Let’s Talk About Skew, Baby…

Tyler Durden

Fri, 08/28/2020 – 09:20

“Ce qu’il y a de certain c’est que moi, je ne suis pas Marxiste.”

(“What is certain is that I myself am not a Marxist.”)

– Karl Marx, 1882

Summary:

The bullish narrative of aggressive retail call buying driving markets higher conceals an important market dynamic of decreasing liquidity and an increasing mismatch between buyers and sellers as option volatility selling strategies, like call overwriting, retreat in the aftermath of poor performance. These dynamics drive a scenario of increased fragility that raises prospects for extreme moves in both directions.

This is going to be short, but sweet.

Over the past few weeks, media chatter has been steadily increasing with breathless comparisons to the DotCom bubble as many of the momentum favorites have churned higher and higher, and alongside their relentless rise, a consistent rise in the pricing of their Out Of The Money (OTM) call options.

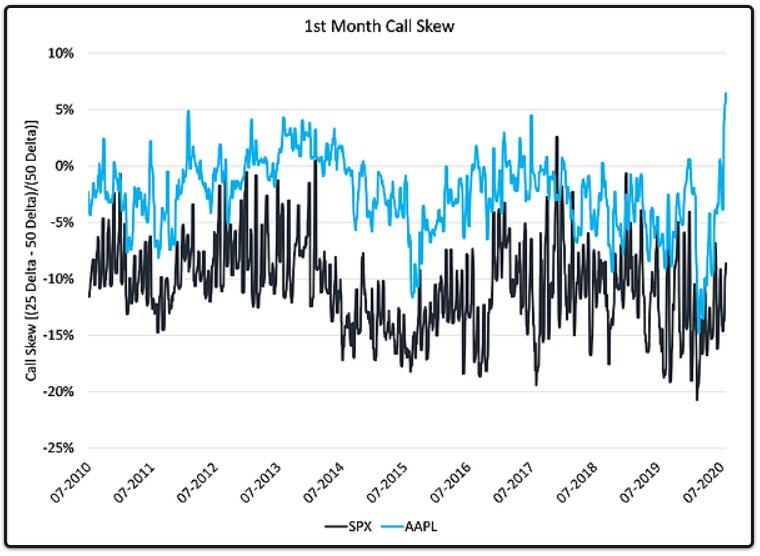

For starters, it is important to emphasize that this is a single stock rather than an index phenomenon. As a simple example, Apple (AAPL) 25 delta – 50 delta front month call option implied volatility skew has risen to decade highs while the S&P’s is hanging out in normal territory.

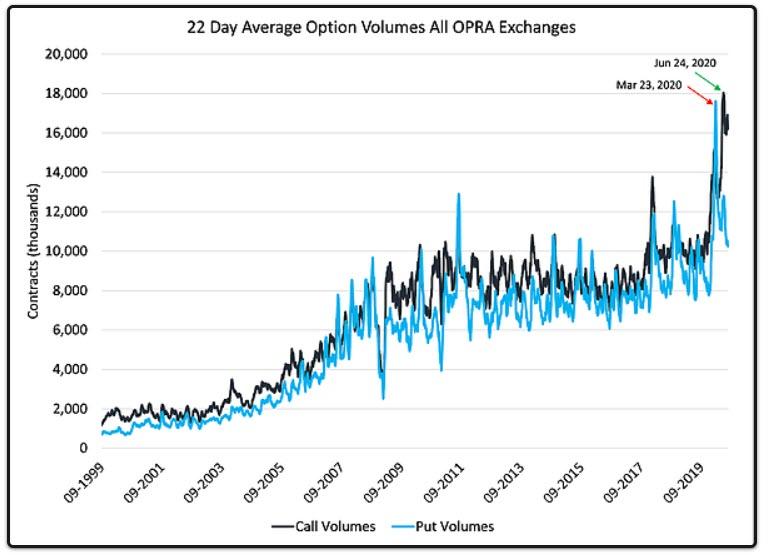

Concurrently, a chart has been making the rounds highlighting explosive call option volumes. While this is true, what is not represented is that just a few months ago we experienced record high put volumes. This market has truly been an equal opportunity offender in just the span of a few months. Given the extraordinary moves we have seen in stocks like AAPL, the obvious question becomes “Are we seeing a replay of DotCom mania?” Well, “yes, but…”

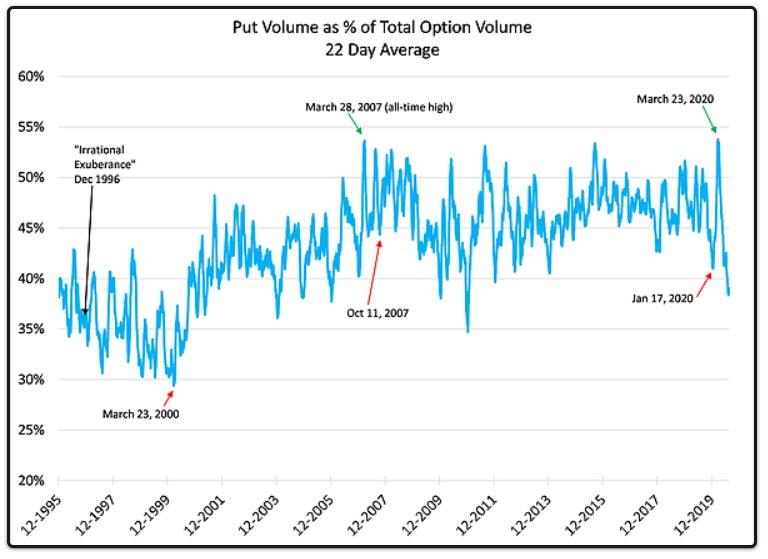

If we utilize a longer time frame to compare the current exuberance for calls to the heady DotCom era, we come nowhere close. The current fraction of option volume for calls, at 62%, remains below the average of 65% for the entire period from Greenspan’s “Irrational Exuberance” speech to the crashing of the Nasdaq on March 23, 2000. What does appear unusual is the near record share of puts as a fraction of option volumes (53.7%) on March 23, 2020 (the day before the recent trough in equity prices and almost exactly 20 years to the day from the record low reached in the DotCom cycle when only 29% of option volume went to puts).

The unfortunate answer appears to be that the behavior we are seeing is not tied to massive speculation in calls, but rather a predictable dynamic driven by increased dealer hedging costs given an in increasingly illiquid market.

This is the source of the subtitle of this piece – the well-known disclaimer by Marx that if he were to listen to the Marxist rants of his followers, he would not consider himself to be a Marxist. At the core of the error in Marxism is the belief in the Labor Theory of Value; that cost determines price. This is only true in a monopolistic environment, which could only happen if option market making were becoming increasingly dominated by a few large players. We have seen no evidence of this. (Narrator: there is evidence for this)

via ZeroHedge News https://ift.tt/34FF2zx Tyler Durden