Kolanovic Says Trump Re-Election Odds Are Soaring, Prompting Nate Silver To Melt Down On Twitter

Tyler Durden

Mon, 08/31/2020 – 14:25

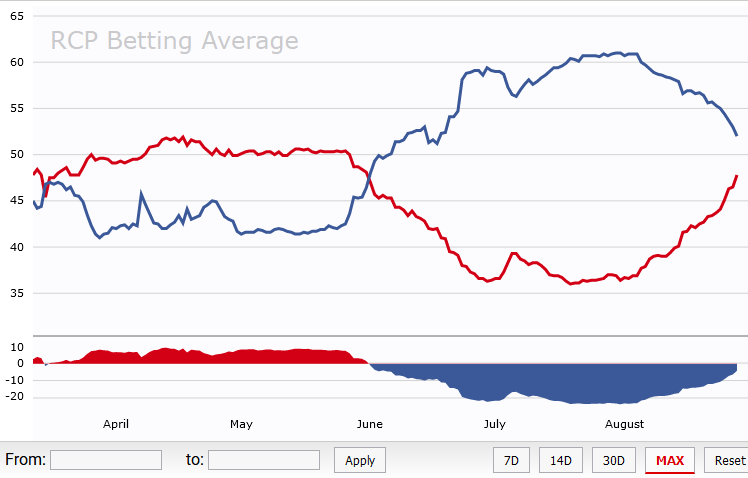

On Saturday, we showed that Trump had received a healthy boost in support following the Republican National Convention and the latest rioting in Kenosha and elsewhere, while enthusiasm for Joe Biden has slipped, according to a new poll by Morning Consult. We also showed that a far more dramatic race was reflected in Real Clear Politics‘ betting average between Trump and Biden, using data from oddsmakers Betfair, Bovada, Bwin, Matchbook, Smarkets and SpreadEx.

This morning, in his latest note, Marko Kolanovic laid out “what is next for markets” and his contention was that as the data we showed over the weekend reveal, “investors should position for rising odds of Trump re-election” as “Trump’s re-election chances are rising and are already higher than currently reflected in investment styles.” This matters because “the impact on sectors and factors (momentum vs value, cyclicals vs tech, ESG) could be dramatic and investment portfolios should adjust for a potential Trump re-election.”

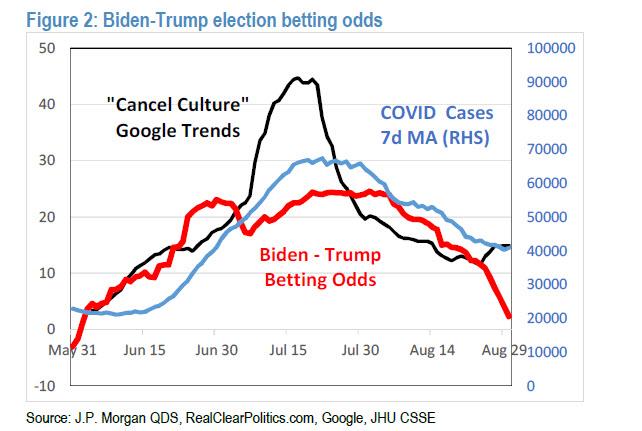

“Over the past few days, Trump’s betting odds are rapidly increasing” Kolanovic said, stating that he analyzed and quantified “2 effects that we believe are driving this shift and may significantly impact the election outcome.” The JPM quant then explained that “Trump’s betting odds started plummeting with the onset of large protests in early June. During the month of August, Trump was as much as 25 points behind and investors took Biden’s election for granted (we cautioned this may be premature). However, during the month of August, Trump’s betting odds started improving, with the largest increase happening over the past week. Currently, betting odds have Trump virtually tied with Biden.”

Kolanovic then asks what caused this initial collapse and then full recovery of Trump’s odds. His response: “we believe it is largely due to two effects: 1) the impact of the degree of violence in protests on public opinion and voting patterns and 2) a bias in polls due to Trump voters being more likely to decline or mislead polls”, both factors we discussed extensively over the past week (here and here).

Then, after laying out the dynamics our readers are already familiar with, Kolanovic says that “momentum related to the Wasow effect will continue in favor of Trump, unless Democrats pivot away from their stance regarding demonstrations. This may not be easy however, given that top Democrats have called for daily demonstrations (e.g. Kamala Harris) and rallied their base around the theme of defunding police and would need to effectively adopt Trump’s policy after 3 months as a reaction to polls. Some party officials already rationalized or promoted the behavior.”

Then there is the question of turnout: here Kolanovic makes a critical point saying that “turnout strongly depends on the left wing of the party (‘Bernie bros’, Marxist elements, etc.), which would be alienated by such a shift” [toward demonstrations].

Of course, the fading impact of Covid will also have an impact on the election: “Another important driver in determining both the market direction and election outcome is the progression of COVID-19. Figure 2 shows that daily US COVID-19 cases also correlate with Trump betting odds. New COVID-19 cases rate has been declining by about ~20,000 cases/day per month. Given that there are no very large states that have yet to see widespread outbreaks that can significantly boost new cases, this will likely set the pandemic on course to subside in time for the election. Declining cases may further provide a boost to Trump’s election odds.

Finally, Kolanovic notes that the last important driver of election odds will be the outcome of presidential debates: “Currently, top Democrats are calling for the historically unprecedented action of cancelling debates. Cancelling debates would likely not bode well for Biden, as recent polls suggest that 61% of voters think Biden should address the question of dementia publicly, and 52% are either not sure or think that Biden has the condition.”

And while the JPM strategist concedes that “a lot can happen in the next ~60 days to change the odds” he currently believes “that momentum in favor of Trump will continue, while the most investors are still positioned for a Biden win. Implications could significant for the performance of factors, sectors, COVID-19 winners/losers, as well as ESG.“

* * *

With just over two months left, it remains to be seen if Trump’s momentum persists but what we found unquestionably hilarious is that shortly after Kolanovic’s warning was publicized, none other than Nate Silver who predicted the 2016 would be won by Hillary (see here and here), though granted with some caveats and far less vocally than his even more clueless peers who had all predicted a Hillary landslide, had a meltdown on twitter, slamming the two core arguments behind Kolanovic’s opinion, proceeding directly to ad hominem attacks, calling Marko a “financebro” to wit:

“both of these propositions are almost entirely lacking in evidence, to the point where they’re more superstitious than empirical, but are an interesting window into the mindset of techbros and financebros who are buying up Trump shares on prediction markets.”

Both of these propositions are almost entirely lacking in evidence, to the point where they’re more superstitious than empirical, but are an interesting window into the mindset of techbros and financebros who are buying up Trump shares on prediction markets. https://t.co/HmNKxSG1ob

— Nate Silver (@NateSilver538) August 31, 2020

The meltdown continued for several more tweets, and culminated with the following scathing attack: “A chart like this is nonsense, and the analysis behind it is lacking any sort of empirical anchor and is otherwise hopelessly confused. It’s amazing that they shared it with a reporter because they thought it would make them look smart.”

Most of what makes political prediction markets dumb is that people assume they have expertise about election forecasting because they a) follow politics and b) understand “data” and “markets”. Without more specific domain knowledge, though, that combo is a recipe for stupidity.

— Nate Silver (@NateSilver538) August 31, 2020

Part of it I guess is you don’t look smart by pointing out the obvious, the obvious being that the candidate who has been ahead in the polls all year (Biden) is the favorite, though the question of *how much* of a favorite requires a lot of technical and domain expertise.

— Nate Silver (@NateSilver538) August 31, 2020

Nate, chill out “pollbro” and stop pretending like there is some profound, abstruse and complex science involved here – there isn’t – and that only certified grand druids of polling have a right to opine on the future. If anything, you are the one who should shut up, instead of trying to “look smart” by bashing Kolanovic, who at least lays out his logic and – ultimately – his clients will decide if he is right or wrong with their wallet. It’s called skin in the game: if Marko is right, he will be rewarded, if he is wrong he may lose his job. You, on the other hand, were hopelessly wrong in 2016 and yet here you are pretending you have some arcane “technical and domain expertise.”

What really prompted Silver’s implosion? It appears that despite his catastrophic track record from 2016, Nate still believes he somehow holds a monopoly on forecasting and “analyzing” polls and thus Kolanovic’s upstaging of Silver was taken especially personally, even though we are shocked that people still care and listen to what Silver has to say. Incidentally, Nate, it wasn’t you but this website that explained for much of 2016…

- “ABC/Wapo Effectively Admit To Poll Tampering As Hillary’s “Lead” Shrinks To 2-Points“

- “How Reuters “Tweaked” Its Latest Poll (Again) To Show A Clinton Lead“

- “Statisticians Warn Of “Systemic Mainstream Misinformation” In Poll Data“

- “CNN Goes “Full Reuters” – Attempts To Rig VP Debate Poll With Too Many Dems In Sample“

- “New Podesta Email Exposes Playbook For Rigging Polls Through ‘Oversamples’“

… why the polling results in 2016 were meaningless and why people should not rely on what they predicted. We were right, you were wrong.

Oh and for those who care or keep records of such things, Silver’s latest take – perhaps having learned from the 2016 fiasco – is that “Biden is slightly favored to win the election.”

So what does happen next? Well, the good news is that in just a few weeks we will know who is right and wrong. If Trump’s polling suddenly reverses and Biden steamrolls the president, well then it won’t be the first time that a “once in a decade” opportunity to bet on a reversal has gone wrong. On the other hand, we sincerely hope that if Trump is victorious on Nov 3 that Nate Silver finally finds a job that he is good at.

via ZeroHedge News https://ift.tt/34OCJKt Tyler Durden