“Great Jobs Numbers!” Trump Booms As US Unemployment Rate Unexpectedly Tumbles To 8.4%

Tyler Durden

Fri, 09/04/2020 – 09:35

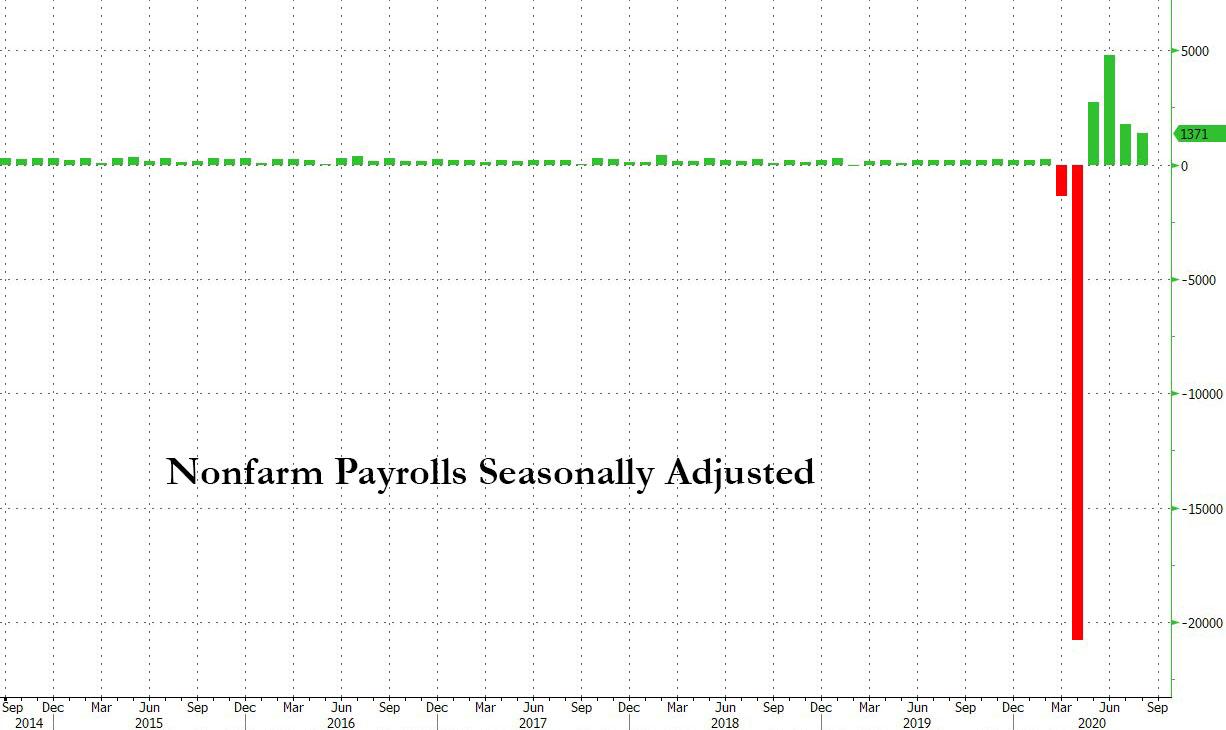

Amid a wide range of sellside estimates, and a whisper number that was either too high or too low depending on whom you asked, moments ago the BLS reported that in August, the number of payrolls was almost unexpectedly in line with consensus expectations: according to the August jobs report, some 1.371MM payrolls were created, essentially on top of the 1.35MM expected.

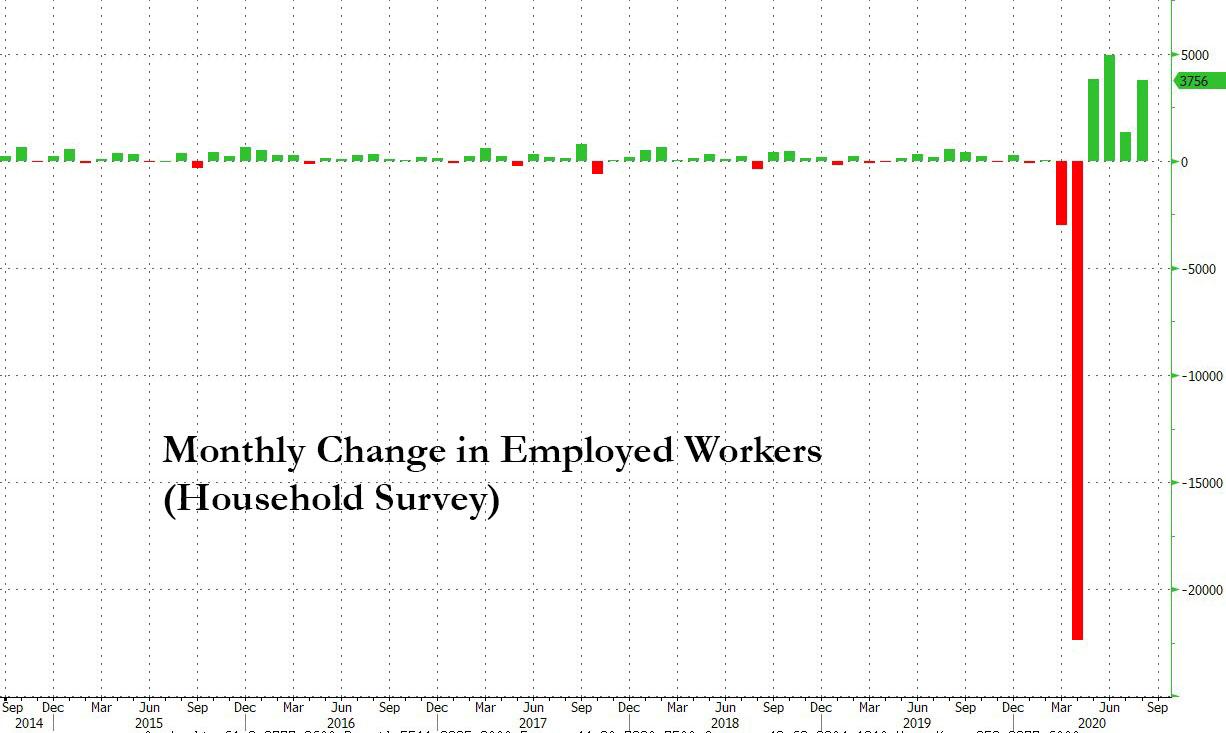

But if the Establishment survey was strong, the Household Survey was a blockbuster print, where a whopping 3.8 million newly employed workers were uncovered, as the total rose from 143.5 million to 147.3 million.

This was clearly a better than expected report, where some had expected a substantial slowdown in August due to a spike in virus cases across Sunbelt states, and U.S. labor-market rebound unambiguously extended for a fourth month in August, giving hope that the economy can continue to recover – and that Trump can parade with a strong labor market in the next two months – despite Washington’s standoff over further government aid to jobless Americans and small businesses.

That said, a quarter of all job gains were thanks to government jobs (Census hiring), so we are confident that one can find issues with the report.

The change in total nonfarm payroll employment for June was revised down by 10,000, from +4,791,000 to +4,781,000, and the change for July was revised down by 29,000, from +1,763,000 to +1,734,000. With these revisions, employment in June and July combined was 39,000 less than previously reported.

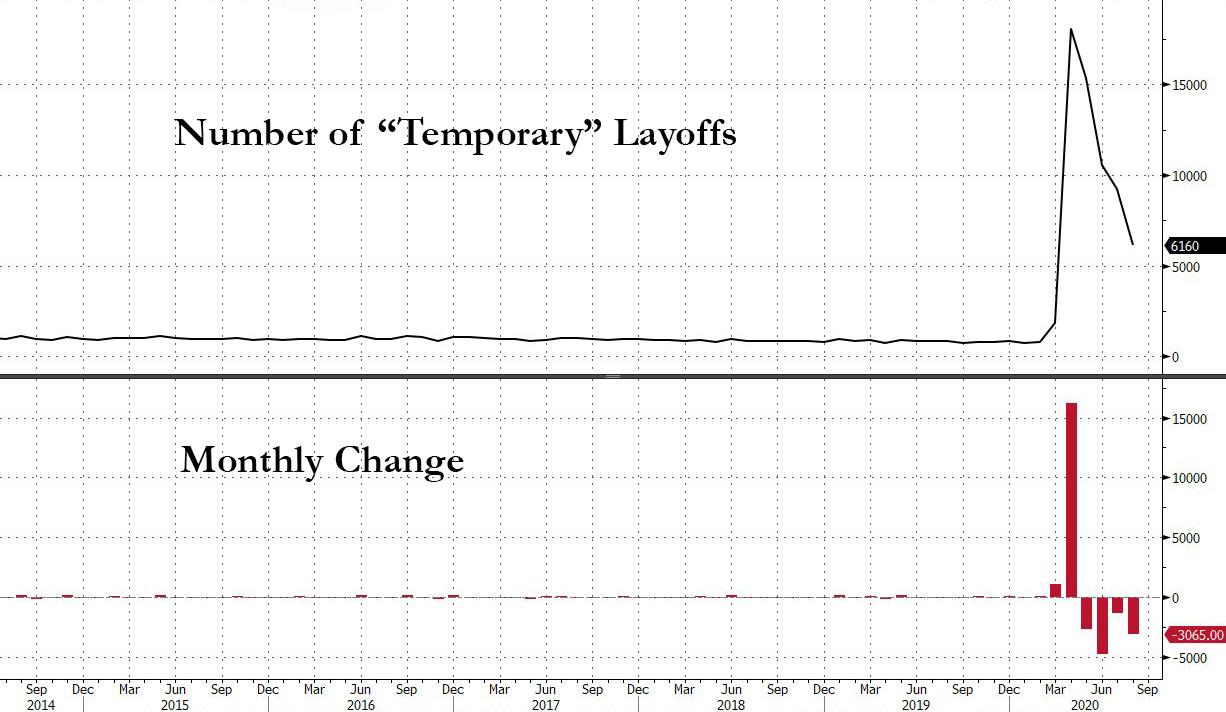

The one series tracked by all, the number of “temporarily” unemployed surprised as it dropped by more than 3 million to just 6.2 million, from 9.2 million the month before. As usual, debate over what defines “temporary” unemployment remains in the foreground.

This was offset by the number of people in the U.S. seeing permanent job losses, which rose by about half a million to 3.4 million, the highest level since 2013. “It points to the ongoing business closures, bankruptcies, and investment cuts across the country.” as BBG’s Katia Dimitrieva said.

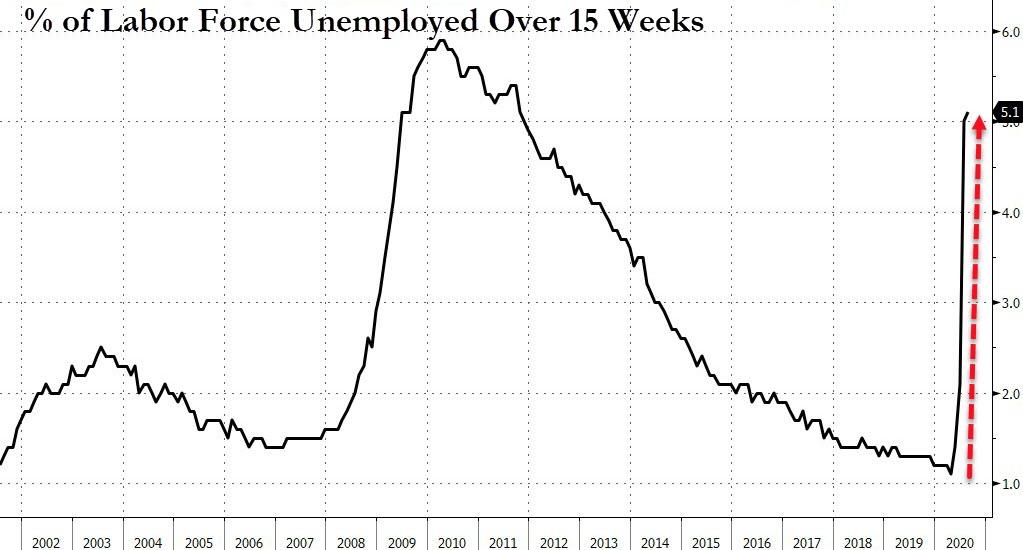

Meanwhile, the percentage of the labor force unemployed for more than 15 weeks: this jumped to 5.1%, the highest since the financial crisis.

The average hourly earnings also printed generally in line, rising by 4.7% in August, unchanged from the previous month, and above the 4.5% expected.

According to the BLS, average hourly earnings for all employees rose by 11 cents to $29.47. Average hourly earnings of private-sector production and nonsupervisory employees increased by 18 cents to $24.81, following a decrease of 10 cents in the prior month. As the BLS notes, the large employment fluctuations over the past several months–especially in industries with lower-paid workers–complicate the analysis of recent trends in average hourly earnings.

Also worth noting is that the average workweek for all employees on private nonfarm payrolls increased by 0.1 hour to 34.6 hours in August. In manufacturing, the workweek rose by 0.3 hour to 40.0 hours, and overtime increased by 0.1 hour to 3.0 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 34.0 hours.

The labor force participation rate rose modestly, from 61.4 to 61.7, as the Civilian Labor Force rose by 1 million to 160.8 million in August while the population rose by just 200K to 260.558MM.

Where there was a surprise was in the unemployment rate, which unexpectedly tumbled from 10.2% in July to 8.4%, smashing expectations of a 9.8% print. It looks like Trump wants to go into the November elections with a 7% or lower unemployment rate.

Despite all the superlatives, let’s not forget that In August, nonfarm employment was below its February level by 11.5 million, or 7.6 percent. Looking at the sector breakdown, government employment rose in August, as expected, reflecting temporary hiring for the 2020 Census. Notable job gains also occurred in retail trade, in professional and business services, in leisure and hospitality, and in education and health services.

Some more details:

- Employment in government increased by 344,000 in August, accounting for one-fourth of the over- the-month gain in total nonfarm employment. A job gain in federal government (+251,000) reflected the hiring of 238,000 temporary 2020 Census workers. Local government employment rose by 95,000 over the month. Overall, government employment is 831,000 below its February level.

- Retail trade added 249,000 jobs in August, with almost half the growth occurring in general merchandise stores (+116,000). Notable gains also occurred in motor vehicle and parts dealers (+22,000), electronics and appliance stores (+21,000), and miscellaneous store retailers (+17,000). Employment in retail trade is 655,000 lower than in February.

- Employment in professional and business services increased by 197,000. More than half of the gain occurred in temporary help services (+107,000). Architectural and engineering services (+14,000), business support services (+13,000), and computer systems design and related services (+13,000) also added jobs over the month. Employment in professional and business services is 1.5 million below its February level.

- Employment in leisure and hospitality increased by 174,000 in August, with about three-fourths of the gain occurring in food services and drinking places (+134,000). Despite job gains totaling 3.6 million over the last 4 months, employment in food services and drinking places is down by 2.5 million since February.

- Employment in education and health services increased by 147,000 but is 1.5 million below February’s level. Health care employment increased by 75,000 over the month, with gains in offices of physicians (+27,000), offices of dentists (+22,000), hospitals (+14,000), and home health care services (+12,000). Elsewhere in health care, job losses continued in nursing and residential care facilities (-14,000). Employment in private education rose by 57,000 over the month.

- Employment in transportation and warehousing rose by 78,000 in August, with gains in warehousing and storage (+34,000), transit and ground passenger transportation (+11,000), and truck transportation (+10,000). Employment in transportation and warehousing is down by 381,000 since February.

- The other services industry added 74,000 jobs in August, reflecting gains in membership associations and organizations (+31,000), repair and maintenance (+29,000), and personal and laundry services (+14,000). Employment in other services is 531,000 lower than in February.

- Financial activities added 36,000 jobs in August, with most of the growth in real estate and rental and leasing (+23,000). Employment in financial activities is down by 191,000 since February.

- Manufacturing employment rose by 29,000, with gains concentrated in the nondurable goods component (+27,000). Despite gains in recent months, employment in manufacturing is 720,000 below February’s level.

- Employment in wholesale trade increased by 14,000 in August, reflecting an increase of 9,000 in the nondurable goods component. Wholesale trade employment has declined by 328,000 since February.

- Employment was changed little in mining, construction, and information.

The August payrolls report also provided some curious supplementary data, as follows:

In August, 24.3 percent of employed persons teleworked because of the coronavirus pandemic, down

- from 26.4 percent in July.

- In August, 24.2 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic–that is, they did not work at all or worked fewer hours at some point in the last 4 weeks due to the pandemic. This measure is down from 31.3 million in July. Among those who reported in August that they were unable to work because of pandemic-related closures or lost business, 11.6 percent received at least some pay from their employer for the hours not worked.

- About 5.2 million persons not in the labor force in August were prevented from looking for work due to the pandemic. This is down from 6.5 million in July. (To be counted as unemployed, by definition, individuals must either be actively looking for work or on temporary layoff.)

The bottom line, as Tony Bedikian, head of global markets at Citizens Bank, summarized: “We are still moving in the right direction and the pace of the jobs recovery seems to have picked up, but it still looks like it will take a while and likely a vaccine before we get back close to where we were at the beginning of this year. We continue to be optimistic that the economy has turned a corner and that we’ll continue to see steady progress.”

The report was certainly enough for Trump to declare that it was a “Great Jobs Numbers!” one which “broke the 10% level faster and deeper than thought possible.”

Great Jobs Numbers! 1.37 Million Jobs Added In August. Unemployment Rate Falls To 8.4% (Wow, much better than expected!). Broke the 10% level faster and deeper than thought possible.

— Donald J. Trump (@realDonaldTrump) September 4, 2020

Even so, employment remains 11.5 million below pre-pandemic levels and the level of long-term and permanent unemployment is rising. Much hinges on fiscal stimulus for states and companies from the government in months ahead.

In terms of market impact, Bloomberg speculates that “the lower unemployment rate is likely to force Fed officials to rethink their most pessimistic forecasts for employment and other economic projections.”

via ZeroHedge News https://ift.tt/3bvqx2K Tyler Durden