Goldman Warns Of “Near-Term Setback” For Stocks As Record Bullish Nasdaq Sentiment Suffers Near-Record Shock

Tyler Durden

Mon, 09/07/2020 – 18:45

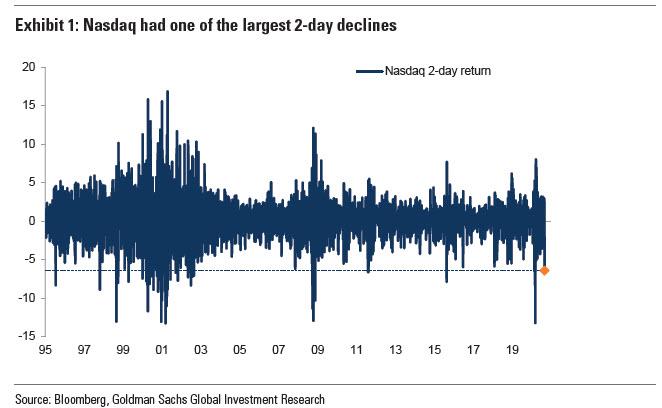

In a stark reminder of the market excesses reached last week, Goldman writes that the Nasdaq had one of the largest 2-day declines in the last 30 years after the SoftBank gamma trade was exposed.

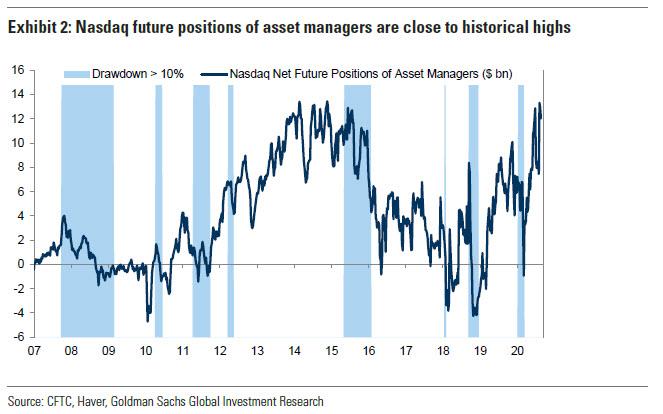

Meanwhile, the sheer buying frenzy into this plunge was unprecedented, and was characterized by a significant increase in options positioning into US equity and US Tech in particular, with the put/call ratio in the US reaching a historical low, the single stock skew back to pre-Covid levels and the spot-vol correlation turned into positive territory. “Such stretched option positioning has historically highlighted a negative asymmetry of near-term equity returns”, Goldman writes, pointing out that Nasdaq net equity future positioning at the peak was close to historical highs.

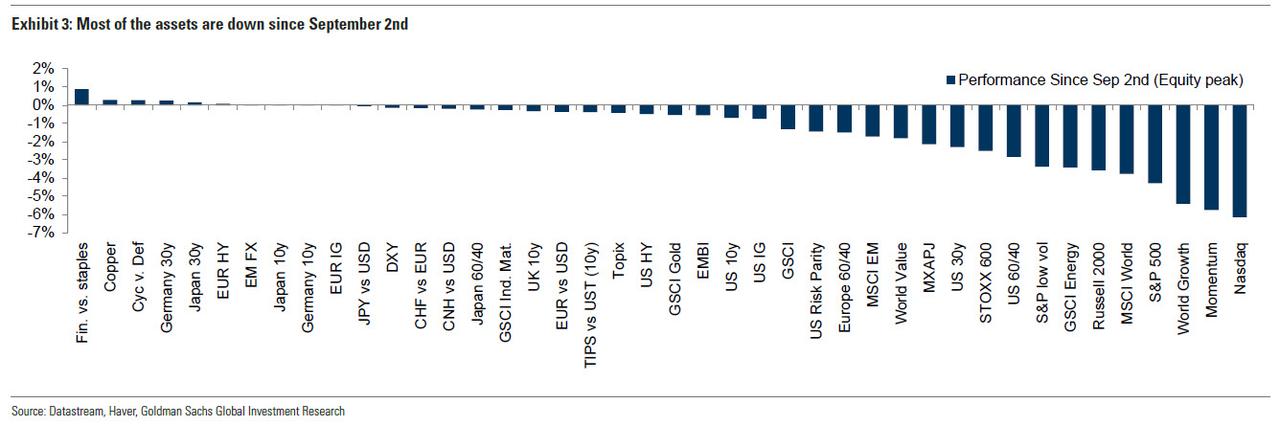

The silver lining is that as the meltup breadth was relatively narrow, so was the selloff, and here a key catalyst in addition to merely positional unwind is that the US 10y real rates increase (+8bps since the lows) “has likely triggered a rotation out of longer duration equities such as ‘Growth’ and Tech.”

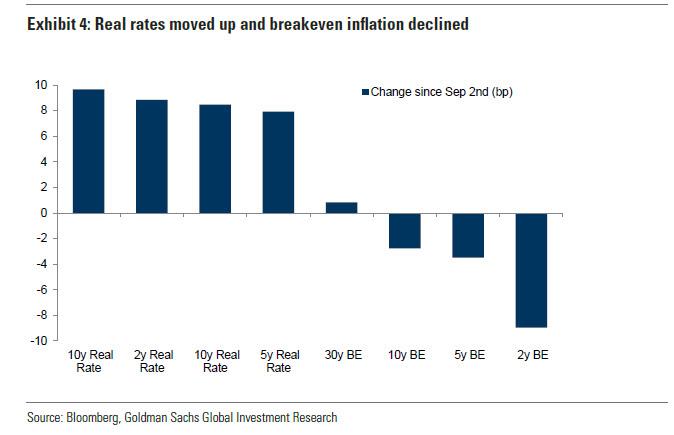

Echoing what we said in our discussion of the unprecedented divergence between real rates and breakevens, Goldman points out that with nominal yields being anchored by central banks, “breakeven rates and real rates are more likely to move in opposite direction” adding that “while phases of increasing breakeven rates coupled with lower real rates are usually very friendly for both risky assets and safe assets, lower breakeven rates and higher real rates tend to be very negative for markets as all assets typically decline.” In line with this framework, since Sep. 2 most assets are down and multi-asset investors struggled to diversify the correction.

This also means that amid the gamma trade unwind, the dollar performance, usually positive in this environment, was mixed given the resilience of EM FX.

Nonetheless, despite conceding that the risk of corrections remains elevated, and warning that “a near-term setback” is likely, Goldman expects the current bull market to continue “as the improved growth outlook coupled with supportive monetary policies should maintain the search for yield elevated and foster a compression of the ERPs.” Specifically, Goldman lists the following ten reasons why despite one of the biggest 2-day crashes in the Nasdaq on record, the levitation will continue:

- We are in the first phase of a new investment cycle, following a deep recession. The ‘Hope’ phase – the first part of a new cycle, which usually begins in a recession as investors start to anticipate a recovery, is typically the strongest part of the cycle. That is what we have been seeing this year.

- The economic recovery looks more durable as vaccines become more likely.

- Goldman economists have recently made upward revisions to their economic forecasts and it is likely that analysts’ expectations will follow.

- The bank’s Bear Market Indicator (which was at very elevated levels in 2019) is pointing to relatively low risks of a bear market despite very high valuations.

- Policy support remains very supportive for risk assets. There is both a central bank ‘put’ – a belief that central banks will be there to provide as much liquidity as is required – and a fiscal ‘put’ as governments have scaled up their willingness to support growth.

- The Equity Risk Premium has room to fall.

- The resumption of zero nominal interest rate policy in the recent past, together with the extended forward guidance, has created an environment of greater negative real interest rates. This should be highly supportive to risk assets in an economic recovery.

- Equities offer a reasonable hedge to higher inflation expectations.

- Equities look cheap relative to corporate debt, particularly for strong balance sheet companies (60% of US companies and 80% of European companies have dividend yields above the average corporate bond yield).

- The digital revolution continues to gather pace. We think this transformation of the economy and stock markets has further to go. These companies could continue to drive valuations and returns in this bull market.

via ZeroHedge News https://ift.tt/3jVzoxE Tyler Durden