‘Millions Of Americans Will Suffer’ – Janet Yellen Warns Of Devastating Fiscal Cliff If Congress Fails To Act

Tyler Durden

Wed, 08/26/2020 – 15:45

Former Federal Reserve Chair Janet Yellen and Jared Bernstein, chief economist to former vice president Joe Biden, penned an op-ed for the New York Times on Monday blaming Congress for their inability to pass additional fiscal support as depressionary unemployment and surging virus cases and deaths weigh on the economic recovery.

The op-ed, titled “The Senate Is on Vacation While Americans Starve,” outlines monetary policy by itself cannot save the economy from the virus-induced recession, and the solution will require additional rounds of fiscal stimulus to thwart a deepening fiscal cliff (see: “Look Out Below”: Why The Economy Is About To Fly Off A Fiscal Cliff”).

“If senators still fail to resolve stalled negotiations when they return after Labor Day, millions of needy Americans will suffer — and the overall economy could degrade from its current slow rebound in growth to no growth at all,” Yellen and Bernstein wrote.

The pair said monetary policy alone could not generate a robust recovery, and further support will need to have a fiscal component to cushion households.

“Both monetary policy, which is the Federal Reserve’s job, and fiscal policy, the job of the federal government, have complementary roles to play in supporting the economy,” they said.

Yellen and Bernstein warned about a faltering recovery as the virus continues to rage across the country, forcing states to pause or reverse reopenings:

“Now, so-called real-time data show consumer spending slowing overall and deteriorating conditions for low-income households, who have become more anxious about how they will pay for their rent and their food,” they wrote, suggesting 30 million Americans are going broke and hungry.

“These numbers reflect the confluence of at least three forces: acceleration of the spread of the virus; expiration of the supplemental federal unemployment benefits; and the ending of various eviction moratoriums,” they said, noting an economic recovery cannot occur unless the virus disappears.

“It became clear this summer that public health measures across much of the country were relaxed too soon and without proper medical safeguards against the coronavirus,” they added.

The economists said, “the Federal Reserve has largely done its job,” suggesting Congress “cannot expect the Fed to keep everything together on its own.”

Yellen and Bernstein wrote the op-ed, in what could be a move to shift blame to Congress for the coming growth scare that could lead to a correction in the stock market.

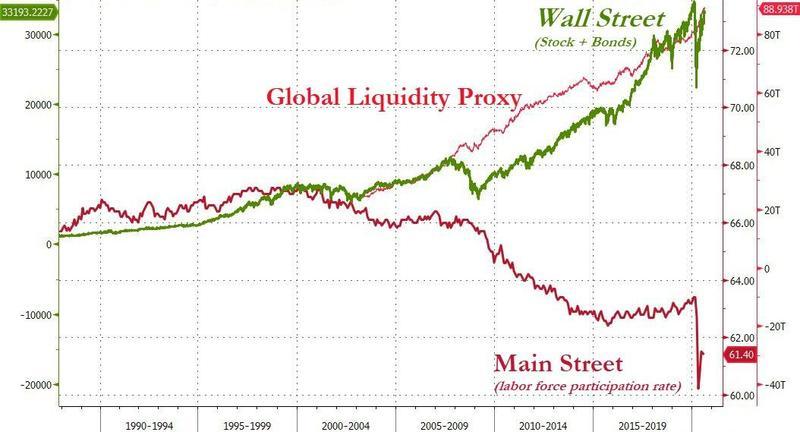

The party on Wall Street, driven by liquidity via central banks and bailouts from Congress have reinflated financial assets to nosebleed valuations as the labor market implodes.

Morgan Stanley’s Michael Wilson suggested a “growth scare to be followed by a rate scare” could be seen in the weeks or months ahead.

via ZeroHedge News https://ift.tt/3hBKlna Tyler Durden