Nearly A Third Of Americans Had Unpaid Housing Bills In August

Tyler Durden

Fri, 08/14/2020 – 19:40

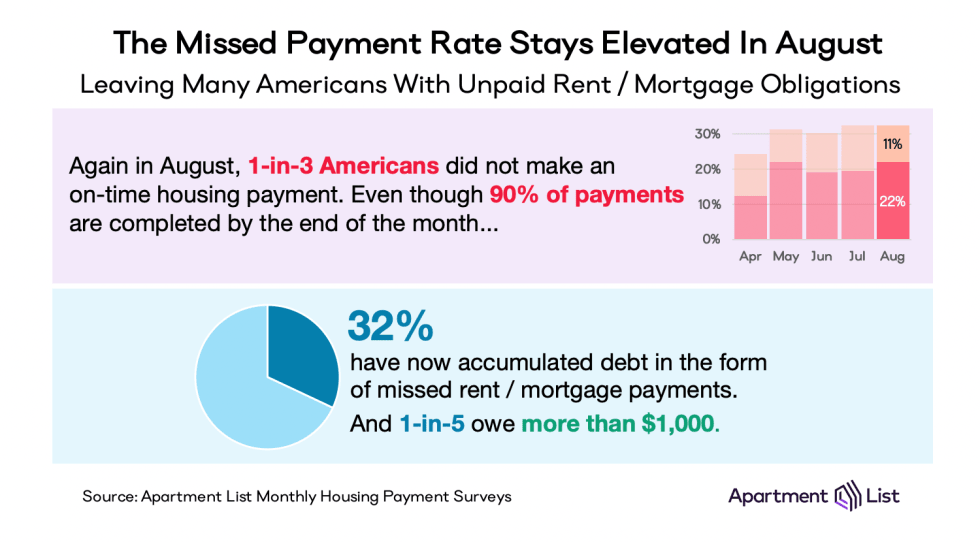

Nearly a third of Americans for the fourth consecutive month failed to pay rent or mortgage payments in full. Personal finances of millions of folks have quickly deteriorated through summer. Unpaid housing bills are mounting as the virus-induced downturn continues to unleash the worst employment crisis since the Great Depression of the 1930s.

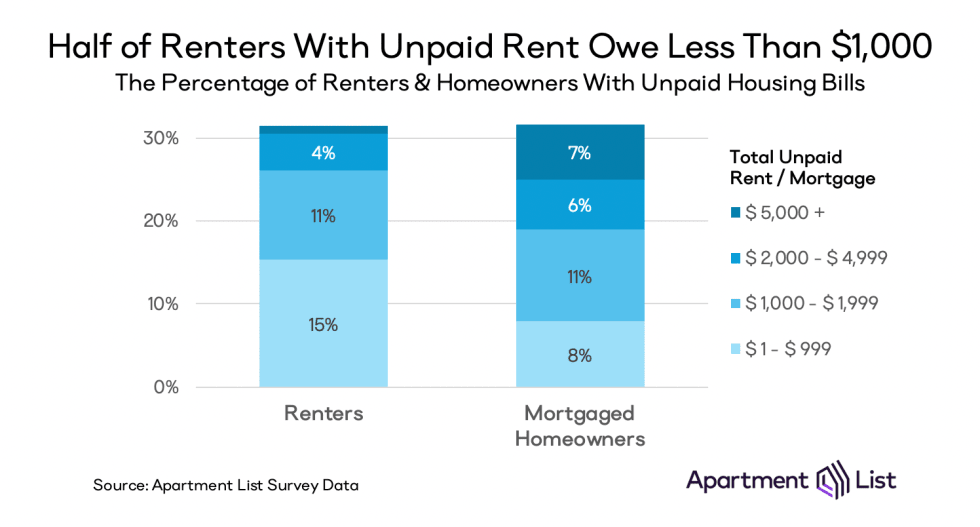

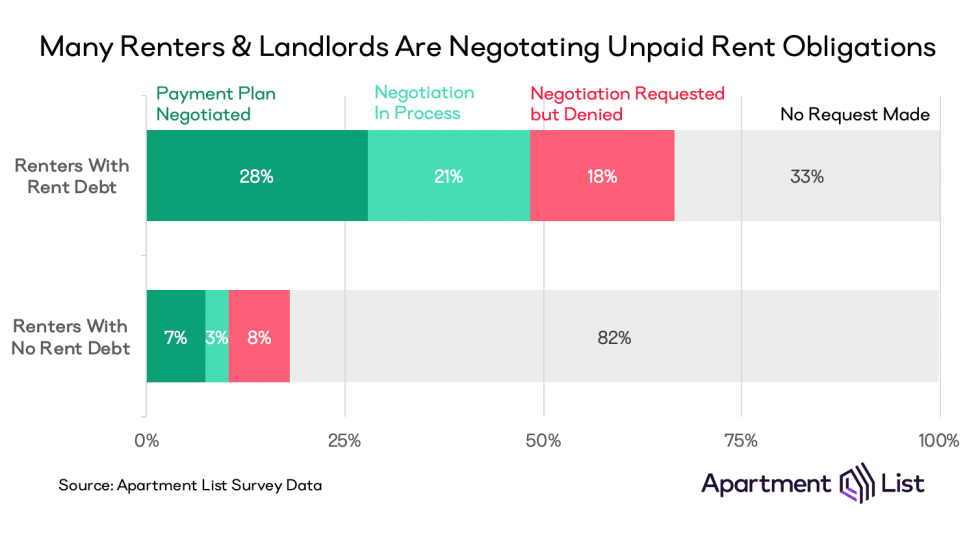

A new survey via Apartment List, an online rental platform, found 32% of renters (and homeowners) entered August with unpaid housing bills. At least 20% of respondents owed more than $1,000. Among renters with back rent due, 49% have renegotiated lease agreements with their landlords or are doing so.

Here’s the percentage of renters and homeowners with unpaid housing bills.

Renters and landlords are renegotiating lease agreements over unpaid rent obligations.

“As the pandemic rages on, missed housing payments are continuing to pile up. For the fourth straight month, we found that roughly one-in-three Americans failed to make their full rent or mortgage payment in the first week of the month,” Apartment List said.

The website added, “many of the protections and benefits put in place at the outset of the pandemic are now expiring, and the prospects for another round of stimulus remain uncertain. As unpaid housing debt builds, concerns around eviction and foreclosure are mounting. Although landlords and lenders are showing a willingness to negotiate, housing security is currently in jeopardy for an unprecedented number of Americans.”

The survey (of about 4,000 people) sheds more light on the finances of the average American has rapidly deteriorated over the summer with deep economic scarring realized as depressionary unemployment levels risks derailing the economic recovery.

Even before the virus-induced recession, the bottom 90% of Americans had insurmountable debts and limited savings. As soon as the mass layoffs hit in late March, tens of millions of folks saw their incomes quickly evaporate, unable to service bills, buy food, or like we’re focusing on this piece, pay rent, or mortgage payments.

The Trump administration quickly responded to this distress by handing out $600 per week stimulus checks, imposing an eviction moratorium, and allowing homeowners to defer mortgage payments in a forbearance program.

At the moment, a quarter of all household income is derived from the government.

So when stimulus checks stopped on July 31, and the eviction moratorium expired a couple of weeks ago, this means millions of Americans are greatly suffering in August.

With no timeline on the next round of stimulus, and or even if the rent eviction moratorium will be reimposed, the poor financial health of Americans doesn’t lend credibility a V-shaped recovery will be seen this year.

via ZeroHedge News https://ift.tt/3atcKsE Tyler Durden