Latin American Economies Will See “Record-Breaking Contraction” This Year

Tyler Durden

Sat, 08/15/2020 – 07:35

With coronavirus cases surging in Latin America, there’s another issue emerging: A sharp economic downturn that may not result in recovery until late next year.

Alberto Ramos, head of Latin America economic research at Goldman Sachs, told CNBC Wednesday that the outlook for Latin American countries is “pretty uninspiring.”

“We expect to climb (out) of a very deep hole during the second half of the year and throughout 2021,” Ramos said, adding that countries such as Argentina, Peru, and Mexico are expected to record double-digit contractions in growth. He said other countries may experience slightly less severe declines but are “still a record-breaking contraction — at least the worst we’ve seen since the Second World War.”

Ramos explained inflation remains low on the continent, which would allow central banks to ease for a much longer timeframe to support faltering economies.

“The continuation of the low growth environment can be socially and politically destabilizing and also undermine the credibility of the institutions,” he warned.

When Latin America emerges out of the pandemic if that is late next year or after, there will be wider wealth inequality, fiscal crises among governments, and more social and political polarization.

Already, Argentina has had to strike a deal with creditors after the third default in two decades.

The culprit to this depressing economic outlook, as readers may know, is the COVID-19 pandemic, has transformed several countries in the region into virus hotspots, like Brazil, Mexico, Peru, Colombia, and Chile.

Even before the virus, many countries in Latin America had ailing economies, massive debt loads, and were battered by sluggish commodity prices:

“Latin America has not been doing well over the last half-decade,” said Jerry Haar, an international business professor at Florida International University. “This is like a kick to the groin to someone who already has a double hernia.”

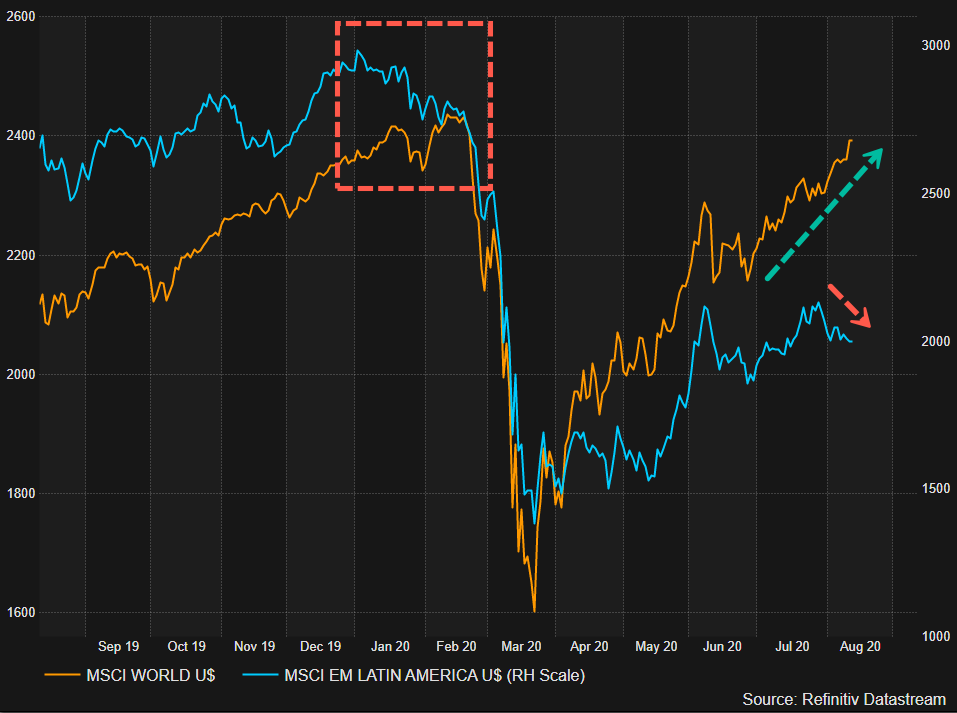

MSCI Emerging Markets Latin America Index remains in a bear market, down 38% from its peak in 4Q17. The index started to plunge in late January, sank 53% during the pandemic, has since had an underwhelming recovery.

MSCI Latin America lags behind the MSCI World Index.

Calls for a “debt jubilee” in emerging market economies continue to soar this year.

via ZeroHedge News https://ift.tt/2E7fHD8 Tyler Durden