Tesla’s P/E Ratio Moves Past The Thousand Mark

Tyler Durden

Sun, 08/23/2020 – 09:20

Authored by Bruce Wilds via Advancing Time blog,

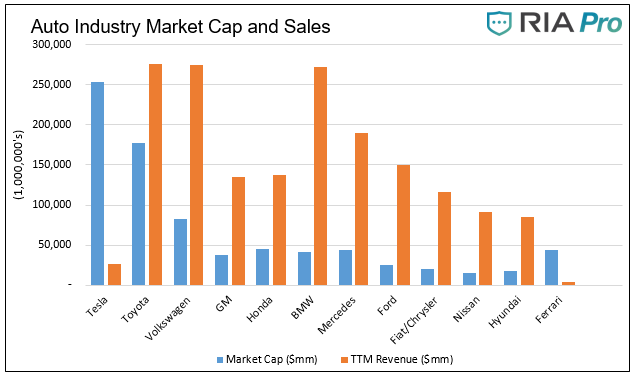

Tesla’s valuation seems a bit over the moon considering on Friday it closed for the second time over $2,000. With the stock at a whopping P/E ratio of 1,066 times earnings, Tesla sports a market cap of over 373 billion dollars. Those of us without a great love for Tesla or Elon Musk see this as the poster child of absurdity. By comparison, Volkswagen, which sold over 10 million vehicles last year has a market cap of $82 billion and auto giant Toyota around $218 billion. Simply put, Tesla’s market cap has risen 244% this year while the market cap of the industry, excluding Tesla, is down 17%.

Only Thing Hotter Than The Car Is the Stock

In normal times Tesla would most likely be a company only visible in the rear-view mirror. The value of Tesla’s stock dramatically changed years ago following the report where it made its first quarterly profit, its market value soared to more than $10 billion. A large part of the increase in the stock price occurred because people that had short positions in the stock were squeezed into buying back their stock. This is something that has happened time and time again causing speculation that the company plays fast and loose with the numbers it reports.

Fast forward to today and we find that Tesla’s recent rally pushed its market value has made it by far the most valuable automaker in history. It is impossible to deny that Tesla’s stock has been on a hot streak, but not just lately, a year ago it traded for only $211 per share. The momentum has been infectious throughout the year and it took five trading sessions for Tesla stock to rally 40%. At Friday’s high of $2,081.68, Tesla stock was up more than 51% in the last eight trading sessions.

Part of the recent surge has been contributed to an announced a 5-for-1 stock split. Over the last three months, Tesla stock is up more than 150%. From the March lows, shares are up an astounding 493%. If that feels too cherry-picked, just realize that Tesla is up 390% year-to-date and more than 800% over the past 12 months. Part of the irony surrounding Tesla’s current high multiple market cap is that company could take or borrow five billion dollars to buy 100,000 of its own cars to destroy. This would increase sales sending profits and revenues even higher.

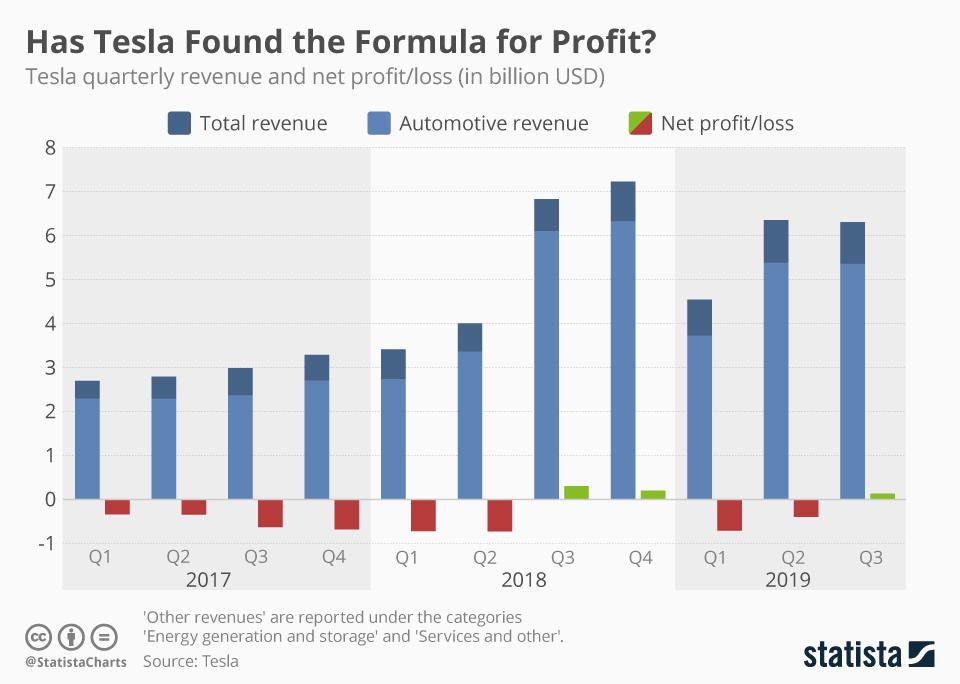

Tesla Has Been A Cash Burner!

With Tesla stock soaring to new highs it is again time to revisit the “Tesla – Musk” phenomenon. I have written several articles focused on this subject over the years and like many skeptics, I’m amazed at Elon Musk’s cat like ability to remain viable. Like a cat with nine lives, Musk is a high-flyer that continues to amaze those of us predicting his doom with his gift to avoid falling to the ground. After all his antics and misrepresentations I have to wonder why this clown is not in jail. The only answer I can reach is that somebody is keen on protecting the stock market from the shock of a Tesla meltdown.

Interestingly, in an interview from the World Economic Forum in Davos President Trump sang the praise of Musk calling him “one of our great geniuses” and urged that “we have to protect our genius.” This might help explain the settlement between Elon Musk and the SEC. It was seen by many investors as proof Washington remains a hotbed of cronyism and collusion. For all the turmoil and damage Musk spread upon investors rather than jail time or any meaningful punishment he received a slap on the wrist. Apparently protecting the exorbitant stock price of Tesla and those holding long positions took precedence over the law and justice. According to the posted settlement filings, Musk was to step down for 3 years as Chairman and pay a $20 million fine. Tesla was also to pay a $20 million fine. Following that Musk again started to bash and defy the SEC.

Revenue Has Not Kept Pace With Valuation

In the past, I likened Musk and Tesla to John Delorean and The DeLorean Motor Company that is remembered for its stainless steel DeLorean sports car featuring gull-wing doors. The company had a brief and turbulent history that ended in receivership and bankruptcy in 1982. Near the end, in a desperate attempt to raise the funds his company needed to survive, DeLorean got involved in drug trafficking but was acquitted of the charges brought against him because officials had overstepped the law.

For many investors, in the past, it was difficult to ignore that Tesla is billions of dollars in debt. Some of that debt has been rolled into creating new shares, which dilute the value of existing shares. Also, there was the issue of “corporate incest” and Tesla’s acquisition of ailing SolarCity in an all-stock $2.6 billion merger, this has turned out to be a bad deal. At the time Musk owned 22% of SolarCity which was founded by his cousins. The merger was promoted on the idea that Tesla’s mission since its inception was part of Elon Musk’s overall “Secret Tesla Motors Master Plan” to expedite the world’s transition to sustainable energy and away from a fossil fuel economy.

Tesla’s fortunes have moved in lockstep with a surging stock market. In an overview in early 2017, I wrote about how as I continued my research for the update my eyes began to glaze over at the magnitude of the subsidies that Musk had been granted. Government support is a theme of all his companies, and without it, none of them would exist. It also bolsters the argument that true price discovery is gone in our current stock market. Today several forces including stock buybacks and what has become known as the “Plunge Protection Team,” appear to jump in at any sign of a pullback. This destroys the proper pricing of assets which are the bedrock of free markets.

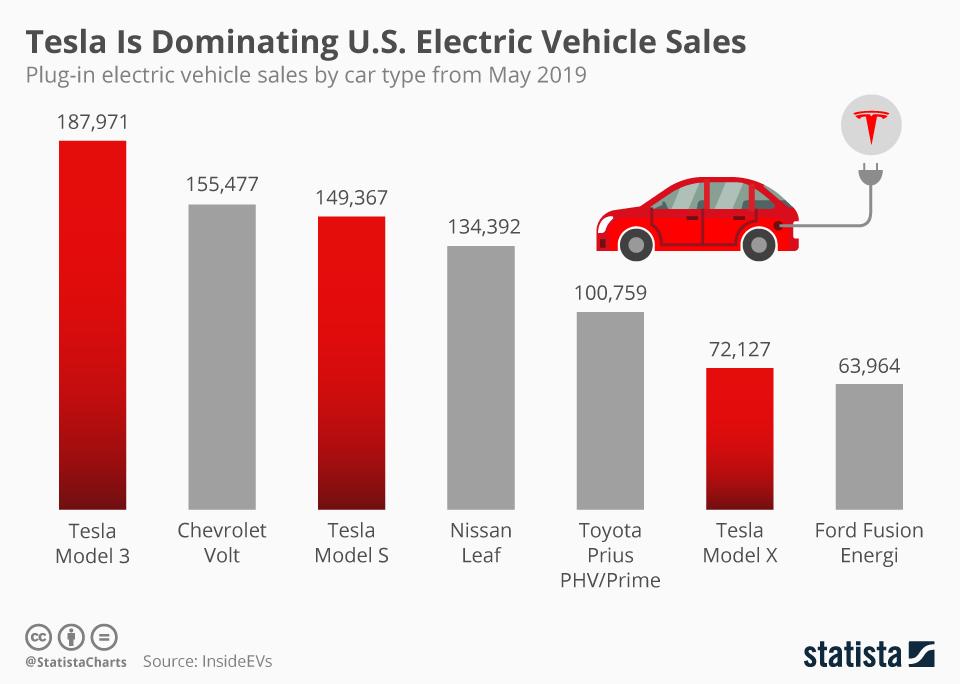

Key Is “Future” Tesla Demand

Many articles, such as the one appearing on Seeking Alpha, have pointed out Tesla’s success is not carved in stone and may depend on demand for its vehicles. Tesla is priced for breakneck growth but its product line-up and production capacity do not support this narrative.

With over 100 different electric cars expected to hit the markets by 2025, it is difficult for a realist to envision Tesla being able to remain viable unless its market share massively grows. As for new vehicles, Musk said there are 250,000 reservations for his ‘planned” new cybertruck but with only refundable $100 deposits true demand is questionable.

While Tesla sports a valuable advantage by being the first big player in the electric vehicle (EV) category it is not protected by a great number of patents. The big advantage of other manufacturers being slow to release EV cars is not expected to last. The technology is easy to replicate and most auto manufacturers have lines of EVs due out this year and next. Many of these cars will come at far cheaper prices and Tesla’s competitors will offer their customers service shops and trade-ins. This means Tesla’s first-mover advantage may quickly slip away.

Another interesting development missed by many Tesla enthusiasts is that an electric car-sharing service that debuted in Indianapolis in 2015 has pulled the plug on its network of rechargeable cars after residents failed to embrace the vehicles. Blue Indy ended its collaboration with the city of Indianapolis on May 21st, saying in a statement that the car-sharing service “did not reach the level of activity required to be economically viable.”

Even as Tesla’s saga has become both a phenomenon and a conundrum, it is almost impossible for many investors to see the path forward for Tesla as guaranteed. It may speak volumes that during a recent twenty-five hundred mile round trip from the Midwest to Florida I saw only one Tesla. Since returning home I have seen only one other, this underlines Tesla has a very small footprint. This is why so many investors remain appalled at Tesla’s valuation and continue to stand by their claims it is destined to fail.

Musk should be on top of the world after forcing shorts to capitulate but it seems his ego never rests. An example of this is how Musk tweeted his Boring Company would complete a commercial tunnel in Las Vegas and it would be fully operational in 2020. Critics have pointed out that Boring has not proved its technology and talent can scale to municipality size projects. The Boring’s tunnel projects have been debunked by PhDs and ridiculed by government officials. Ph.D. chemist and video blogger Phil Mason recently said. “There’s no revolution here. Let’s be honest here: he’s driving a car through a sewer pipe.”

As to where Tesla’s stock price is going, predictions are all over the board. Ark Invest chief Catherine Wood told CNBC that she sees Tesla shares hitting $6,000 within the next five years. Others of us continue to agree with David Stockman. He wrote in May of 2015, in an honest free market, Tesla would have long ago been carted off to the chapter 11 junk shredder. Even consumer advocate and former presidential candidate Ralph Nader issued a stark warning that things were overdone, he said, “When the stock market bubble implodes, it will have been started by the surge in Tesla shares beyond speculative zeal.

Where this stock is going is a matter of opinion, some investors argue Tesla should be viewed as a tech stock rather than the maker of electric vehicles and a car company. Also, few people view Tesla’s investment in China as risky and that the new Shanghai plant, as well as Model Y production, could pressure profit margins in 2020. Instead, they choose to focus on Tesla as the tip of the arrow in the attack on climate change. The flip-side of this argument is that electric vehicles are not as environmentally friendly as portrayed.

via ZeroHedge News https://ift.tt/3j9F8n8 Tyler Durden