Peak Schizophrenia: Wall Street Turns Extremely Bullish Just As It Finds All Assets Overvalued Most Ever

Tyler Durden

Tue, 08/18/2020 – 10:57

In addition to manipulating what was once a “market” and is now simply a political tool, the Federal Reserve has also proven itself to be the best manipulator of investor psychology, because after it relentlessly ramped stocks since their March lows to a new all time high hit moments ago, the bears have well and fully capitulated as the latest Bank of America fund manager survey funds.

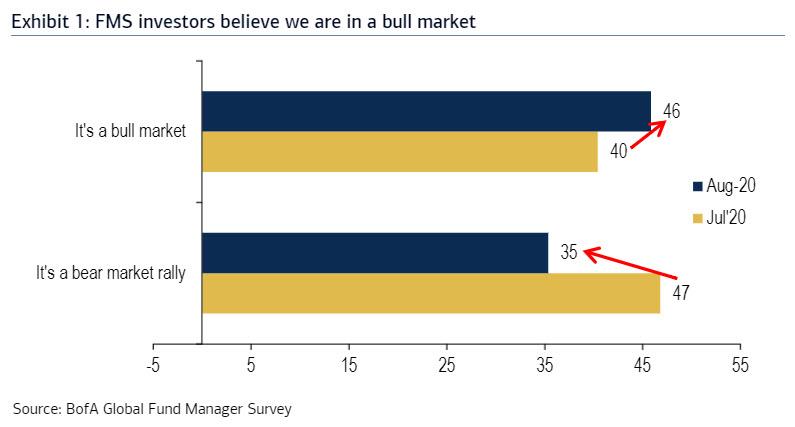

According to BofA CIO Michael Hartnett, who just concluded the August Global Fund Manager survey which polled 181 participants with $489 billion in AUM, a majority of professional investors say it’s no longer a “bear market rally” contrary to the prevailing view since the March lows...

… and in a world where “the price is right” – all thanks to the Fed of course – they now expect higher growth with (net 79%, the highest since Dec’09)…

… profits & inflation…

… expect a COVID-19 vaccine announcement early Q1’21, all of which is inflationary and yet the same group of “professionals” also believe the 10-year Treasury yield will be below 0.5% by year-end which would be a deflationary supernova. So just the typical schizophrenic contradictions we have grown to expect from the monthly BofA survey.

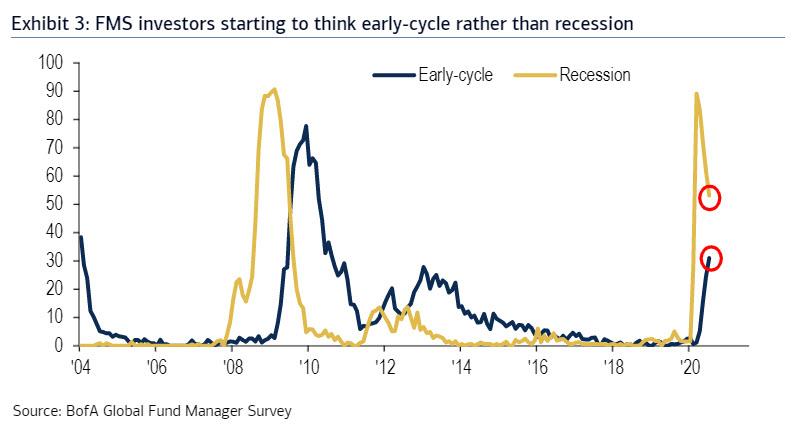

What is most remarkable however is that by pumping $80BN into the market every month without stopping, the Fed has managed to shift the prevailing consensus from “it’s a recession” to this is actually an “early cycle”; indeed in the last survey, only 53% believe in the former, while a whopping 31% believe in the latter, the most since the financial crisis.

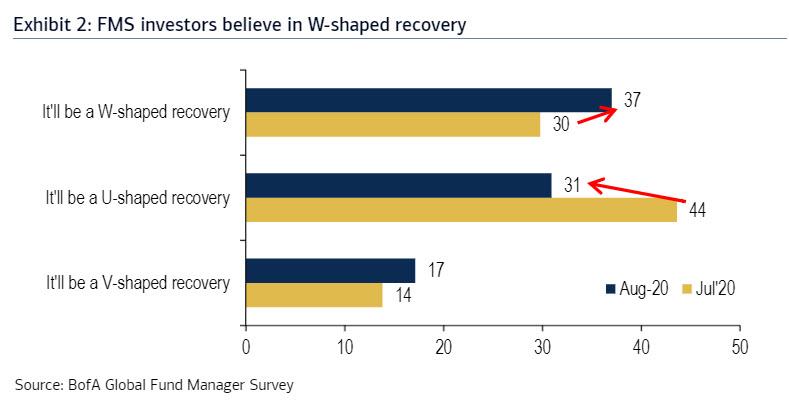

That said, not everyone has gotten the Men In Black market neuralyzer treatment, and while bullish sentiment now prevails, a tiny minority (17%) now expect a V-shaped recovery, many expect W-shape (37%) or U-shape (31%).

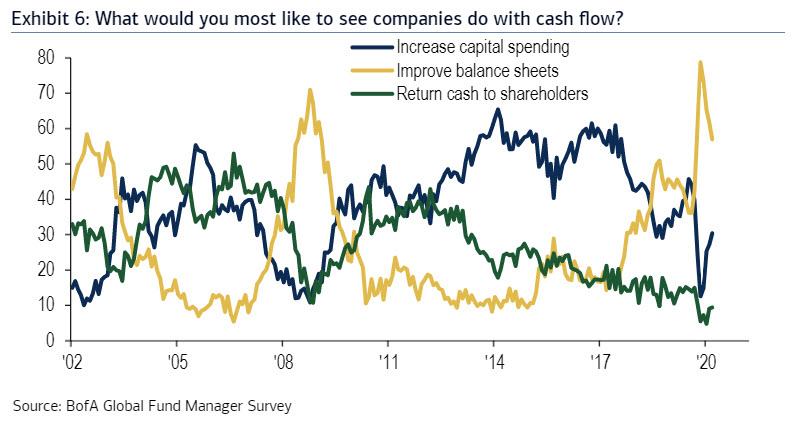

At the same time CIO’s want CEO’s to reduce debt (57%) not expand capex (30%), with almost nobody demanding with buybacks and dividends, and why should they: stocks are already at all time highs thanks to the Fed buying everything so who needs buybacks.

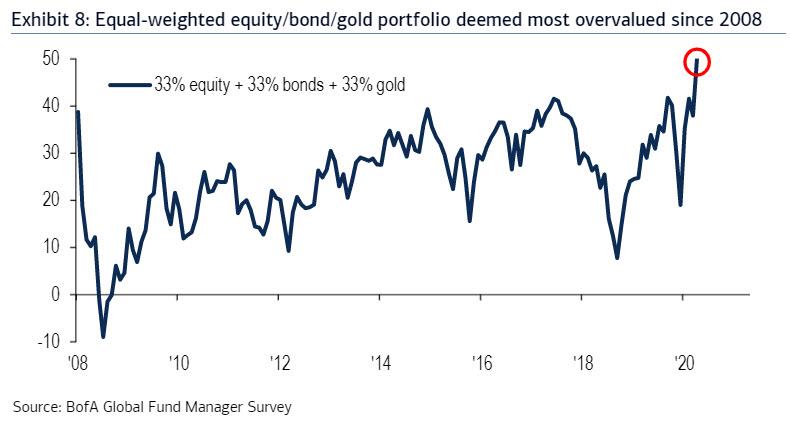

And the punchline of this latest entry in the annals of Wall Street schizophrenia is that even as they rush back into stocks, these so-called professional investors believe that all assets (stocks/bonds/gold) most overvalued since 2008…

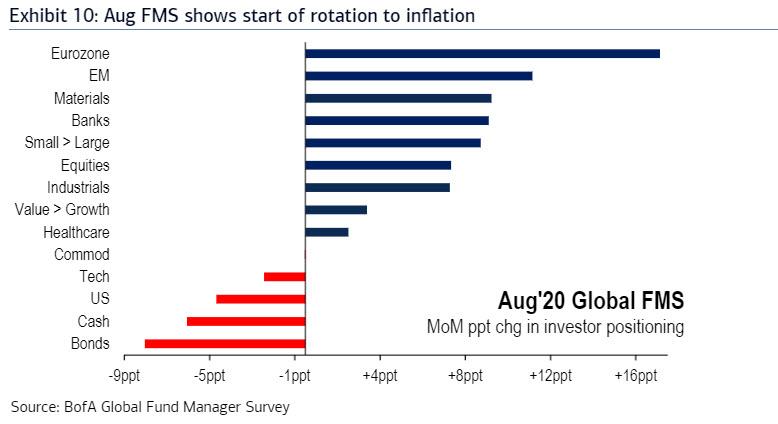

… and while they expect nominal yields to drop to all time lows, they are – a BofA notes – rotating into inflation assets: Europe & EM stocks (US$ debasement theme), banks, small cap & value stock.

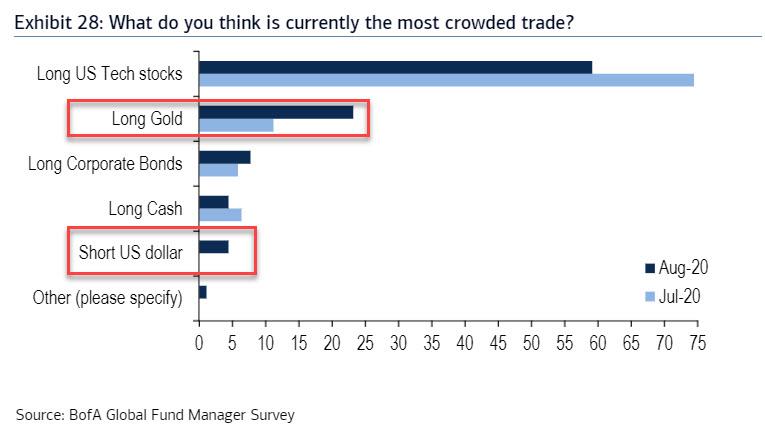

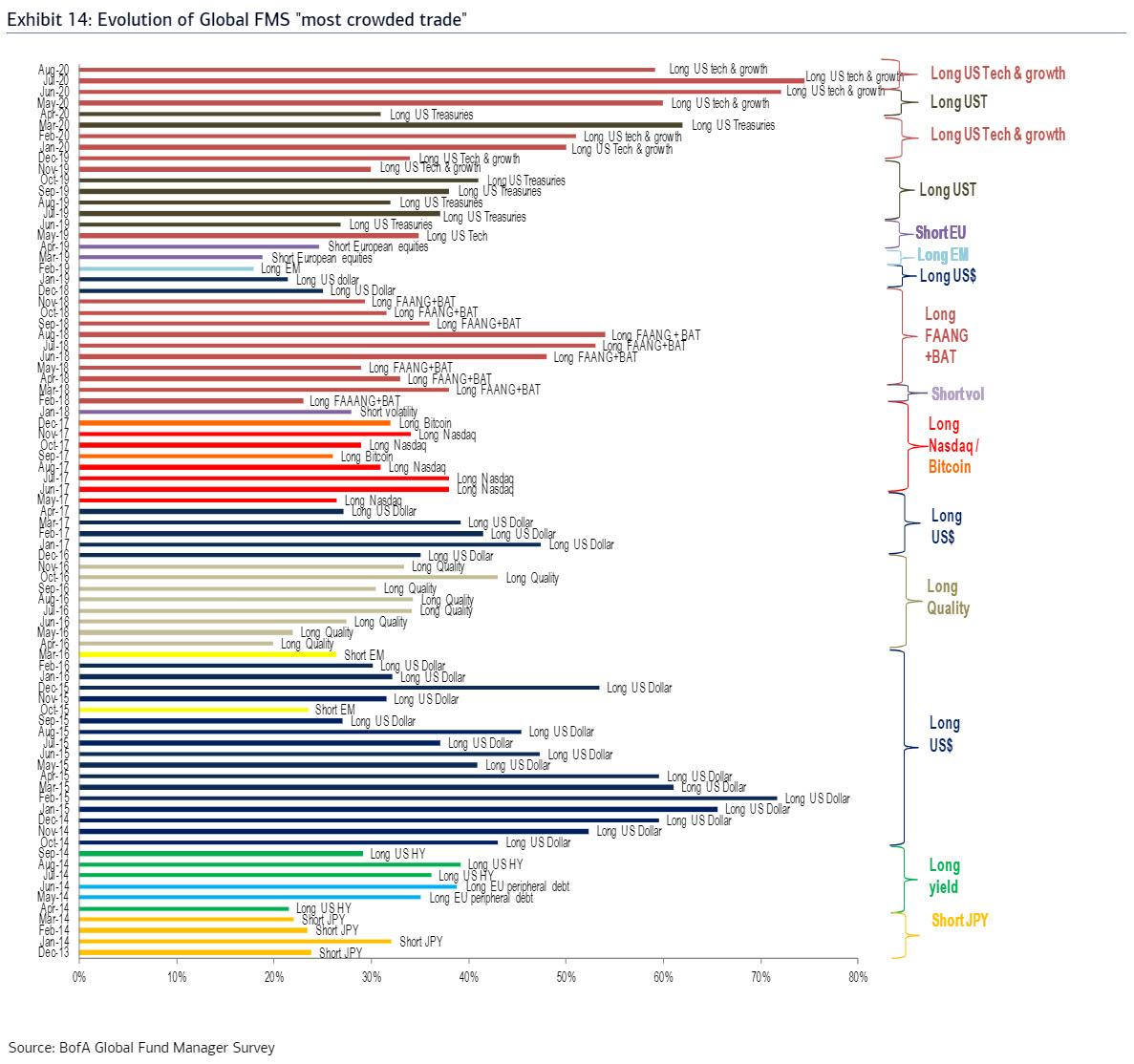

Some other observations: FMS investors say long US tech (59%) most crowded trade…

… then long gold (23%), corporate bonds (8%) even though we expect that short USD 4% will be next month’s most popular trade as we noted over the weekend…

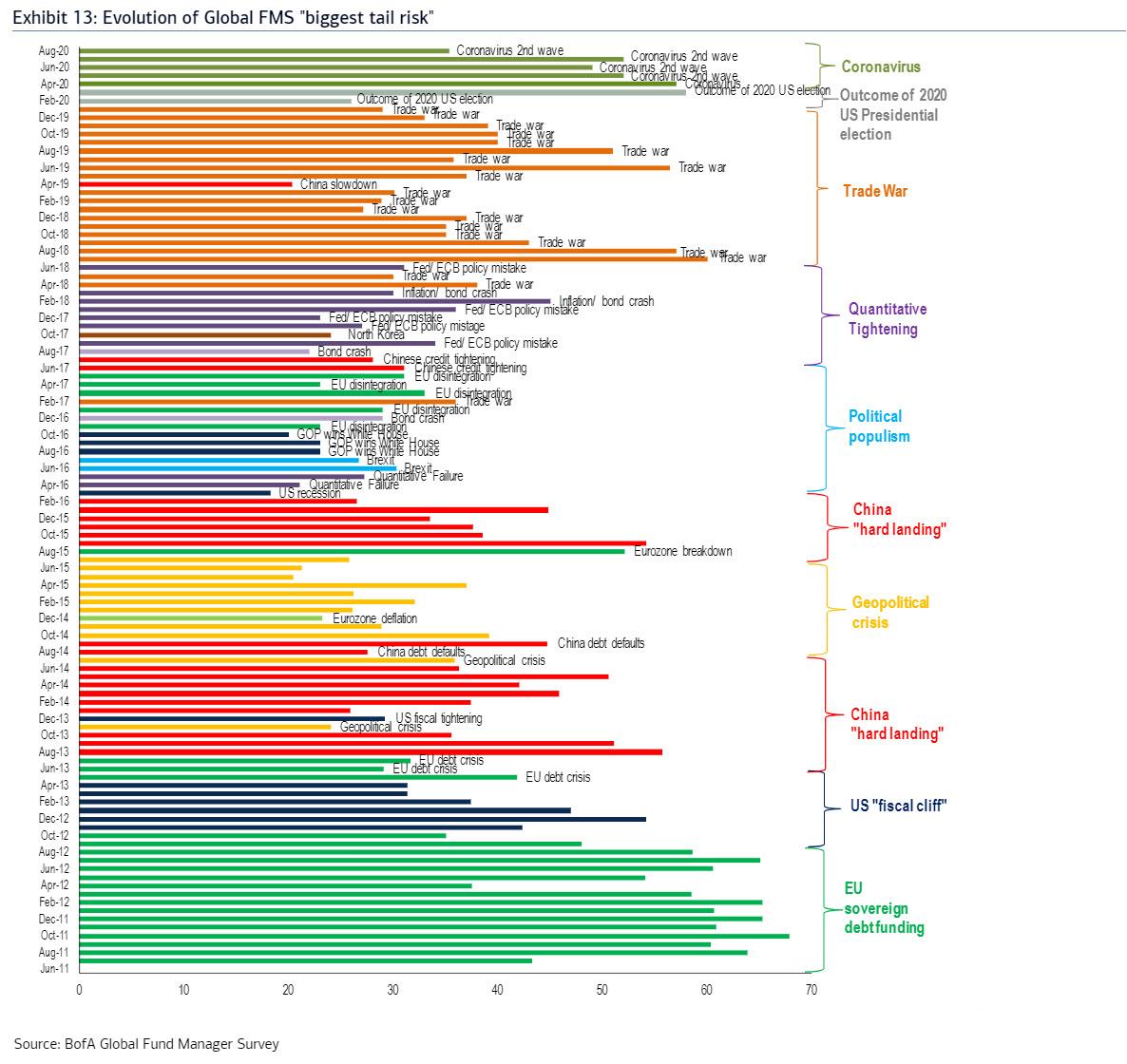

… while top tail risks are COVID-19 second wave (35%), followed by US-China trade war (19%) & US election (14%).

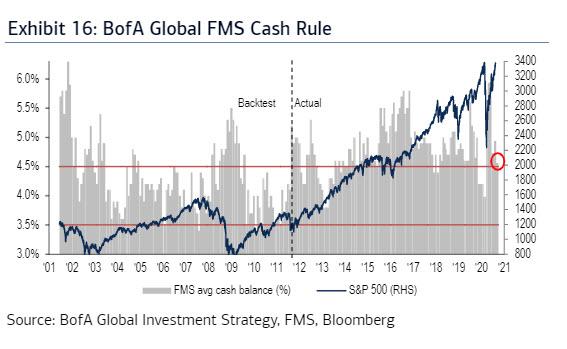

Putting the August survey in context, Hartnett summarizes that this was the most bullish FMS since Feb’20, but he does not think “positioning is dangerously bullish” as FMS cash levels down to 4.6% but in neutral range (<4% = greed, >5% = fear)…

… and the BofA Bull & Bear Indicator up to 3.7, far from excess bullish.

As a result, asset allocation is stubbornly skewed toward US growth stocks; but Aug FMS shows “green shoots” for “inflation assets”…rotation to Europe & EM stocks ($-debasement theme), banks, small cap & value stocks.

FMS contrarian trades: risk-on vaccine & higher rates = cyclical rotation best played via long small cap value, short tech; risk-off political volatility (roughly 70% think flip of US Senate is risk-off) best played via short healthcare stocks.

via ZeroHedge News https://ift.tt/2EhonXD Tyler Durden