Bank Of America Sees S&P500 Closing The Year Anywhere Between 2,200 To 4,000

Tyler Durden

Thu, 09/03/2020 – 09:50

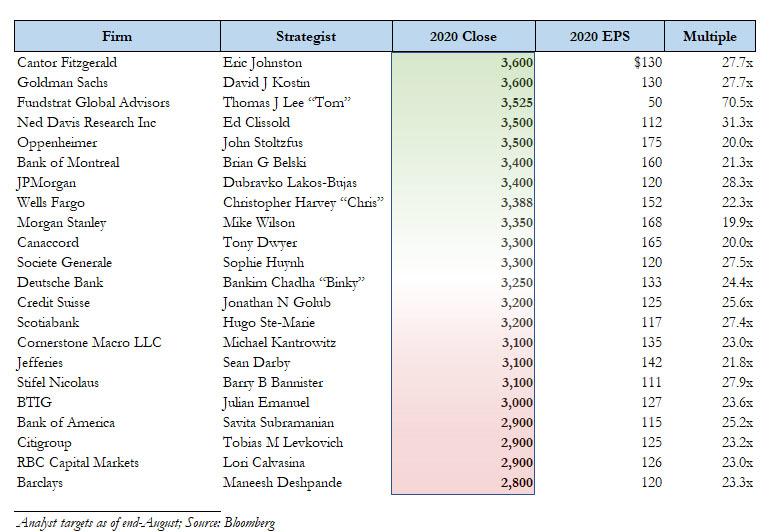

Perhaps feeling the pressure to do something after we published a chart yesterday showing that its S&P price target was among the lowest of all Wall Street strategists tracked by Bloomberg…

… as a record disconnect has opened up between the S&P and the average sellside price target…

… but this morning Bank of America’s chief equity strategist Savita Subramanian threw in the towel and in a note titled “The New Abnormal”, and following price target hikes by her BofA colleagues on both Apple and Tesla (just as the two stocks appear to have peaked for now), joined the chase, raising the bank’s S&P price target from 2,900 to 3,250.

Lamenting that “near-zero real rates are apparently the new normal” Subramanian writes that the quality composition of the S&P500 has improved (largely by cyclical sectors getting smaller), “warranting a lower equity risk premium” similar to the argument used by Goldman three weeks ago when it hiked its own price target from 3,000 to 3,600. Additionally, Subramanian claims that fundamentals have also improved: “the ratio of upward to downward management guidance is the highest since Reg FD. The hit to sales from COVID-19 was offset by record sales at Tech and other social distancing beneficiaries.”

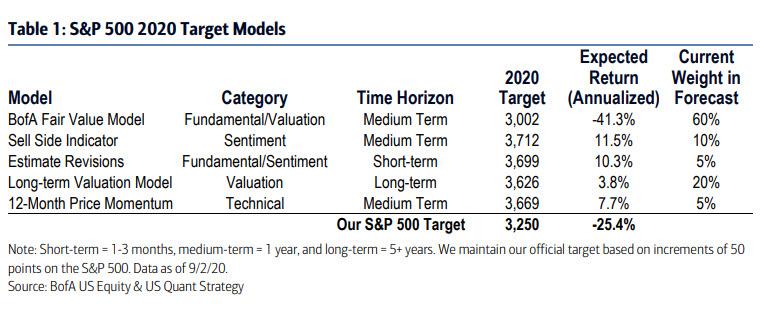

The BofA strategist then “refreshes” her various models (full table below) and writes that “four of our five target models forecast positive returns from here, and two (Wall St. sentiment and earnings revisions) forecast above average returns.” While fair “value model” remains the most bearish, it amusingly increased from 2481 to 3002 this month based on a $3 increase in 2021 normalized earnings and a 100bp lower discount rate. With these adjustments, BofA’s target is now 3250, still lower than current market levels.

One particular catalyst BofA points to is a functional covid vaccine, which “would be really bullish for benchmarks” as it would propel the depressed sectors of the market higher:

S&P 500 leadership has been focused in two themes: secular growth and quality/cash return – not surprising given sluggish economic growth and a scarcity of income. The market-cap weighted composition of the S&P 500 is now 70% high quality, a record, versus the Russell 2000 which is 23% high quality (and other regions are similarly low quality biased). Thus in a full COVID-19 recovery scenario, which would favor cyclicals, the S&P 500 could meaningfully lag other markets.

Despite its newly found optimism, BofA writes that “we are not out of the woods, in fact quite the contrary” and adds that the months ahead of an election “typically see a demonstrable increase in volatility; super accommodative policy is hitting some speed bumps – failure to pass more stimulus, proposed corporate tax hikes, etc., pose risks.” One latent risk – a COVID-19 second wave risk – could increase amid autumn/back to school, even as layoffs are accelerating. At the same time, valuations are extended on all measures except relative to bonds (to be discussed in a subsequent post).

But the only thing that really matters – liquidity – remains abundant, “with dry powder at private and public funds, high cash allocations among individuals, still tepid sentiment on stocks, and not a lot of better income options than US equity dividends.”

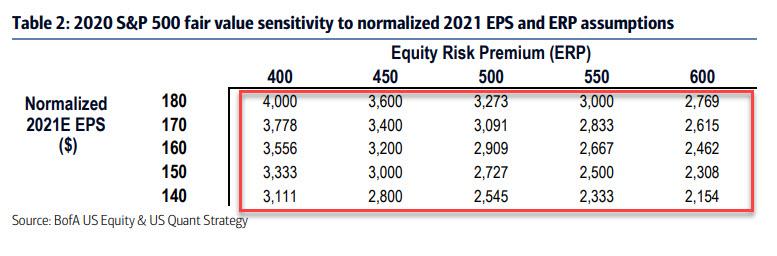

In any case, while BofA triangulates its price target to 3,250, it concedes that the range of outcomes is enormous, and “based on realistic worst case (second wave, double dip recession) vs. best case (vaccine, stimulus, continued low rates) scenarios” the banks sees the S&P closing the year anywhere between 2200 to 4000.

via ZeroHedge News https://ift.tt/2QUsewQ Tyler Durden