Futures Tumble, Dollar Soars After European PMIs Slump, Putting Recovery In Doubt

Tyler Durden

Fri, 08/21/2020 – 08:06

US stock index futures dropped, tracking European markets a day after the tech-heavy Nasdaq closed at a record high, as optimism in a virus-vaccine breakthrough and faith in the record tech rally was challenged by concerns over an unexpected frop in Eurozone PMIs which put the biggest recovery narrative in recent months in doubt.

Among US stocks, Deere & Co rose 4.5% premarket after it revised up its full-year earnings forecast and reported a smaller-than-expected decline in quarterly profit. Pfizer rose 1.5% after reporting positive additional data from an early-stage study of its experimental coronavirus vaccine being developed in collaboration with German biotech firm BioNTech. U.S.-listed shares of BioNTech jumped 8.1%. Tesla gained another 1.8% after surging past the $2,000 mark on Thursday for the first time and extending its rally ahead of an upcoming share split.

US stocks finished higher on Thursday as investors continued to bet on tech heavyweights including Apple and Amazon.com to ride out the pandemic as U.S. data painted a picture of a wobbly economic recovery. However the market’s bad breadth is getting extremely narrow: yesterday stocks closed green even though 70% of all companies closed in the red.

U.S. tech darlings “continue to mask the broader concerns spearheading an end-of-week rally,” said Nema Ramkhelawan-Bhana, head of research at Johannesburg-based Rand Merchant Bank. “Wider credit spreads and bond bidding suggest an air of nervousness is starting to creep in.”

Joe Biden accepted his party’s nomination Thursday to challenge President Donald Trump in a speech that cast November’s election as not merely the choice of a president but a fundamental referendum on the nation’s character.

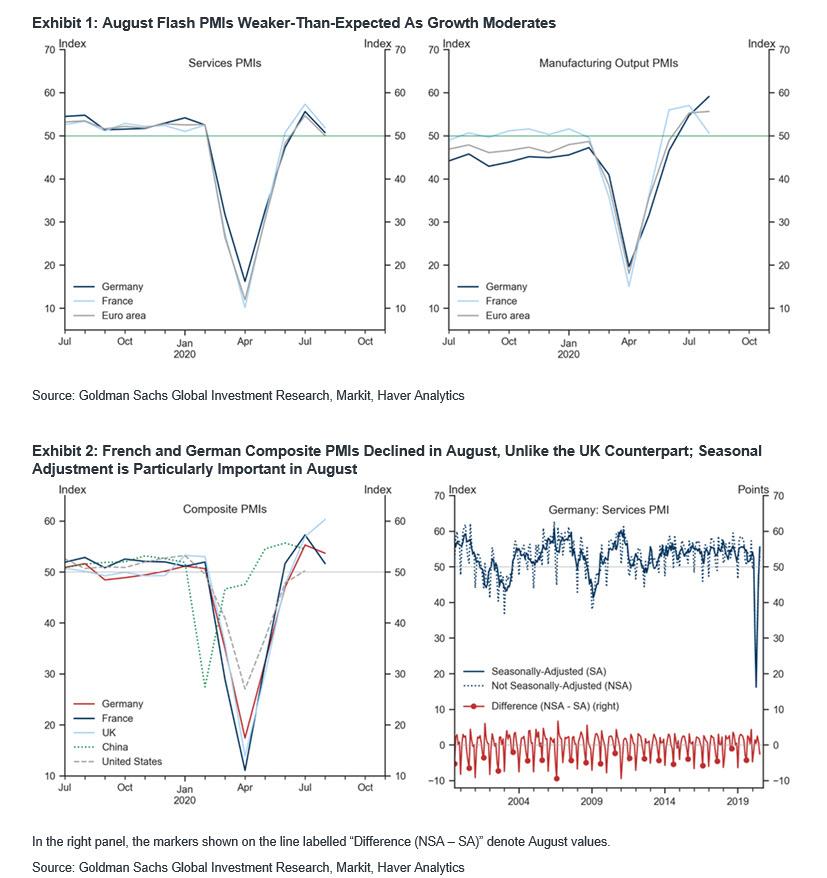

European stocks and the euro slumped after European PMI composite readings unexpectedly declined in August from July, missing expectations even as U.K. data was materially stronger (UK flash composite PMI 60.3 vs 57; est. 56.9). Job losses were a notable feature of the surveys.

As Goldman writes, after a record, better-than-expected cumulative improvement of 41.2pt over May-July, the Euro area composite PMI declined by 3.3pt to 51.6 in August, notably below expectations. The overall decline was heavily skewed towards the service sector, with the manufacturing PMI little changed from July. Across countries, the German and French composite PMIs were also weaker than expected, with the sequential weakening in France broad-based across sectors but solely concentrated in services in Germany. The implicit decline in the composite PMI outside of France and Germany was only marginally smaller than the decline in the Franco-German composite PMI. The weakening in the PMIs suggests that the pace of sequential growth has moderated as the gap in the level of activity relative to pre-Covid narrows (consistent with high-frequency activity indicators):

- Euro Area Composite PMI (August, Flash): 51.6, consensus 55.0, last 54.9.

- Euro Area Manufacturing PMI (August, Flash): 51.7, consensus 52.7, last 51.8.

- Euro Area Services PMI (August, Flash): 50.1, consensus 54.5, last 54.7.

- Germany Composite PMI (August, Flash): 53.7, consensus 55.0, last 55.3.

- France Composite PMI (August, Flash): 51.7, consensus 57.0, last 57.3.

The broader miss was led by France whose manufacturing PMI unexpectedly dropped in August after a two-month rebound. The sharp fall put in doubt the country’s recovery and led to a decline in the euro. Meanwhile Germany’s recovery also lost momentum, with mixed PMI figures. PMI for services declined while manufacturing continued to improve

Earlier in the session, Asian stocks gained, led by communications and IT, after falling in the last session. Most markets in the region were up, with Taiwan’s Taiex Index gaining 2% and South Korea’s Kospi Index rising 1.3%, while Australia’s S&P/ASX 200 dropped 0.1%. The Topix gained 0.3%, with Fujikyu and TSUNAGU GROUP HOLDINGS I rising the most. The Shanghai Composite Index rose 0.5%, with Whirlpool China and Ningbo Jifeng Auto Parts posting the biggest advances.

Earlier this week, the S&P 500 clinched a record high, recouping the last of its losses caused by the coronavirus-driven slump and joining the Nasdaq in notching new highs even as investors remained on edge over a stalemate in talks between House Democrats and the White House over the next coronavirus aid bill as about 28 million Americans continued to collect unemployment checks. There was some hope that a deal would be reached tomorrow when a $25BN post office spending proposal is considered.

In FX, the dollar gained against a basket of its peers largely thanks to a sharp drop in the Euro which reversed an early gain that came at the back of hopes over a coronavirus vaccine after the latest PMI data challenged the narrative that euro area growth will outperform the US; the EURUSD slumped after data showed French manufacturing unexpectedly contracted in August after a two- month rebound; German and euro area data also missed expectations. The common currency retreated as much as 0.6% to 1.1780.

The euro poised for first weekly drop in nine; interbank desks fade the dip given Thursday’s rebound after 21-DMA support held, yet short-term traders look for a move toward 1.1750, three traders in Europe said.

The offshore yuan rose to its strongest level in seven months against the dollar, as China’s economic and market rebound from the pandemic has proved one of the world’s fastest.

Elsewhere, Turkey’s lira gained amid speculation President Recep Tayyip Erdogan will announce a major Turkish energy discovery in the Black Sea later Friday.

In rates, Treasuries advanced while European bond yields were flat to 1bp lower across the curves; the 10Y Treasury yield dropped -3bp to 0.6282%, flattening the 2s-10s curve. German 2-yr, 10-yr yields 1bp lower.

In commodities, Brent ($44.72) and WTI ($42.57) traded lower but were on track for a third weekly gain in New York trading. Gold slumped to $1920 as the dollar surged.

Looking ahead, expected data include PMIs and existing home sales. Deere is reporting earnings

Market Snapshot

- S&P 500 futures little changed at 3,380.00

- MXAP up 0.8% to 170.76

- MXAPJ up 0.9% to 562.42

- Nikkei up 0.2% to 22,920.30

- Topix up 0.3% to 1,604.06

- Hang Seng Index up 1.3% to 25,113.84

- Shanghai Composite up 0.5% to 3,380.68

- Sensex up 0.8% to 38,515.19

- Australia S&P/ASX 200 down 0.1% to 6,111.18

- Kospi up 1.3% to 2,304.59

- STOXX Europe 600 up 0.3% to 366.72

- German 10Y yield fell 1.1 bps to -0.507%

- Euro down 0.4% to $1.1813

- Italian 10Y yield unchanged at 0.789%

- Spanish 10Y yield fell 0.2 bps to 0.289%

- Brent futures down 0.7% to $44.59/bbl

- Gold spot down 0.8% to $1,932.61

- U.S. Dollar Index up 0.2% to 92.98

Top US News from Bloomberg

- France’s manufacturing PMI unexpectedly dropped in August after a two-month rebound. The sharp fall put in doubt the country’s recovery and led to a decline in the euro. Meanwhile Germany’s recovery lost momentum, with mixed PMI figures. PMI for services declined while manufacturing continued to improve

- Composite PMI fell below estimates in the euro-area.

- The U.K. economy rebounded to a seven-year high, with composite PMI performing better than expected, while retail sales for July beat estimates, pushing the pound upwards momentarily

Global market snapshot courtesy of NewsSquawk:

Asian equity markets traded mostly positive as the region benefitted from the tech-led gains on Wall St where Apple prodded above the USD 2tln market cap status and as firm gains in Tesla, Microsoft, Intel and Facebook also fuelled the big tech resurgence resulting to outperformance in the Nasdaq, although upside was capped in the broader market amid mixed data releases including higher than expected Initial Jobless Claims. ASX 200 (-0.1%) and Nikkei 225 (+0.2%) both initially took impetus from the constructive handover from US peers but with upside in Australia later retraced following soft PMI data and with weakness seen in defensives as well as the top-weighted financials sector, while the Japanese benchmark contended with the effects of a mixed currency and resistance at the 23,000 level. Hang Seng (+1.3%) and Shanghai Comp. (+0.5%) were underpinned amid the continued PBoC liquidity efforts in which it injected CNY 150bln through 7-day reverse repos and CNY 50bln in 14-day reverse repos. This was the first occasion the central bank utilized the latter instrument in around 2 months, and there was also recent confirmation from China’s MOFCOM that the US and China will be conducting the delayed trade discussions in the approaching days. Finally, 10yr JGBs were flat and continue to eye the 152.00 level to the upside despite the gains in Japanese stocks, with mild support provided by the BoJ’s presence in the market for JPY 870bln of JGBs and the central bank also offered to purchase JPY 200bln in corporate bonds from 25th August with a remaining 3-5yrs to maturity.

Top Asian News

- Pressure Grows on Hong Kong to Re-Open Economy as Cases Drop

- Hong Kong to Start Virus Testing Blitz of Whole City on Sept. 1

- India Slaps New Curbs on Visas, Schools to Stem China Influence

- Millions Escaped Caste Discrimination. Covid-19 Brought It Back

European equities (Eurostoxx 50 +0.3%) have held onto opening gains despite a brief dip lower in the wake of French PMI metrics. However, the pessimism surrounding the August outturn for France was short-lived for broader European assets with equities paring declines ahead of the German release. The German release painted a slightly less downbeat picture with a firmer manufacturing outturn alongside a softer than expected services, with the eventual EZ-wide release posting a miss on expectations for both sectors but ultimately remaining in expansionary territory. IHS Markit noted “the eurozone stands at a crossroads, with growth either set to pick back up in coming months or continue to falter following the initial post-lockdown rebound”. Nonetheless, sentiment for European equities remains afloat in what has been a relatively choppy week in terms of price action for the region. Sectoral performance in Europe is broadly firmer with the exception of energy names which are tracking crude prices lower. Travel & Leisure names are faring the best thus far with some reprieve been granted to the likes of Ryanair (+1.6%) and easyJet (+1.4%), however, with the UK continuing to add more countries to its quarantine list (albeit, has removed Portugal), it’s difficult to see how much conviction will be placed upon a recovery in the sector. Elsewhere, individual movers include Kingspan (+7.4%) post-earnings, Wirecard (+5.4%) amid reports that it has found a suitor for its UK assets, whilst Accor (+2.6%) shares continue to remain supported alongside talk of a potential bid for InterContinental Hotels. To the downside, laggards are relatively sparse with Maersk (-2.8%) and Saipem (-2%) lower on the day following downgrades at JP Morgan Chase and Bernstein respectively.

Top European News

- Europe’s Economic Recovery Stumbles After Initial Bounceback

- U.K. Economy Rebounds With Activity Rising to Seven-Year High

- Pessimism Returns to Brexit Talks as Hopes for Deal Slip Away

- Advent Said to Mull Over $1.2 Billion Sale of Health Firm Mediq

In FX, sub-par French Flash PMIs triggered the losses in the Single Currency, with the French manufacturing metric surprisingly falling back into contraction, whilst Germany and EZ held their heads above the 50 threshold, but largely missed forecasts. EUR/USD has receded from its 1.1882 high and took out an interim support area around 1.1840-45 to test 1.1800 to the downside. Participants will now be eyeing any updates on the Belarus front in regard to sanctions, with little on the docket in terms of scheduled events. Conversely, UK Retail Sales and PMIs topped forecasts across the board but gains Sterling were short-lived as the currency succumbs to the Buck, whilst Brexit talks remain in limbo as officials suggest no progress has been made on outstanding points in the latest round of negotiations. Cable has given up its 1.3200 status (vs. high 1.3255) and continues declining in light of pessimistic comments from both the EU and UK Chief Brexit negotiators, with the former nothing that at this stage, a deal seems unlikely and both sides highlight the little progress mate. EUR/GBP has recovered off lows amid the latest Brexit headlines, with the cross initially dipping below the Aug 13th low ~0.8948 before rebounding to session high at 0.8980.

- DXY – Propped up by the post-PMI Euro – the index is back around 93.000 from an overnight base of 92.570 , with the highs from Wednesday (93.059) and Monday (93.124) the next points of resistance ahead of yesterday’s peak at 93.248. Looking ahead to today, the calendar remains light with US Markit PMIs and Existing Home Sales the only scheduled events.

- JPY – USD/JPY had been ebbing overnight in light of the weaker Dollar during APAC hours, but the JPY holds onto gains in early EU hours despite the Dollar rebound as PMI-related haven flows keeps the Japanese currency buoyed. USD/JPY dipped below 105.50 from 105.80 at best ahead of the weekly base at 105.104. Note: USD/JPY sees around USD 550mln in options rolling off at 105.00 at the NY cut.

- AUD, CAD, NZD – All narrowly softer in what is a Dollar story. AUD/USD as dipped back below 0.7200 (vs. high 0.7215), whilst Westpac raised its year-end forecast to 0.7500 from 0.7200 as their case of a momentum stall is still not convincing. NZD/USD remains contained within a tight current range of 0.6525-0.6550, with overnight comments from the RBNZ Chief economy noting that the Central Bank has scope to act aggressively if needed. Similarly, the revival of the Dollar and declines in the crude complex sees the Loonie yield, with USD/CAD testing resistance at 1.3200 (vs. low 1.3159) ahead of Canadian Retail Sales, with today’s option expiries seeing USD 505mln at 1.3225 alongside a sizeable USD 1.7bln between 1.3250-60.

- EM – Mixed trade across EMs but the Lira stands out as the outperformer after the CBRT lifted the TRY interest rate on swap transactions from 8.25% to 9.75% yesterday to match the lending rate. Furthermore, the Turkish President is expected to announce “good news” today in regard to an energy discover in the black sea, most likely natural gas. USD/TRY has trades sub-7.2500 from a high of 7.3380.

In commodities, WTI and Brent October futures have waned off overnight highs, albeit with the magnitude of price action relatively small thus far. Crude-specific news flow has remained light, but the contracts saw a sentiment-driven leg lower amid the overall down-beat flash PMIs from the EU. Both contracts trade lower by some USD 0.20/bbl apiece, with WTI testing USD 42.50/bbl to the downside (vs. high 42.96./bbl) whilst its Brent counterpart dipped below USD 44.75/bbl from around USD 45/bbl at best, with only the weekly Baker Hughes rig count slated on the calendar. Elsewhere, spot gold and spot silver yield to the post-PMI Dollar strength, with the former losing further ground below USD 1950/oz (vs. high 1956/oz) whilst latter briefly dipped below USD 27.00 from 27.54 at best. In terms of base metals, copper continued to grind lower with the Shanghai inventories again posting another rise in stocks. Dalian iron ore prices fell overnight as the steel-demand-driven rally somewhat fizzled whilst China’s iron ore portside stockpile rose to four-month highs.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 52, prior 50.9

- 9:45am: Markit US Services PMI, est. 51, prior 50

- 9:45am: Markit US Composite PMI, prior 50.3

- 10am: Existing Home Sales, est. 5.41m, prior 4.72m; MoM, est. 14.62%, prior 20.7%

DB’s Jim Reid concludes the overnight wrap

The brief excitement that we got in markets late Wednesday proved to be fairly short-lived in the end with equities at least pretty much back to the status quo again yesterday. Indeed there were more gains for the S&P which nudged up +0.32% with the NASDAQ (+1.06%) once again leading the way and finishing at yet another record high. However, all this came on a foundation of low volumes and pretty thin breadth of gains when you dig below the surface – a theme that’s been fairly consistent all week. A stat that stood out yesterday was that just 30% of the S&P 500 actually advanced with the equal weighted index down -0.55%. In fact, while the benchmark S&P 500 is up +0.38% this week the equal weighted index is actually down -1.43%.

In fairness markets did open on the back foot after the latest weekly initial jobless claims data came in at a higher-than-expected 1.106m for the week through August 15. That was well above the consensus forecast of 920k, and marks a rebound from the prior week’s 971k reading, which was the first time the weekly number had fallen below a million since the pandemic began. Though it’s only one week, the +135k increase in claims is the largest weekly jump since late March, and raises fears that the labour market recovery is unlikely to be a smooth one. While continuing claims represented somewhat better news, with a decline to 14.844m in the week through August 8 (vs 15m expected), they still remain at more than twice the peak after the GFC back in 2009, suggesting there’s still a long way to go before we get back to any king of normality.

Treasury yields were already a couple basis points lower going into that and they held that level into the evening with 10y yields in particular closing -2.9bps lower. The curve also keeps doing its best to unwind some of last week’s bear steepening with 2s10s and 5s30s curves both -3.1bps flatter yesterday. Meanwhile the USD had a more choppy session but ultimately ended a shade weaker with the dollar index down -0.10%. It’s also down a further -0.16% this morning.

On that, it’s worth noting that yesterday our FX team took profit on their EURUSD trade having nearly reached their 1.20 target earlier this week. They now see a more balanced outlook approaching September, with positioning becoming stretched, virus statistics becoming worse in Europe, and the Fed signalling a less dovish stance for September. This isn’t to say that they’re turning bullish on the dollar all of a sudden, but having nearly reached 1.20 the risks are more evenly balanced in comparison to their strong conviction view earlier this year. See their full note here.

Looking ahead to today, the highlight will likely be the release of the flash PMIs for August, which will give us one of the first indications of global economic performance into the month. Overnight, we’ve already had the Australian and Japanese numbers with Japan’s manufacturing PMI coming in at 46.6 (vs. 45.2 last month) however the services print fell to 45.0 (vs. 45.4 last month). The decline in the services PMI was more pronounced in Australia given the localized lockdowns as it came in at 48.1 (vs. 58.2 last month) but the manufacturing PMI was relatively stable at 53.9 (vs. 54.0 last month). Later today, we’ll hear from Europe and the US, where the consensus is expecting a continued rebound in activity from the lows of the initial lockdowns. Remember though that these are diffusion indices, so they simply ask respondents whether conditions are better or worse than in the previous month, rather than measuring growth itself. As a result they can struggle to capture the extent of any declines or rebounds when the numbers are at extreme levels as they’ve been recently.

This will be important to keep in mind if the current uptick of coronavirus cases persists and causes partial shutdowns of economies in infected areas. Italy reported the most new cases since mid-May yesterday, while weekly cases in the UK have recently risen over 8000 for the first time since early June. However, despite cases rising, German Chancellor Merkel and French President Macron have indicated they oppose nationwide lockdowns, and want the continent to coordinate a strategy for avoiding a further economic slowdown from the virus. In Asia, South Korea’s new infection wave has spread nationwide and the country reported additional 324 cases in the past 24 hours. On the positive side, Pfizer and BioNTech said that their vaccine candidate is on track for regulatory review as early as October, assuming clinical success. Meanwhile, the NHK reported that Japan is set to allow foreign residents shut out by virus-related restrictions back into the country from September.

Asian markets have followed Wall Street’s lead this morning with the Nikkei (+0.43%), Hang Seng (+1.25%), Shanghai Comp (+0.78%) and Kospi (+2.27%) all up. The positive vaccine news mentioned above seems to be aiding sentiment. Futures on the S&P 500 are also up +0.27%. In terms of other data releases, Japan’s July CPI came in line with consensus at +0.3% yoy while both core and core-core CPI came in a shade lower than expectations at unchanged and +0.4% yoy respectively.

In other overnight news, President Trump said that “We will give tax credits to companies to bring jobs back to America, and if they don’t do it, we will put tariffs on those companies, and they will have to pay us a lot of money,” if he gets re-elected.

Back to yesterday, there weren’t any major surprises from the release of the ECB minutes. In terms of things to note, they showed that the Governing Council’s focus was shifting away from market stabilisation as a focus towards price stability. For example, the number of references to “financial conditions” fell to 8 in the latest minutes, having been 23 back in June. There was also more time devoted to the weakness in longer-term inflation expectations, with 3 mentions versus 1 in the last minutes. The STOXX 600 closed down -1.07% in Europe yesterday while bond yields on the continent were 1-3bps lower with the exception of BTPs which finished flat.

In other news, yesterday we got confirmation that China and the US are to have a call soon to discuss the progress of their trade deal, expected in the “near term” although no exact date was given. Kudlow confirmed yesterday that Lighthizer “has said a number of times that he actually is pleased with the progress” on the trade pact. Further evidence therefore of ring-fencing the trade pact in the US-China tit for tat. Staying with US politics, moderate Democrats from swing states are urging Speaker Pelosi and Congressional Republicans to restart stimulus talks that have stalled. However Pelosi also noted that she would not support a ‘skinny bill that only dealt with the unemployment benefits without offering funding help to the states that need it.

As for the remaining data yesterday, August’s Philadelphia Fed business index came in at 17.2 (vs. 20.8 estimated), down from last month’s 24.1 reading. This is the second month in a row that the gauge has fallen, though the ISM adjusted index ticked up higher to 54.1 from 53.6. Over in Europe, the German PPI reading for July was up 0.2% from the previous month (vs. 0.1% expected), while down -1.7% YoY.

To the day ahead now, and the data highlight is likely to be the aforementioned flash PMIs for August. As well as that, we’ll get UK retail sales and public finance data for July, the advance Euro Area consumer confidence reading for June, US existing home sales for July, and Canada’s retail sales for June.

via ZeroHedge News https://ift.tt/3ghsTmx Tyler Durden