US Housing Starts, Permits Explode Higher In July With Builder Sentiment At Record

Tyler Durden

Tue, 08/18/2020 – 08:40

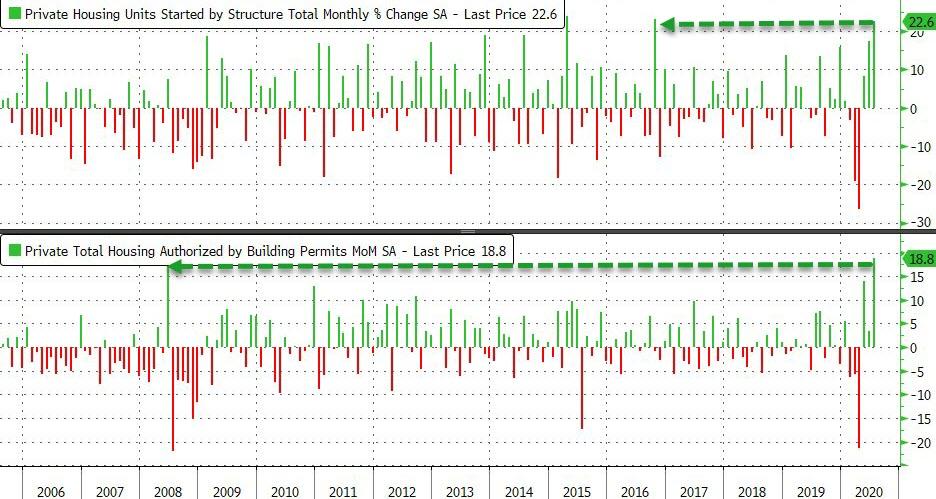

After screaming higher in May and June (after a 3-month collapse), Housing Starts’ rebound was expected to slow drastically in July (while Building Permits were expected to re-accelerate after a disappointing slowdown in June.

However, the analysts could not have been more wrong as both starts and permits exploded higher in July (up 22.6% vs +5% exp, and 18.8% vs +5.4% exp respectively)…

This is the biggest MoM rise in permits since June 2008 (that didn’t end well) and biggest MoM rise in starts since Oct 2016…

Source: Bloomberg

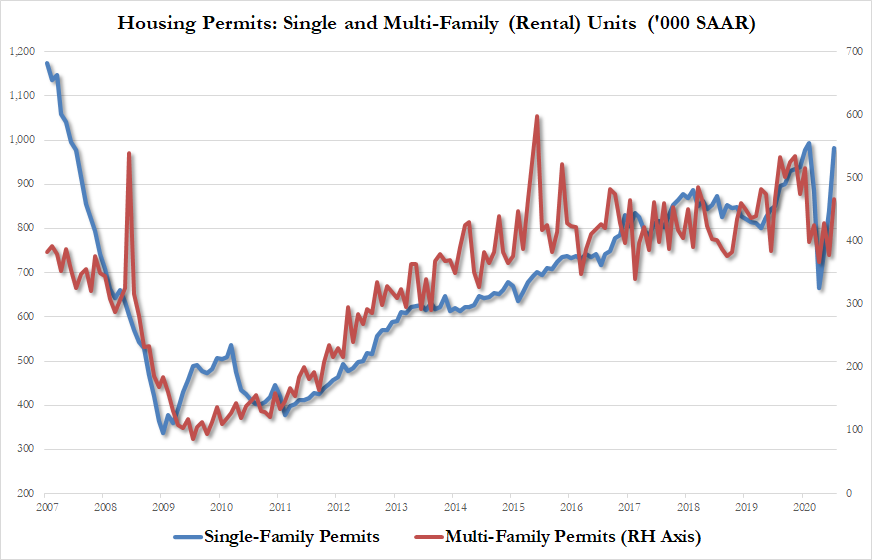

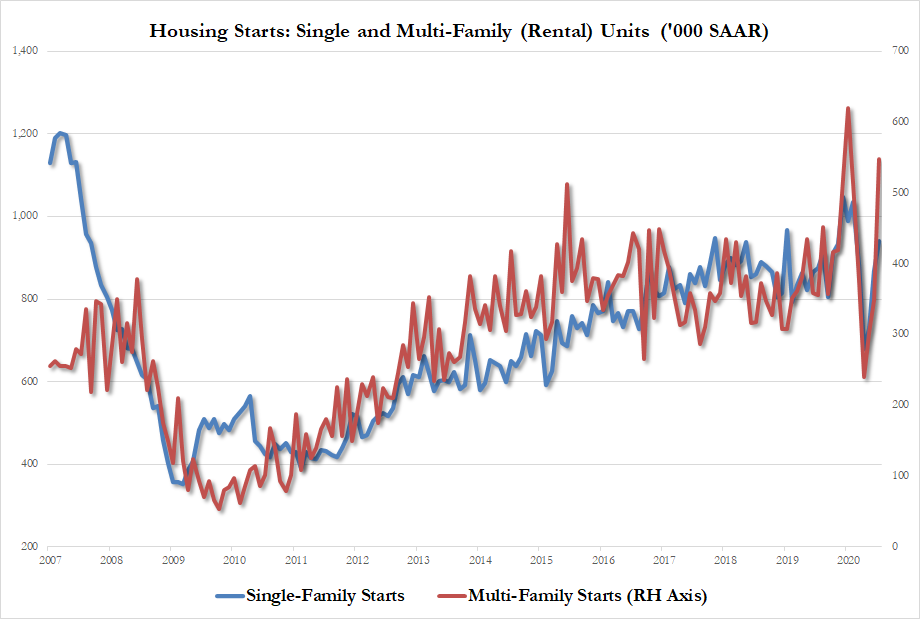

Multi-family Permits surged from 378k SAAR to 467k and single-family permits exploded from 840k SAAR to 983k SAAR (just shy of the record 999k SAAR in Feb 2020)…

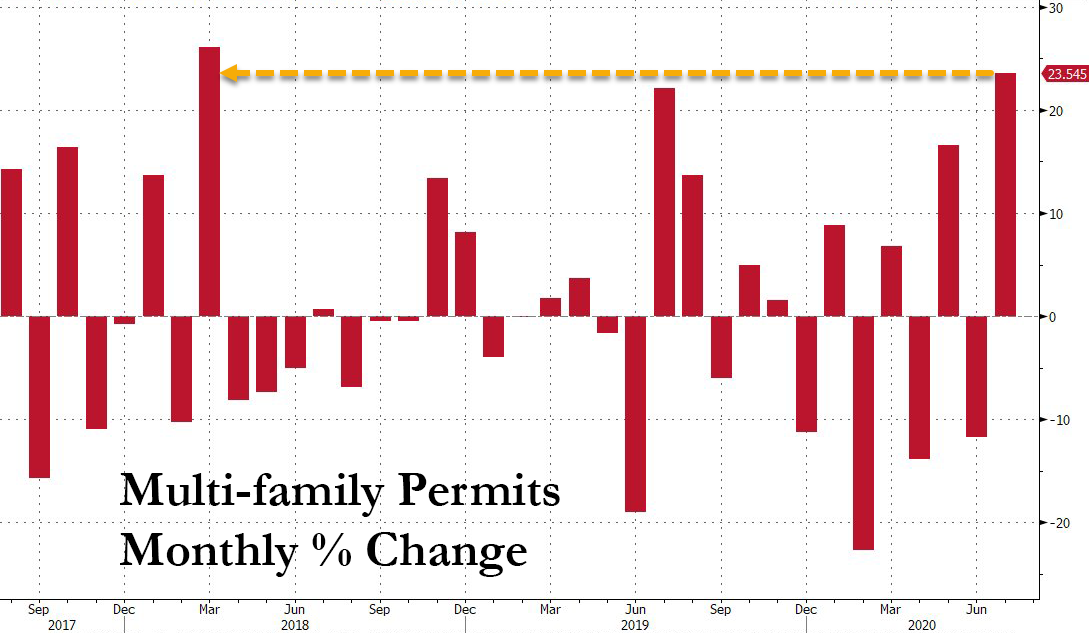

This is the biggest MoM rise in multi-family permits since March 2018..

Source: Bloomberg

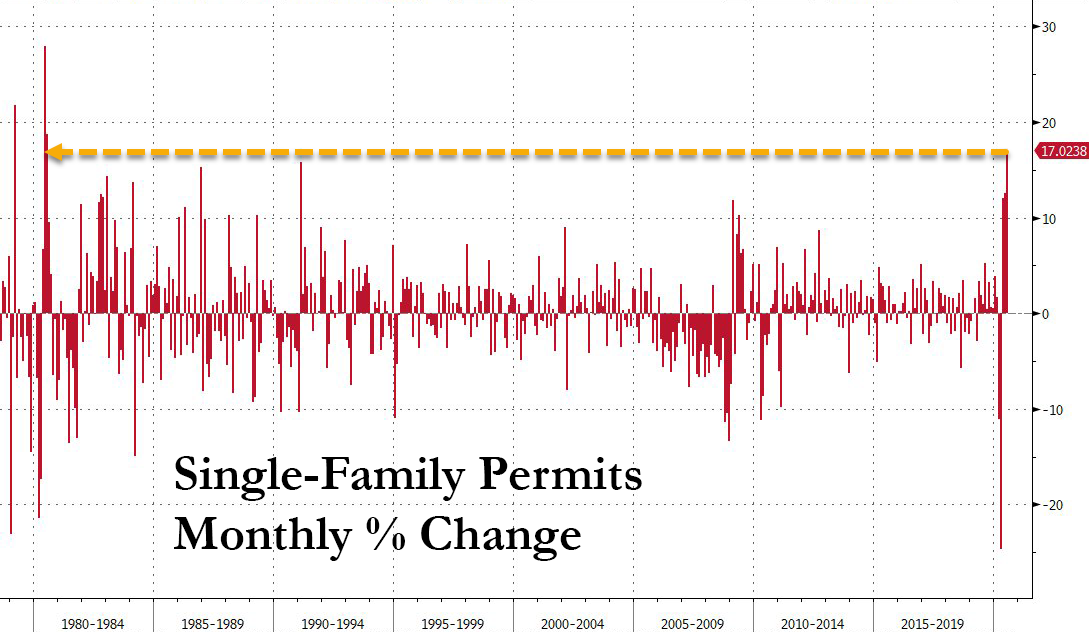

And the biggest jump in single-family permits since July 1980…

Source: Bloomberg

Multi-family Starts screamed higher from 349k SAAR to its second-highest ever at 547k SAAR (and single-family starts rose from 869k SAAR to 940kl SAAR)…

Bottom line: The permits surge was much higher in single-family which makes sense with rents tumbling… but the surge in starts was led by multi-family units.

The real ‘V’ is soaring as fast as homebuilder sentiment…

Source: Bloomberg

But sentiment among buyers appears decoupled still from that of the builders…

Source: Bloomberg

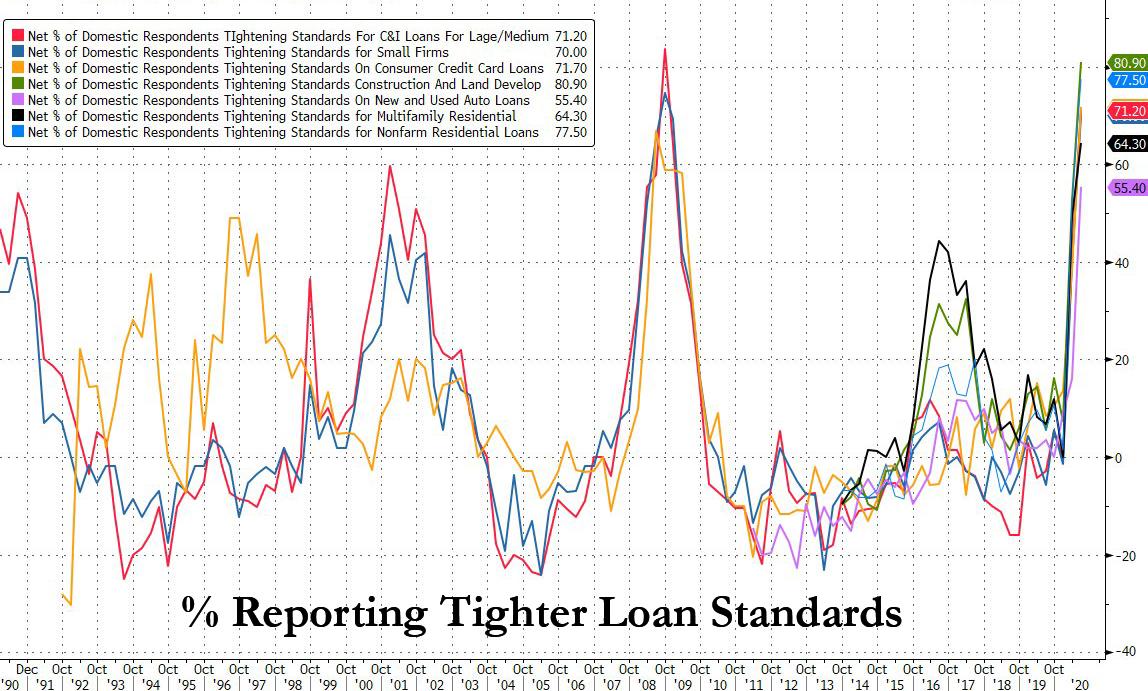

If we build they will come… despite tightening mortgage loan standards and depression-era unemployment?

As we previously details, the loan standards for most products – such as C&I loans, residential mortgages and credit cards – were hiked so much they nearly matched the standards during the financial crisis when it was virtually impossible to get any new loans.

This was the second quarter in a row in which loan officers reported sharply tighter financial conditions.

via ZeroHedge News https://ift.tt/3ayaOzc Tyler Durden