New York Democrats Want To Tax Stock Trades As State Revenues Plummet

Tyler Durden

Mon, 07/20/2020 – 15:12

New York Democrats seem hell bent on driving as many people out of the state as possible. Not only has Mayor Bill de Blasio essentially turned New York City into a demilitarized zone by pulling back on policing, but there are now talk about resurrecting the state’s tax on stock trades. It’s no wonder thousands of hedge fund managers are leaving the city for far more hospitable places like Florida.

Legislators could be prompted to make changes as the state loses approximately 20% of its revenue, which would leave a $61 billion deficit over four years according to Bloomberg. Progressive democrats “are on the ascent” in the state’s legislature while, at the same time, stock trading in the state is on the rise. As a result, the progressives smell blood, as taxing these trades could raise $13 billion per year and stop cuts to numerous government services.

Andrew Silverman, a Bloomberg Intelligence analyst said: “If ever there was an opportune moment for New York to resurrect its stock transfer tax, it’s now. The state legislature is probably more amenable now than at any time in decades.” The stock transfer tax could drive revenue from outside of the state, as well, as it taxes trades that occur in New York, even if the person directing the trade is out of state.

About 100 members of the 213 members of the New York legislature signed a letter last month suggesting that the state consider raising taxes on the rich before it cuts spending. Democrats have also proposed raising taxes on billionaires and large corporations. There is currently a 100% rebate on the tax that has been in place since 1981 when the New York Stock Exchange threatened to leave New York.

We’re not sure why politicians think that couldn’t happen again. After all, they are asking for it.

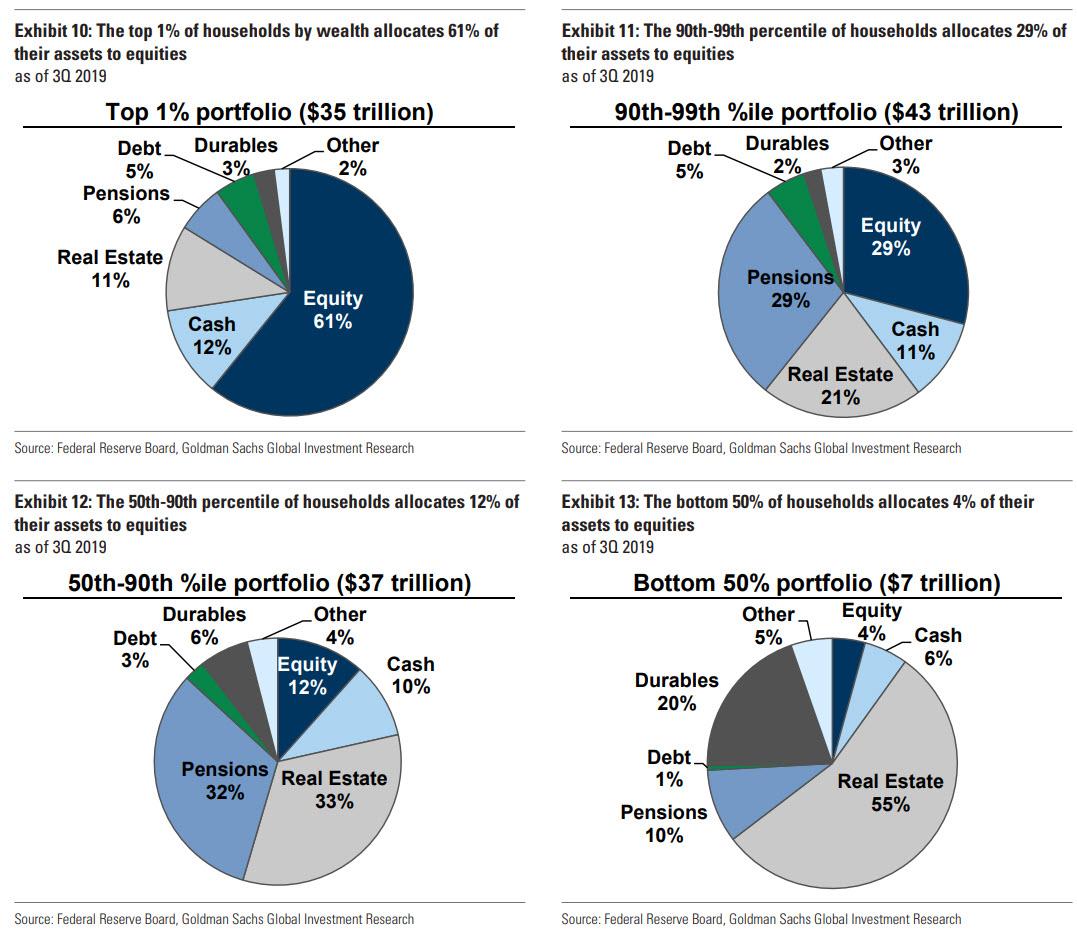

The left’s argument for the tax is that in 2016, the wealthiest 10% of Americans owned 84% of stocks. The author of the study that determined this, Edward Wolff, said: “Every single significant exchange in the world has a financial transaction tax save one, which is Germany, and they’ve proposed it there. Is the London Stock Exchange out of business? Have they moved to Dublin?”

The proposed bill is arguing for a 1.25 cent tax on the sale of stock worth $5 or less and a tax of up to 5 cents for stock worth over $20 per share. The revenue would go to New York’s general fund for three years and then would go to infrastructure and the MTA.

The tax would (obviously) find heavy opposition from banks and Wall Street firms. Wall Street is already responsible for 17% of the state’s tax revenue and 181,200 jobs.

The risk of unintended consequences is not daunting Democrats: Freeman Klopott, a spokesman for Democratic Governor Andrew Cuomo’s budget office, concluded: “In the digital age it would be even easier for transactions to simply be moved out of state to avoid the tax.”

What the democrats don’t seem to understand is that much of this legacy tax revenue – and the jobs that create it – could be at risk as they continue to push businesses out of the state with additional taxes. And what’s the point of a new tax when it is offset by a mass exodus of the the states’ biggest taxpayers, resulting in a far more dire fiscal outcome?

via ZeroHedge News https://ift.tt/3hi9BOM Tyler Durden