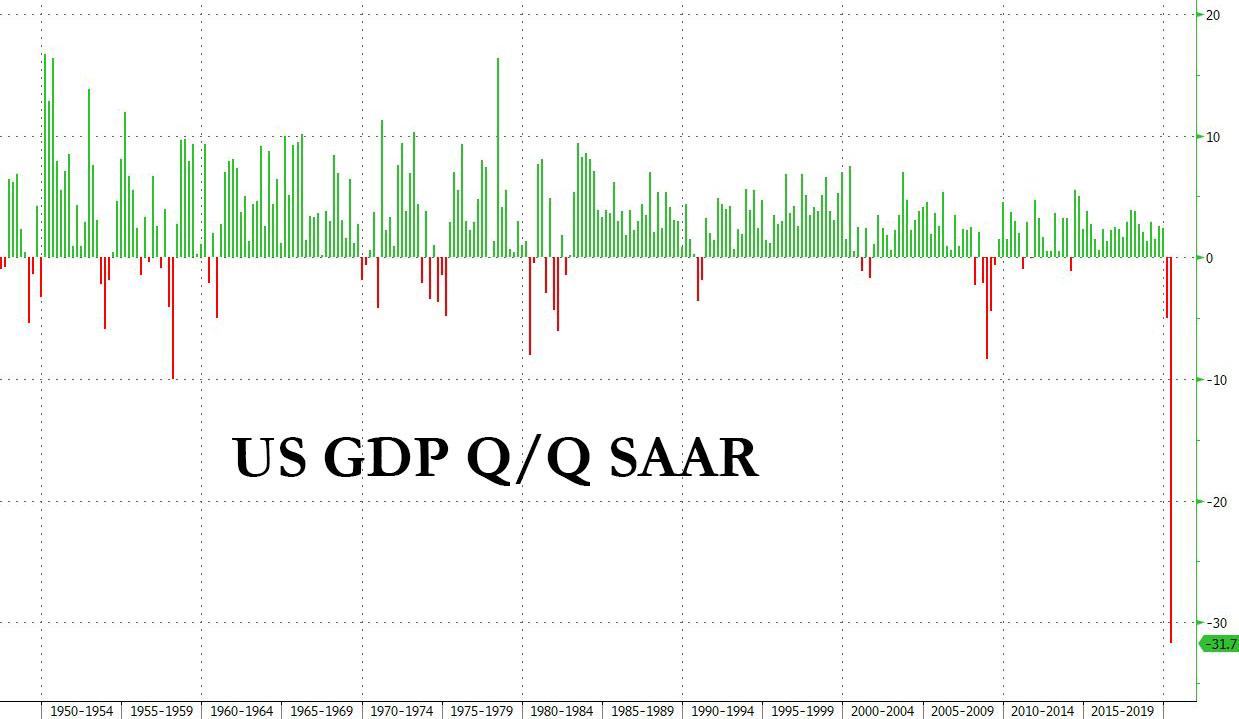

Record GDP Plunge Revised Slightly Higher: US Economy Contracted 31.7% In Q2

Tyler Durden

Thu, 08/27/2020 – 08:35

One month after the worst ever GDP print in US history revealed that in the 2nd quarter the US economy contracted by -32.9%, moments ago the BEA unveiled in its first revision of GDP that the slowdown was just modestly better than expected, coming in at -31.7%, beating expectations of a -32.5% number.

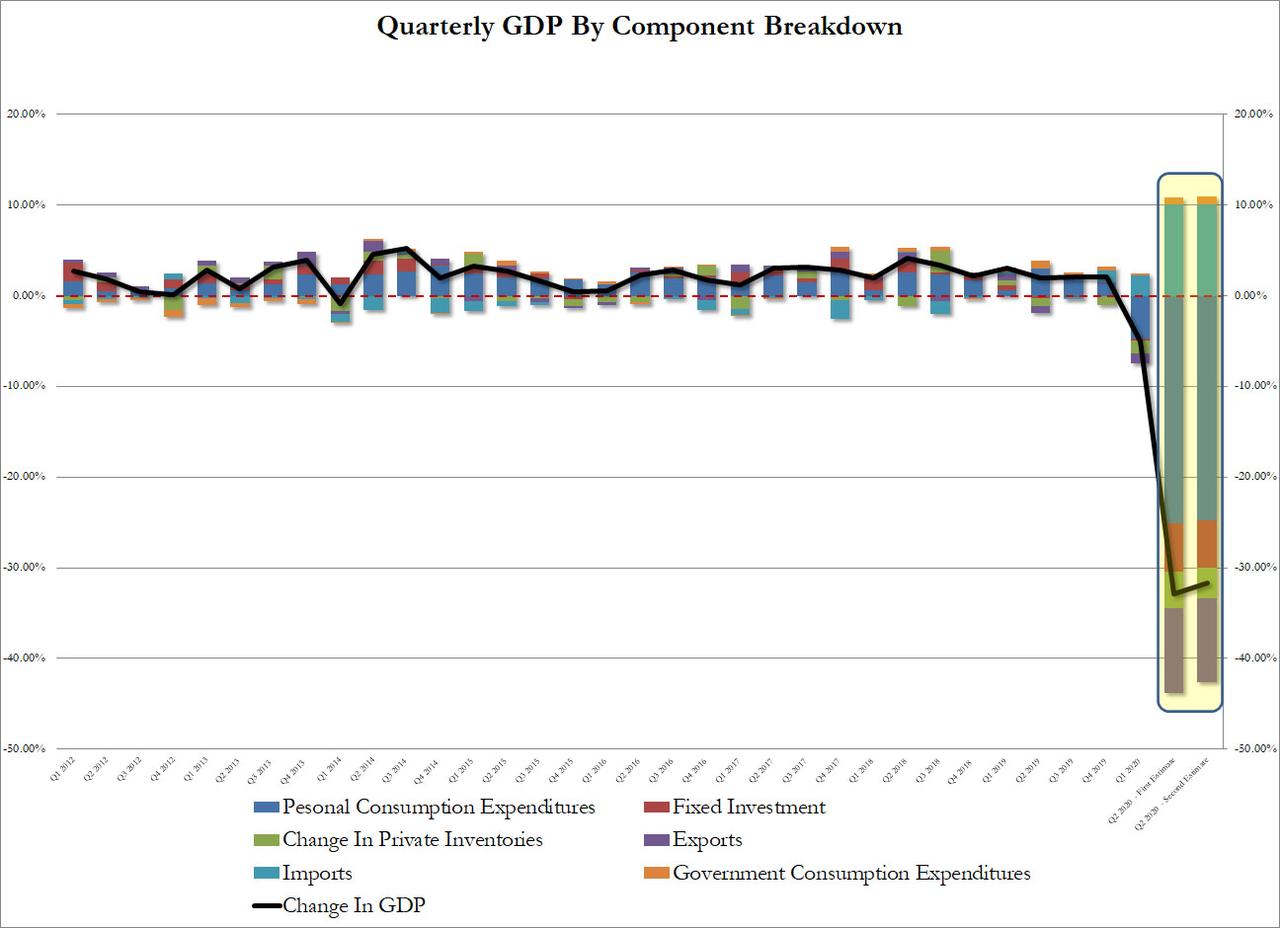

The decrease in real GDP reflected decreases in consumer spending, exports, business investment, inventory investment, and housing investment that were partially offset by an increase in government spending. Imports, a subtraction in the calculation of GDP, decreased.

The decrease in consumer spending reflected a decrease in services (led by health care) and goods (led by clothing and footwear). The decrease in exports primarily reflected a decrease in goods (led by capital goods). The decrease in business investment primarily reflected a decrease in equipment (led by transportation equipment). The decrease in inventory investment primarily reflected a decrease in retail (led by motor vehicle dealers). The decrease in residential investment primarily reflected a decrease in new single-family housing. The increase in government spending reflected an increase in federal spending related to payments made to banks for processing and administering the Paycheck Protection Program loan applications.

Looking at the 1.2% improvement in the GDP estimate from the original print, it was the result of an increase in government spending reflected an increase in federal spending related to payments made to banks for processing and administering the Paycheck Protection Program loan applications.

Some details:

- the decline in personal consumption was revised higher from -25.05% to -24.76%

- the decline in fixed investment was revised from -5.38% to -5.20%; Nonresidential fixed investment, or spending on equipment, structures and intellectual property fell 26% in 2Q

- the decline in change in private inventories was revised from -3.98% to -3.46%

- the boost from net trade was revised from 0.68% to 0.90%

- the contribution from government was unchanged at 0.82%

For those keeping tables on inflation, the GDP price index fell 2% in 2Q after rising 1.4% prior quarter; core PCE q/q fell -1% in 2Q after rising 1.6% prior quarter.

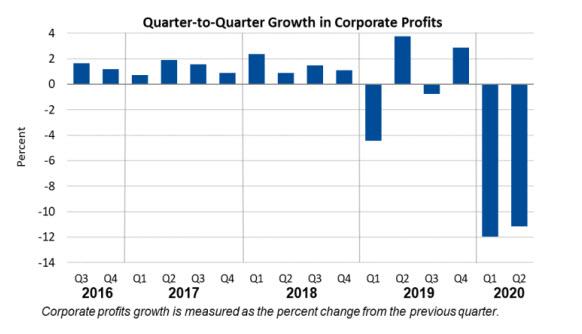

In the first look at corporate profits, the BEA calculates that profits from current production decreased 11.1% at a quarterly rate

in the second quarter after decreasing 12.0% in the first quarter. Corporate profits decreased 20.1% in the second quarter from one year ago.

Profits of domestic non-financial corporations decreased 15.0 percent after decreasing 14.4 percent.Profits of domestic financial corporations increased 9.2 percent after decreasing 8.9 percent. Profits from the rest of the world decreased 20.3 percent after decreasing 8.4 percent.

Overall, while still historic, the GDP number was largely expected within a margin of error, and the question is how far does GDP rebound in the all to key third quarter, the first look of which we will get just days before the presidential election on Nov 3.

via ZeroHedge News https://ift.tt/2G3WS51 Tyler Durden