Futures Slide Ahead Of Jobless Claims As Gold Surge Continues

Tyler Durden

Thu, 08/06/2020 – 08:17

US stock index futures dropped on Thursday alongside European stocks as investors looked forward to the latest weekly jobless claims report to gauge the pace of a rebound in the labor market, while also anticipating a new fiscal stimulus bill.

The top decliner among components of the Nasdaq 100 index was Western Digital shares, which sank 8.9% pre-market after the hard drive maker reported weaker-than-expected fourth-quarter revenue and forecast a soft current quarter outlook.

In Europe, mining giant Glencore Plc led losses among peers after scrapping its dividend. U.K. broadcaster ITV Plc slumped after saying it wouldn’t provide an outlook for the rest of the year after the pandemic led to its worst-ever drop in advertising sales. Turkey’s lira tumbled to its lowest level against the dollar as interventions by state banks failed to reassure markets.

Earlier in the session, Asian stocks were little changed, with materials and energy rising, after rising in the last session. Most markets in the region were up, with South Korea’s Kospi Index gaining 1.3% and India’s S&P BSE Sensex Index rising 1.1%, while Hong Kong’s Hang Seng Index dropped 0.7%. The Topix declined 0.3%, with Japan Sys Tech and Grace falling the most. The Shanghai Composite Index rose 0.3%, with Sichuan Hongda and Bohai Automative Systems posting the biggest advances. Chinese shares dropped after Secretary of State Pompeo warned of ‘significant threat’ from ‘untrusted Chinese apps’.

“There are some risks of the market relying too heavily on positive news around the fiscal stimulus and an earnings season that still wasn’t that great, even if many companies did beat,” Kerry Craig, global market strategist at JPMorgan Asset Management in Melbourne, said on Bloomberg TV. “There’s a case for markets, in the U.S. particularly, taking a pause from here on out rather than continuing this rally, given how strong it has been.”

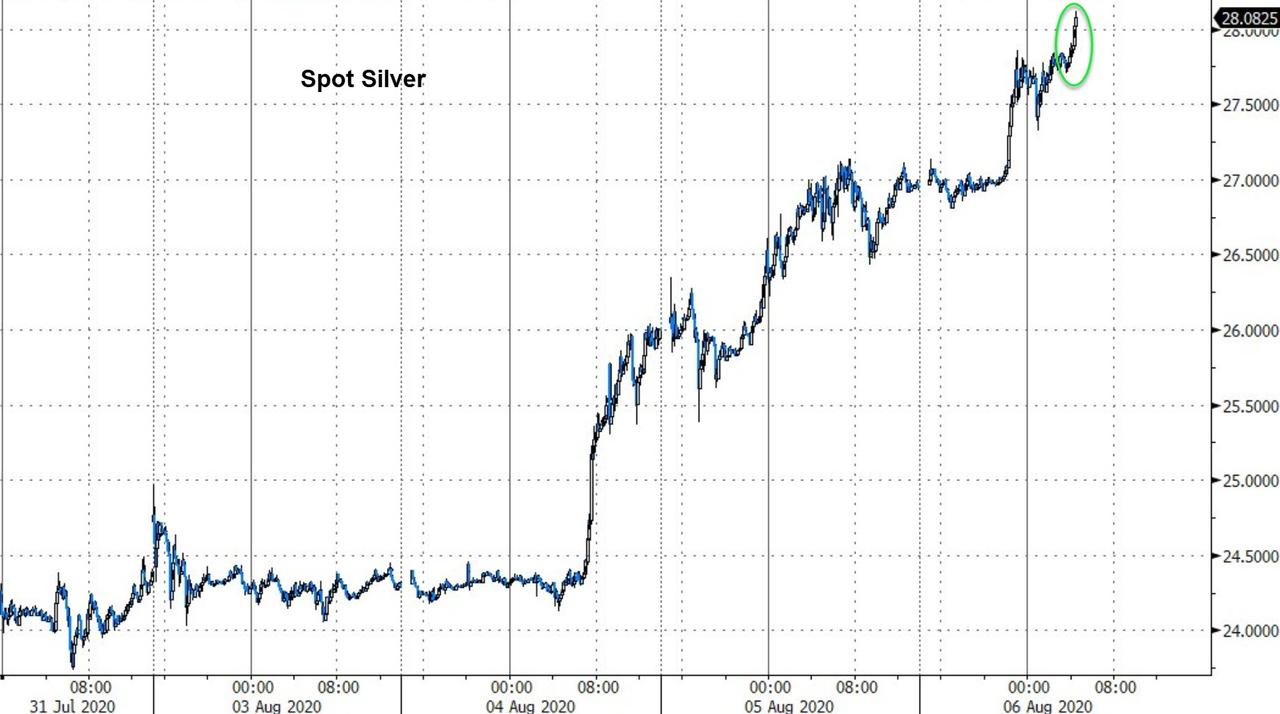

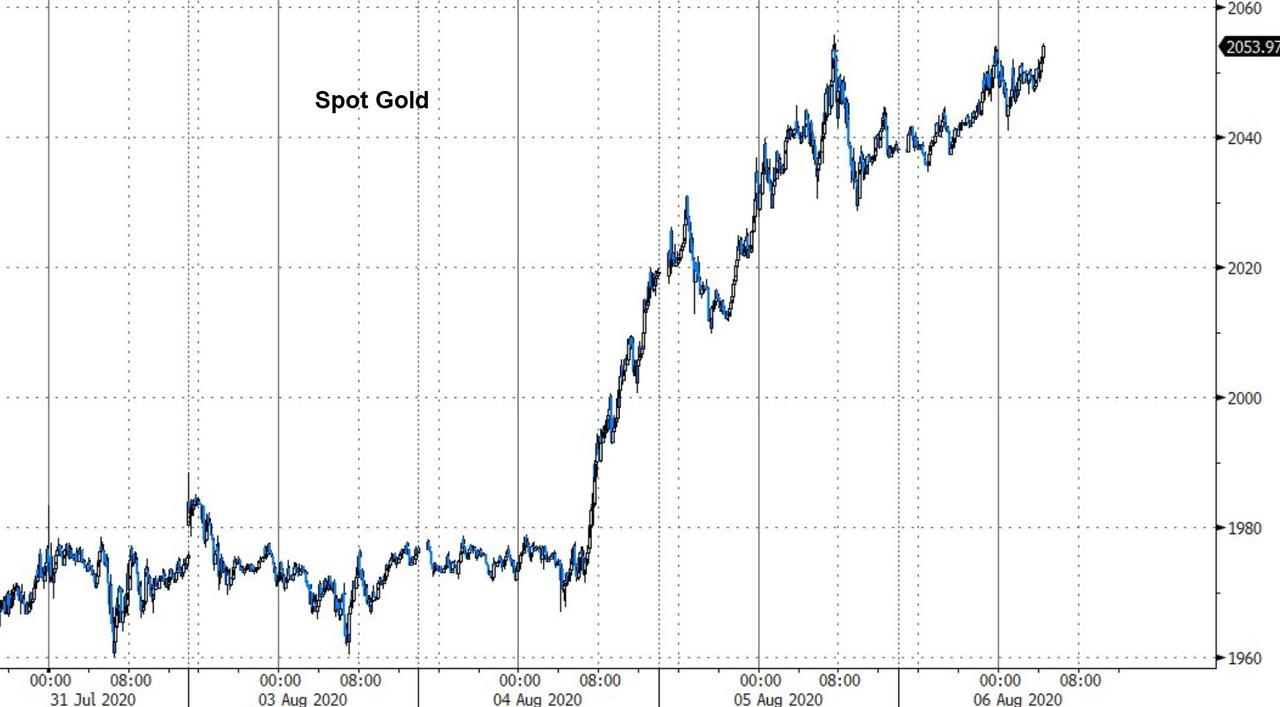

Gold pushed further above $2,000 an ounce for a third day before news on whether the U.S. will approve another trillion-dollar aid package (or much bigger) to counter the coronavirus. Silver prices were up 25% in July, the second-biggest monthly gain for the white metal on record, anbd are extending gains this week, with spot silver spiking above $28 this morning…

And gold rising too…

In FX, the dollar index halted its slide after falling for two sessions after California reported its second-deadliest day from the virus and Florida’s tally topped 500,000. Traders are monitoring negotiations for the next virus aid package while Cleveland Federal Reserve President Loretta Mester said more fiscal support is needed after a sharp drop in U.S. employment gains in July. The pound strengthens as much as 0.5% against the U.S. dollar as the BOE points to the pitfalls of negative rates, and leaves them on hold at a record low of 0.1%. Turkey’s lira tumbled to its lowest level against the dollar as interventions by state banks failed to reassure markets. The Norwegian krone trimmed some of its gains after it reached its highest levels since January on Wednesday as a rally in oil prices falters. Australia’s dollar also trims its gains after rising on an uptick in iron ore prices.

China’s yuan weakened for the first time in three sessions, following a rapid advance a day earlier that some traders saw as excessive. The currency dropped 0.16% to 6.9458 per dollar as of 5:14 p.m. in Shanghai. The slide came after the yuan rallied 0.6% on Wednesday, driven by optimism on China-U.S. relations as senior officials from the two countries planned to discuss the trade deal this month. That hopefulness then faded as the U.S. stepped up its attack on Chinese technology firms. The earlier advance took the yuan’s 14-day relative strength index versus the dollar beyond a level which to some traders signaled the gains were overdone

In rates, treasuries bull-steepen as long-end yields shed up to 4bp, extending slide in early U.S. session as S&P 500 futures fall, led by European stocks on earnings. Yields were lower by 1bp to 4bp across a flatter curve with 2s10s, 5s30s spreads tighter by 2.5bp and 1.4bp; 30-year touched 1.179%, lowest since April. Dip-buying during Asia session and a flurry of futures activity including block trades sparked the move, which continued through European morning.

Looking at today’s initial claims report, consensus expects a 1.415 million Americans filed for state unemployment benefits in the latest week, down slightly after two consecutive weeks of huge increases triggered fears of a stalled recovery in the labor market.

Market Snapshot

- S&P 500 futures up 0.1% to 3,320.00

- STOXX Europe 600 down 0.2% to 364.28

- MXAP up 0.1% to 169.72

- MXAPJ up 0.4% to 567.44

- Nikkei down 0.4% to 22,418.15

- Topix down 0.3% to 1,549.88

- Hang Seng Index down 0.7% to 24,930.58

- Shanghai Composite up 0.3% to 3,386.46

- Sensex up 1.2% to 38,101.69

- Australia S&P/ASX 200 up 0.7% to 6,042.19

- Kospi up 1.3% to 2,342.61

- German 10Y yield fell 0.9 bps to -0.515%

- Euro down 0.06% to $1.1856

- Brent Futures down 0.3% to $45.03/bbl

- Italian 10Y yield rose 2.5 bps to 0.847%

- Spanish 10Y yield fell 1.3 bps to 0.296%

- Brent futures down 0.2% to $45.06/bbl

- Gold spot up 0.7% to $2,051.33

- U.S. Dollar Index down 0.01% to 92.86

Top Overnight News from Bloomberg

- Twitter Inc. and Facebook Inc. blocked a video shared by accounts linked to U.S. President Donald Trump for violating their policies on coronavirus misinformation in clip of an interview in which he said children were “virtually immune” from Covid-19

- German manufacturing continued its recovery in June, with orders rising much stronger than forecast after restrictions to contain the coronavirus were loosened

- Investors should consider the risk of a successful coronavirusvaccine unsettling markets by sparking a sell-off in bonds and rotation out of technology into cyclical stocks, warned Goldman Sachs Group Inc

- Glencore Plc won’t pay its deferred dividend after net debt spiked because the commodities giant poured money into its trading business to cash in on volatile price swings

Asian equity markets traded mixed amid a lack of fresh catalysts and with the region failing to take advantage of the mild tailwinds from Wall St where cyclicals led the upside and the DJIA outperformed its major peers after the blue-chip index received a boost from a surge in Disney shares post-earnings and with Boeing also flying high after optimism on its ability to navigate through the aviation crisis. Furthermore, participants continue to hang on COVID-19 relief discussions where the latest headlines suggested that progress must be made by this Friday or else President Trump is ready to take executive action. ASX 200 (+0.7%) was positive with the index kept afloat of the 6000 level, supported by the commodity-related sectors and with the RBA continuing its QE operations for a 2nd consecutive day. Nikkei 225 (-0.4%) was subdued by a firmer currency and as earnings remained in focus with Honda Motor and Mitsui Engineering & Shipbuilding among the worst hit after posting losses during the prior quarter, while KOSPI (+1.3%) benefitted alongside strength in index heavyweight Samsung Electronics after it unveiled a new phablet, foldable smartphone and wearable products. Hang Seng (-0.7%) and Shanghai Comp. (+0.3%) failed to hold on to early gains with sentiment dampened by a continued PBoC liquidity drain and ongoing US-China tensions with the US said to want untrusted Chinese apps removed from US app stores and President Trump criticized that Hong Kong will not be a successful financial exchange anymore in which the city will dry up and fail. Finally, 10yr JGBs were weaker amid spill-over selling from USTs and with prices also dampened by weaker demand at the 10yr inflation-indexed auction.

Top Asian News

- India’s Central Bank Holds Rates, Focuses on Financial Stability

- Thailand Picks Ex-Banker as Finance Chief to Fight Crisis

- Philippines Raises Budget Deficit Ceiling Until 2022

- Japan Stocks Fall as Traders Shift Holdings Before Summer Break

A choppy day in European stock markets [Euro Stoxx 50 -0.4%] as losses seen at the open where met with a bout of buying – which took most of Europe into positive territory – but price action thereafter reversed. UK’s FTSE 100 (-1.3%) remains the underperformer in the region in the aftermath of the BoE monetary policy decision, which prompted a firmer GBP thus providing unfavourable currency conditions. On the other side of the spectrum, DAX (Unch) has remained somewhat resilient amid post-earning gains from a number of heavyweights including Siemens (+2.7%) and Adidas (+4.0%) who hold 8.3% and 4.4% weightings respectively. Sectors are mostly lower with the exception of industrials – which benefits from the broader losses across materials – but broader sectors do not show a particular risk bias. The breakdown paints a similar picture and sees Industrial Goods & Services leading the gains, with Travel & Leisure now flat after Lufthansa (Unch) trimmed gains, albeit the Co. reported less dire-than-expected numbers. Individual movers again are largely oriented around earnings: Adecco (+1.1%), Credit Agricole (-0.5%), ING (-0.2%), Glencore (-5.9%) – with the latter narrowing its FY20 copper production guidance after reporting deteriorations in both revenue and adj. EBIT.

Top European News

- Merck KGaA Lifts Profit Outlook as Pandemic Seen Abating

- Pound Gains, Bonds Fall as Prospect of BOE Negative Rates Fades

- Lufthansa Rises as Airline Widens Job Cuts, Analysts Cite Beats

- Hammerson to Raise $1.1 Billion as Covid Hurts Malls

In FX, EUR/GBP – The cross has drifted back down towards 0.9000 following a much more pronounced Euro retreat from post-German data peaks relative to Sterling after a less pessimistic BoE near term outlook via the latest MPC minutes and MPR. Indeed, Eur/Usd has reversed sharply from 1.1915 to circa 1.1840, while Cable is holding firm on the 1.3100 handle between 1.3113-82 even though the Dollar has clawed back losses against most major counterparts and vs GOLD that has been instrumental in terms of the Greenback’s downfall. Back to the Pound, post-policy meeting comments from Governor Bailey underlined the message that NIRP remains under review and in the toolbox, but not currently on the agenda.

- DXY/NZD/CAD/AUD – Consolidation, short covering and a technical rebound may all be contributing to the broad Buck bounce after the index breached the prior ytd low, but held close to 92.500 at 92.495 in the run up to Friday’s jobs data. However, 93.000 is capping the recovery for now as US Treasury yields and the curve stabilises amidst dip and block buying after Wednesday’s post-Quarterly Refunding bear-steepening and a bumper NFP print could yet prompt renewed Dollar selling given the likely boost to overall risk sentiment. Nevertheless, the Loonie has pared gains from 1.3250+ towards 1.3300, Kiwi is back below 0.6650 and Aussie sub-0.7200 against the backdrop of retracements in crude and commodities.

- CHF/JPY – Both displaying degrees of resilience in the context of the aforementioned Greenback revival, as the Franc maintains 0.9100+ status and Yen stays comfortable afloat of 106.00 within a raft of hefty option expiries spanning 105.00 to 106.25 – for full details check out the headline feed at 7.30BST. Ahead, Japanese household spending data may provide some independent impetus for the Jpy before the monthly US labour report.

- SCANDI/EM – The Norwegian and Swedish Crowns have been undermined by waning risk appetite on top of the downturn in oil prices, with Eur/Nok and Eur/Sek hovering around 10.6400 and 10.3100 respectively even though the single currency remains well off early highs, but the Turkish Lira is plunging further below 7.0000 vs the Dollar and looks destined to revisit record lows (7.2690), at least, as the rout continues and some market participants speculate whether the CBRT is compliant if not complicit with Try depreciation as a means of addressing the country’s deteriorating finances having depleted reserves and approaching the limits of monetary easing. Conversely, a Rupee rebound after the RBI confounded consensus for a 25 bp rate cut and remained on hold, while the Czech Koruna is anticipating the CNB to stand pat later.

In commodities, WTI and Brent futures remain in the doldrums in early European trade as a firmer Dollar and subdued risk sentiment weighs on prices amid a lack of fresh fundamental catalysts for the complex, whilst analysts at JPM have trimmed their H2 2020 pol demand forecast by 1.5mln BPD – potentially on account of second wave woes. On the docket, traders will be eyeing the possible release of Saudi Aramco’s OSPs for September – which could come later this week or early next week according to sources. Expectations point towards an OSP cut to their flagship grade to Asia amid the easing of supply cuts from OPEC+. Elsewhere, spot gold ekes mild gains relative to recent performance and trades on either side of USD 2050/oz, whilst spot silver remains the outperformer, some analysts cite the sharp recovery in global industrial activities coupled with constrained mining activity as factors behind the rally. Finally, Shanghai base metals had. a session of firm gains with prices hitting multi-month highs – with Nickel prices closing higher by almost 3% after a key miner Philippines reimposed lockdown measures, whilst Dalian iron ore rose some 3% on a rosier Chinese steel demand outlook

US Event Calendar

- 7:30am: Challenger Job Cuts YoY, prior 305.5%

- 8:30am: Initial Jobless Claims, est. 1.4m, prior 1.43m; Continuing Claims, est. 16.9m, prior 17m

- 9:45am: Bloomberg Consumer Comfort, prior 44.3

via ZeroHedge News https://ift.tt/2EPjqpk Tyler Durden