Fed Releases POMO Schedule For Next Two Weeks: Will Buy $9BN In Treasuries And MBS Daily

Tyler Durden

Mon, 07/27/2020 – 15:46

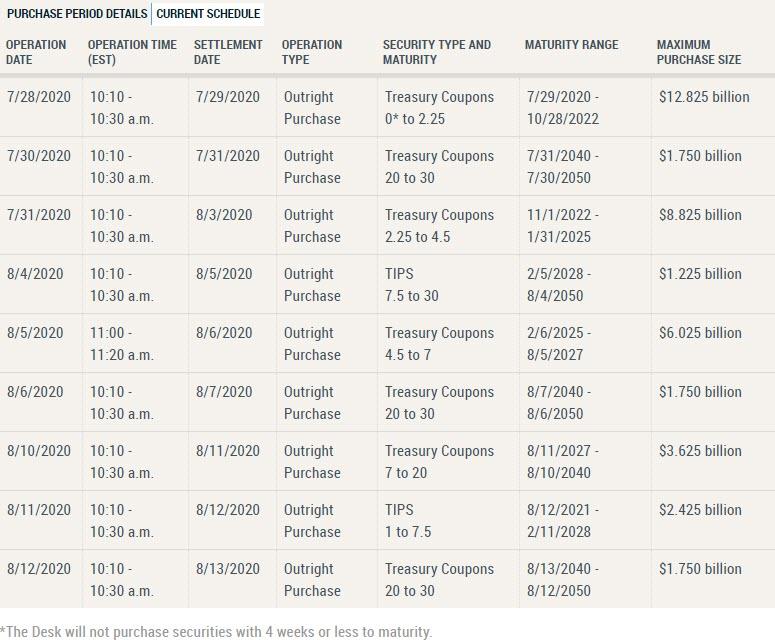

Now that the Fed’s release of POMO is more of a periodic affair than every Friday, moments ago the NY Fed published its latest POMO schedule for both Treasurys and MBS for the next two weeks, covering the period July 28 – August 12.

In line with the recent Fed disclosure that the central bank will purchase about $80 billion in Treasurys monthly, the latest schedule shows an average daily purchase of about $4.5 billion, or $40.2 billion spread over 9 days, identical to the previous two week POMO schedule. For MBS the average daily is nearly identical, at fractionally higher, at $4.7 billion daily, or $51BN spread over 11 days. In total, the Fed will continue to purchase roughly $9 billion in Treasurys and MBS almost every day for the next two weeks.

Here is the latest summary of Treasury POMOS. Of note: the biggest POMO will take place tomorrow and Friday, July 28 and 31, when the Fed will monetize $12.825BN and $8.825BN worth of US debt.

The Agency MBS can be found at the following link.

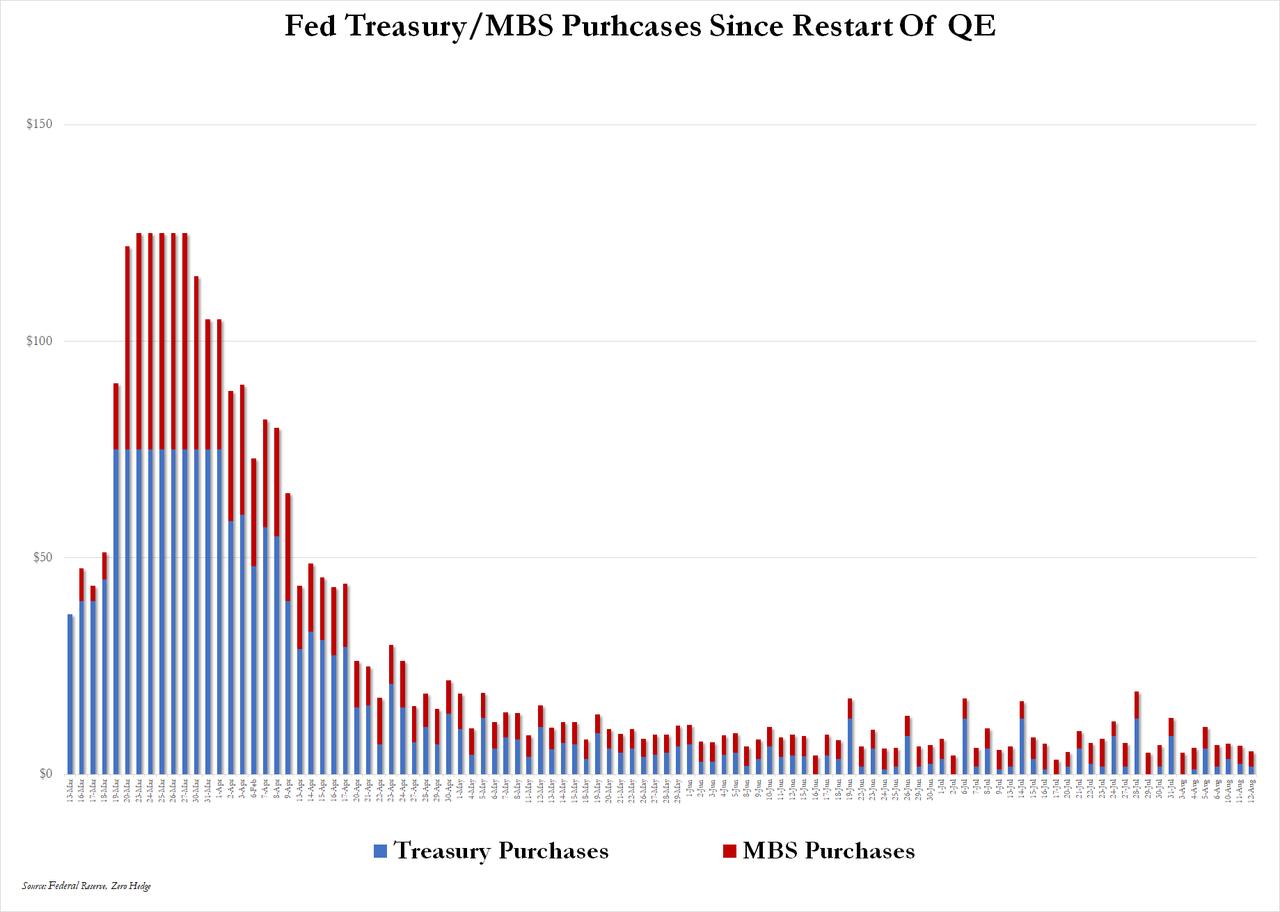

The visual summary of all TSY/MBS POMO since the start of QE Unlimited on March 13 is shown below. Since then, a total of $2.9 trillion in TSY and MBS have been purchased by the Fed in the open market.

via ZeroHedge News https://ift.tt/2X0EL5C Tyler Durden