Market Positioning Into Jackson Hole

Tyler Durden

Thu, 08/27/2020 – 07:30

From Andrea Biagioni of Morgan Stanley

Powell is on deck tonight and here’s where we stand…

Between rising US-China tensions, unemployment insurance benefits expiring and dwindling volumes the last month, one would have thought, a pullback would have come to fore. But that’s also probably the reason why it didn’t. In fact, it’s been the opposite has happened with global equities making new all-time highs.

As we move into September, which has been SPX’s worst month on average since ’00, while the same risks remain, the positioning set up is quite different. Further, what is concerning now is that we have “peak Fed” and potentially a growth/rates scare around the corner. According to Mike Wilson, this is likely to drive a tactical pullback in the coming weeks (but it is also the reset the market needs before the next leg of the bull market).

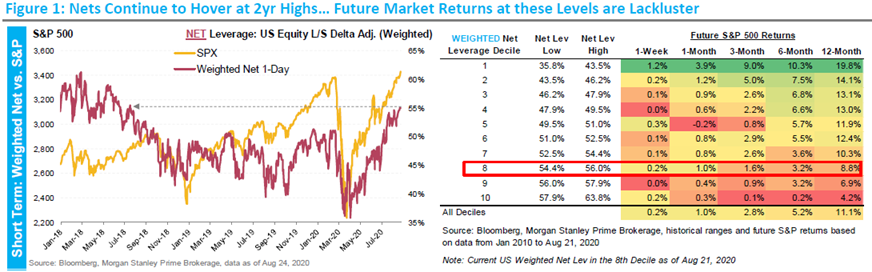

Per our PB Content team, US Equity L/S weighted net leverage has rebounded significantly and surpassed levels seen throughout all of 2019 and 2020 thus far and currently stand at the highest levels since July ’18. For context, the last time nets were last at these levels (July ’18), they were actually slowly starting to decline as the market was also inching towards all-time highs, but ultimately dropped around the 4Q18 market sell-off.

The rebound in net leverage this year has come from a mix on short covering, some long additions, coupled with the market continuing to make new highs. Net leverage is currently at 55% which is the 75th %-tile since 2010 – typically when nets are at these levels, future S&P returns for the next few months are usually pretty lackluster.

For the Fed specifically, Ellen Zentner believes Powell’s update at Jackson Hole tonight will mark an important moment in monetary policy. Her confidence is bolstered by a series of appearances that have been scheduled for the aftermath – Clarida, Brainard, Williams, even Yellen and Bernanke – all key personnel you would expect to see on a major framework announcement.

She expects this will include information on flexible average inflation targeting, which will formerly be adopted in the FOMC statement in September, and opens up another runaway for Powell to deliver new forward guidance in December.

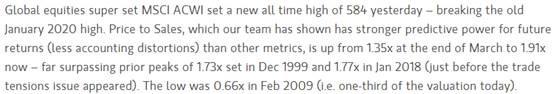

All in, expectations are pretty high heading into the testimony and so are valuations. Per Jonathan Garner today:

Additionally, SPX 14 RSIs are back to highs last seen in Jan’20 and Jan ‘18

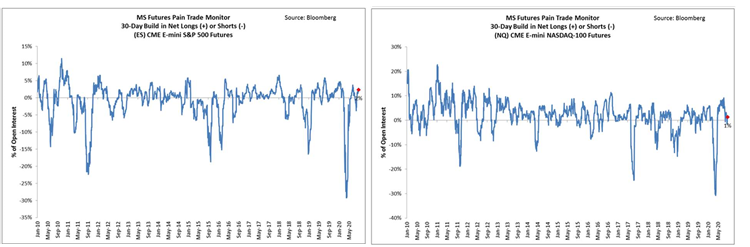

And futures positioning, is a long ways from the short skew earlier this year

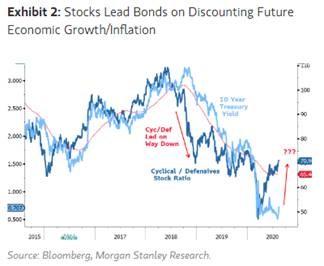

From Mike Wilson’s perspective, backend rates are likely going up in meaningful way between now and next year (btw, this is the part of the call he gets the most pushback).

Contributing to that view, he thinks a growth scare which is likely to prompt action from Congress to deliver a larger than expected package, which will in turn help drive rates higher. While it’s pretty impossible to call when Nasdaq tops given the wall of money into top 5 names, a taper tantrum could be the catalyst .

Moving beyond this reset, he still maintains the big money will be made in next 12 months by buying interest sensitive stocks. He believes materials, basic resources, banks, consumer cyclicals, hotels, airlines are still priced for no vaccine or herd immunity and rates not moving. Our reopening baskets = MSXXOPN1 and MSXXOPN2 are well placed here.

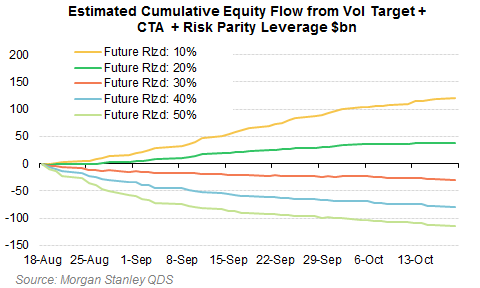

Finally, while systematic strategies are a market support right now (with ~$30-35bn expected buying over next two week), it will not prevent a correction if there was some external market shock (i.e. taper tantrum?).

Our QDS team notes that with low realized vol (like it is now, near 10%), systematic strategies will continue to buy. But if there was a shock to the market, they would actually flip to sellers. The below chart shows future realized vol = SPX realized vol. So you can see they would continue to contribute to equity demand in a low vol environment, but if there were some shock and vol rose, that would flip to selling.

via ZeroHedge News https://ift.tt/2D8PrZe Tyler Durden