Kodak Crashes 45% After Gov’t Loan Deal Placed On Hold After Recent Allegations

Tyler Durden

Mon, 08/10/2020 – 07:23

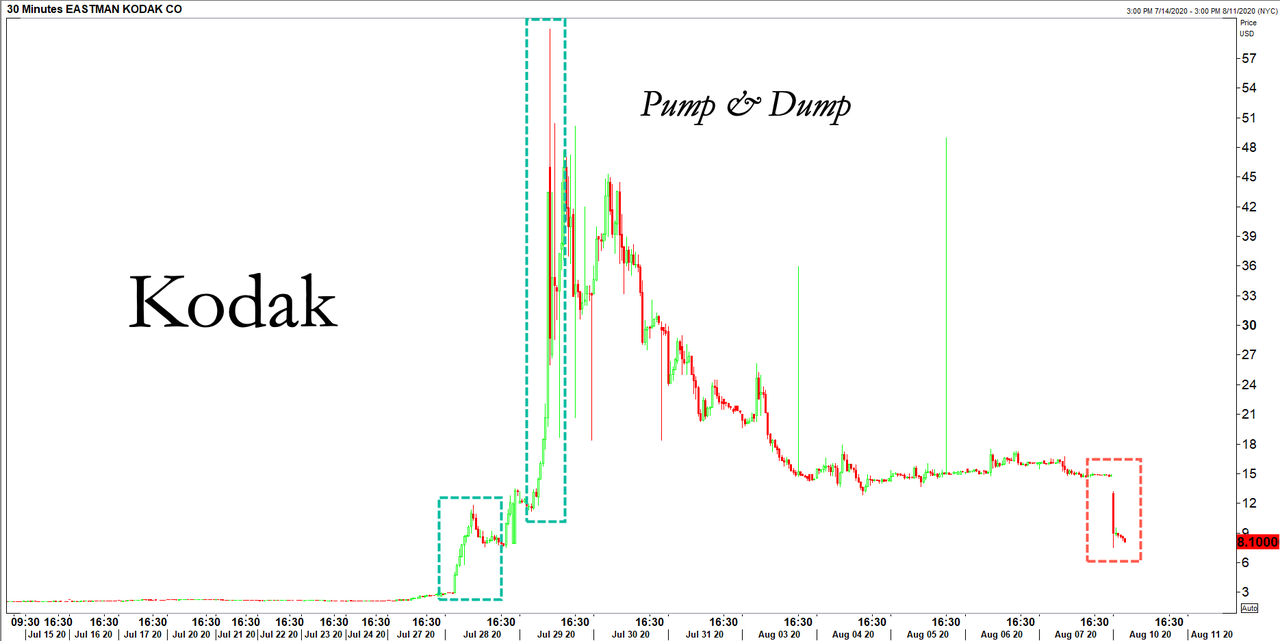

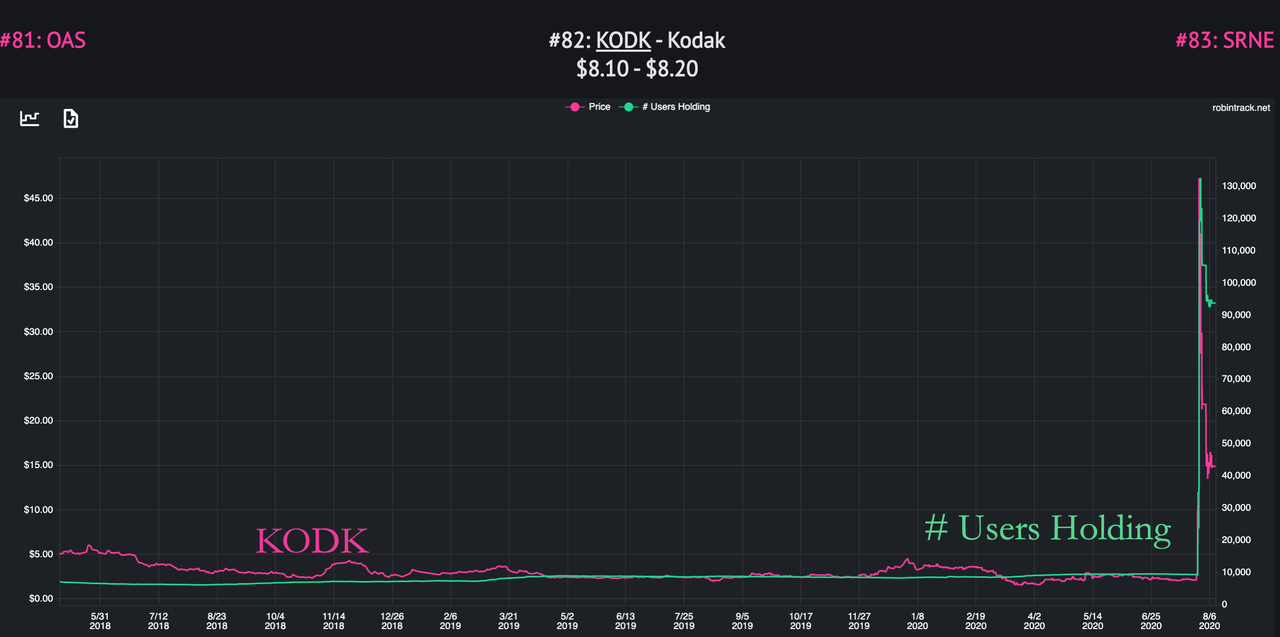

The top decliner in Monday pre-market trading is Eastman Kodak Co, plunging at least 45% to $8.10 after its $765-million loan agreement with the federal government to manufacture pharmaceutical ingredients was put on hold due to “recent allegations of wrongdoing.”

On Friday evening, the Development Finance Corporation (DFC) tweeted: “On July 28, we signed a Letter of Interest with Eastman Kodak. Recent allegations of wrongdoing raise serious concerns. We will not proceed any further unless these allegations are cleared.”

On July 28, we signed a Letter of Interest with Eastman Kodak. Recent allegations of wrongdoing raise serious concerns. We will not proceed any further unless these allegations are cleared.

— DFCgov (@DFCgov) August 7, 2020

In late July, Kodak shares soared more than 2,000%, from $2.80 to $60 per share in a matter of two trading sessions following the loan agreement with the government.

The Wall Street Journal reported over the weekend the Securities and Exchange Commission (SEC) is reviewing how the company controlled the disclosure of the loan.

The SEC will also examine stock options granted to management ahead of the release.

Several Democrat-led congressional committees have raised issues about Kodak’s “lack of pharmaceutical experience” because it’s a photography company. Democrats also want more transparency into why management was granted stock-options before the release that instantly became profitable.

More than 90,000 Robinhood traders own Kodak.

via ZeroHedge News https://ift.tt/30Lf0bP Tyler Durden