Has It Begun?

Tyler Durden

Fri, 09/04/2020 – 08:01

Authored by Bill Blain via MorningPorridge.com,

“All these tiny little bubbles, brewing up trouble…”

Going to keep the Porridge short this morning as we ponder what’s occurring in stock markets, and what’s likely to happen today and over the weekend.

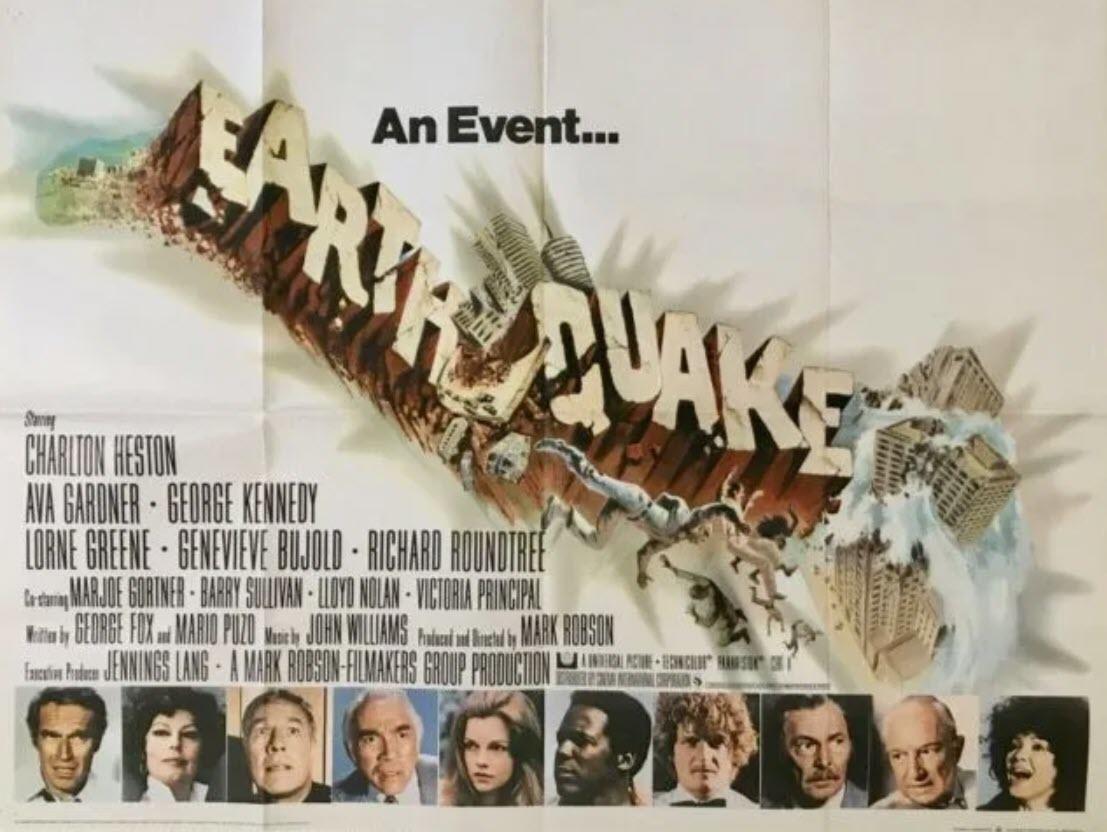

Yesterday was an “ouch” moment for markets as Richter Force 5 slip hit Tech Stocks. Did it herald the Big One or was it just another tremblor? Will it prove the long-fear “Minsky Moment” many market-bears have been waiting for; when the bubblicious bull market wakes up to the reality that easy money isn’t the same as a strong economy? Or is it likely to be a more selective correction to the crazy valuations on the growth/tech sector?

Or might it just be another Friday morning storm in a tea-cup? (No – I doubt it.)

Yesterday’s “crash” looks tiny compared to the pace and slope of the recovery in stock prices since March. However, September is often a cruel month for markets (as is October) and the degree of disbelief at record prices, stratospheric valuations and little tangible evidence to back them up seems to have tipped the balance from buy to sell.

I should have known a correction was coming – I had proof!

One of my chums bought a 3x levered Short FAANG ETF earlier this week. He’s a lovely and market-smart fellow – but let’s just say he’s made his money by trading lucky rather than being intellectual about markets! A number of my chartist friends were also saying a crisis was upon us.

As usual.. I ignored the evidence… Silly me.

The key issue about whether the current wobbling bull run is sustainable is going to be liquidity. All that money that’s been pumped into bond markets creating zero returns has had the effect of making Equities the only upside game in town. Now, the costs of the pandemic are coming due – the trillions that have been splurged on bailouts, furloughs and the QEI are largely spent.

Can Governments slow the slide by promising more?

In terms of the Pandemic economic damage we are hearing less about “whatever-it-takes” which means we worry more about the unspoken reality: “we can’t save everyone.” In the absence of further significant stimulus – there are bound to be market doubts about how to justify current record valuations. It’s another tip to the scales.

Stimulus and liquidity will be much talked about this weekend. Timing isn’t great. The US is closed Monday – which may mean deeper panic, or more time for a scramble as Central Banks put market dampners in place, and for governments to scrape together agreement on further stimulus measures to avoid the ultimate embarrassment of an “emperors new-clothes moment”: a real market crash accompanying the looming Pandemic depression.

Expect to see Trump tweet about how stupid the Fed is. It will be their fault. Its always someone else’s fault.

Papers are full this morning of parallels with the Dot.Com crash of 2000. This is not the same. The FAANGs and others are profitable firms making good money – the stocks to be really concerned about are different.

-

The Tech Firms making no money, no profits, and producing few goods, but trading at 4-digit or infinity P/Es.

-

Stocks in sectors at risk from the pandemic.

-

Banks as NPLs get set to soar.

-

Zombie firms addled by debt, which have seen their stock price pulled higher by expectation the tech stock rises will lift all stocks in its wake.

If this is it, then it’s going to be a fundamentals-quake.. It’s not a repeat of the 2000 Dot.Com Slide. There is lots in the press about options and the effects of financially-illiterate retail driving a logic-defying rise in VIX alongside rising markets. Happens. Get over it.

A big issue to further rattle markets on the back of a slide will be the US election. Trump was looking better as he reset the election on to the battleground of his choosing: Law and Order, and making Biden appear weak on social unrest. (I reckon the moment Biden “took the knee” was laudable, but may have cost him the election as conservative US voters who might have preferred him to Trump were shocked.)

If this correction deepens, the electoral focus will switch back to Trump and his foolish notion a strong stock market represents a strong economy.. Everything still to play for.

Final thought: interest rate repression via ZIRP and QEI on bonds means returns from defensive assets will remain improbably low. That still favours strong equity fundamentals for the economic recovery that is and will occur post-Pandemic. Place your bets accordingly.

via ZeroHedge News https://ift.tt/31ZCMRT Tyler Durden