Futures Punch To New Record High After US-China Reaffirm Committment To Trade Deal

Tyler Durden

Tue, 08/25/2020 – 07:59

Three things send the market higher these days: i) optimism that Congress will finally renew the fiscal stimulus which expired on July 31; ii) optimism that a covid vaccine will miraculously fix the global economy, and iii) in a throwback to 2019 optimism on the US-China trade deal. We got a dose of iii) late on Monday when the USTR reported that top U.S. and Chinese trade officials reaffirmed their commitment to a Phase 1 trade deal which has seen China lagging on its obligations to buy American goods, with a call (originally scheduled for Aug 15) in which both sides saw “progress and are committed to taking the steps necessary to ensure the success of the agreement”, and demonstrating a willingness to cooperate even as tensions rise over issues ranging from data security to democracy in Hong Kong.

Given the exchanges between the U.S. and China recently “have been negative, any small bit of positivity is seen as a big step forward, even when it isn’t,” said David Madden, market analyst at CMC Markets UK. It was certainly enough to push US equity futures higher for a fourth straight session, with the Emini punching to a new all time of 3,448.75 during the Asian session which saw shares rise throughout most of Asia, before trimming gains to around 3,440 after the European open.

The S&P 500 and Nasdaq both clocked new record highs on Monday, with the benchmark index surpassing its pre-pandemic high last week even as recent economic data pointed to a wobbly recovery from the virus-led downturn. However, even as the ES was up some 0.3%, Nasdaq futures were shockingly in the red sparking panic and hysteria among a generation of retail daytraders who have never seen a red open in a centrally-planned market.

Salesforce.com, Amgen and Honeywell climbed between 3.6% and 4% premarket on news they would join the blue-chip Dow Jones Industrial Average index on Aug. 31. This came at the expense of three companies that are getting kicked out of the DJIA including E&P titan and formerly world’s most valuable company Exxon Mobil, Pfizer and Raytheon Technologies which were down between 1.5% and 2.4%. Best Buy dropped despite reporting earnings that beat on the top and bottom line; Folgers coffee maker JM Smucker medical device maker Medtronic are also due to report quarterly results before the opening bell.

Investors also remain focused on vaccine progress as global economies reopen. Moderna said it’s near a deal to supply at least 80 million vaccine doses to the European Union.

“A steady flow of progress with Covid-19 treatments/vaccines is delivering the latest boost to risk appetite,” said Oanda senior market analyst Edward Moya, but just like Morgan Stanley, he cautioned that “market breadth however does not support the surge to record high territory for U.S. indexes.”

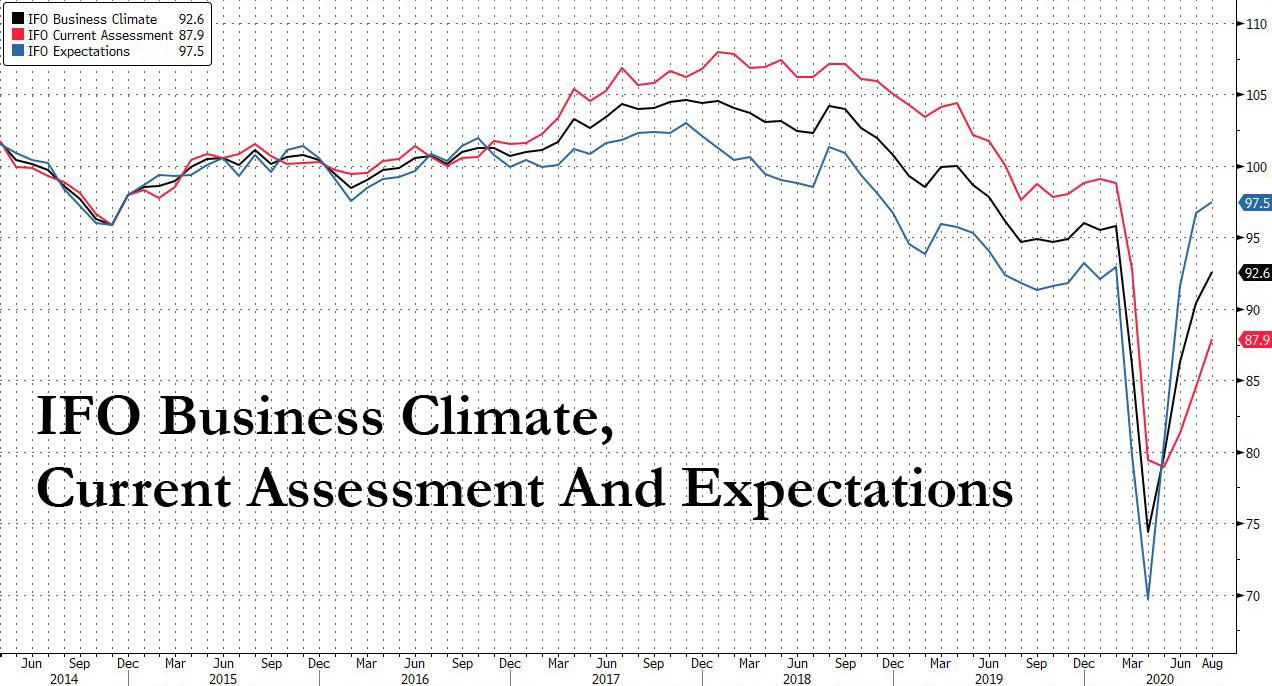

European stocks advanced for a second day after the latest IFO surveys showed German companies turning slightly more optimistic on the economic recovery despite missing expectations on, well, expectations:

- Ifo Expectations 97.5 vs. Exp. 98.0 (Prev. 96.7)

- Ifo Current Conditions 87.9 vs. Exp. 87.0 (Prev. 84.5)

- Ifo Business Climate 92.6 vs. Exp. 92.1 (Prev. 90.4)

The current assessment continues to lag expectations about the future, a reversal to pre-covid days.

The Stoxx Europe 600 Index climbed 0.4% as of 10:28 a.m. in London, with travel stocks advancing more than 2% and leading gains among sectors.

In Asia, markets were broadly higher, with Tokyo, Taipei, Seoul and Sydney all in the green while peers in Hong Kong and Shanghai slipped. South Korea’s Kospi Index gained 1.6% and Jakarta Composite rising 1.2%, while Shanghai Composite dropped 0.4%. Japan’s Topix gained 1.1%, with Globeride and Land Co rising the most. The Shanghai Composite Index retreated 0.4%, with Jiangxi Hongdu Aviation Industry and Dalian Bio-Chem posting the biggest slides.

In rates, treasuries traded heavy into early U.S. session with yields cheaper by 1bp-4bp across the curve in bear-steepening move. Treasury 10-year yields close to cheapest level of the day at 0.684%, highest in several days; long-end-led losses steepen 2s10s, 5s30s by ~2bp. Factors weighing on the curve include IG credit issuance, start of Treasury auction cycle and grind higher in S&P 500 futures. In Europe, Bunds lag Treasuries by 2bp while gilts trade broadly in line. As Bloomberg notes, concession starts to build into front-end also with $50b 2-year note sale at 1pm ET, ahead of $51b 5-year Wednesday and $47b 7-year Thursday.

In FX, the dollar and yen have softened against most currencies, while the euro has been topping the top-performing list as Action Economics recaps. This dynamic has come amid risk-on positioning in global markets. EUR-USD lifted to the mid 1.1800s, posting an intraday peak at 1.1843, which is 60 pips up on Monday’s New York closing level. The euro has also rallied against the yen, which is the day’s biggest loser, and most other currencies. While a bout of general dollar selling has helped to lift EUR-USD, there have concurrently been a couple of cues to buy euros, including August German Ifo business climate indicator, which beat forecasts in rising to a headline reading of 92.6, and remarks from German finance minister Scholz, who said there are signs that the German economy is developing above forecasts. USD-JPY, meanwhile, posted an eight-day high at 106.38, which is a gain of just over 40 pips on yesterday’s closing level. The biggest mover out of the main currency pairings and crosses was EUR-JPY, which was showing over a 0.8% gain. The cross printed a six-day high at 125.97. GBP-JPY was not far behind, while AUD-JPY was showing a near 0.5% upward advance. Cable pegged an intraday high at 1.3126. USD-CAD posted a five-day peak at 1.3240 in pre-London trading, subsequently settling lower.

In commodities, oil was slightly higher as traders kept a watchful eye on Tropical Storm Laura, which is expected to strengthen into a hurricane before making landfall later this week. U.S. gasoline futures rose to the highest level since March on concern over possible fuel shortages. Elsewhere, gold dipped as low as $1,922 an ounce trading in a narrow range.

Looking at today’s calendar, we’ll get the FHFA house price index for June, new home sales or July, as well as the Conference Board’s consumer confidence reading and the Richmond Fed manufacturing index for August. The Conference Board is expected to show U.S. consumer confidence improved slightly in August after falling more than expected in July amid a flare up in coronavirus cases. Otherwise, San Francisco Fed President Daly will be speaking, and earnings releases include Salesforce, Medtronic, Intuit and Autodesk. Investors also await Federal Reserve Chairman Jerome Powell’s address on Thursday for hints on the central bank’s next steps to support an economic recovery.

Market Snapshot

- S&P 500 futures up 0.3% to 3,439.25

- STOXX Europe 600 up 0.4% to 372.29

- MXAP up 0.3% to 172.99

- MXAPJ up 0.2% to 572.19

- Nikkei up 1.4% to 23,296.77

- Topix up 1.1% to 1,625.23

- Hang Seng Index down 0.3% to 25,486.22

- Shanghai Composite down 0.4% to 3,373.58

- Sensex up 0.06% to 38,824.20

- Australia S&P/ASX 200 up 0.5% to 6,161.39

- Kospi up 1.6% to 2,366.73

- German 10Y yield rose 2.1 bps to -0.47%

- Euro up 0.3% to $1.1817

- Italian 10Y yield unchanged at 0.819%

- Spanish 10Y yield rose 3.3 bps to 0.36%

- Brent futures up 0.3% to $45.28/bbl

- Gold spot down 0.1% to $1,926.57

- U.S. Dollar Index down 0.3% to 93.06

Top Overnight News from Bloomberg

- The U.S. and China reaffirmed their commitment to the phase-one trade deal in a biannual review, demonstrating a willingness to cooperate even as tensions rise over issues ranging from data security to democracy in Hong Kong

- Germany’s coronavirus daily new cases increased at a pace not seen for almost four months

- Moderna Inc. has announced it is close to a deal with the EU to provide at least 80 million vaccine doses

- Storm Laura is expected to be upgraded to a hurricane when it makes landfall on the American gulf coast in the next few days, leading U.S. gasoline futures to rise to their highest since the start of the pandemic on fears over potential fuel shortages

Courtesy of NewsSquawk, here is a quick recap of global markets:

Asian equity markets were mixed after trading mostly higher as the region initially took impetus from the fresh record highs on Wall St where cyclicals outperformed and with risk appetite also spurred by COVID-19 plasma treatment hopes, as well as reports US and China’s top trade negotiators held a constructive conversation on the Phase 1 agreement. ASX 200 (+0.5%) was led by tech and financials although gains in the benchmark index were capped by resistance at the 6200 level and amid headwinds from a deluge of earnings, while Nikkei 225 (+1.4%) outperformed as exporters cheered recent currency weakness and with the government to ease the ban on foreign residents returning to the country. Hang Seng (-0.3%) and Shanghai Comp. (-0.4%) also began higher after the PBoC boosted its liquidity efforts with a total CNY 300bln of reverse repo operations and following talks between USTR Lighthizer, Treasury Secretary Mnuchin and China’s Vice Premier Liu He in which both sides saw progress and were committed to taking the next steps required to ensure the success of the deal. However, gains later faded given that discussions were not much of a surprise and with the PBoC distancing itself from lowering capital requirements for bank, while Hong Kong was also cautious ahead of Chief Executive Lam’s announcement on social distancing arrangements later today as the current restrictions which limits public gatherings to two people are set to expire. Finally, 10yr JGBs were lacklustre with price action contained below the 152.00 level after weakness in T-notes and demand sapped by the gains in stocks, with the 20yr JGB auction doing little to spur prices despite printing improved results.

Top Asian News

- U.S., China Signal Progress on Trade Deal as Relations Fray

- Hong Kong to Relax Social Distancing Rules as Virus Cases Drop

- Credit Suisse’s Head of Asia Technology to Join Xiaomi as CFO

- Thai Cabinet Approves Extension of Emergency for Another Month

Stocks in Europe trade with modest gains (Euro Stoxx 50 +0.6%) albeit off highs, as sentiment somewhat improved following the mixed APAC lead. Some suggest that the “constructive” US-Sino trade call is spurring risk assets. However, it is worth remembering that there has been no new progress/developments in terms of trade, and in the grand scheme of things, US-Sino relations remain at all-time-lows on a number of fronts – e.g. geopolitics, capital markets and technology. On the data front – the German Ifo survey showed optimism in the country has increased, but economists noted that the German recovery is fragile and stocks were largely unfazed by the release. Sectors are mostly in the green, although the cyclical tilt seen at the open has somewhat faded, but nonetheless, financials and travel & leisure hold their top positions in the region, whilst materials and energy lag amid the price action in their respective complexes. In terms of individual movers, Aveva (+3.9%) holds onto gains after announcing a proposed acquisition of Osisoft for an enterprise value of USD 5bln. Nokia (+0.5%) and Ericsson (+1.2%) remain firm after reports noted that the Indian government is looking to phase out equipment from Chinese companies including Huawei from its telecoms network amid border tensions – with Nokia and Ericsson potentially to gain from this. On the flip side, Swisscom (-1.0%) is subdued after Swiss competition watchdog opened a probe into the Co. amid suspected abuse of market position within the broadband sector.

Top European News

- German Businesses Signal Optimism Recovery Is on Track; Germany Closes In on Agreement to Extend Job-Preserving Aid

- Credit Suisse to Cut Branches, Staff by Merging Swiss Unit

- Vanishing Jobs and Empty Offices Plague Britain’s Retailers

- Italy Clashes With Ex- Monopoly Over Future of Phone Network

In FX, as the DXY hovers just above the 93.000 level within a confined 93.012-351 band, major Dollar counterparts are also sitting close to big figures awaiting firm breaks or clearer direction, like the Euro in wake of an encouraging German Ifo survey on balance. To recap, 2 out of the 3 metrics exceeded expectations, but the more forward looking outlook reading missed consensus remains the institute was reserved in describing the economic recovery as fragile. Hence, Eur/Usd was toppy ahead of yesterday’s peak and hefty option expiry interest close by at 1.1850 in 1 bn. Meanwhile, Cable continues to pivot 1.3100 ahead of CBI trades and amidst the ongoing threat of Britain leaving transition without a Brexit trade deal, and the Franc is still tethered to 0.9100 after a dip in Swiss Q2 payrolls was largely nullified by an upward revision to the previous quarter. However, the Yen has retreated through 106.00 and into a lower range on a loss of safe-haven premium and with US Treasury yields backing up before this week’s auctions amidst curve re-steepening.

- NZD/AUD/CAD – The Kiwi is holding above 0.6500 in advance of NZ trade data and the Aussie has gleaned more indirect support from another firm PBoC CNY fix that in turn has given the CNH fresh impetus to test 6.9000 vs the Greenback. Aud/Usd is meandering between 0.7152-82 following mixed independent impulses overnight via an improvement in ANZ weekly consumer confidence in contrast to labour data revealing a 1% decline in jobs for the month to August 8 and 2.8% drop in the state of Victoria for a national fall of 4.9% relative to mid-March (pre-pandemic or the ‘first’ wave as such). Conversely, the Loonie is licking wounds beneath 1.3200 and detached from choppy oil prices following Canada’s appeal to the WTO against US soft lumber levies.

- SCANDI/EM – Marginal Nok outperformance even though Norwegian GDP was a bit weaker than forecast in Q2, but the Try has not derived much traction on the back of a rise in Turkish manufacturing sentiment and the Rub is not tracking the firm tone in Brent against the backdrop of ongoing geopolitical/diplomatic tensions that are also weighing on the Lira.

In commodities, WTI and Brent front month futures remain relatively flat in early European trade, with the benchmark only some USD 0.2-0.3/bbl off overnight lows. Traders are keeping a keen eye on the developments in the Gulf of Mexico as Tropical Storm Laura is forecast to evolve into a major hurricane before making landfall late-Wednesday, whilst Marco was downgraded to a Tropical Depression. On that front, the latest update from the Search Results Bureau of Safety and Environmental Enforcement (BSEE) estimates around 82.4% of current oil production shuttered – with the next release scheduled for 1400ET/1900BST. WTI Oct resides around USD 42.50/bbl (vs. low ~42.30/bbl), whilst its Brent counterpart trades around USD 45.25/bbl (vs. low USD 45.08/bbl). Traders will now be eyeing the weekly release of the Private Inventories in the absence of macro headlines – albeit price action could be muted as hurricane developments are timelier. Elsewhere, spot gold trades choppy within a tight range on either side of USD 1930/oz whilst spot silver sees similar action around 26.50/oz – both moving in tandem with the Buck ahead of Fed Chair Powell’s speech on Thursday. In terms of base metals, Dalian iron ore prices fell some 3.5% whilst Shanghai steel rebar edged lower as downstream demand recovery missed market forecasts. Conversely, Shanghai nickel prices rose almost 2% at one point amid dwindling Chinese port inventories.

US Event Calendar

- 9am: FHFA House Price Index MoM, est. 0.3%, prior -0.3%; House Price Purchase Index QoQ, prior 1.7%

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.1%, prior 0.04%; YoY NSA, est. 3.6%, prior 3.69%

- 10am: Conf. Board Consumer Confidence, est. 93, prior 92.6; Present Situation, prior 94.2; Expectations, prior 91.5

- 10am: New Home Sales, est. 790,000, prior 776,000; MoM, est. 1.8%, prior 13.8%

- 10am: Richmond Fed Manufact. Index, est. 10, prior 10

DB’s Jim Reid, freshly back from vacation, concludes the overnight wrap

If you’d have told me at the start of the year that at the end of August I’d be quarantining with my family and not allowed to leave the perimeter of my garden then I’d have been extremely worried and assumed that one of my children had dug up the bubonic plague. Thankfully it’s less worrisome than that and instead because I was on holiday in the French Alps and new travel rules now apply back to the U.K from France. Ironically the French Alps have hardly seen new cases rise even if they have in say Paris and parts of the South of France. So if you’d have got back two days before me from Paris you wouldn’t have to quarantine but I do from the Alps. We still had to cut our holiday short by a week to ensure the children didn’t miss their first days at school next week. Elite athletes are exempt from these rules but after trying to show the customs officer at the Channel Tunnel my golf swing I wasn’t given special dispensation.

So we’ve been looking after three young terrors at home over the last week and it’s been painful with nothing to do or nowhere to go. Bronte also doesn’t understand why she doesn’t get walked. All first world problems admittedly but I really don’t understand those that say the best thing about Covid is that you get to spend more time with your family. I love them all dearly but an hour or two a day is ideal (that doesn’t include my wife by the way).

So I actually mean it when I say it’s good to be back in my home office mentally and physically quarantining from the kids. Over the holiday I’ve been thinking a lot about the virus and the way forward and I continue to scratch my head about the end game. Within the next few weeks we should know much more about the state of play with regards to the leaders in the vaccine race (supportive news yesterday for the AstraZeneca/Oxford Uni version as we’ll see below). That’s probably going to be the most important newsflow of the next month or so. We’re trying to collate as much info as possible on the current state of play with vaccines and will try to put out a piece next week on where we are at. Obviously if a vaccine gets approved in the coming weeks then we’ll likely have a realistic end game within months as I’m sure we’ll go into mass production very quickly.

However without a vaccine it feels like global strategies are very difficult to decipher. When lockdowns started back in March the main rational was to ensure health services did not get overrun. Five months on, the number of Covid cases in hospitals are relatively low in many areas and yet many countries seem to be trying to keep cases as low as possible as a badge of honour and the world has got so scared that such a strategy seems to meet high approval. Countries that are seeing cases rise are looked at with great suspicion even if hospitalisations are still relatively low. However is such suppression a sustainable strategy? Given this is happening in the northern hemisphere summer I can’t help wondering where we’ll be in two or three months time and what the reaction will be from the authorities.

The good news is that there continues to be plenty of evidence that those catching the virus seem to be from younger, less vulnerable cohorts and this seems to be contributing to a lower and lower case fatality rate across the globe alongside better treatment and possibly the virus mutating. To be fair listening to politicians the bar to renewed full lockdowns seems to be high around the world, but equally the bar to getting to anything resembling normality also seems very high. So we are in Covid limbo until a vaccine or a yet unidentified master plan materialises. All ahead of a northern hemisphere autumn and winter when life will naturally move more indoors.

To be fair all of this continues to be a passing curiosity to the US equity market which continues to hit new highs even if the breadth of the winners has narrowed further in recent weeks. Yesterday showed some signs of rotation and catch up from the laggards though, which helped push the S&P 500 up a further +1.00%, having already risen for 7 of the last 8 weeks. The move took the index to another record high and puts it +6.03% on a YTD basis. The airline industry led the S&P yesterday, gaining +8.23% as optimism on a possible vaccine buoyed the beaten down industry higher. In fact American Airlines (+10.53%), Carnival (+10.17%), United (+9.93%), Delta (+9.28%) and Norwegian Cruise Line (+7.58%) were five of the seven best performing stocks in the index. Elsewhere, tech stocks underperformed as there was some rotation out of biotechs (-0.47%) in particular. The Nasdaq closed +0.60% higher yesterday (also to a new record) with the tech-dominated index now standing at an astonishing +26.83% higher YTD.

On the vaccine news, AstraZeneca shares were up +2.06% following the FT report that the Trump administration could bypass normal regulatory standards for the Oxford vaccine. As the election approaches it seems inevitable that Mr Trump will want to encourage as much positivity on the virus as is in his power. So one to watch.

Oil prices were buoyant as well yesterday, with Brent crude up +1.76% to $45.13/bbl in a move that wiped out all of last week’s declines and helped energy stocks lead the equity advance on both sides of the Atlantic. Over in Europe, equities saw even bigger moves higher, with the STOXX 600 up +1.58% and the DAX up +2.36%.

The rotation into risk assets saw sovereign bonds lose ground somewhat yesterday, and yields on 10yr Treasuries were up +2.6bps by the close. With market participants awaiting Fed Chair Powell’s speech at Jackson Hole for any policy hints, our global head of rates research Francis Yared wrote a blog post yesterday (link here) in which he says that a lot of the expected dovishness is already priced into markets. As a result, only a material upsizing in QE should have a material market impact. There was a similar pattern for European rates too yesterday, where yields on 10yr bunds (+1.6bps), OATs (+0.9bps) and gilts (+0.7bps) all rose. And in line with this retreat from safe assets, gold extended its falls from the previous week with a further -0.60% decline. It’s now -6.53% off its highs 3 weeks ago.

Overnight the key news has been that the US and China’s top trade negotiators discussed the Phase 1 trade deal last night and the US concluded that both sides saw progress and are committed to its success. The US statement said that “The parties also discussed the significant increases in purchases of US products by China as well as future actions needed to implement the agreement,” while adding that China has made progress on other commitments like taking steps to ensure greater protection for intellectual property rights and removing impediments to American companies in the areas of financial services.

Asian markets are mostly positive this morning outside of China and HK which are seeing the Hang Seng (-0.53%) and Shanghai Comp (-0.19%) both down. The Nikkei (+1.84%), Kospi (+1.44%) and Asx (+0.42%) are up though alongside futures on the S&P 500 (+0.46%). Elsewhere, gold and silver prices are also up +0.39% and +0.49% and in agriculture commodities, CBT soybeans and corn future prices are up +1.10% and +1.52% respectively.

On the coronavirus and as alluded to at the top, countries around the world continue to re-implement restrictions at the first uptick in cases. Zurich has announced new limits on social gatherings of up to 100 unless masks are worn and have mandated that masks must be worn within shops. This followed news that the Netherlands have issued 10-day quarantine measures on all travelers from Spain, as well as the majority of travelers from France. This comes as Spain posted four month highs in cases last week. In what may be a harbinger for the colder month’s ahead, Germany is planning to stop testing people returning from hotspots, citing a lack of testing capacity for the virus. Those travelers will still have to undergo quarantine measures and will have to get tested themselves in order to exit their quarantine early. These measures weighed on the STOXX 600 Travel and Leisure stocks (-0.09%), which did not see the same performance as their American counterparts on the upbeat vaccine news.

We did get further signs of stabilisation in new cases in the United States though, with Florida reporting the lowest number of new cases since mid-June yesterday, while New York state saw their infection rate fall to 0.66%, the lowest since the beginning of the pandemic. In a sign of further normalization following the recent uptick in cases, Apple announced plans to reopen some of the over 120 stores that they had reclosed during the summer outbreak. This could happen as soon as the end of this month. Across the other side of world, Singapore has identified a total of 58 cases in the country’s largest foreign workers dormitory which houses c. 16,000 people and as a precaution has placed another 4,800 workers from the same dormitory on stay-home notices. Meanwhile, South Korea added a further 280 cases in the past 24 hours up from 266 a day earlier and also ordered kindergarten, elementary, middle and high schools in the greater Seoul area to shift to online classes from partial attendance. Elsewhere, Qantas Airways said overnight that it will cut an additional 2,500 jobs due to the COVID impact on top of the earlier announced plans to eliminate 6,000 jobs or 20% of the workforce.

To the day ahead now, and data highlights from Germany include the Ifo business climate indicator for August along with the final reading of Q2’s GDP. Meanwhile in the US, we’ll get the FHFA house price index for June, new home sales or July, as well as the Conference Board’s consumer confidence reading and the Richmond Fed manufacturing index for August. Otherwise, San Francisco Fed President Daly will be speaking, and earnings releases include Salesforce, Medtronic, Intuit and Autodesk.

via ZeroHedge News https://ift.tt/2Ysbt0r Tyler Durden