Class 8 Orders 'Dead Cat Bounce' 2 Months After Hitting Their Lowest Level In 25 Years

Tyler Durden

Mon, 07/20/2020 – 04:15

Class 8 trucking orders – often seen as a gauge of how the U.S. production economy is faring, have been brutalized for almost all of 2020 so far due to the ongoing pandemic. But June’s data appears to suggest a slight respite in orders, despite crashing retail sales, even though we’re not quite certain that it’s going to carry into the second half of the year.

Regardless, June is traditionally a tough month for Class 8 orders and the industry (and its analysts) are optimistic.

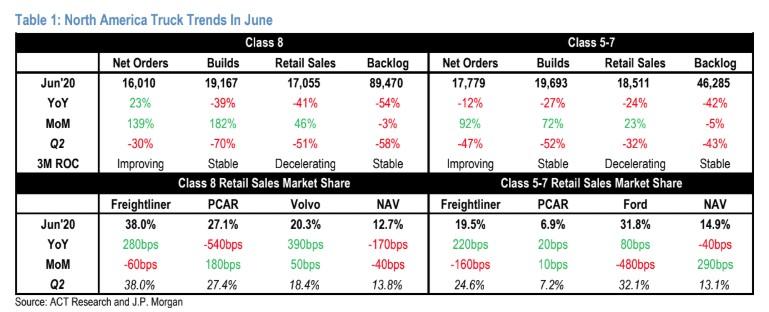

Final Class 8 truck data for June has been released and retail sales were down 41% YoY to 17,055 units. Orders were up 23.2% for the month, marking a small bounce back for the industry.

This comes after two incredible poor months that we highlighted (ZH Class 8 report April, ZH Class 8 report May) where orders hit their lowest level in 25 years. In May, new orders “recovered” slightly to a dismal 6,687 number before taking off this June.

Regardless, Class 8 orders remain down 24.7% YTD, mostly as a result of a continued lagging economy and pressured supply chain due to the coronavirus pandemic. In the first half of 2020, 65,814 trucks were ordered, compared with 87,466 in the first half of 2019.

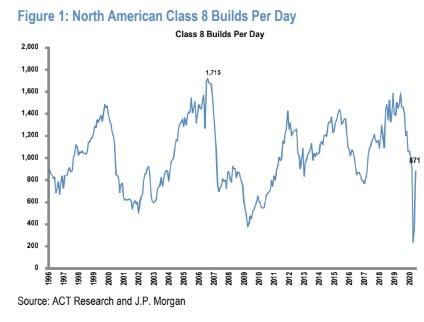

Retail sales are also lagging YTD, still down 39%, according to data from JP Morgan. Builds have appears to make somewhat of a V-shape recovery, but were down 39% YoY in June and have fallen 70% in Q2. Builds remain down 52% year to date.

But that hasn’t stopped the industry’s perpetually bullish analysts, who weigh in on the numbers every month and – somehow – can find the positive in almost the most dismal of reports.

Don Ake, FTR’s vice president of Commercial Vehicles said: “The Class 8 market is on the slow, steady recovery that matches our forecast. It is also encouraging that fleets are showing enough confidence in the economy to begin placing some viable orders. The trend should continue, but a significant increase is not expected until October when the big fleets begin placing orders for 2021 delivery.”

He continued: “June’s order activity is good news, after last month’s disappointing number. We expected orders to average around 10,000 units for a few months. Now they have averaged 11,000 for the past two months.”

Kenny Vieth, ACT president and senior analyst commented: “North American Class 8 net orders were up against an easy year-ago comparison, when orders were under pressure from still large backlogs and rising equipment overcapacity.”

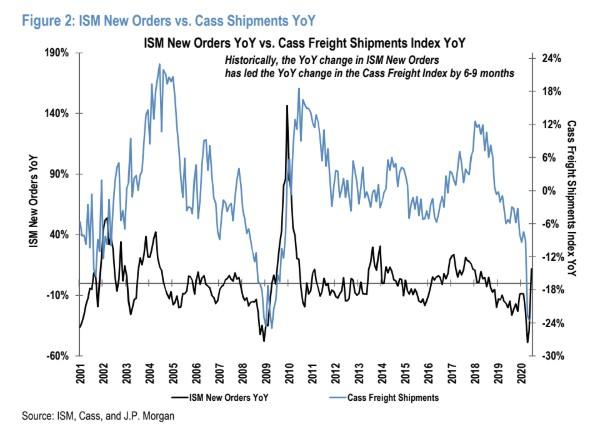

ISM New Orders Index posted its strongest jump on record (up 24.6pts MoM) to 56.4 in June, up 11.7% YoY to its highest level since January 2019, JP Morgan noted.

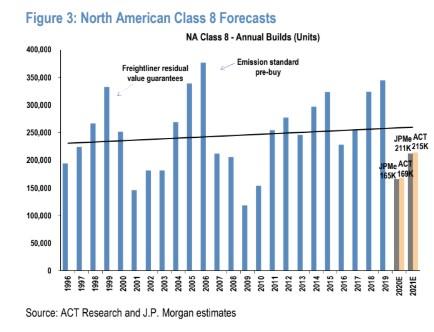

JP Morgan is still, however, forecasting Class 8 builds of ~165,000 (down 52%) for the year.

via ZeroHedge News https://ift.tt/30tzrIL Tyler Durden