“We Should Be Concerned” – Fed Spooked By Biggest Market Crash Since March

Tyler Durden

Thu, 09/03/2020 – 16:01

US equity market crashed most since March today (Nasdaq down 6% at its worst and The Dow down over 1000pts at its nadir)…

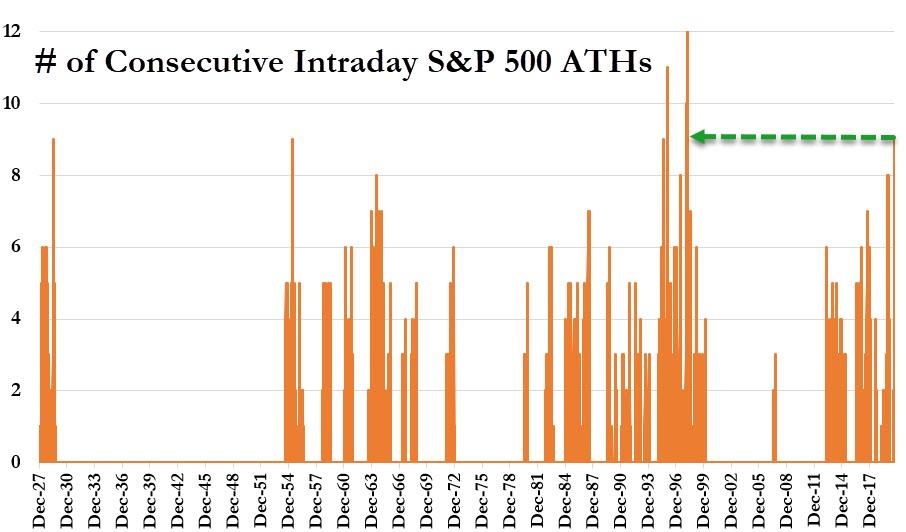

The S&P 500’s longest streak of intraday all-time-highs since 1998 is now over…

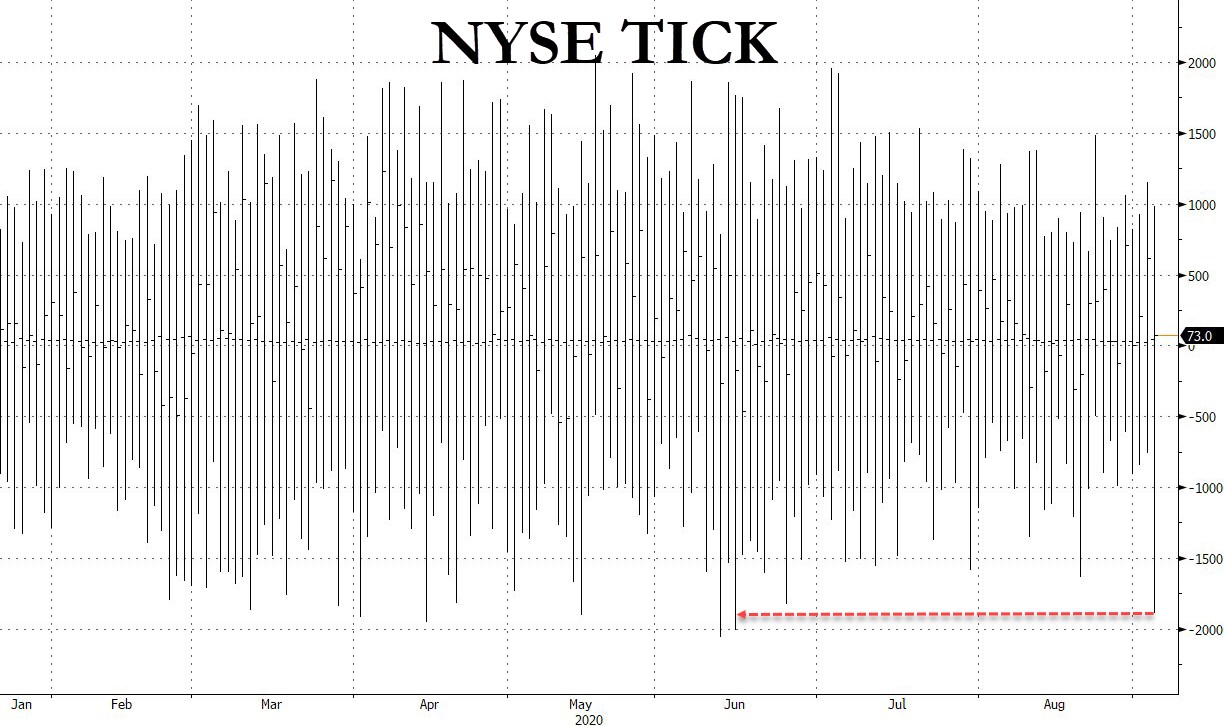

Biggeset sell programs since June…

Source: Bloomberg

The Dow is back in the red YTD and Small Caps are back at one-month lows…

Source: Bloomberg

And VIX exploded to its highest since June…

Newly-minted options gurus suddenly flipped from gorging on calls to panic-buying puts…

Source: Bloomberg

As FANGs were fucked…

Source: Bloomberg

Apple cooked…

AAPL is once again smaller than the entire Russell 2000…

Source: Bloomberg

And Tesla twatted (into a bear market from the highs)…

We suspect this is the scene in more than a few home offices this evening:

But hey, don’t worry, CNBC had some words of advice sprinkled in throughout the session:

“…today’s pullback is a drop in the bucket”

“…what we’ve been waiting for – a healthy pause that refreshes”

“…the damage today is really not as bad as it looks”

– Bob Pisani

The Fed’s speakers didn’t help:

-

1215ET *BOSTIC: WE SHOULD BE CONCERNED ABOUT THE RISK OF ASSET BUBBLES

-

1340ET *EVANS: “I MARVEL” AT STOCK MARKET RISE DESPITE UNCERTAINTY

Are they trying to send a signal to the markets?

Credit was weaker but has been signaling an end to the exuberant bounce for over a month…

Source: Bloomberg

It appears bonds were right after all…

Source: Bloomberg

Bonds were bid with 10Y Yields plunging back to 60bps…

Source: Bloomberg

The Dollar managed to hold gains today but was very uninterested in the chaos underway in stocks…

Source: Bloomberg

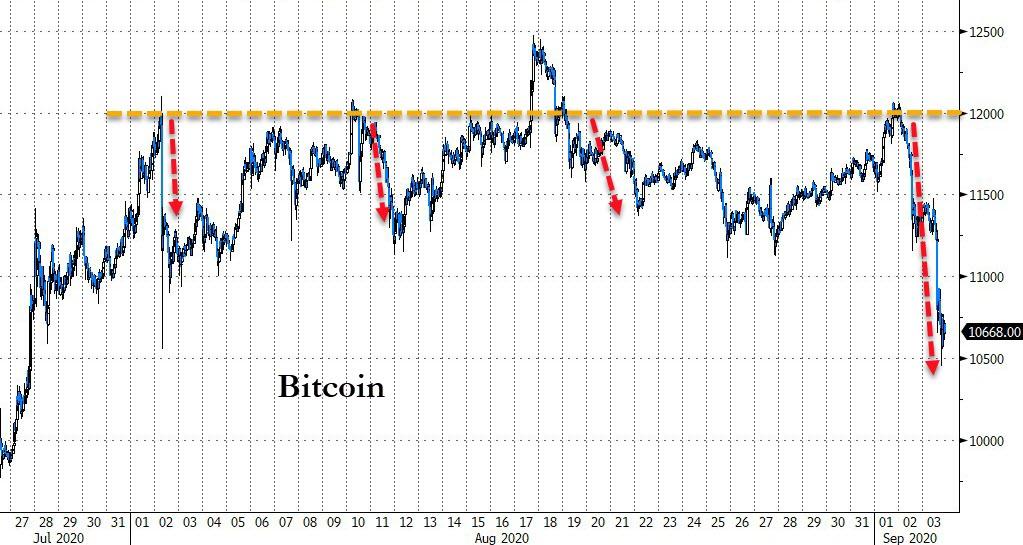

Cryptos were also dumped today with Bitcoin extending its slide…

Source: Bloomberg

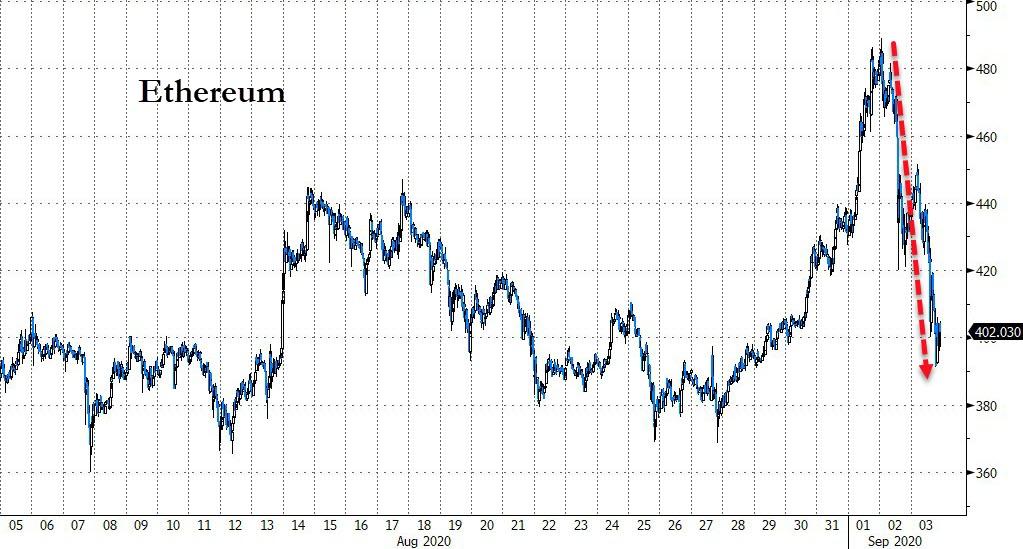

And Ethereum was clubbed back below $400…

Source: Bloomberg

Nothing escaped the selling (apart from bonds of course) as gold was hit (but tried to bounce back)…

And silver was hit harder…

Oil also tanked, but tried to bounce back…

And another high-flyer – Lumber – was chopped…

Source: Bloomberg

And finally, don’t say you weren’t warned that time was up…

Source: Bloomberg

As Sven Henrich points out:

“September 3rd marked the top in 1929 following a furious rally fueled by wild optimism, excessive retail speculative behavior and markets disconnecting far above the fundamentals of the economy.”

More to come?

Source: Bloomberg

via ZeroHedge News https://ift.tt/3lXSgOm Tyler Durden