Apple Soars Above $400 For First Time On Blockbuster Earnings; Announces 4 For 1 Stock Split

Tyler Durden

Thu, 07/30/2020 – 16:43

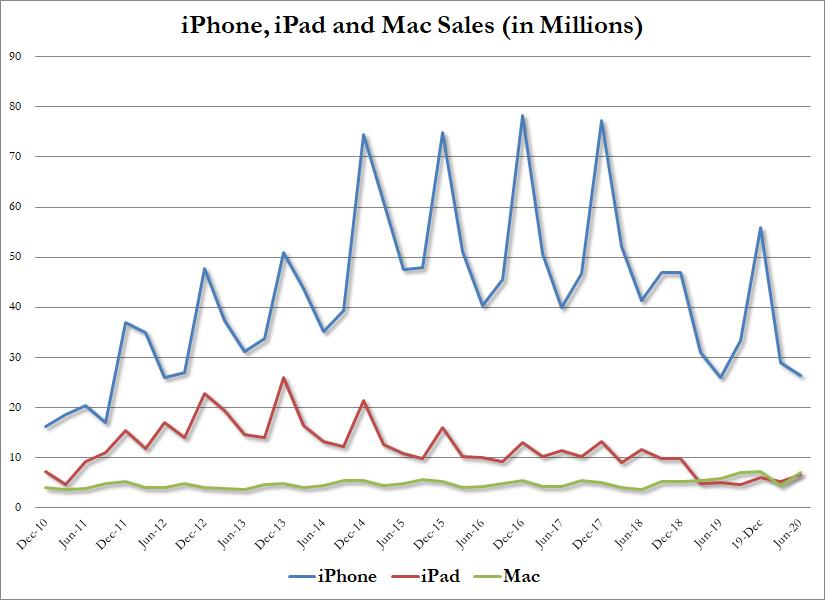

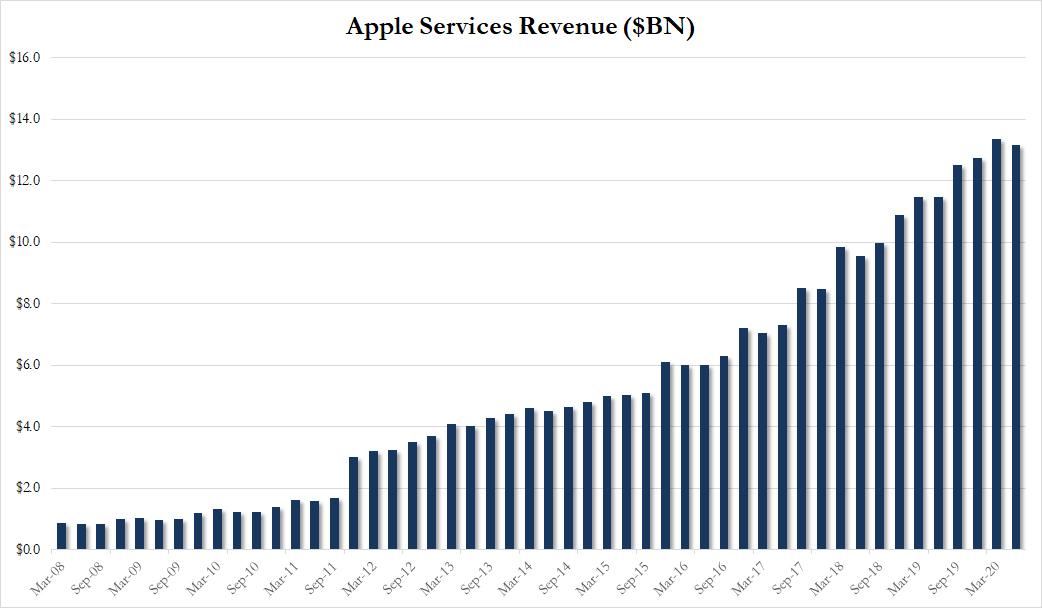

Heading into the current, Q3 quarter – typically one of Apple’s slowest of the year – Wall Street was expecting Apple to report revenue of $52.2 billion, or another slight decline from last year, even though Apple didn’t provide guidance for the quarter and is unlikely to do so again until the coronavirus pandemic ends. Despite the slowdown, AAPL shares rallied a whopping 43% from April through June, Apple’s best quarterly performance in eight years (during what is typically its slowest quarter). As Bloomberg notes, analysts cited everything from the iPhone maker’s App Store revenue growth, the potential of its wearable products, stock buybacks and the potential of its services business as helping outweigh the impact of the coronavirus. The biggest driver of optimism is the release a 5G iPhone, expected later this year. At the same time, while looking at the current quarter, analysts were expecting a continuation of recent trends, including a sizable dip in iPhone sales, at revenue of over $21.3 billion, but a jump in services, with revenue of $13.12 billion.

So with that in mind, moments ago AAPL joined the rest of the megatech sector in reporting absolutely blockbuster results largely boosted by the record stimulus – in both the US and across the world – which included:

- Revenue growth of a huge 11%, amid expectations of a decline

- iPhone sales were up, on projections of a decline

- All other categories – Mac, iPad, Wearables, Services – grew

And while Apple didn’t give a forecast again, it did announce a 4 for 1 stock split, clearly anticipating further gains.

Here are the Q3 details:

- Revenue of $59.7 billion, smashing estimates of $52.3 billion

- EPS of $2.58, also shaprly above the estimate of $2.07

- iPhone revenue grew 1.7% to $26.4 billion.

- Services grew 15% to $13.2 billion.

- Mac sales were up 21% at $7 billion.

- iPad revenue grew 31% to $6.6 billion

- Wearables, home and accessories jumped 17% to $6.5 billion, est $6.09

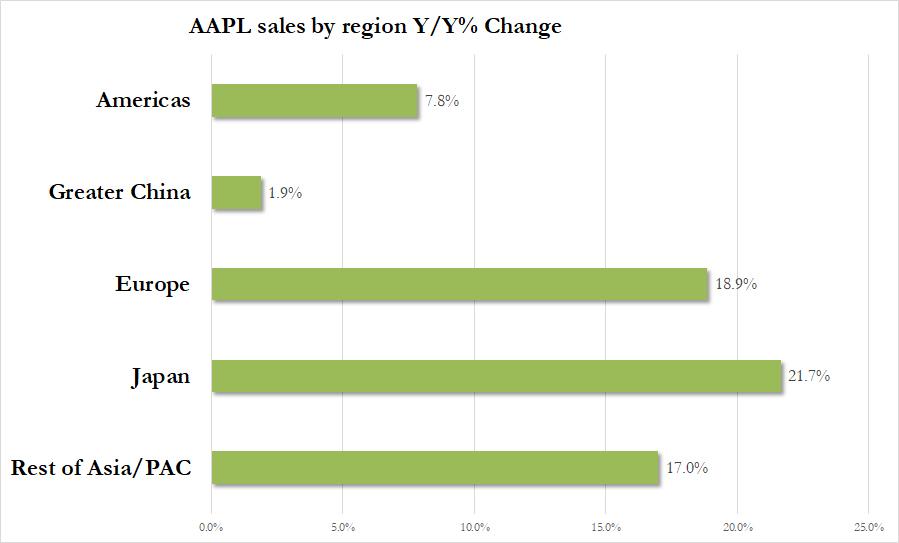

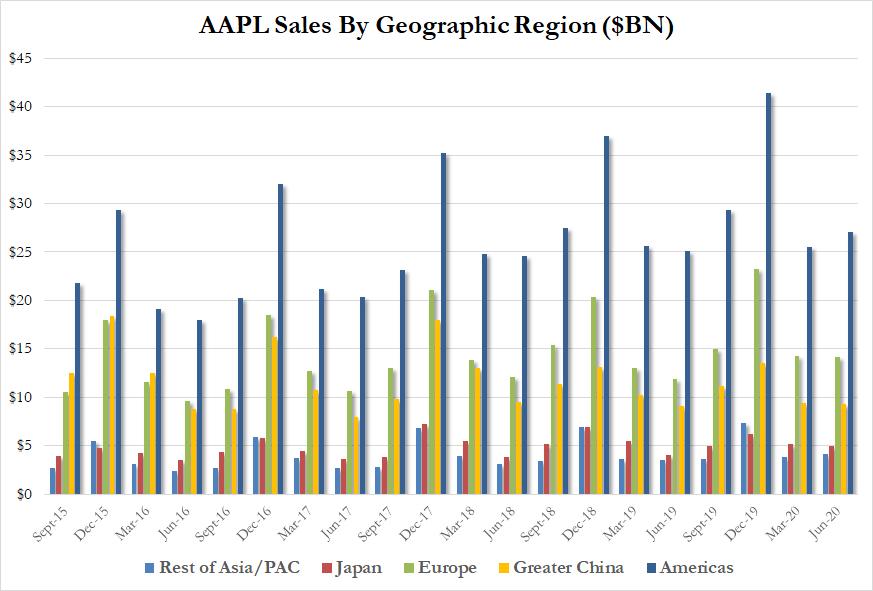

Did Americans use their stimulus checks to buy iPhones and Apple watches? It sure seems that way. Only it wasn’t just America: Apple sales were up in every region with the Americas contributing the most.

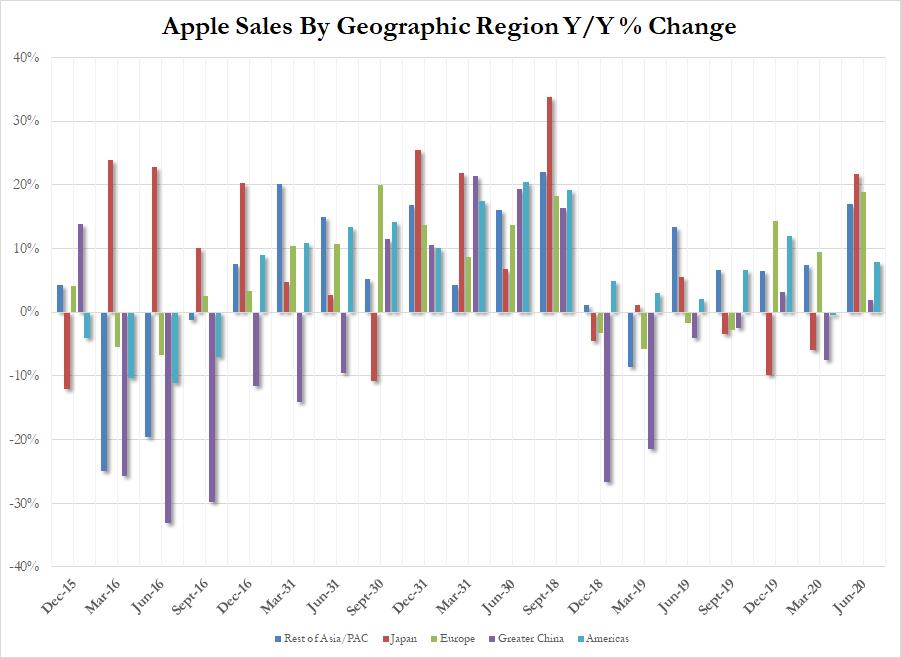

For the first time in two years, sales rose Y/Y across all regions:

And while this was supposed to be a slow quarter for AAPL, it was anything but:

Just as remarkable is that contrary to expectations of a decline in unit sales, everything from iPhones, to iPads to Macs saw higher revenues Y/Y, as locked down consumers snapped up new iPhones, iPads and Mac computers to stay connected during the pandemic.

There were a few blemishes, including a rare sequential decline in Service revenue, which dipped to $13.156BN from $13.348BN last quarter.

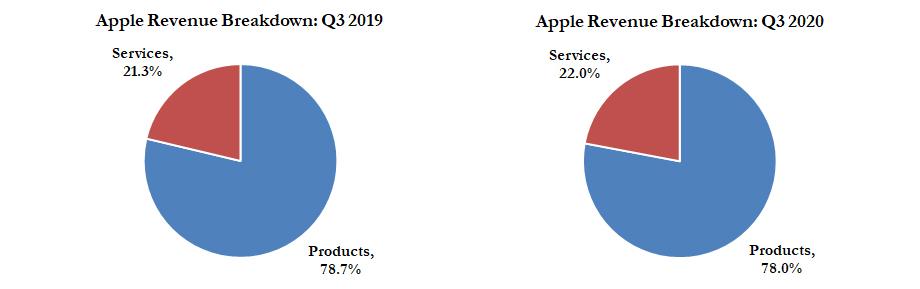

Services dipped from a record 22.9% of total revenue last quarter to 22.0%, still up from 21.3% a year ago:

Discussing the quarter, CEO Tim Cook said:

It was broad-based quarter in terms of our growth. iPhone did better than what we had expected. We saw a slow first three weeks of April where the Covid-19 impact was particularly bad. And then when the lockdowns and point of sales began to come back some, we saw a marked improvement in May and June, more than we had estimated.”

A few more bullet points from the Bloomberg TV interview:

- Pandemic “likely” helped results for Mac and iPad due to work from home and remote learning

- “Digital services had a really strong performance with record revenues on the App Store, Apple Music, Video, and Cloud Services.”

- “Advertising and AppleCare were impacted by reduced economic activity and the store closures”

- iPhone and wearables “likely” were hurt due to the store closures.

- Store closures “weigh” on results and he expects it to continue to.

- “We’re not giving guidance because of the uncertainty.”

And some details on the stock split:

“Each Apple shareholder of record at the close of business on August 24, 2020 will receive three additional shares for every share held on the record date, and trading will begin on a split-adjusted basis on August 31, 2020.”

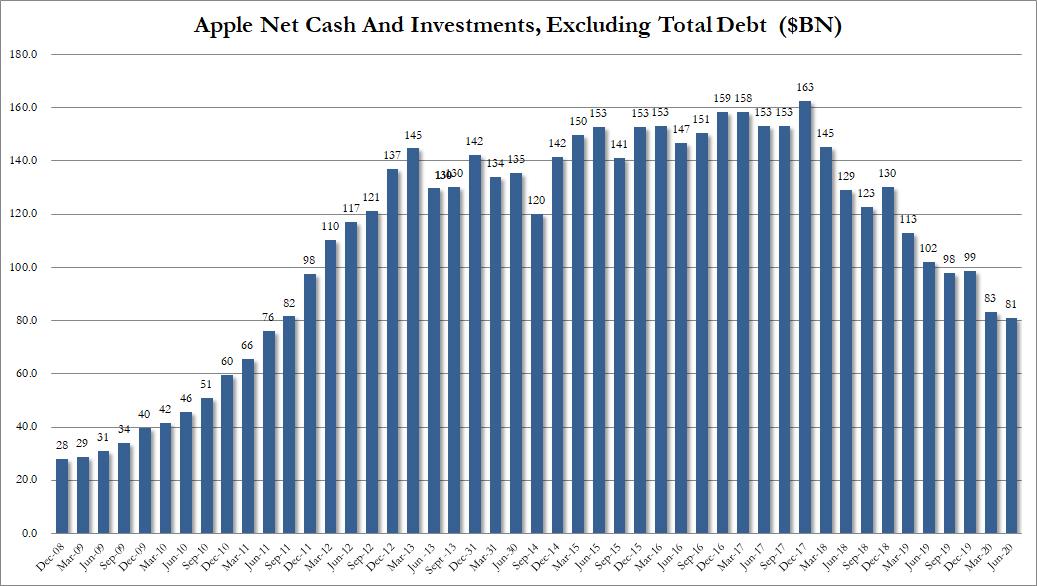

One thing that won’t get prominent notice is Apple’s net cash (excluding total debt), which after hitting a record of $163BN in Dec 2017 has shrunk in half to $81BN, the lowest level in 9 years.

Joining most other tech companies, Apple said that its U.S. employees won’t return to the office until early 2021; earlier in the week Google said that its employees will stay home until next July.

In any case, looking at the market verdict, investors are clearly delighted and just like the other gigatech companies, Apple stock is soaring, and after exploding above $400, has taken out its previous all time high.

via ZeroHedge News https://ift.tt/3jV5haj Tyler Durden