20Y Treasury Prices At Record Low Yield Amid Relentless Demand For Duration

Tyler Durden

Wed, 07/22/2020 – 13:14

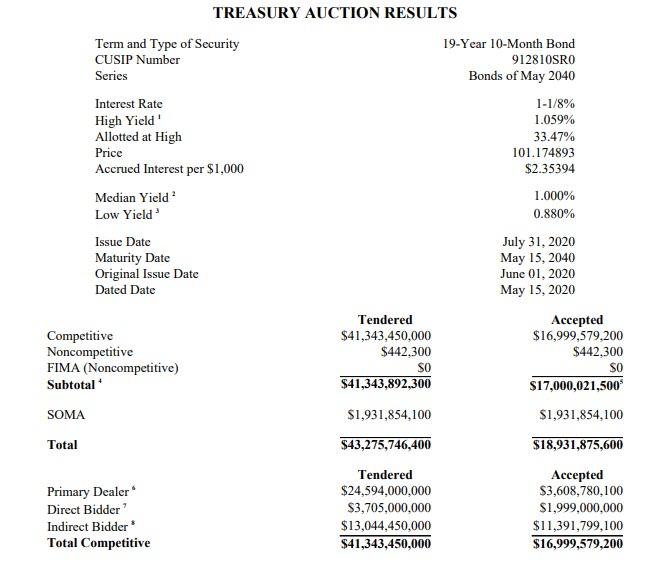

Two months after the first 20Y auction in 34 years priced at a yield of 1.22% amid surprisingly strong demand, moments ago the Treasury sold its third batch of the recently restarted 20Y Treasury in the form of a $17 billion reopening (19-years-10-months) of the original Cusip (SR0), which priced at a high yield of 1.059%, far below last month’s 1.314%, yet tailing modestly to the 1.050% When Issued.

The auction metrics are as follows:

- Bid to Cover: 2.43x compared to 2.63x last month and below the 2.53x in the inaugural, May auction.

- Indirects: 67.0%, well above both June’s 61.6% and May’s 60.7%

- Directs: 11.8%, a bit drop from the 16.5% in June, and also below May’s 14.7%

- Dealers: 21.2%, almost unchanged from last month’s 21.9%.

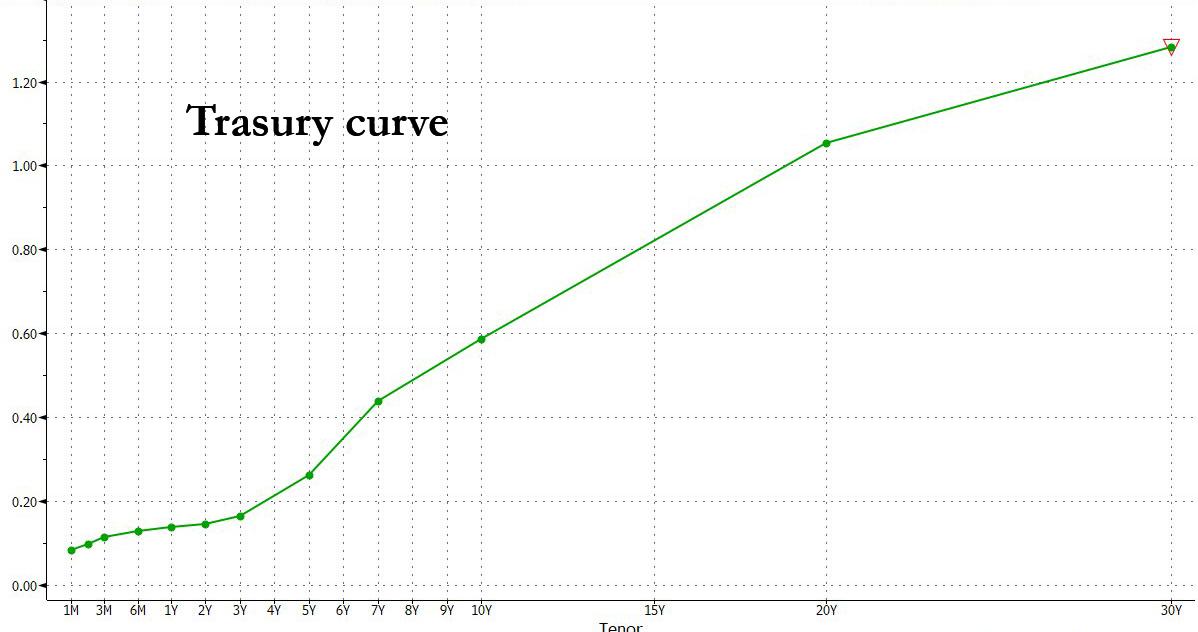

One possible reason for the modest tail is that the curve has been rallying, with 10Y trading below 0.59%, just shy of all time lows, thus providing little opportunity for concession.

Of course, since there is just one auction in recent history to compare today’s auction to, superficially the auction was quite strong, although one look at the curve shows that the 20Y is somewhat “kinky” on the curve.

via ZeroHedge News https://ift.tt/39hjObx Tyler Durden