“Never-ending Monetary Accomodation”: Here Is The Fed Warning About The Consequences Of What The Fed Just Did

Tyler Durden

Thu, 08/27/2020 – 09:53

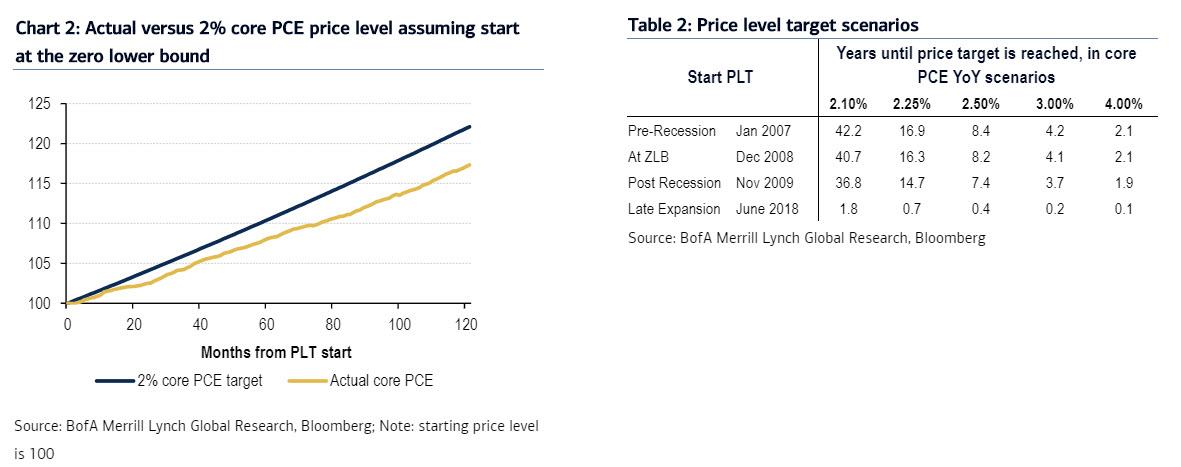

It’s official: as Powell unveiled moments ago, the Fed is now operating under an explicit Average Inflation Targeting platform, with the Fed seeking inflation that averages 2% over time, a step that implies allowing for periods of overshoots, and assures no rate hikes for years to come (according to BofA simulations, a 2% AIT would mean no rate hikes for up to 42 years). At the same time, the Fed’s shift on maximum employment will allow labor-market gains to run more broadly.

Regarding price pressures, the document says the committee will target “inflation that averages 2% over time” and will aim to bring inflation above the 2% target following periods when inflation runs below that level.

“The maximum level of employment is a broad-based and inclusive goal,” Powell said in a speech delivered virtually for the central bank’s annual policy symposium traditionally held in Jackson Hole, Wyoming. “This change reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities.”

In its statement, the Fed also said its decisions would be informed by its assessment of “shortfalls of employment from its maximum level.” The previous version as Bloomberg notes had referred to “deviations from its maximum level.” The change de-emphasizes previous concerns that low unemployment can cause excess inflation.

To be sure, pragmatic Fed watchers will immediately admit that there is nothing new here: after all the Fed’s implicit core PCE inflation target has already been 2% yet even with a record $7 trillion balance sheet, the Fed failed to hit it for years.

In other words, the Fed failed to even sustainable reach its target, but this time will be different. Yeah right.

But there are bigger problems with AIT: as BofA wrote earlier this week, explicit AIT could also cripple the Fed’s already waning credibility, not least of all because “it would also bring up difficult issues around the appropriate time period to calculate averages and the maximum realized inflation rates the Fed would tolerate while the average climbs higher.” Indeed, the Fed’s credibility is already on the line given:

- the market’s pricing of inflation expectations well below 2% for the next 30 years, and

- its decade-long miss in achieving its inflation mandate

Additionally, as we discussed on Tuesday, the Fed now needs to reveal the specific time period over which PCE inflation is required to average 2% before beginning a policy normalization (hiking) process. This is a problem, because in simulations conducted by the BofA rates team, it found this could in require the Fed to remain on hold for 42 years!

Rabobank’s Michael Every had a more pragmatic criticism:

Does anyone think this will work to generate inflation and jobs in the US economy? No. Is the cost of borrowing really the problem now? No. Is anybody pricing in a rate hike for at least five years? No. If they were to make that ten years would it make a firm any more likely to hire someone right now? No. Has YCC worked to create reflation in Japan? No. Yes, at the margin it’s USD negative in that it implies future yields would not be allowed to rise even if inflation did: but presumably once (IF!) inflation (and WAGES!) rise sustainably, the Fed will just hold another Jackson Hole speech and change its operating framework again.

But the best explanation why AIT could be a disaster comes from none other than the Fed itself which in a January report titled “Raising the Inflation Target: Lessons from Japan”, wrote the following:

… in thinking about whether to raise the inflation target to a certain level, central banks need to take into account whether they are able to raise inflation to the new target level. If a new inflation target is too ambitious, and the central bank fails to attain it, the central bank may lose its credibility, which may render less effective any other policies it pursues. Also, the central bank may face the risk of getting trapped in a never-ending monetary accommodation even when real economic activity is strong or when financial stability risks accumulate.

As events in the past decade have shown, the Fed is already trapped in “never-ending monetary accommodation” – the coronavirus pandemic which boosted the Fed’s balance sheet by $3 trillion only made things worse. As for whether a 2% inflation target is too ambitious, well consider that we saw all of this 7 years ago with Bank of Japan in January 2013, when it adopted a higher inflation target in an effort to end chronic deflation. Nearly a decade later it has been an epic disappointment

via ZeroHedge News https://ift.tt/3jkQowM Tyler Durden