Speculation Emerges Over Identity Of Mystery Marketwide Call Buyer

Tyler Durden

Thu, 09/03/2020 – 13:30

Yesterday we explained that much of the bizarre moves seen in the market in recent weeks can be explained as an unprecedented gamma “battle” between one or more funds who were aggressively bidding up calls to the point that VIX was surging even as stocks hit 9 consecutive all time highs, while dealers were stuck “short gamma” and in their attempts to delta-hedge the ever higher highs, would buy stocks thereby creating a feedback loop where the higher the market rose, the more buying ensued.

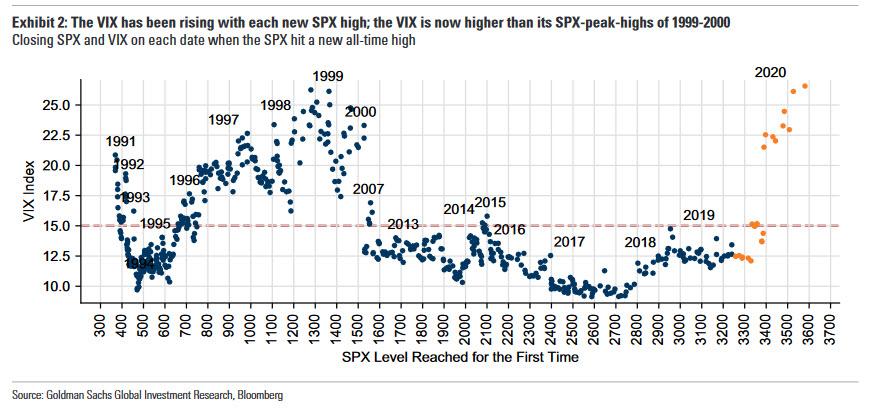

And, as Goldman pointed out this morning following our own observations on the matter yesterday, “each new high for the SPX has come with a higher VIX, and at 26.6 [ZH: make that 32 now] the VIX is now higher than it was at the SPX peaks of March 2000.”

Ahead of today’s market action, Larry McDonald’s Bear Traps report made some follow through observations on this clash between gamma shorts and gamma long, saying that “as we learned with Lehman, greed breaks things. It’s “high-noon” – the only character missing is Gary Cooper. We are witnessing a battle of wills, high speculation where colossal call buyers are forcing the street to get long more and more stock to hedge their upside risk. It’s the March capitulation selling in reverse. Just the way the street had to BUY downside protection in late March (because put buyers outnumbered call buyers 10-1). Today, they are being forced to BUY upside protection in SIZE (call buyers outnumbered put buyers 10-1).””

Just one day later, it appears that this historic gamma squeeze has finally broken and Gary Cooper has finally showed up, with both tech names and the broader market tumbling so perhaps the dynamic that defined the market for much of August is now over.

What happens next? To quote the same PM who a few days ago said that only Tesla matters in this market, well, he hasn’t changed his mind as the following note before the market opened confirmed:

2 things to watch: For convexity selling, the closes in the red for AAPL and TSLA were important. However, watch for confirmation tomorrow morning, further weakness would trigger new incremental option related selling. Just keep an eye on Tesla, it leads everything and has the highest beta. For a rotation signal, I think KO and PEP, etc tell you something real happening…

Yet as some loose ends have been resolve, the real questions emerge and first and foremost is who was it that led this furious gamma charge higher, taking on virtually every dealer?

Once again, we quote the Bear Traps report which first thing this morning may have identified the culrpit behind the most bizarre market action since the Feb 2018 volmageddon:

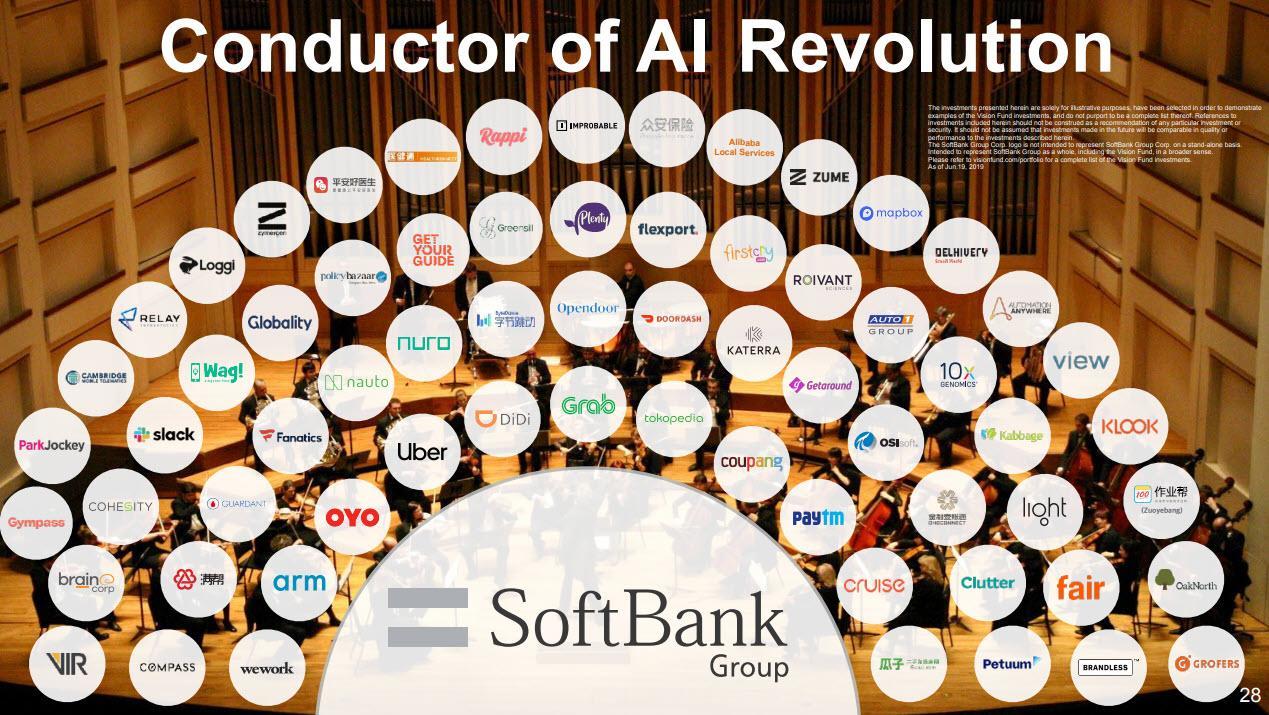

“one large buyer has made a colossal splash in the market and the scent of greed has drawn thousands of other market participants into the dangerous game. Several clients in our institutional chat on Bloomberg have cited SoftBank as the original size buyer. We have NO IDEA if this is true, just that highly credible clients have made this reference several times over the last week.”

It is hardly unreasonable to imagine SoftBank, the “brains” behind such catastrophic investments as WeWork, WireFraud WireCard, and countless other failed “unicorns” would desperately try to Volkswagen not just a handful of tech names, but the entire market in the process. After all, Masa Son is desperate to deflect attention from the fact that as we put it last October, “SoftBank is the Bubble Era’s “Short Of The Century.” And if there is one thing that can salvage the Japanese VC titan’s reputation it is a second tech bubble which blows out the valuation of his countless (otherwise worthless) investments which form the backbone of SoftBank’s “AI Revolution” whatever that means.

Yet as while we seek further proof about the identity of the gamma grabber, spare a thought for everyone else that jumped on the bandwagon only to see their “get rich quick” fortunes turn to smoke. Here again is Larry McDonalds with the anticlimax:

It’s a high-stakes game of musical chairs, the ultimate greater fool theory moment. The colossal call buyer has thrown meat in the water and drawn in the sharks, but unfortunately thousands of Robinhood minnows at the same time. When the large players’ exit, the little guy and gal will be left holding the bag. As my first boss told me at Merrill Lynch in 1990, “In options Larry, they show it to you (lush $$ green premium), and then they take it away.”

One final thought: the HFT(s) that frontrun Robinhood traders giveth and taketh away, and today’s elevator down action demonstrates just how furious the selling is – and will be – courtesy of the algos who sense that a tidal wave of retail selling is about to hit.

via ZeroHedge News https://ift.tt/2GrtdTw Tyler Durden