US Manufacturing PMI “Worryingly Weak” As ISM Spikes To 16-Month Highs

Tyler Durden

Mon, 08/03/2020 – 10:05

Following more rebounds in ‘soft’ manufacturing survey data in Europe and Asia (and LatAm – Brazil Manufacturing PMI exploded to a record in July), both ISM and Markit’s measures of US manufacturing sentiment were expected to continue their v-shaped recovery (despite hard data refuses to follow suit).

However, while the July surveys improved over June, Markit’s PMI notably dropped from the flash print but ISM’s report showed major gains…

-

Markit US Manufacturing PMI MISS 50.9 vs 51.3 exp and 49.8 prior (51.3 flash)

-

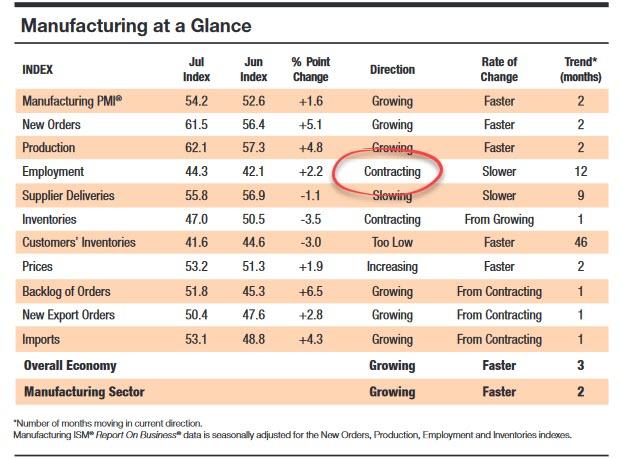

ISM US Manufacturing BEAT 54.2 vs 53.6 exp and 52.6 prior

This is the highest ISM manufacturing print since March 2019

Source: Bloomberg

So take your pick – disappointing intra-month decline (as reopenings are rolled back) or best month in 16 months (because nothing matters)?

ISM New Orders have exploded higher to best since Sept 2018 but employment is not catching up to the “V”…

Source: Bloomberg

On ISM, the company’s spokesperson said:

“The PMI® signaled a continued rebuilding of economic activity in July and reached its highest level of expansion since March 2019, when the index registered 54.6 percent. Four of the big six industry sectors expanded.

The New Orders and Production indexes returned to strong expansion levels. The Supplier Deliveries Index remained at a more normal level of tension between supply and demand. Seven of the 10 subindexes registered expansion, up from five in June,”

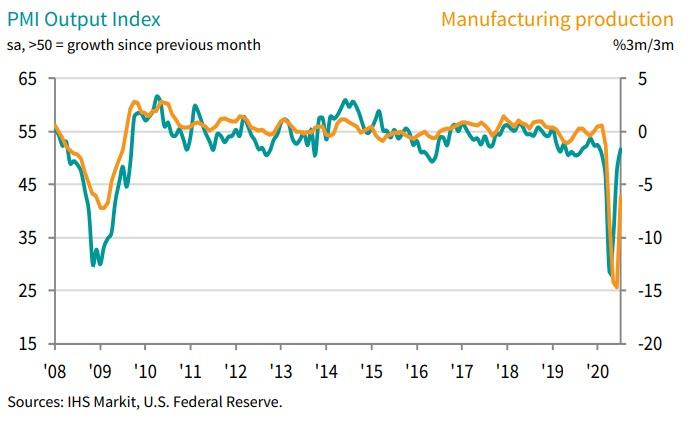

But on PMI, Chris Williamson, Chief Business Economist at IHS Markit notes:

“Although indicating the strongest expansion of the manufacturing sector since January, the IHS Markit PMI remains worryingly weak. Much of the recent improvement in output appears to be driven merely by factories restarting work rather than reflecting an upswing in demand.

Growth of new orders remains lacklustre and backlogs of work continue to fall, hinting strongly at the build-up of excess capacity. Many firms and their customers remain cautious in relation to spending in the face of re-imposed lockdowns in some states and worries about further disruptions from the pandemic.

“Encouragingly, business optimism about the year ahead has revived to levels last seen in February, but many see the next few months being a struggle amid the ongoing pandemic, with a more solid-looking recovery not starting in earnest towards the end of the year or even into 2021.

Further infection waves could of course derail the recovery, and many firms also cited the presidential elections as a further potential for any recovery to be dampened by heightened political uncertainty.”

Finally, as a reminder, the euphoric (phew, thank the lord that’s over) rebound has sent ‘soft’ survey data hopes to a level that has historically not portended a good reaction in markets…

Source: Bloomberg

via ZeroHedge News https://ift.tt/31dP8Ef Tyler Durden