Gordon Johnson: 90% Chance Tesla Reports Q2 Profit, Helped By Regulatory Credits, Warranty Expense Reversals. & Deferred Revenue

Tyler Durden

Wed, 07/22/2020 – 08:05

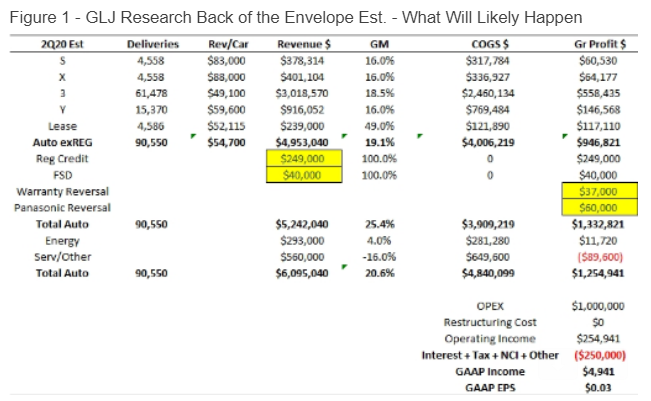

With S&P inclusion hinging on Tesla reporting a profit in Q2, analyst Gordon Johnson thinks that Tesla is likely to report a profit when it delivers earnings after the bell on Wednesday. The company will have several levers to pull in order to do so, Johnson says, laying them out in his latest report.

In a note published this week, Johnson predicts GAAP net income coming in at -$5.059mn, or a loss of -$0.03/shr. He bases his contention that the company will report a profit on several “levers” the company has to pull. First, he says Tesla will be recognizing deferred revenue from full-self driving (which we again remind readers, does not exist):

In short, as detailed in Ex. 1 below, our analysis is based primarily on the following assumptions: (1) on the 3Q19 call, TSLA’s CFO said the roll out of smart summon allowed them to recognize $30mn in deferred revenue; so that seems to be a good proxy for how much full-self-drive (“FSD”) revenue TSLA will recognize per the new feature rolled out in 2Q20 (i.e., red light recognition) – they had ~$600mn of FSD revenue as of 3/31/20, and have said a large chunk will be recognized when they reach full FSD, which they have not yet done.

Johnson also assumes that the company’s amended contract with Panasonic will allow the company to push unit costs lower, which will result in “an additional roughly 100bps in gross margin benefit”.

Regulatory credit sales will also play a key role in helping the automaker turn a profit, the note reads. Johnson says that “due to less cars sold in the EU in 2Q20, we assumed TSLA’s one-time (100% gross margin) regulatory credit sales are $249mn vs. $354mn last quarter”.

Finally, he thinks that Tesla will continue to game its warranty expenses:

Despite an increased incidence of product failure issues, we assume TSLA further, deceptively, reverses its warranty expense by $37mn (this is also a 100% margin “expense reversal”). Thus, with OPEX of ~$1bn, this gets one to -$0.03/shr in 2Q20 EPS. However, given how close this is to break-even, exacerbated by all the inorganic levers TSLA has in which it can pull, we see the probability of a 2Q20 profit/loss at 90:10.

Johnson raises the question at the end of his note whether or not the sell side consensus could be intentionally sandbagging Tesla’s forward estimates in order to create the “illusion” of perpetual outperformance.

Putting aside the fact that Wall Street has been known to do this across all sectors for as long as we can remember, Johnson makes a good point in saying that:

The current 2Q20 Consensus est. for TSLA’s 2Q20 earnings is -$1.20/shr. So what’s the big deal? Well, we see this as a demonstrably low low number given were this to prove accurate, TSLA’s near-term inclusion into the S&P 500 would disappear, and likely send the shares tumbling lower. Consequently, we see the lion’s share of sell-side analysts as intentionally sand-bagging forward ests. for TSLA.

In a matter of hours, we’ll know more…

via ZeroHedge News https://ift.tt/2WMComH Tyler Durden