USDollar, Bond Yields Tumble After Greatest Economic Collapse Ever

Tyler Durden

Thu, 07/30/2020 – 16:00

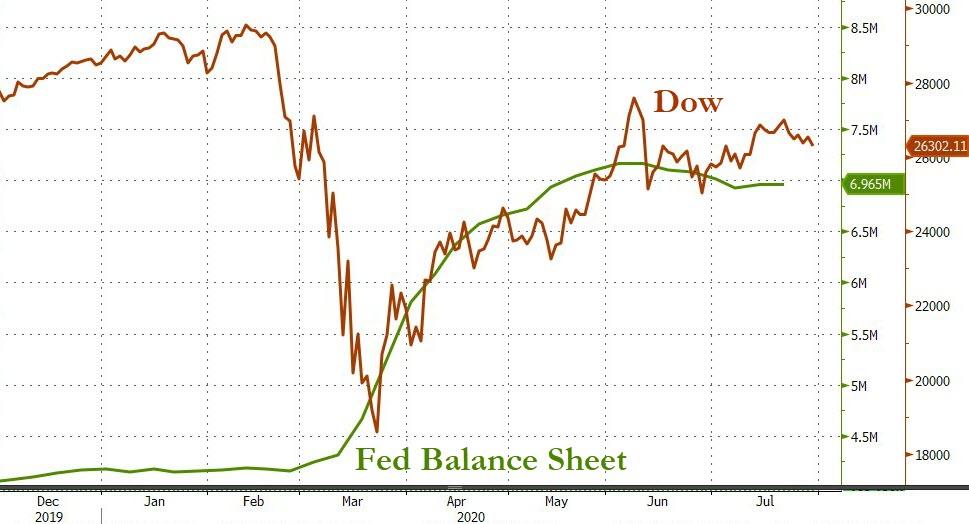

A re-weakening in jobless claims data (confirming no v-shaped recovery), a record-breaking collapse in GDP and consumption (admittedly backward-looking) and Trump tweet hinting at election delays all spoiled the party early on in US equity land but around 1030ET ‘someone’ decided this mini-dip was for buying and everything surged ahead of tonight’s mega earnings data. Only Nasdaq managed gains on the day, however with The Dow the biggest laggard…

Look at The Nasdaq… isn’t it pretty!!!

The bounce appeared to be triggered by a technical test by The Dow of its 200DMA and 50DMA…

The Fed better be ready to do some more buying…

Source: Bloomberg

FANG Stocks rallied intraday ahead of tonight’s earnings, bouncing off unch for the week…

Source: Bloomberg

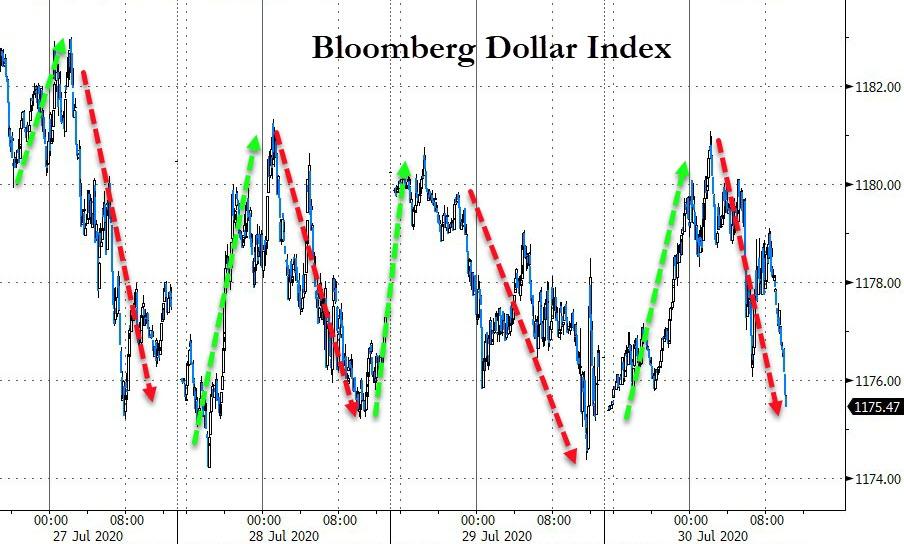

The Dollar continued its pattern of gains in Asia and weakness in Europe and US sessions…

Source: Bloomberg

Breaking down below a critical uptrend line…

Source: Bloomberg

Gold and Silver were spooked briefly higher on Trump’s tweet but retreated to end the day – unusually – lower…

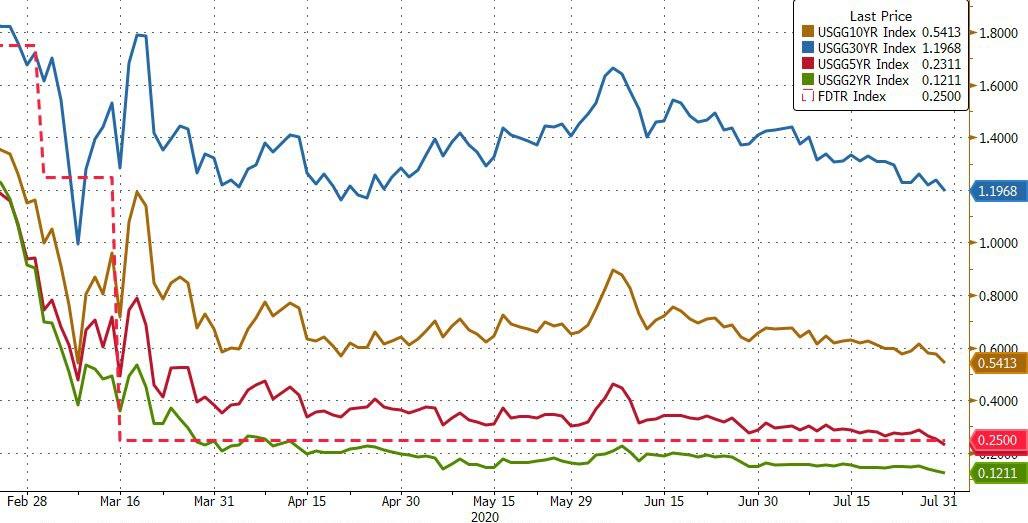

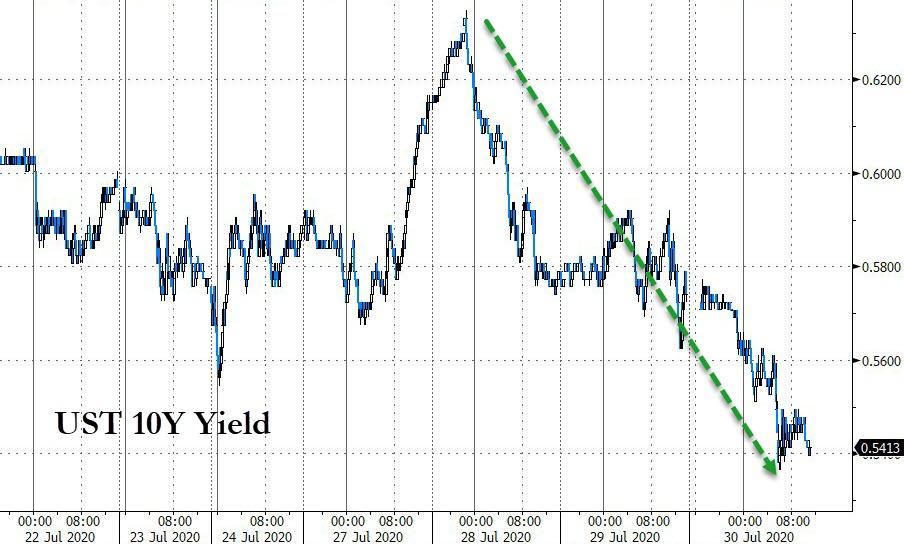

Treasuries were bid with the long-end outperforming (30Y -4bps, 2Y -1bps), 10Y is outperforming on the week…

Source: Bloomberg

Pushing the entire yield curve to record low yields…

Source: Bloomberg

As Stocks remain near record highs…

Source: Bloomberg

With 10Y back at the spike lows from the very worst of the market collapse in March…

Source: Bloomberg

Yield curve has flattened significantly since The Fed statement…

Source: Bloomberg

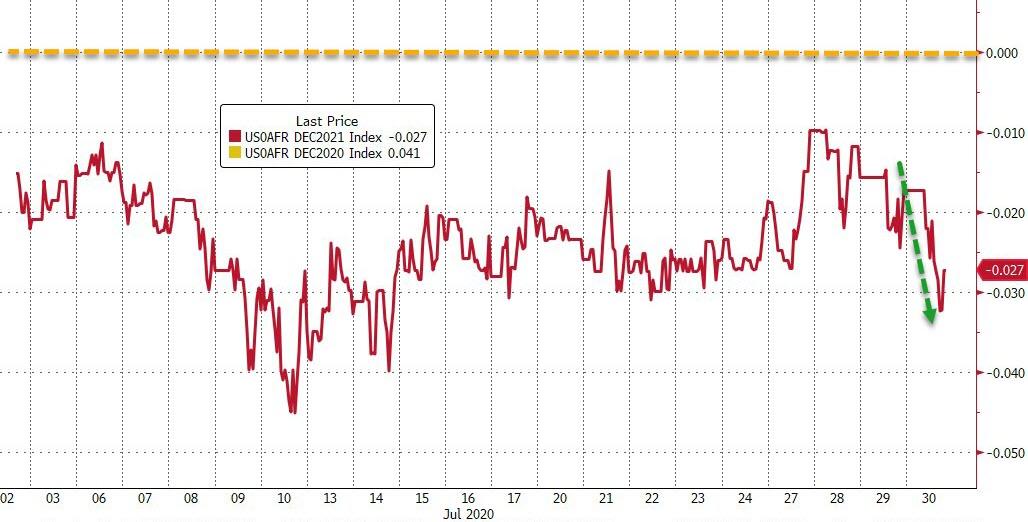

And before we leave ratesville, we note that the Dec 2021 Fed Funds futures is implying a -3bps rate… easing since The Fed yesterday…

Source: Bloomberg

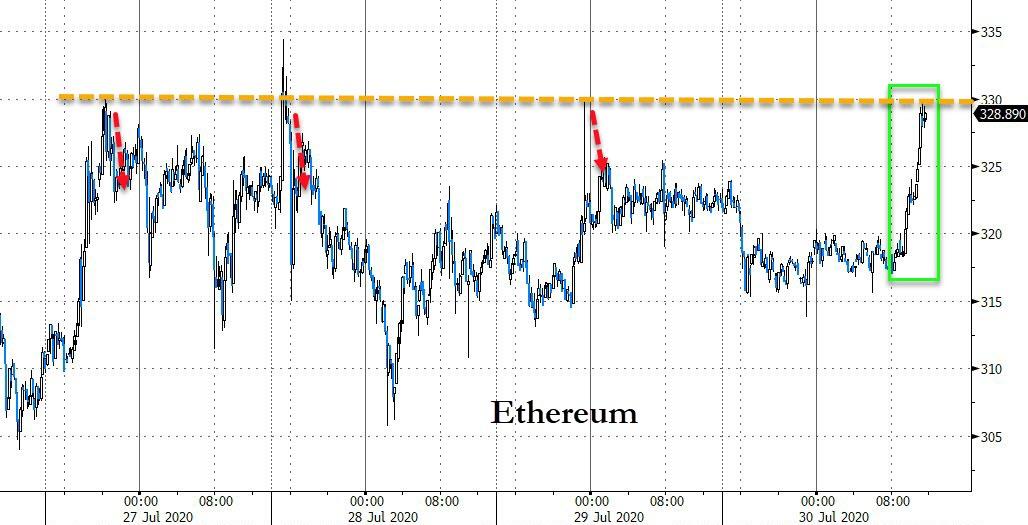

Cryptos were mixed today with Ethereum and Litecoin best but still a big week…

Source: Bloomberg

Ethereum tested back up to $330 intraday…

Source: Bloomberg

The energy complex was hit today with WTI slammed back below $40 to a $38 handle intraday (before panic-buying lifted it back)…

And Nattie tumbling hard…

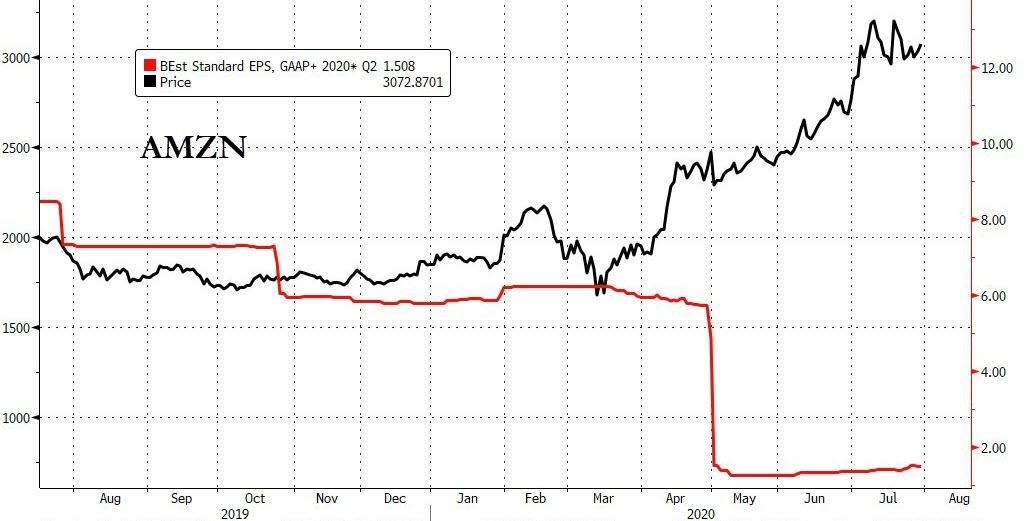

And finally, ahead of tonight’s earnings-pocalypse, a quick look at the big tech names vs their consensus EPS…

Source: Bloomberg

Notice any similarities?

via ZeroHedge News https://ift.tt/2Do5Etm Tyler Durden