Only 7 States Have Signed Up For $300 Unemployment Stimulus As Businesses Warn They Won’t Participate In Payroll Tax Plan

Tyler Durden

Tue, 08/18/2020 – 20:25

With Congress still deadlocked over Phase 4 of the fiscal stimulus – despite a report that Nancy Pelosi was getting closer to the Republican bid of $1 trillion as she was willing to cut the Democrat ask “in half” to reach a deal – according to an update from FEMA, only 7 states, Colorado, Missouri, Utah, Arizona, Iowa, Louisiana and New Mexico, have signed up with FEMA so far to access the additional $300 weekly stimulus for those receiving unemployment benefits under Trump’s Aug 8 Executive Order. Using initial claims data, this accounts for only 6% of Americans receiving unemployment insurance, which means that more than 90% are currently ineligible for the emergency stimulus.

And while more states are expected to continue to sign up, the process will be lagged which will result in delayed payments.

What is interesting, as Citi economists have speculated, is whether states that did not apply to FEMA will end up seeing their unemployment rates fall faster, in other words, will it turn out to be the case that unemployment rate is higher than it would be without the stimulus because some individuals are making more not working?

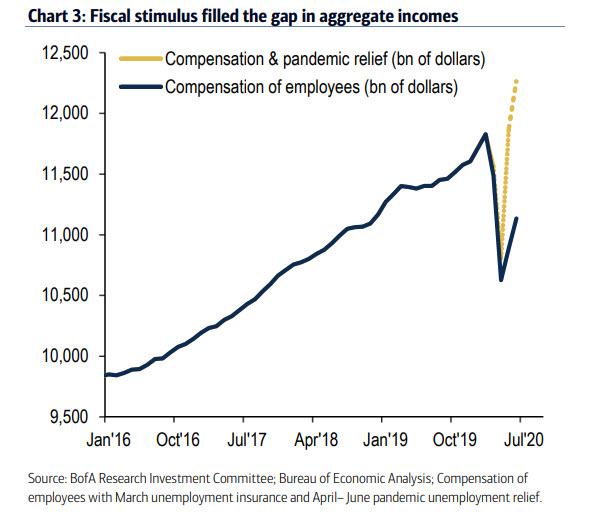

That said, it is concerning that the single biggest boost to the US consumer which buoyed the economy for much of the past three months – federal stimulus for the unemployed…

… is being delayed both through FEMA but also through Congress not moving on Phase 4.

Meanwhile, in another major setback for Trump’s attempt to single-handedly carry the economy through to the Nov 3 finish line without Congress, a coalition of big-name business groups warned that many employers won’t participate in President Trump’s payroll tax deferral plan.

Calling it “unworkable,” they said in a letter Tuesday to Treasury Secretary Steven Mnuchin that it risks saddling their workers with large postponed tax bills they could have trouble paying back. According to the coalition, someone earning $35,000 would see their biweekly pay go up by $83 this year, the groups wrote, but would owe $751 next year. People earning $75,000 would see a $178-per-paycheck bump now, but would face a $1,609 tax bill next year.

The coalition did has a proposal how to “fix” this: fully suspend the payroll tax so it is not due at some point in the future, to wit: “If this were a suspension of the payroll tax so that employees were not forced to pay it back later, implementation would be less challenging.”

However since this is unlikely, the U.S. Chamber of Commerce, National Retail Federation, National Association of Realtors, and the National Association of Manufacturers, among others, all urged policymakers to instead to return to negotiating over a stalled coronavirus relief package in Congress.

“Many of our members consider it unfair to employees to make a decision that would force a big tax bill on them next year,” they said. “It would also be unworkable to implement a system where employees make this decision.”

“Therefore, many of our members will likely decline to implement deferral.”

The letter came as the department races to fill in the details of Trump’s presidential memorandum, issued 10 days ago. As Politico notes, “frustrated with gridlock in Congress, and hoping to boost the economy before the November elections, the president postponed until next year the deadline for paying the workers’ half of the 12.4 percent Social Security tax. Trump doesn’t have the power to eliminate the levy — only Congress can do that — but he’s betting lawmakers will eventually step in and waive the tax bill.”

However, many businesses are apprehensive about the plan, in part because it comes with some financial risk to them. They could potentially be on the hook for paying back deferred taxes for workers who later quit, for example. It would also likely be difficult to administer.

“We hope Congress and the administration come together on a path that supports workers instead of burdening hardworking Americans with a large tax bill next year,” the business groups wrote.

In other words, despite Trump’s victory lap over the reduced unemployment benefits and the payroll tax order, it now appears that neither of these approaches to stimulate the economy will have a tangible impact, leaving the ball once again squarely in Congress’ court, where Democrats will be happy to do nothing until Nov 3 if that means an economic trapdoor opens in the coming weeks, sparking a fresh wave of mass layoffs, and makes Trump’s re-election impossible.

via ZeroHedge News https://ift.tt/3h8zroE Tyler Durden