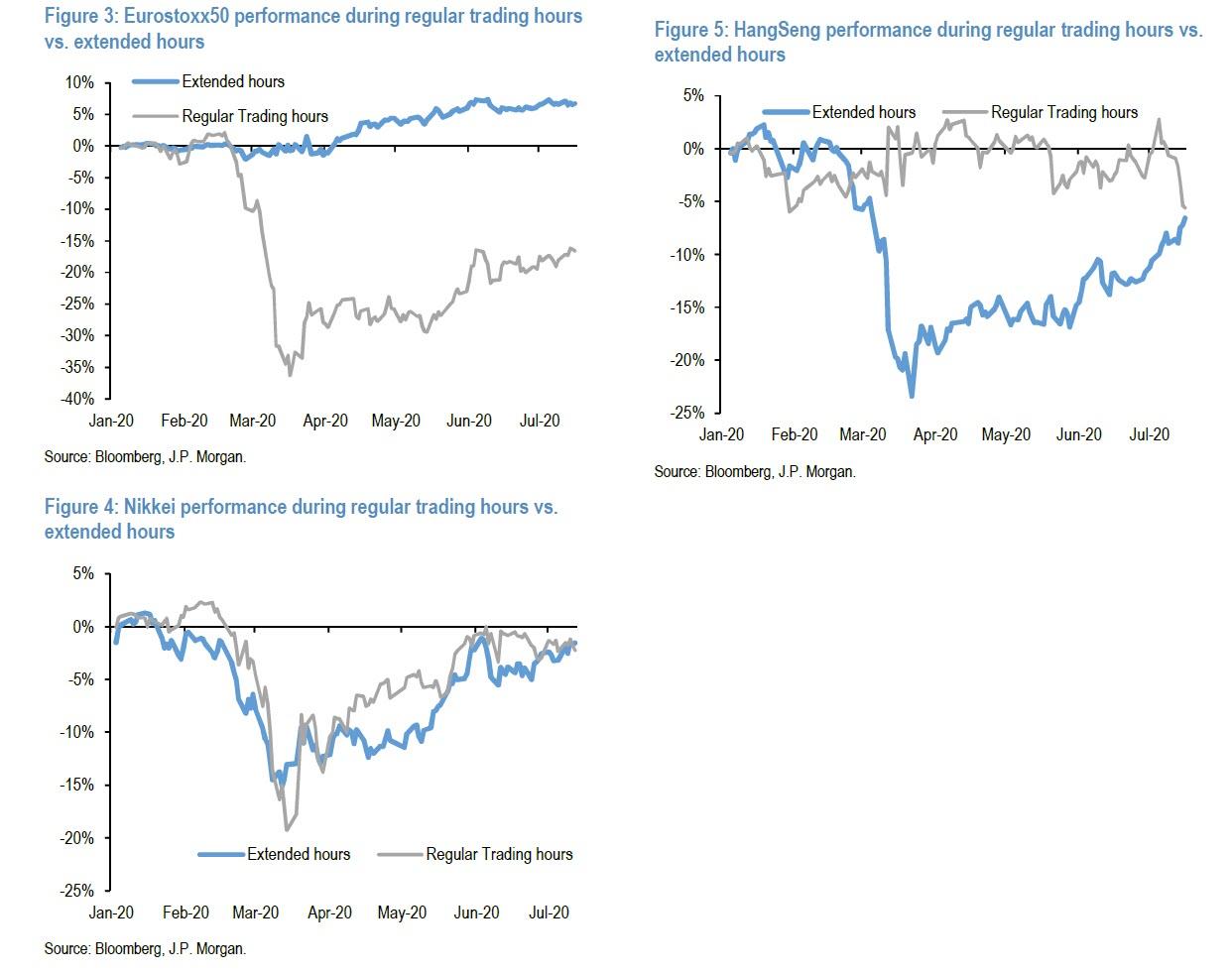

What does the picture for regular vs. extended hours trading performance look like for Asian and European indices? Figure 3 to Figure 5 shows the equivalent of Figure 1 for Eurostoxx50, Nikkei and Hang Seng indices as analyzed by JPM. Figure 3 suggests that, for the Eurostoxx50 index, extended hours had a modest impact on performance and most of the market moves after or before April took place during regular European trading hours. The opposite is true for the Hang Seng index where most of the market moves after or before April took place during extended Chinese trading hours. The picture is more balanced for Nikkei, where average performance was similar during either regular or extended Japanese trading hours.

Looking at the above, JPM finds that charts 3 to 5 suggest “the most important news or flows likely took place during European regular trading hours,“ while “Figure 1 and Figure 2 together suggest that the big drag to US equity market performance seen after US hours trading in the first quarter of the year, dissipated in the second quarter.”

In addition, JPM also notes that it has become easier for the average investor to trade outside of regular hours. In the past, after-hours trading was more for institutional investors. Today, the proliferation of ECNs and other trading facilities has made it easier for individuals to trade in extended-hours sessions. This has likely facilitated the incorporation of information arriving outside of regular market hours into prices.

So what does the above data mean? Well, as JPM’s Panigirtzoglou concludes, the divergence in performance between regular and extended trading hours can be explained by “the arrival of important news after US hours and during European trading hours, including both US and non-US economic data as well as better virus-related news in Asia and Europe.”

Frankly, in a world in which even other JPM strategists admit that neither news nor data matters any more – and only central banks do – we find this explanation to be self-serving BS (after all, the last thing we want is for JPM to analyze the root causes of the massive intervention by the Fed which starting last September was to bail out none other than JPMorgan itself), but whatever is the true reason for the ongoing overnight surge in the Emini, whether it is “important news and better virus news” when US markets are closed as JPM claims, or simply because that’s when central banks are most active in propping up markets, it doesn’t matter: as long as the divergence persists, and allows those who have noticed the “worst kept secret in the market” to literally keep printing money by buying the US close and selling the open, everyone remains happy.

via ZeroHedge News https://ift.tt/2CMSpC0 Tyler Durden