What’s Behind Last Week’s Unprecedented Meltup In The VIX? Citadel Explains

Tyler Durden

Sun, 08/30/2020 – 13:45

Yesterday, we published a collection of some of the most striking, outlandish and shocking market charts we have seen in recent weeks, and while we touched on various issues including the collapse in market breadth, Apple’s imminent overtake of the entire Russell 2000, the historic “growth vs value” decoupling, the record overvaluation of the tech sector vs the collapse in “value”, the fulcrum point was undoubtedly the bizarre moves in the VIX in general, and single name call activity of several giga-cap stocks in particular.

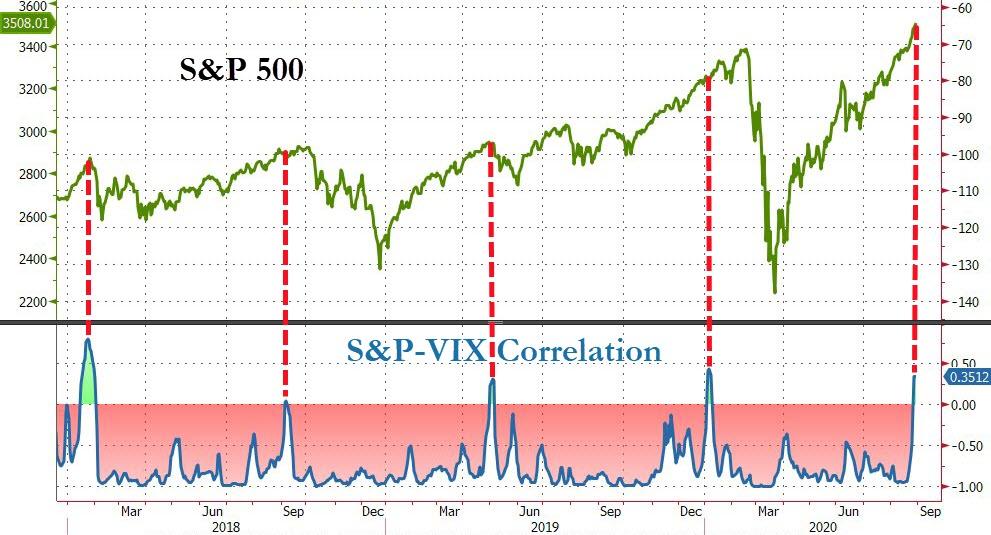

Perhaps of all the charts, one of the most curious observations was the recent meltup in the VIX, and especially the Nasdaq Vol index, which last week was tracking the Nasdaq almost tick for tick, a paradox when considering that the Nasdaq just hit all time highs virtually every day which should depress vol. What was behind this unprecedented inversion of one of the market’s most fundamental correlations?

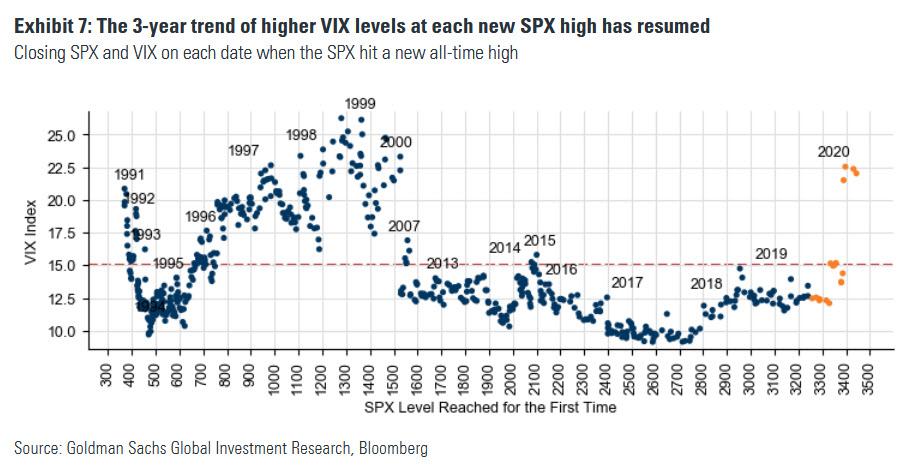

It wasn’t just the Nasdaq of course. On Wednesday and Thursday, the VIX was more than 5% higher each day, with the S&P 500 up both of those days. How rare is this? Very. According to Larry MacDonald, there were just ten days in the last decade with the S&P up 1% with the VIX closing higher. Furthermore, this is especially rare with the market at all-time highs, and as Goldman showed, the last time the VIX was this high at an all time market high was in March 2000, just before the dot com crash.

Needless to say, in a healthy bull market at its best levels, the VIX should be in the low teens, not the lows 20s as shown in the chart above. In fact, as we showed previously, the correlation between volatility and equities was at the highest since January 2018, just days before the Volmageddon event of Feb 2018.

For those scratching their heads, here is an explanation from arguably the most important market maker in the world, Citadel, which just so happens to be at the nexus of institutional and retail orderflow, and “occasionally” just happens to frontrun one or both as a recent settlement with FINRA revealed. So without further ado, here’s why the market went nuts last week, courtesy of the Bear Traps Report:

Over the past few weeks, there has been a massive buyer in the market of Technology upside calls and call spreads across a basket of names including ADBE, AMZN, FB, CRM, MSFT, GOOGL, and NFLX. Over $1 billion of premium was spent and upwards of $20 billion in notional through strike – this is arguably some of the largest single stock-flow we’ve seen in years.

“The average daily options contracts traded in NDX stocks to rise from ~4mm/day average in April to ~5.5mm/day average in August (a 38% jump in volume).

Given this group of 7 stocks accounts for a ~40% weighting in the NDX, the outsized volatility buying in the single names is having an impact at the Index level. So why are Vols moving Wednesday and Thursday when this call buying has been taking place for weeks? Yesterday CRM, one of the names we have seen outsized flow, rallied 26% on earnings – a less than ideal outcome for those short volatility from all the call buying.

As the street got trapped being short vol, other names in the basket saw 3-4 standard deviation moves higher as well – on Wednesday FB rallied 8% (a 3 standard deviation move), NFLX rallied 11% (a 4 standard deviation move), and ADBE rallied 9% (a 3 standard deviation move).

The most natural place to hedge being short single name Tech volatility is through buying NDX volatility. As such, there has been a flood of NDX volatility buyers with NDX vols up about 4 vol points in 2 trading days. And if NDX volatility is going up, SPX volatility/VIX will eventually go up too.”

And there you have it: another squeeze, if this time it was of bulls/vol shorts in a handful of tech names who were forced to cover, sending vol surging which due to the exploding gamma discussed yesterday led to even more buying of the tech index, a move further reinforced by pair trade buying of index vol to hedge single name index vol shorting. Susquehanna derivatives strategist Chris Murphy summarized it best: “We are seeing more ‘upside panic’.”

What is perhaps scariest is that there is nothing on the immediate horizon that suggests this dynamic will end any time soon.

via ZeroHedge News https://ift.tt/3gIdZpA Tyler Durden