Futures Rebound From Furious Selloff But Tech Slide Continues

Tyler Durden

Fri, 09/04/2020 – 07:35

Futures tracking the S&P 500 and Dow indexes bounced on Friday – if not so much the Nasdaq – after Wall Street’s worst session since June, with attention now turning to the crucial jobs report that is likely to show a faltering recovery in the labor market. S&P 500 contracts gained as much as 0.6% ahead of the U.S. open although the bounce appeared to lose power, while Nasdaq 100 Index futures resumes their slide after an attempt to rebound failed.

Despite the recovery in spoos, Nasdaq futures were deep in the red, as shares of Apple and Tesla – the poster children for the furious August ramp – resumed their slide in early premarket trading, suggesting that momentum from the rout may still be present.

After climbing to record highs on the back of historic stimulus and a rally in technology stocks, the S&P 500 and Nasdaq suffered their worst day in nearly three months on Friday as investors booked gains.

Elsewhere, there was a muted reaction to the tech-driven plunge in U.S. markets on Thursday, with European bank stocks rallying after news that Spain’s CaixaBank SA and Bankia SA are exploring a 14 billion-euro merger. Europe’s Stoxx 600 erased opening losses of as much as 1% to trade in the green as investors piled into cyclicals, selling off defensive sectors. Banks led gains, up 1.8%, with an extra boost from deal activity among Spanish lenders. Miners, autos and travel also outperformed, while real estate, tech and food-and-drink stocks fell the most.

Earlier in the session, Asian shares dropped led by health care and communications, with Australia’s benchmark recording the biggest decline since May. The Topix declined 0.9%, with Elematec and GMO Payment Gateway falling the most. The Shanghai Composite Index retreated 0.9%, with Henglin Furnishings and Cfmoto Power posting the biggest slides

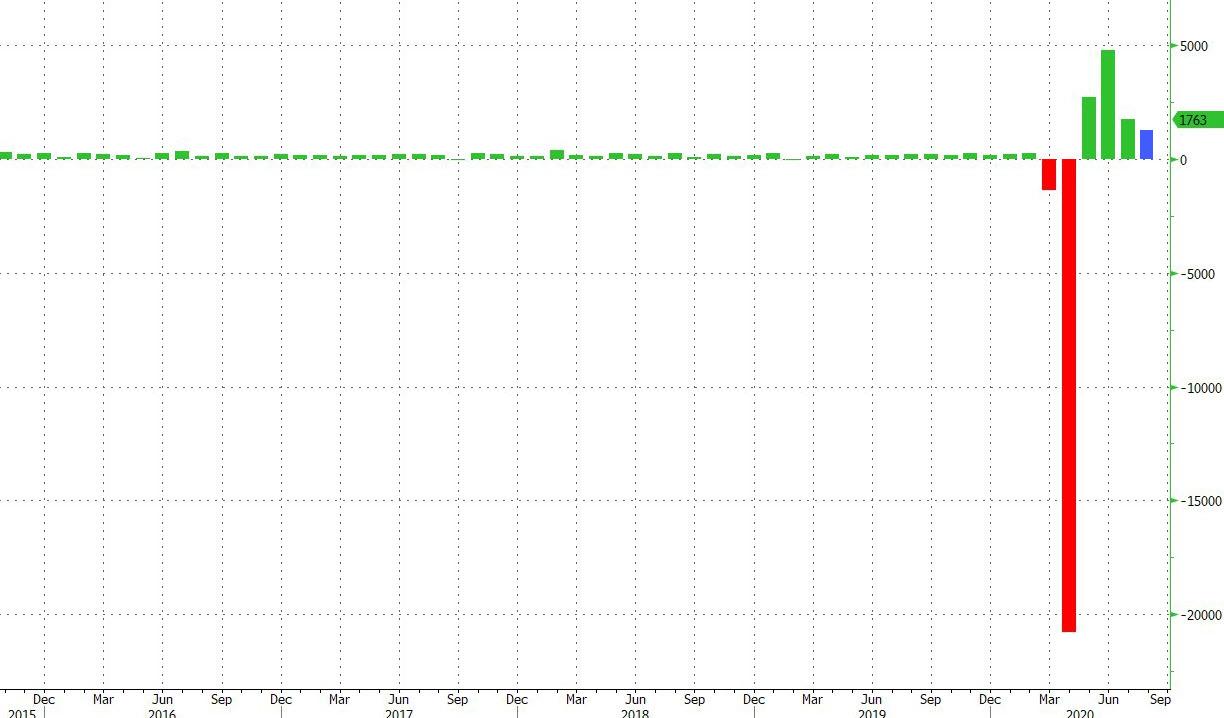

As previewed previously, this morning’s job report is expected to show 1.40 million U.S. jobs created last month, down from 1.76 million in July, as the government’s coronavirus aid ran out and companies from transportation to industrials announced layoffs or furloughs.

The data, expected at 8:30 a.m. ET could add pressure on the White House and Congress to restart stalled negotiations over the next coronavirus relief package, especially with stocks showing notable cracks.

Of course, attention will remain on tech companies. While the industry is generating blockbuster profits, there’s also been an explosion of speculative options among retail investors. For some investors, that’s clear evidence that tech stocks have become overheated according to Bloomberg.

“This is unlikely to be a repeat of the tech wreck of the late 1990s, given how much the market and sector have changed,” said JPMorgan Asset Management strategist Kerry Craig. While valuations are elevated, “we are also mindful of the earnings and revenue potential in the coming years from areas like cloud computing and artificial intelligence.”

In rates, Treasuries were under modest pressure in early U.S. trading with losses led by long end, although the price action was relatively subdued ahead of August employment report. Yields were cheaper by 0.5bp to 2bp across the curve with 2s10s spread steeper by ~1bp, 5s30s by ~1.7bp; 10-year yields around 0.65%, lagging bunds by ~1bp on the day while gilts keep pace. European bonds were little changed, outperforming Treasuries.

In FX, the U.S. dollar consolidated gains on Friday but was set for its biggest weekly rise since mid-June as an overnight drop in high-flying U.S. technology stocks fuelled a bout of risk aversion in global markets. The dollar’s bounce this week comes after weeks of losses which saw the greenback fall to a April 2018 low of 91.74 on Tuesday after the U.S. central bank overhauled its policy framework last week, which would allow it to keep rates lower for longer periods, a negative for the dollar.

“The dollar’s loss-making momentum has stopped a little bit and the recent ECB comments on the euro has also helped but the broader direction of monetary policy making will be a key factor going ahead,” said Ulrich Leuchtmann, analyst at Commerzbank.

Against a basket of currencies the dollar was trading at 92.774 in early London trading. On a weekly basis, it was up 0.6%, its biggest weekly rise since mid-May. “Near-term, if this correction in big tech continues, it will impact overall risk and fuel further demand for the dollar,” Mizuho strategists said in a note. Most currencies held in tight ranges before payrolls; Norway’s krone led gains, while the Australian dollar shrugged off an early dip to climb, after the country recommitted to opening the economy by December

In commodities, oil held above $44 a barrel on Friday and was on course for its biggest weekly decline since June as weak demand figures added to concern over a slow recovery from the COVID-19 pandemic. A U.S. government report showed that domestic gasoline demand fell in the latest week. Middle distillates inventories at Asia’s oil hub Singapore have soared above a nine-year high, official data showed. Elsewhere, spot gold and silver remain contained within tight ranges around 1935/oz and 28.80/oz respectively as the precious metals mirror Dollar action. In terms of base metals, Shanghai copper saw a session of losses as it tracked the performance in Chinese markets, whilst Dalian iron futures also tracked lower.

To the day ahead now, and as mentioned the US jobs report will likely provide the main highlight. Otherwise, we’ll also get German retail sales for July, the August construction PMIs from Germany and the UK, and the Canadian jobs report for August. Meanwhile, central bank speakers include the ECB’s Lane and Villeroy, along with the BoE’s Saunders.

Market Snapshot

- S&P 500 futures up 0.4% to 3,476.00

- STOXX Europe 600 up 0.5% to 368.06

- MXAP down 1.2% to 171.58

- MXAPJ down 1.3% to 566.34

- Nikkei down 1.1% to 23,205.43

- Topix down 0.9% to 1,616.60

- Hang Seng Index down 1.3% to 24,695.45

- Shanghai Composite down 0.9% to 3,355.37

- Sensex down 1% to 38,602.63

- Australia S&P/ASX 200 down 3.1% to 5,925.51

- Kospi down 1.2% to 2,368.25

- Brent futures up 0.4% to $44.25/bbl

- Gold spot up 0.2% to $1,934.36

- U.S. Dollar Index little changed at 92.70

- German 10Y yield rose 1.3 bps to -0.475%

- Euro down 0.09% to $1.1841

- Italian 10Y yield rose 0.3 bps to 0.849%

- Spanish 10Y yield rose 0.9 bps to 0.335%

Top Overnight News from Bloomberg

- U.S. House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin have agreed to work to avoid a government shutdown just before the November election, and to not let the battle over stimulus funding delay a stopgap bill

- Coronavirus cases surpassed 26 million worldwide, while deaths exceeded 868,000

- Australia’s Prime Minister Scott Morrison announced that most state and territory leaders were committed to reopening the country’s economy by December in an attempt to bring it out of its first recession in decades

- The Bank of England is likely to have to ease monetary policy further to help combat the economic impact of the coronavirus, according to central bank official Michael Saunders

- Boris Johnson’s government said it will be able to avoid border chaos when the U.K. completes its split from the European Union despite stark warnings from industry over its lack of readiness

A quick look at global markets courtesy of NewsSquawk

APAC stocks declined across the board as the region reacted to the bloodbath on Wall St where markets slipped aggressively from record levels and the DJIA fell over 800 points and Nasdaq shed over 5% amid a tech rout, as well as the paring of risk heading into the NFP jobs data and US holiday weekend. ASX 200 (-3.0%) and Nikkei 225 (-1.1%) were heavily pressured in the face of the tech-related headwinds which resulted to hefty losses for the sector in Australia and dragged the index beneath the 6,000 level, while sentiment in Tokyo also deteriorated as exporters suffered the ill-effects of a firmer currency. Elsewhere, Hang Seng (-1.3%) and Shanghai Comp. (-0.9%) conformed to the broad losses in the region which followed a substantial net liquidity drain of CNY 470bln by the PBoC this week, and as tensions lingered with Chinese President Xi suggesting China will never accept foreign interference and with Global Times stating China will further cut holdings of US bonds due to concerns about a US crackdown and risks of ballooning US deficit although the reports cited economist and not government officials. Finally, 10yr JGBs traded flat as prices failed to benefit from the stock rout and the BoJ’s presence in the market, which was for a relatively reserved JPY 520bln of JGBs heavily focused on 5yr-10yr maturities.

Top Asian News

- Sri Lanka’s President Seeks to Restore Sweeping Executive Powers

- Chinese Banks Plan $29 Billion in Bond Sales to Replenish Capital

- Turkey Warns West It Will Continue to Shop Around for Missiles

- Yum China Is Said to Raise $2.2 Billion in Hong Kong Listing

European equity markets have staged somewhat of a recovery since the cash open (Euro Stoxx 50 +0.5%) after erasing losses of some 0.9% following a downbeat APAC session – with gains lead by the periphery, namely the IBEX (+1.6%) propped up by source reports that Bankia (+30%) and Caixabank (+15%) are working on a merger, with a deal to be closed in the next few days. Thus, the European financial sector is outperforming with the FTSE MIB (+0.6%) also benefitting given its large exposure to banks. Overall sectors present a cyclical/value tilt, whilst IT clambered its way from the bottom after initial pressure from Wall Street’s tech rout. The breakdown also sees a firm performance amongst Travel & Leisure names, underpinned by the recovery in sentiment alongside relief as Greece and Portugal were not added to UK’s travel quarantine list despite speculation. In term of individual movers, Telecom Italia (+0.2%) remains subdued after the Italian Industry Ministry stated that the Co. may not have a majority stake in Italy’s future single broadband network operator, thus providing impetus to Mediaset (+8.1%). Finally, Imperial Brands (+2.9%) remains underpinned by a positive broker move.

Top European News

- Russia Rate Cut in Question After Novichok Claim Hits Ruble

- London’s Housing Market Lures Hong Kongers Seeking Safe Haven

- Bank of England Rate Cuts Aren’t Lowering Mortgage Costs

- One in Seven U.K. Homes Are Selling in a Week After Tax Cut

In FX, the Dollar looks laboured ahead of NFP and Monday’s US market holiday, or simply fatigued after its recovery exertions that culminated in the DXY reaching 93.074 before petering out. Pre-NFP caution and consolidation has curtailed price action with major pairings restrained within narrow ranges, exemplified by the index sticking to tight confines just below the round number (92.887-658). US Treasuries are back in bear-steepening mode to offer the Greenback support, while stocks are attempting to draw a line under yesterday’s rout awaiting further direction from the aforementioned jobs data.

- CAD/AUD/GBP/NZD – All marginally firmer vs the Buck, but mainly in corrective trade following heavy recent losses as the Loonie rebounds from 1.3140 to 1.3100+ ahead of Canada’s labour report with some traction from a stabilisation in crude prices, the Aussie bounces from around 0.7250 despite a slender miss vs consensus in July retail sales and the Pound also finds some support near a half round number to revisit the 1.3300 handle irrespective of a slowdown in the UK construction PMI or dovish sounding comments from BoE’s Saunders. Meanwhile, the Kiwi is pivoting 0.6700 and assessing the NZ COVID-19 situation following the first death and PM Adern’s review of current restrictions on September 14.

- EUR/JPY/CHF – Even more tightly bound against the US Dollar, with the Euro capped by the 200 HMA (1.1866) and heavily flanked by option expiries stretching from 1.1780-90 right up to 1.2000 (for full details see the headline feed at 6.57BST). Similarly, the Yen sits between decent expiry interest from 106.00 to 106.70-80 if it ventures beyond the 106.07-24 band that seems unlikely given little inclination amidst reports suggesting the BoJ is about to raise its assessment of the Japanese economy, and the Franc is straddling 0.9100.

- SCANDI/EM – The Nok has regained a degree of composure alongside oil, but the Try remains deflated in wake of Thursday’s soft Turkish CPI data and licking wounds off fresh all time lows.

In commodities, WTI and Brent front month futures trade have recovered off worst levels to eke mild gains in early European hours, in what seems to be a sentiment-driven move in tandem with stock markets heading into this month’s US labour market report. Oil-specific news-flow has remained light with participants continuing to flag the resumptions of Gulf of Mexico supply alongside an uncertain demand outlook. WTI Oct makes headway just above USD 41.50/bbl (vs. low (40.84/bb) whilst Brent Nov extends gains above USD 44/bbl (vs. low USD 43.53/bbl). Looking ahead to next week, monthly oil import numbers from China, released on Monday, will be eyed as a gauge of demand in the nation, ahead of the EIA STEO, although the OPEC and IEA MOMRs will be released on the following week. Elsewhere, spot gold and silver remain contained within tight ranges around 1935/oz and 28.80/oz respectively as the precious metals mirror Dollar action. In terms of base metals, Shanghai copper saw a session of losses as it tracked the performance in Chinese markets, whilst Dalian iron futures also tracked lower with rising portside inventories also weighing on the metal.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 1.35m, prior 1.76m

- 8:30am: Unemployment Rate, est. 9.8%, prior 10.2%

- 8:30am: Average Hourly Earnings MoM, est. 0.0%, prior 0.2%; Average Hourly Earnings YoY, est. 4.5%, prior 4.8%

DB’s Jim Reid concludes the overnight wrap

Ahead of today’s all-important US jobs report, there was a rout in markets yesterday led by the tech sector. Having reached a record high just the day before, the S&P 500 fell -3.51% in its biggest one-day decline since June 11th, with the VIX volatility index spiking up 7.0pts to its highest levels since mid-July. Interestingly, the jump in volatility was across the curve and the election volatility premium remains intact even after the large spike yesterday. As mentioned big tech was the main culprit behind the losses after having continuously powered forward since March. The NASDAQ fell -4.96% in its biggest daily fall for nearly 3 months, as Apple (-8.01%), Microsoft (-6.19%) and Amazon (-4.63%) all lost ground. For context though, this move only gives up the last week of gains for the NASDAQ and it is still up +27.70% on the year and +67.01% since the March lows.

Many recent winners were particularly hard hit as profit-taking took over. Stay-at-home stocks saw pull backs with Zoom (-9.97%), Docusign (-8.73%), and Slack (-7.93%) all falling, while Tesla (-9.00%) and Apple fell for the second day after rising early in the week following their stock splits. Late in the session, news came out that the US Justice Department plans to file antitrust charges against Google (-5.00%) in the coming weeks, the news initially pushed the stock another -1.5% lower though it made much of that back by the close.

Our tech strategist Apjit Walia, who sits in my team, published “America’s Racial Gap & Big Tech’s Closing Window” on Wednesday where he discussed tech inequality but also the surprisingly low number of only 1 in 3 Americans now having a positive view on Big tech companies according to our proprietary survey. As Apjit says the window for these companies is closing and post election they are likely to see closer scrutiny whoever wins. See the note from earlier this week here. Given his long history in the tech sector and reputation it’s not impossible that his note has had some influence on markets over the last 24 hours.

The large moves yesterday were evident across an array of asset classes and countries, as there was a broader rotation out of risk assets into safe havens. European equities saw a similar reversal to the US, as they pared back their strong gains at the open for the STOXX 600 to close down -1.40%. Oil fell to their lowest levels in over a month, down over -2% at one point, before Brent settled at -0.81% and WTI -0.34%. Core sovereign bonds rallied on both sides of the Atlantic, with yields on 10yr Treasuries (-1.3bps) and bunds (-1.5bps) falling further. Over in FX meanwhile, the Swiss Franc was the top-performing G10 currency, with the dollar index slightly lower (-0.12%). Not all havens gained though with gold dropping -0.62%. Silver fell -3.14%.

Overnight in Asia markets are down but not excessively so. The Nikkei (-1.30%), Hang Seng (-1.83%), Shanghai Comp (-1.38%), Kospi (-1.56%) and Asx (-3.11%) are all lower. Futures on the S&P 500 are down a further -0.56% though while those on the Nasdaq are down -1.29% indicating that the Wall street sell off might extend into today. We’ll see how the Robinhood community, that aren’t used to markets going down, react. Elsewhere oil prices are down a further c. -1% this morning and spot gold prices are back up +0.39%.

In terms of news this morning the Global Times reported (citing experts) that China may gradually reduce its holdings of US Treasury bonds to about $800 billion from the current level of more than $1 trillion, as the ballooning US federal deficit increases default risks and the Trump administration continues its blistering attack on China. The Global Times is believed to be well connected to the Chinese Communist party but it is not clear whether the article was official. For context China’s holdings of US bonds had dropped by c. -3.4% yoy as of the end of June. Another story worth highlighting is that the House Speaker Nancy Pelosi and Treasury Secretary Mnuchin have agreed to work to avoid a government shutdown in October right before the election, and not let the stalemate over virus-relief legislation hold up a vital stopgap spending bill.

In other overnight news, the UK government said that its “Eat Out to Help Out” initiative, which ended on August 31, has already led to GBP 522mn being committed versus the estimated GBP 500mn. The figure will increase further as the establishments have until the end of September to claim the money back. While we are on this its worth highlighting our CoTD from yesterday (link here) which showed how the initiative led to jump in restaurant reservations in the UK in August and has been very useful at shaping behaviour habits in a country more badly hit by the virus than many others.

On the coronavirus, there were further concerning trends yesterday, with the UK reporting the most cases (1,757) since early June yesterday. The French Health Ministry acknowledged that increased testing does not fully explain the recent rise of French cases as the weekly caseload is now the highest of the pandemic. Elsewhere Israel is planning on imposing lockdowns on 30 towns that have the highest infection rates in the country in one of the stricter recent reactions to new outbreaks. Under the lockdown, businesses and the majority of schools will be closed with residents required to be within 500 meters of their homes. Separately in the US, Dr Fauci warned that 7 states were at risk of a surge, including Illinois and Indiana. Governor Cuomo of New York reopened malls in the state, but is still unsure on indoor dining in New York City creating issues for the service industry into the winter. Meanwhile as cases are surging on school campuses, a New York state university sent students home for the semester and Indiana University warned of “uncontrolled spread” at fraternities and sororities.

As the dust settles from yesterday’s swings, attention today will turn to the US jobs report for August, which will be the first release since the enhanced unemployment benefits lapsed at the end of July. Our US economists here at DB are looking for a +1.2m increase in nonfarm payrolls, which should push the unemployment rate down to 9.7% (vs. 10.2% at present). If realised, that would bring the total gains in nonfarm payrolls since April to +10.5m, but even then it would still mean that less than half of the -22m jobs lost in March and April had been recovered, so this is likely to be a long journey yet. Today’s jobs report is also the penultimate one before the presidential election in less than 2 months’ time, so is also likely to take on a good deal of political significance, as President Trump and the Republicans look to claim credit for the economic rebound taking place.

Ahead of that later, we got the weekly initial jobless claims yesterday for the week through August 29th, which showed a decline to a post-pandemic low of 881k. That said, it’s worth bearing in mind that changes in the seasonal adjustments mean this number isn’t directly comparable to last week’s, and that the unadjusted number actually showed an increase in claims of 7,591 up to 833,352. The other main release came from the services and composite PMIs, where the Euro Area composite PMI was revised up to 51.9 (vs. flash 51.6), and the German reading also saw an upward revision to 54.4 (vs. flash 53.7). Finally, the ISM services index in the US came in at 56.9 (vs. 57.0 expected), though the employment index only rose to 47.9, so still remaining in contractionary territory. Prices paid though jumped to 64.2 vs 57.6, the highest since November 2018.

To the day ahead now, and as mentioned the US jobs report will likely provide the main highlight. Otherwise, we’ll also get German retail sales for July, the August construction PMIs from Germany and the UK, and the Canadian jobs report for August. Meanwhile, central bank speakers include the ECB’s Lane and Villeroy, along with the BoE’s Saunders.

via ZeroHedge News https://ift.tt/3lOaUbl Tyler Durden