With A Record Number Of Bulls, The Euro Is Ripe To Tumble After “Euphoric Run”

Tyler Durden

Wed, 09/02/2020 – 11:35

Yesterday morning just moments after the EURUSD hit 1.20, the highest level in over two years, a level which sparked selling across European market, we predicted that any minute now the ECB would start talking down the EUR taking us back to “square one” in the currency wars.

Literally minutes after our tweet, European Central Bank chief economist Philip Lane confirmed that the dollar’s plunge is likely over – at least against the Euro – when he said that the EUR exchange rate “does matter” for monetary policy, which caused investors to hit reverse on the recent run-up in the euro, because as Bloomberg notes while that comment may seem benign, “traders are very sensitive to any comment from the central bank, which usually chooses not to comment on currency developments.”

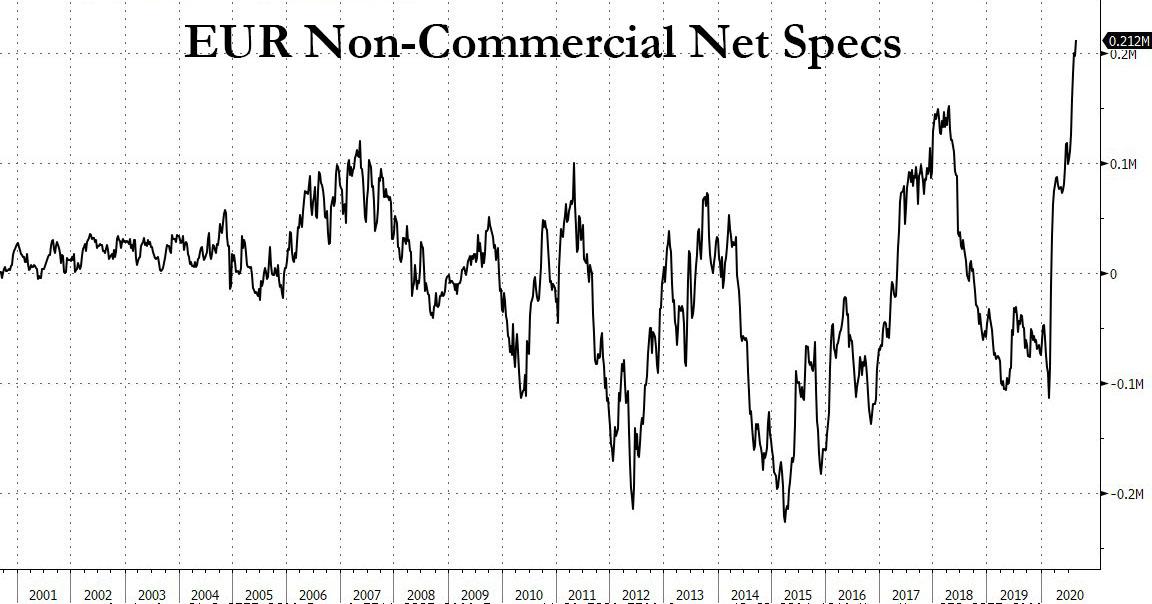

Furthermore, in the recent EUR runup, non-commercial speculators took their futures exposure to a record high, and with momentum now reversing following the ECB’s comment, we somehow doubt these momentum chasers will form a line and wait to exit in cool, calm and orderly fashion.

Which brings us to a note published overnight from Bloomberg macro commentator Laura Cooper, in which she correctly observes that “Euro Is Ripe for a Reality Check After Euphoric Run.”

Below she explains why:

The euro’s advance against the dollar is due for a pause as economic data rolls over, the tailwind from compressed rates fades and bullish sentiment skews risks to the downside. EUR/USD’s rally of almost 7% this year has come amid historic European Union stimulus, virus containment, growth recoveries and broad dollar weakness. Yet further gains will be harder to come by with much good news priced in.

Upside surprises in European economic data are fading relative to the U.S. for the first time since mid-July, and high-frequency indicators are stalling below pre-pandemic levels. Meanwhile, forecast revisions are turning upward in the U.S. while holding steady in the euro area. That contrasts with 2017, when improving EU expectations converged with the U.S. to propel EUR/USD to multi-year highs above 1.23.

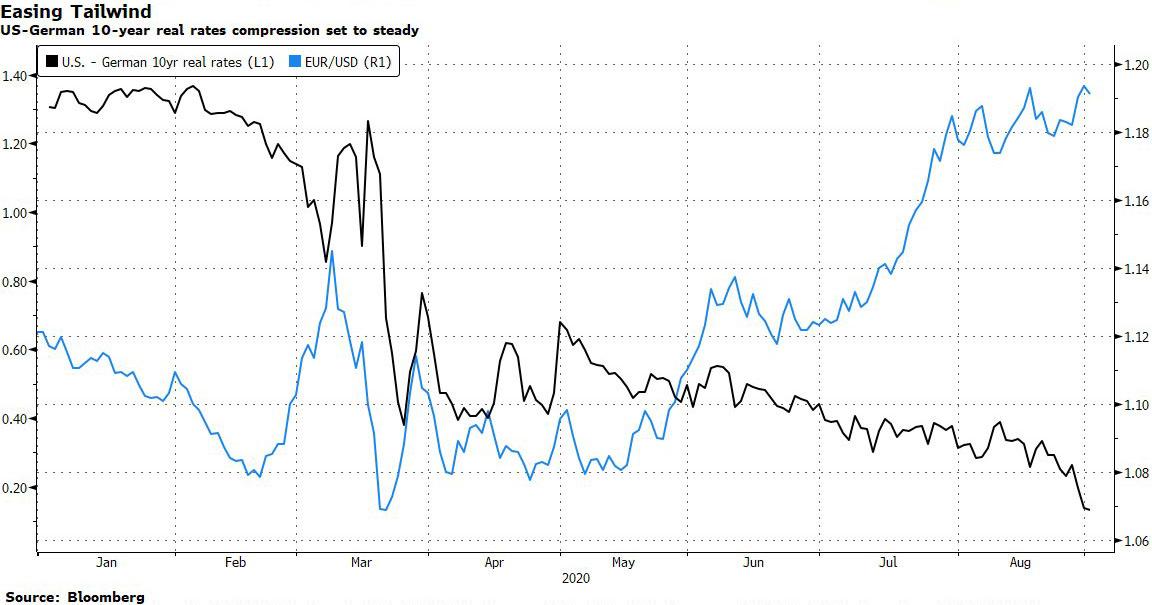

The collapse in real-rate differentials that sparked EUR/USD upside is stalling just shy of 10bps, a seven-year low. The euro tailwind from rate compression is fading, with policy expectations firmly anchored on both sides of the Atlantic.

Central bank balance sheets have less of a bearing on EUR/USD — three-year rolling correlations show the relationship between monthly changes in the monetary base and FX performance has weakened.

Plus, the relative pace of Federal Reserve and European Central Bank balance sheet expansion should be comparable going forward. The ECB’s balance sheet is forecast to grow from 55% of GDP currently to ~70% by late 2021, which should fall just shy of the estimated pace of Fed expansion.

There is the possibility that near-term dollar fears are overblown. Risks from twin U.S. deficits are cushioned by excess private savings. Election risks appear priced into the greenback, given a Biden presidency has been favored in betting markets since March. The dollar is still the reserve currency of choice given the absence of an alternative, and is further supported by bouts of risk-off sentiment.

The ECB could push back on euro strength, with the broad trade-weighted index testing its all-time high seen in 2009. The ~2% climb since July could shave roughly 10bps-20bps off already weak core inflation. That would pressure policy makers to act, given 5y5y forward swaps show inflation expectations are struggling around 1.25% — a sharp contrast with above 2.15% in the U.S.

Speculators who have extended bullish euro positioning to a record are likely following momentum-type strategies, signaling optimism is already priced in, with questionable room to extend.

To be sure, stretched positioning isn’t necessarily a sign of an imminent snapback. As seen in 2017, when z-scores for speculative longs go above two standard deviations, they tend to signal more near-term gains. Yet other positioning gauges are already rolling over — for instance, the Citigroup pain index is already slipping from its recent peak.

The medium-term euro outlook remains bright. European equities, which are at an all-time low relative to the S&P 500, should benefit if lapsed U.S. fiscal stimulus and political risks fuel a sustained cyclical rotation. But after incredible momentum this year, more euro upside looks harder to come by.

via ZeroHedge News https://ift.tt/3hTiFue Tyler Durden