Noble Files For Bankruptcy One Month After Rushing To Pay Executive Bonuses

Tyler Durden

Fri, 07/31/2020 – 17:50

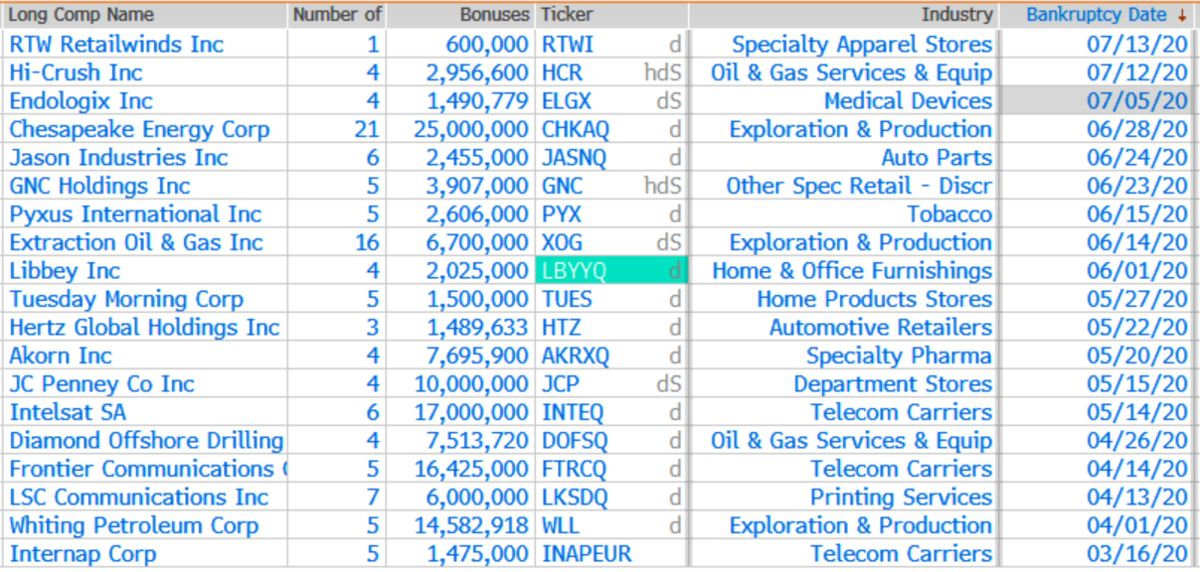

Two weeks ago we wrote that “Executives Of Bankrupt Companies Made $131 Million In Bonuses This Year.” Well, it time to add a few more million to it, courtesy of Noble Corporation’s very generous shareholders.

Back on July 2, in an 8-K discussing the “Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers” Noble Corp. announced that:

In response to the ongoing significant market uncertainty, the Board of Directors (the “Board”) of Noble Corporation plc, a public limited company incorporated under the laws of England and Wales (the “Company”), approved modifications to the Company’s overall compensation program on June 26, 2020 to more appropriately retain and motivate its key employees during this period of uncertainty and increased workload. The Board worked with compensation and other advisors to design and appropriately align the revised program.

This happened even though Bloomberg Javier Blas reminds us, just weeks earlier, in late May, Noble shareholders already opposed, “on an advisory basis”, the compensation of the company’s named executive officers (75.3m votes against executive compensation, 74.1m votes in favor):

And let’s not forget that in late May, shareholders already opposed, “on an advisory basis”, the compensation of the company’s named executive officers (75.3m votes against executive compensation, 74.1m votes in favor) #OOTT

— Javier Blas (@JavierBlas) July 2, 2020

To many, this accelerated ramming of an exec bonus was the clearest sign yet that a bankruptcy was inevitable. And sure enough, fast forward to today when Noble, the giant offshore drilling contractor (not to be confused with Noble Energy), filed a prepackaged bankruptcy plan with which it hopes to cut more than $3.4 billion of debt after a crash in crude prices made undersea oil wells too expensive.

The Chapter 11 filing in Texas bankruptcy court would eliminate all of the company’s bond borrowings by swapping debt for equity, the company said in a statement.

Noteholders agreed to invest $200 million of new capital through second-lien notes, and Noble has lined up a $675 million secured revolving credit facility backed by current lenders including JPMorgan Chase & Co. Noble reported both assets and liabilities of $1 billion to $10 billion, according to the bankruptcy petition; the company expects to emerge from Chapter 11 before the end of the year, and will continue operating while in bankruptcy.

According to Bloomberg, the London-based company, one of the biggest owners of offshore rigs, failed to cope with a glut of floating drilling capacity that was a decade in the making, as exploration companies shifted focus to cheaper inland shale. The plunge in crude prices made any near-term recovery in offshore drilling even less probable.

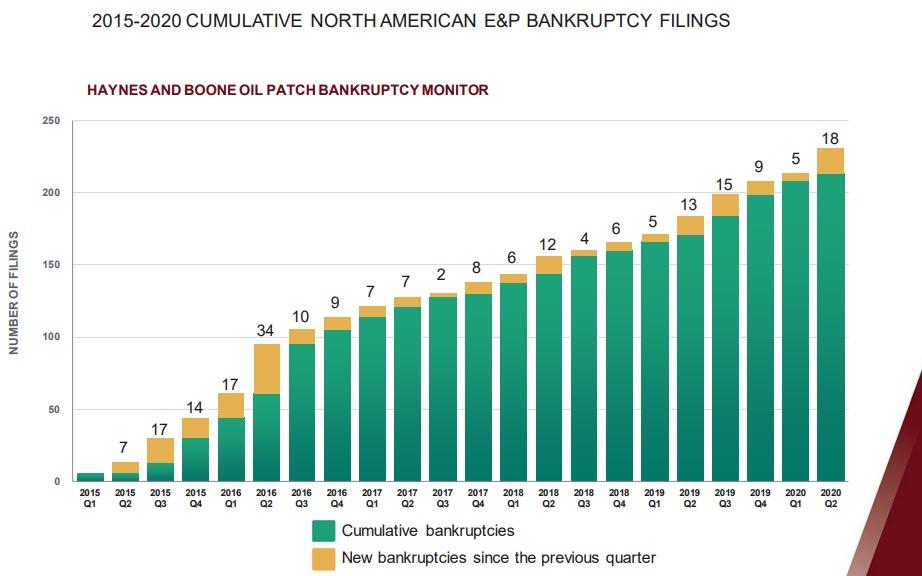

Noble’s filing adds to the more than 200 bankruptcies by oilfield service companies dating from 2015, according to the law firm, Haynes and Boone.

Noble follows competitor Valaris Plc announcing Thursday that it may file for Chapter 11, while Diamond Offshore Drilling Inc. filed for bankruptcy in April.

More importantly, Noble also follows dozens of other companies in rushing out executive bonuses for a “job well done” just weeks or even days before a bankruptcy filing, just to make sure the team that led the company into bankruptcy is “incentivized” enough to stay on board during the Chapter 11 (or 7) proceedings, even though that should be on the bondholders dime and not by draining the company’s prepetition coffers.

via ZeroHedge News https://ift.tt/33d8Um7 Tyler Durden