Hedge Fund Fees “In Free Fall” As Even Wall Street’s Largest Succumb To The Robinhood Model

Tyler Durden

Wed, 07/29/2020 – 13:15

It turns out that even hedge funds are not immune to the Robinhood model. And it looks like the days of 2 and 20 are over.

We already know that the retail brokerage landscape has changed significantly since Robinhood burst on the scene, offering commission free trades. Names like e-Trade, Ameritrade and Schwab have all changed their business models to offer the same service, leading to consolidation within the industry and widespread adoption of what looks to be the “new” brokerage business model: selling order flow to make money behind the scenes instead of charging a commission.

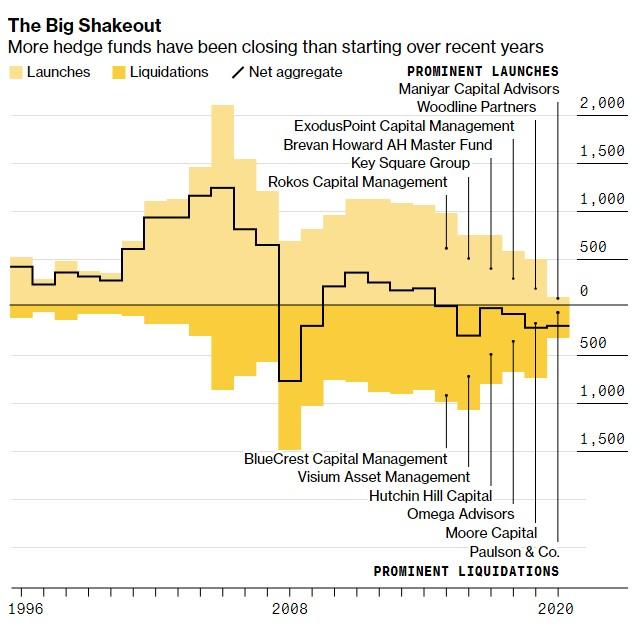

Now hedge funds – suffering from poor performance and shrinking business prior to the pandemic – are looking to make a similar shift to combat what Bloomberg is calling a “terminal decline”.

The new report highlights some of the “specials” funds are offering to attract new business, including one fund in London that is foregoing performance fees until a high water mark is hit and another in Hong Kong is that offering “full-loss insurance” to cover all losses.

Even well known manager Kyle Bass is telling his clients he will only charge 20% if he earns triple digit returns in a new fund he is spinning up.

Paul Singer’s Elliot Management Corp. is also lowering their fees in exchange for locking up investor capital for longer amounts of time. The company has a share class that will lower investor fees to 1.5% from 2%. Redemptions for this class are spread out over 18 months.

The goal for hedge funds now – long critiqued for their excessive fees – is less about growth and more about survival.

Andrew Beer, founder of New York-based Dynamic Beta Investments said: “The hedge fund industry is littered with the carcasses of small funds that never reached scale. Fees in the industry are still twice what they should be.”

Indeed, it looks as though the days of the stand-out celebrity hedge fund managers justifying their 2% annual management fee and a 20% cut of profits may be over. The exotic strategies that only hedge funds had access to in the 1990’s are now widely available to retail traders.

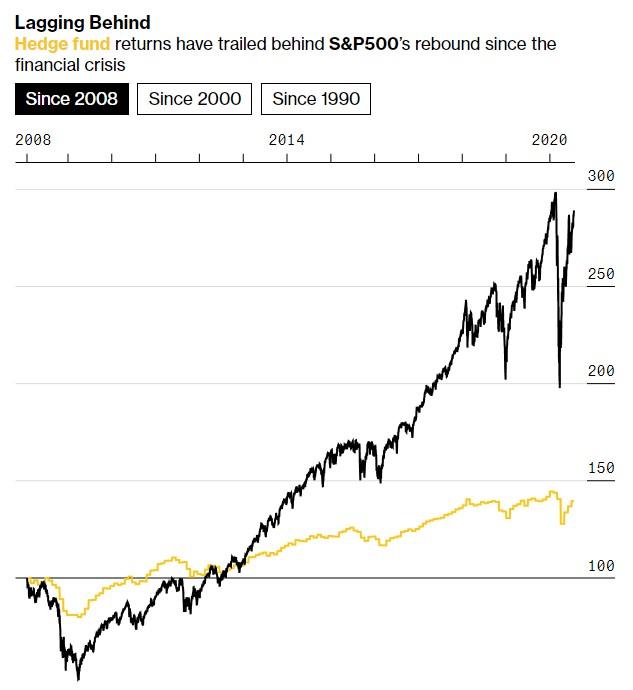

Hedge funds have also been mired with poor performance (relative to the S&P) since 2008, leading even well known names like Alan Howard, David Harding and Paul Tudor Jones to cut their fees. Now, with the bull market looking shaky and possibly on its last legs in the midst of a pandemic, managers like Ray Dalio and Michael Himntz have had some of their worst months on record.

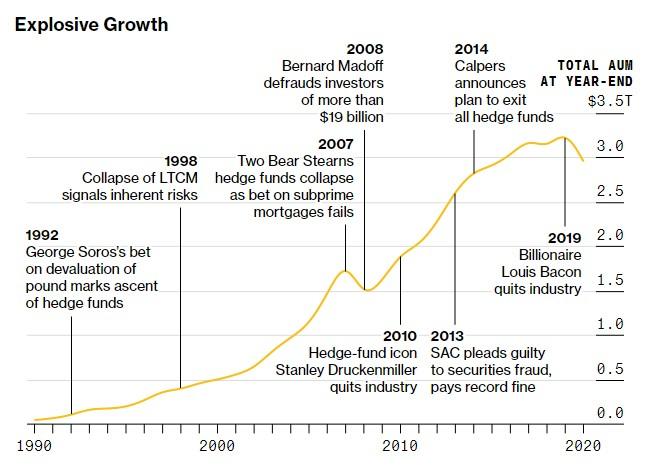

Hundreds of billions flowed into the industry in the decades leading up to the 2008 financial crisis. But returns then slumped after the Fed decided to step in and essentially eliminate the idea of stock picking and price discovery. Volatility – usually an important variable that hedge fund managers could capitalize on – all but disappeared completely as a result. In 2014, the largest U.S. pension fund decided to exit hedge funds when CALPERS withdrew $4 billion in investments. So far, in the first half of 2020, hedge funds have lost 3.4%.

Saleem Siddiqi, founder of Musst Investments said: “Some hedge funds have become like very large oil tankers cruising down the Suez Canal at snail’s pace. Lower asset levels will cut reliance on management fees and potentially refocus managers on performance.”

Bloomberg has included on their site an interactive calculator to help give readers an idea of how much hedge fund fees can add up to – in addition to several interactive charts that provide visuals on exactly how the industry is “evolving”. You can view those charts and maps here.

Meanwhile, fees aren’t the only concept that hedge funds are “borrowing” from the Robinhood crowd. They are also approaching the founder of RobinTrack – a website that keeps track of what stocks Robinhood retail traders own – to aggregate the site’s data for “real-time insight into where amateur stock pickers are sending their money,” according to Bloomberg.

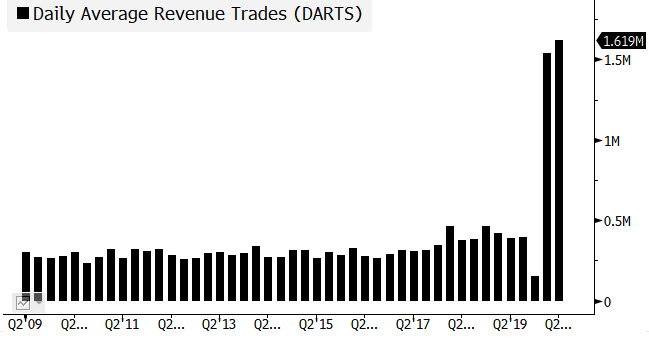

As we noted in an article several weeks, ago, this Robinhood-inspired shift not just in hedge funds – but in the entire industry – was captured beautifully in a series of Tweets from Bloomberg’s Morgan Barna, CFA. She showed how trading volume spiked significantly in Q1 and Q2 of 2020, obviously attributable to the Covid lockdown and the introduction of new “traders” who have followed the herd, led by Barstool Sports’ Dave Portnoy, into the market.

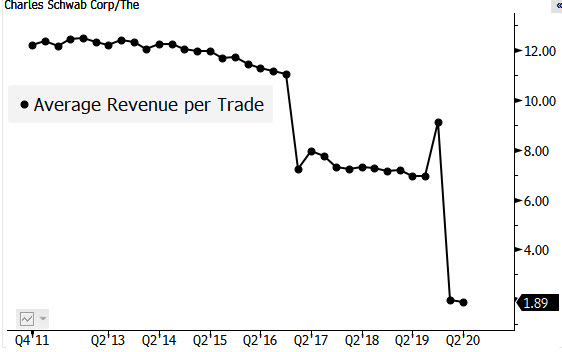

She also showed how Schwab has seen its revenue per trade collapse over the last 5 years, as the brokerage has tried to keep pace (or in some cases lead the charge) for lower commissions to help bring in new clients.

For all intents and purposes, commissions no longer seem to exist for stock trades and have been almost totally priced out of the industry.

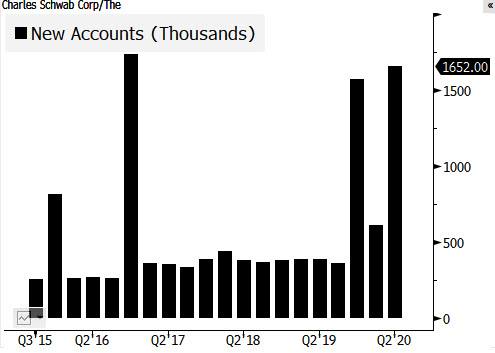

Finally, she showed that interest in creating retail accounts continues to rise.

Among the surprises we’ve seen during the Covid lockdown has been the fact that Americans are actually saving money and paying off credit cards, instead of spending it, with the economy melting down and the government wiring them free checks. They are also putting this money into brokerage accounts, as you can see below:

This is, like the fall of the hedge fund industry, been completely enabled by the Fed, behind the scenes, doing everything it can to make sure that the NASDAQ continues to hit new highs despite what has been an unprecedented economic collapse in the country.

In addition to “saving” the market by sacrificing the dollar, the Fed may be able to add two new names to its running death count: hedge funds and retail brokerage profits.

via ZeroHedge News https://ift.tt/2Xak2w2 Tyler Durden