Elon Musk Has Now Earned Nearly $9 Billion In Compensation In Less Than 3 Years

Tyler Durden

Sun, 09/06/2020 – 14:50

The after hours pullback in Tesla shares on Friday after hours – due to the company being snubbed for inclusion to the S&P index – likely isn’t enough to prevent CEO Elon Musk from receiving $2.9 billion more in stock options, putting his executive compensation total at a massive $8.8 billion.

In a matter of less than 36 months after Musk’s pay plan was put into place – a pay plan that had a 10 year runway – the CEO has amazingly hit milestones that have qualified him for billions of dollars in stock options.

With the stock’s recent performance, Musk qualifies for another 8.44 million in stock options, which he will add to the 16.9 million in options he unlocked in may and July, according to Bloomberg.

His latest tranche was unlocked after Tesla’s 6-month and 30-day average trailing market value both exceeded $200 billion. Another performance goal — logging a combined $3 billion of adjusted earnings before interest, taxes, depreciation and amortization topping $3 billion over four quarters — was achieved as of June 30, a filing shows.

Meanwhile, the same report reveals that the average Tesla employee made a median pay of $58,455 last year.

Musk’s compensation goals – as was pointed out by many in early 2018 – had little to do with GAAP profitability and consistent cash flow and instead were focused on 12 market capitalization milestones and 16 revenue and/or EBITDA milestones; the easiest figures to manipulate, should one be so inclined to do so.

Many who were critical of Musk’s compensation plan said it offered little incentive for the company to reach profitability, only to grow in size of market cap. Back in 2018, even the New York Times called Musk hitting his pay plan goals “laughably impossible”.

But instead, Musk did it. And he did it in less than three years.

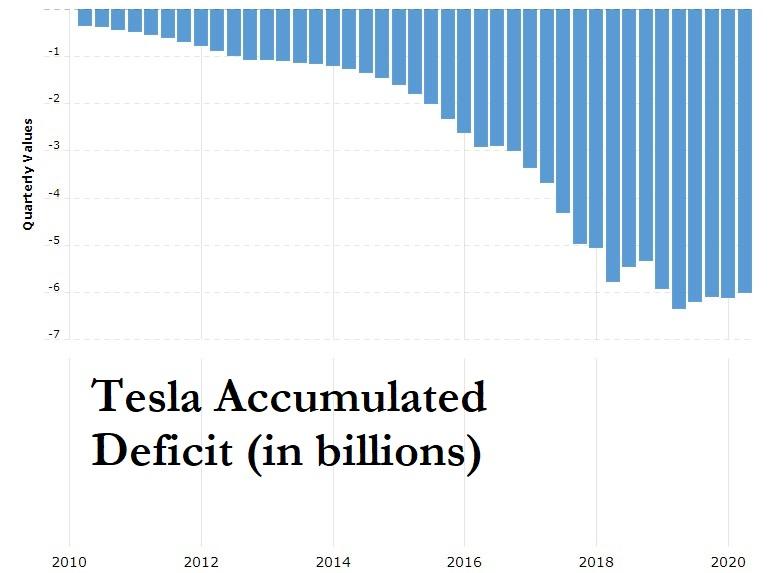

For a stunning comparison, while Musk was taking in $9 billion in compensation, Tesla was adding to a $6 billion accumulated earnings deficit.

How unlikely is it that Musk would qualify for these options in such a quick time span? Well, the stock would have needed to have done something like this:

Honestly, do people just think this is a coincidence

I mean, seriously. Stock does literally nothing for the better part of a half decade and then the company’s third GC in a year quits, isn’t replaced, and the stock goes parabolic

Not normal IMO pic.twitter.com/4UXqCYAFLI

— Quoth the Raven (@QTRResearch) September 1, 2020

via ZeroHedge News https://ift.tt/3i7Q7gx Tyler Durden