Unexpectedly Ugly, Record Large 2Y Auction Prices At New All Time Low Yield

Tyler Durden

Mon, 07/27/2020 – 11:46

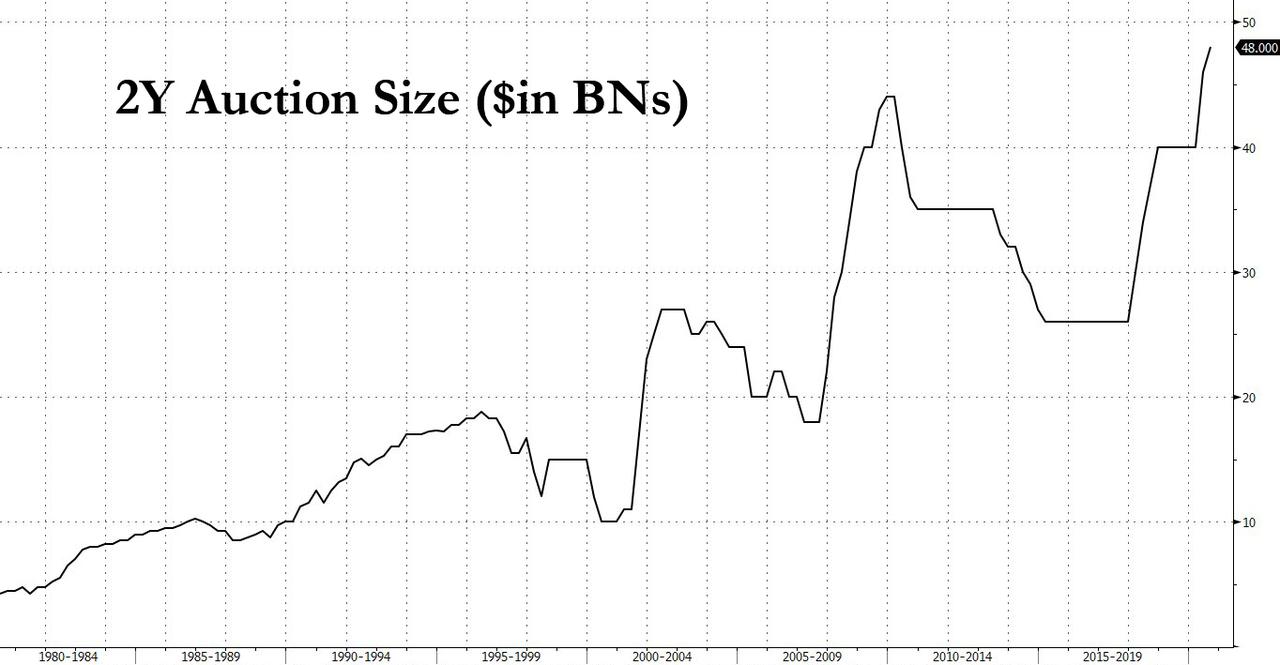

As part of this week’s abbreviated auction schedule, moments ago in its first of two auctions scheduled for Monday, the Treasury sold a record $48 billion in 2Y paper, the biggest auction size for that maturity on record.

And despite the record low yield, the auction was quite ugly as buyers clearly demanded a concession at these record low yields.

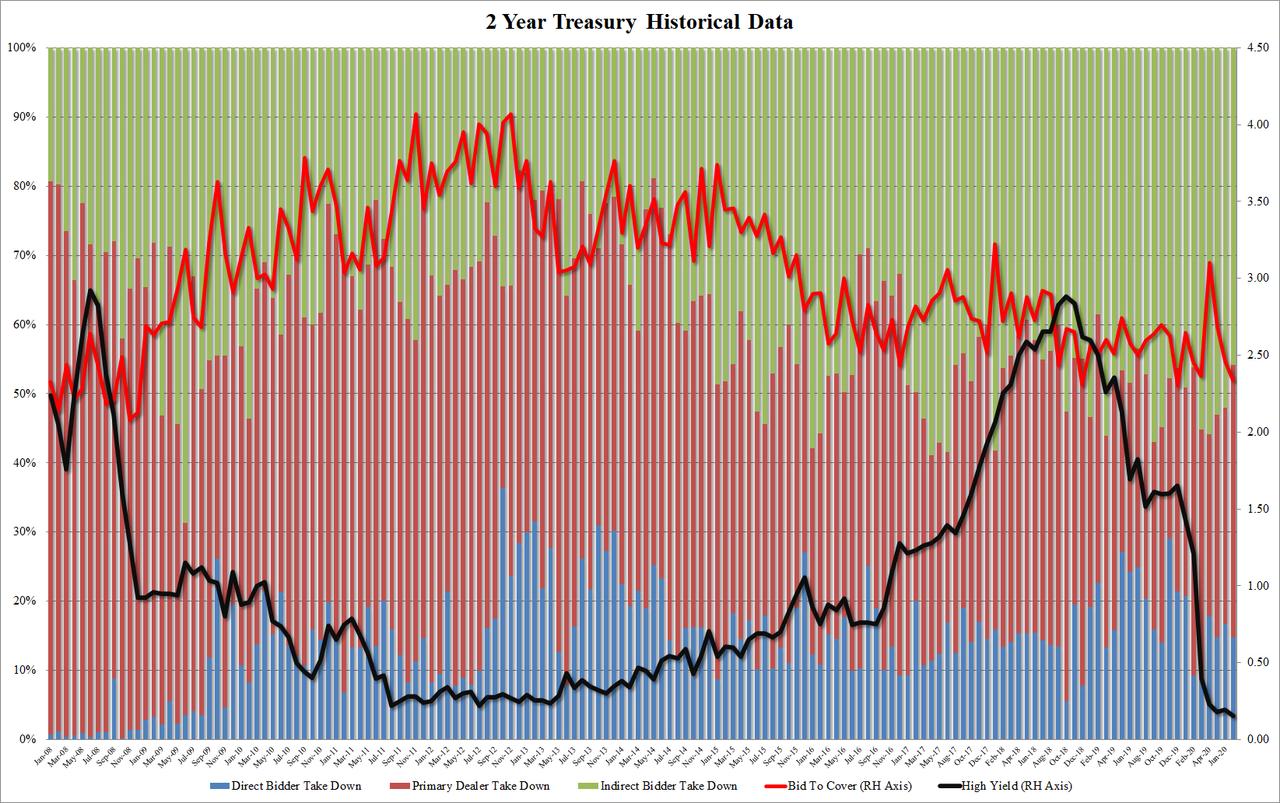

While the auction stopped at a high yield of 0.155%, which was well below last month’s 0.193% and the lowest 2Y auction yield on record, it tailed the 0.146% When Issued by almost 1 basis point.

The Bid to Cover was also ugly, sliding to just 2.340, a far cry from the 3.102 in April, and the lowest going to December 2018.

Finally, the internals were just as ugly, with the Indirects tumbling to 45.84%, far below the 52.0% in June and the 51.9% six auction average; in fact, it was the lowest Indirect takedown since last July. And with Directs taking 14.8%, or just in line with the recent average, Dealers were left with 39.3%, the highest since February (although it’s just a matter of time before they flip it back to the Fed).

Overall, a surprisingly ugly auction, and one which has put a bad taste in buyers’ mouths ahead of today’s $49BN 5Y auction.

via ZeroHedge News https://ift.tt/2CK08RT Tyler Durden