Americans’ Income & Spending Rose More Than Expected In July (Before Handouts Stopped)

Tyler Durden

Fri, 08/28/2020 – 08:39

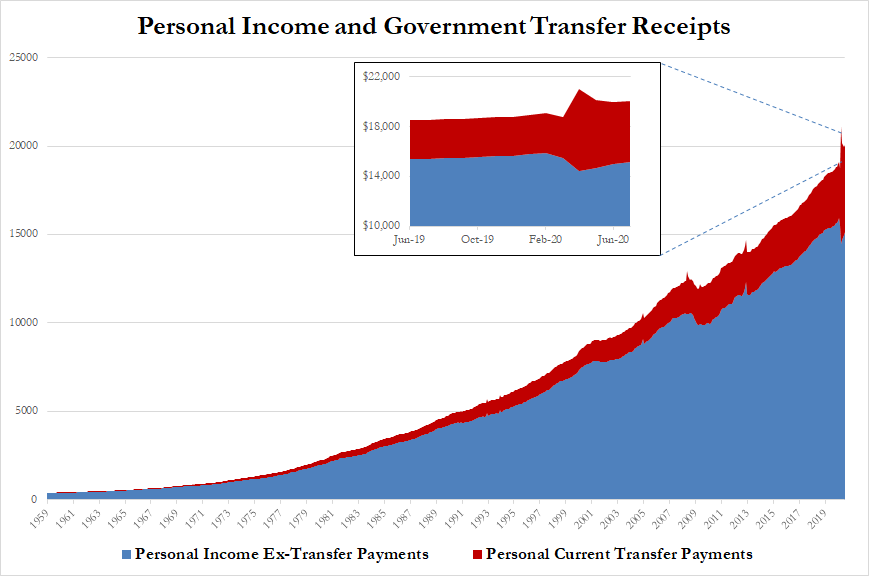

Analysts expected the trend of the last two months to continue in July with personal spending rebounding (though at a slower pace) and personal incomes shrinking back, but both surprised to the upside with a +0.4% MoM rise in incomes and +1.9% MoM jump in spending ( vs -0.2% and +1.6% respectively).

Source: Bloomberg

Incomes (thanks to govt transfers) are still up 8.2% YoY while spending remains down 2.8% YoY…

Source: Bloomberg

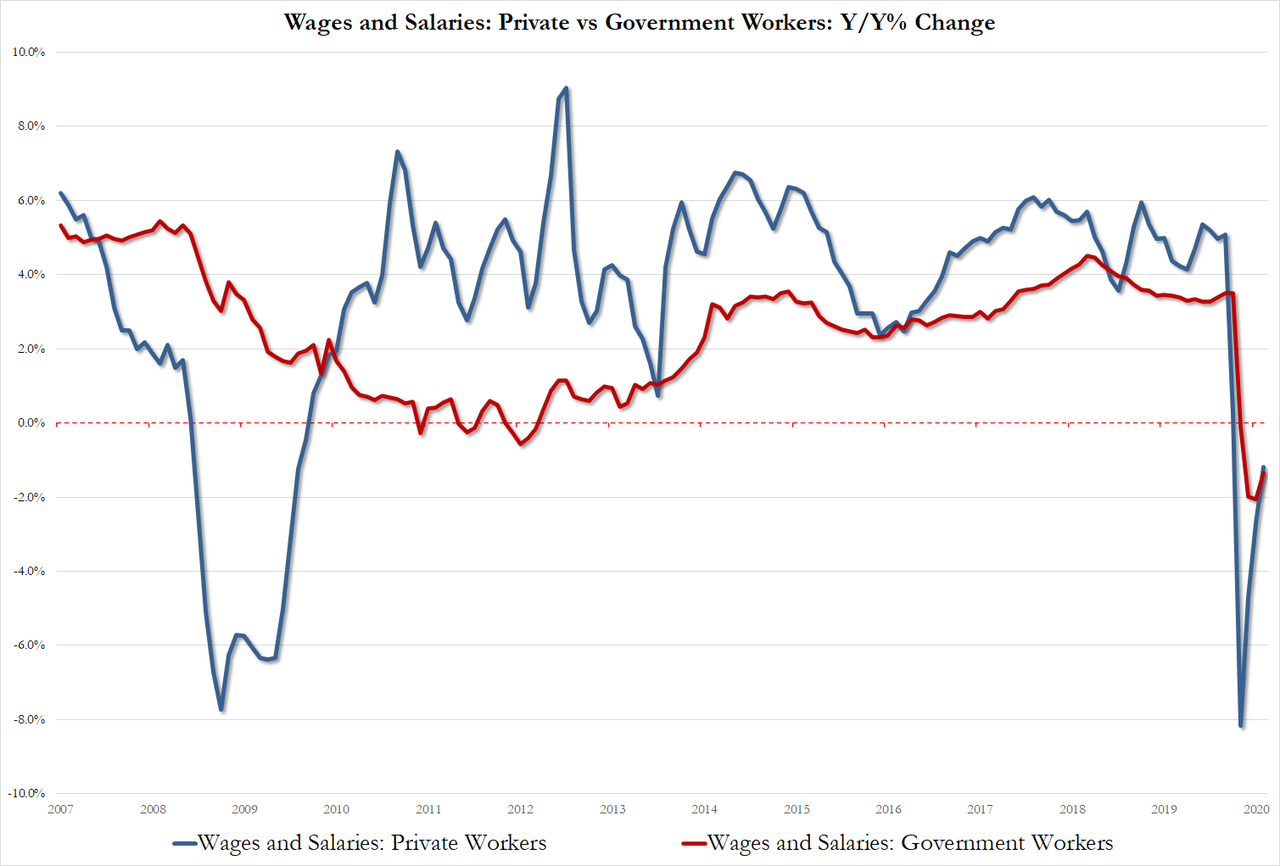

Private workers’ pay fell less than government workers’ pay in July on a YoY basis:

-

Private sector wages dropped -1.2% Y/Y, better than -2.7% last month

-

Government worker wages dropped -1.3%, better than -1.3% last month

Overall spending is back to Nov 2017 levels, but “V”-ing nicely off the 2012 lows…

Source: Bloomberg

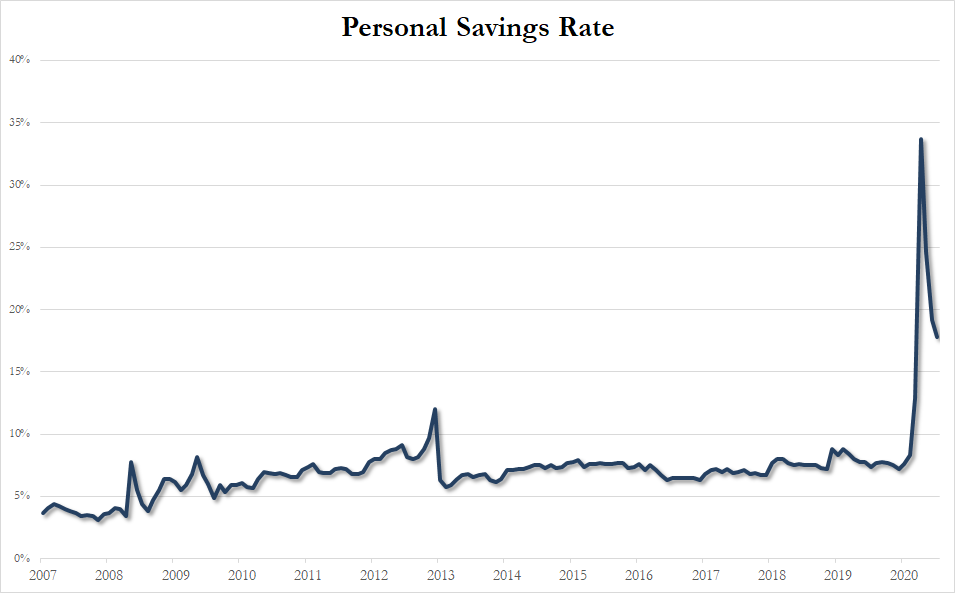

Sending the savings rate lower (from 19.2% to 17.8%)…

Finally we note that The Fed’s favorite inflation indicator – Core PCE Deflator – re-accelerated in July, but at 1.3% remains well below any old or new mandate-driven level…

Bear in mind that this data – from July – was before the big handouts all stopped!

via ZeroHedge News https://ift.tt/3hDgGtJ Tyler Durden