IBM Revenues Tumble Most In 5 Years But Beat Of Sharply Lower Expectations Sends Stock Surging

Tyler Durden

Mon, 07/20/2020 – 16:34

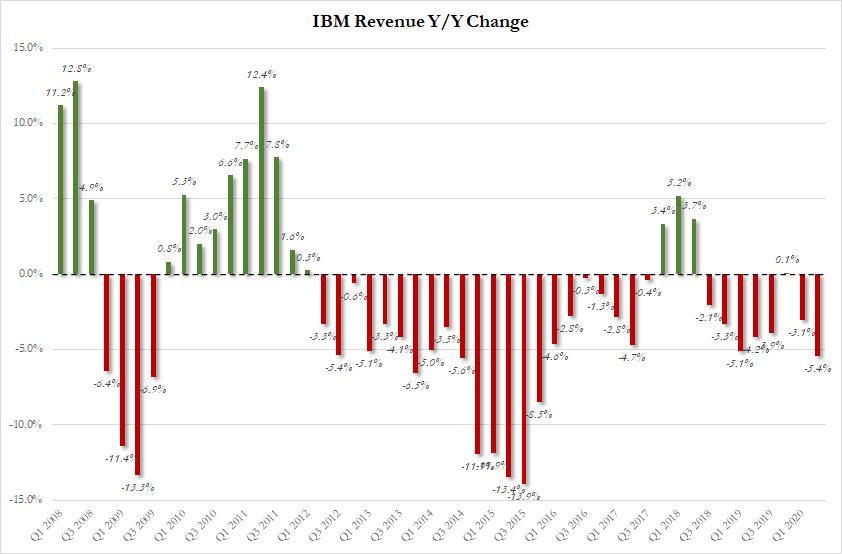

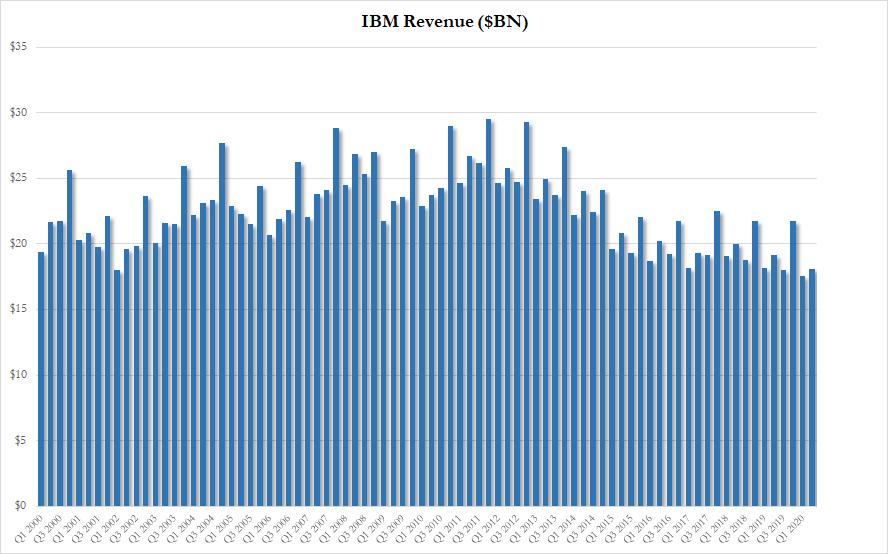

There was some hope last year that IBM was finally turning things around: after all, after 5 consecutive quarters of declining revenues, the company had just managed to grow its top-line for the first time since Q2 2018, and only for the 4th time in the past 8 years. Alas it was not meant to be, and moments ago IBM revealed that after sinking in Q1, revenue once again declined in the first quarter, sliding another 5.4% – the biggest annual drop in sales since Q4 2015 – amid the spread of COVID-19, even as Red Hat sales boosted its cloud business up 30% Y/Y to $6.3BN.

That said, there was a silver lining: after the company reported the lowest revenue in the 21st century last quarter at $17.6BN, in Q2 IBM managed a modest sequential rebound, with revenue rising to 18.1$BN, even as Wall Street was expecting another 20 year low in the top-line.

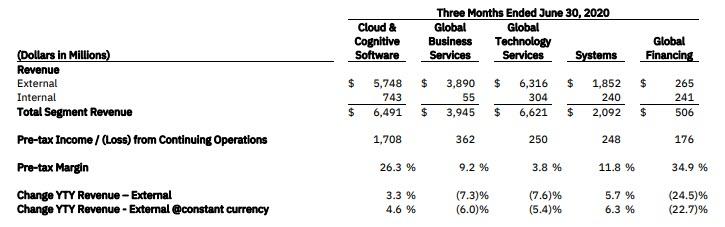

Some more Q2 revenue details, which beat across every single product group:

- Cloud and cognitive software revenue $5.75 billion, better than the estimate of $5.58 billion

- Global business services revenue $3.89 billion, better than the estimate of $3.74 billion

- Global technology services revenue $6.32 billion, -7.6% y/y, also better than the estimate of $6.17 billion

- Systems revenue $1.85 billion, +5.6% y/y, estimate $1.65 billion

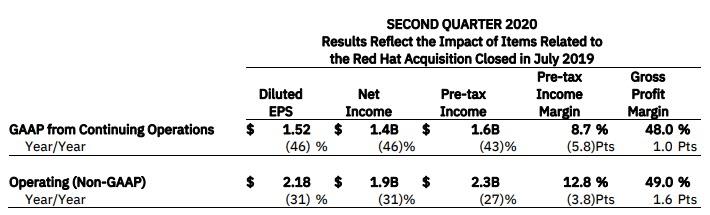

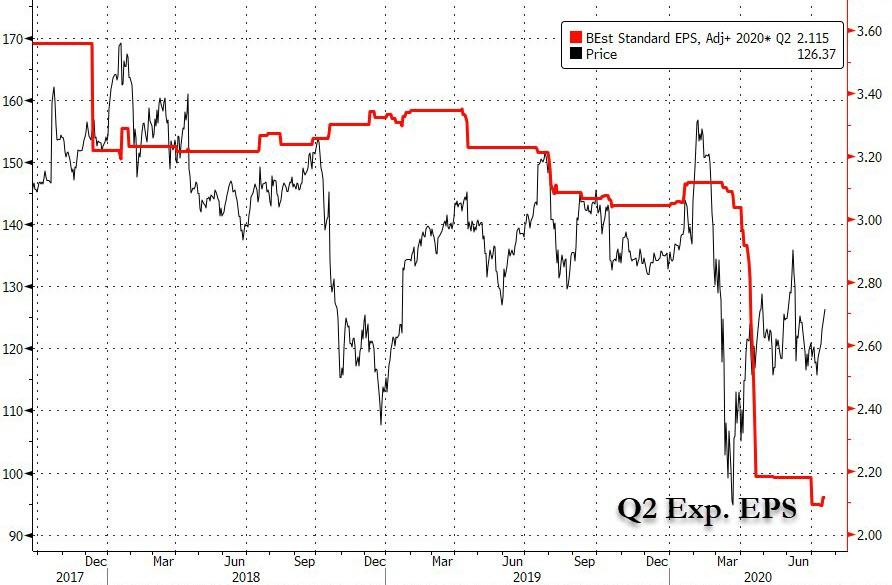

Not only did the long-suffering tech giant report stronger than expected revenues, its also posted EPS that came in at a whopping $2.18, far above the $2.07 expected… which was a 31% drop Y/Y.

Also here is the “beat” in question:

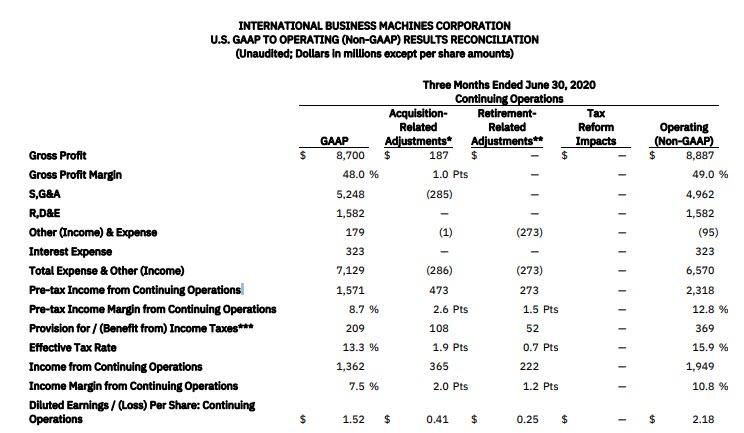

As usual, this EPS number was the product of aggressive accounting magic because the unadjusted EPS was $1.52, or 30% below the adjusted number. The GAAP to non-GAAP bridge was, as usual, ridiculous and a continuation of an “one-time, non-recurring” addback trend that started so many years ago we can’t even remember when, but one thing is certain: none of IBM’s multiple-time, recurring charges are either one-time, or non-recurring.

“Our clients see the value of IBM’s hybrid cloud platform, based on open technologies, at a time of unprecedented business disruption,” said Arvind Krishna, IBM chief executive officer. “We are committed to building, with a growing ecosystem of partners, an enduring hybrid cloud platform that will serve as a powerful catalyst for innovation for our clients and the world.”

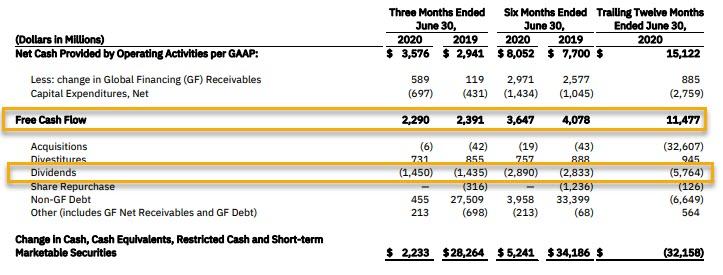

Just like last quarter, IBM did not have enough visibility into the future to give any guidance, yet it was confident enough that no matter what happens it will keep handing almost every penny it makes to its shareholders, as was the case in Q2, when IBM’s free cash flow was $2.3 billion, and the company returned $1.5 billion to shareholders in dividends.

“Our prudent financial management in these turbulent times enabled us to expand our gross profit margin, generate strong free cash flow and improve our liquidity position,” said James Kavanaugh, IBM senior vice president and chief financial officer. “We have the financial flexibility to continue to invest in our business and return value to our shareholders through our dividend policy.”

And speaking of cash flow, IBM ended the second quarter with $14.3 billion of cash on hand which includes marketable securities, up $5.2 billion from year-end 2019. Debt, including Global Financing debt of $21.9 billion, totaled $64.7 billion.

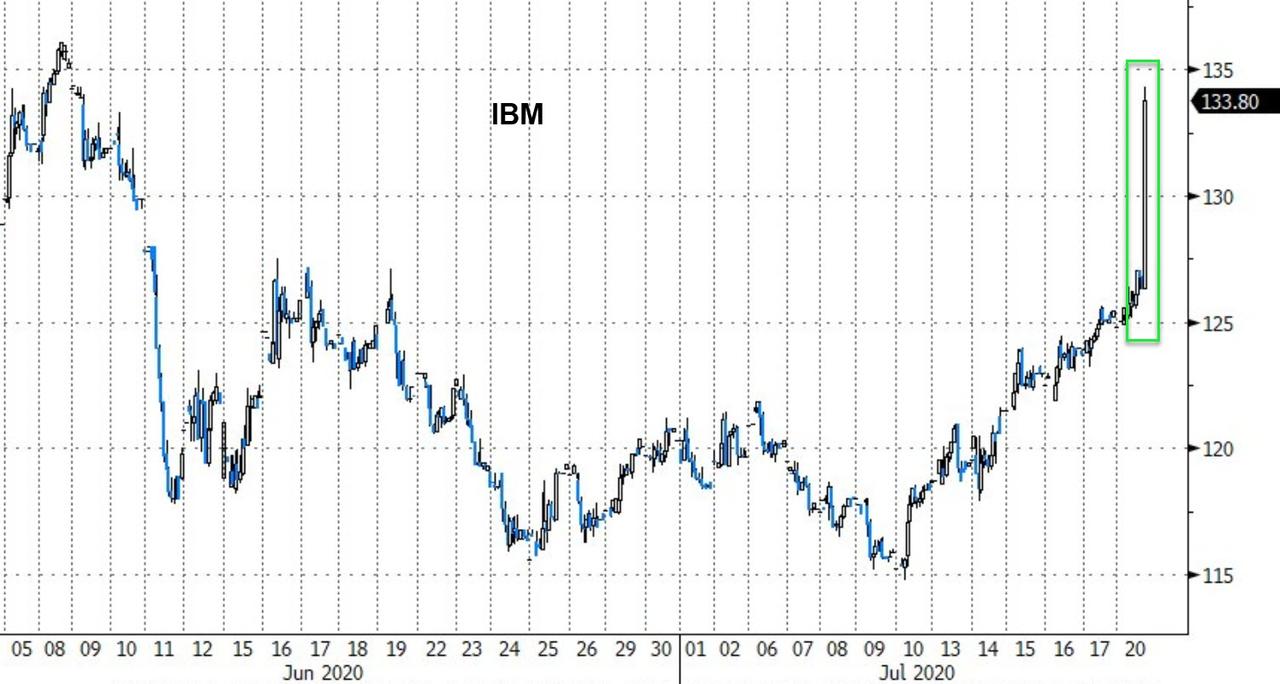

So while IBM’s core business remains a melting ice cube, a strong quarter from Cloud which helped the company’s revenues beat expectations, was enough to push long-suffering IBM stock some 5% higher after hours, although if prior quarter are an indication most of this gain will be gone by tomorrow morning.

via ZeroHedge News https://ift.tt/2WBqL1J Tyler Durden