Goldman Prime: Hedge Funds Bought The Dip After The Market Rout

Tyler Durden

Wed, 09/09/2020 – 13:59

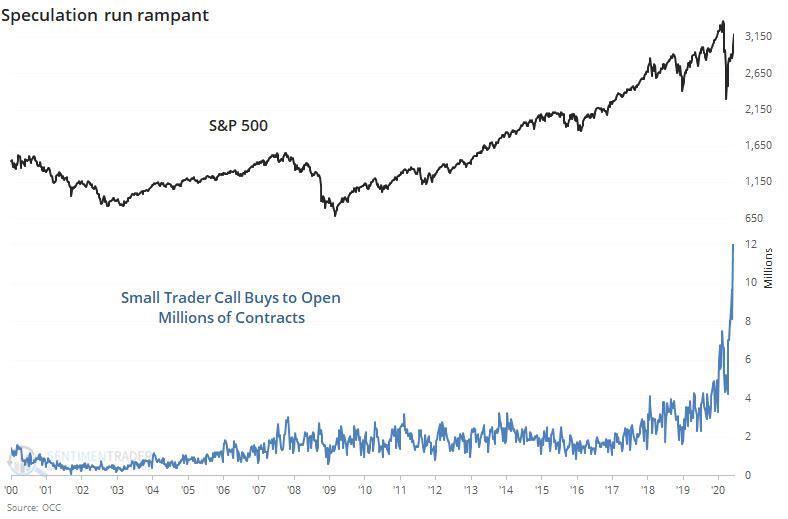

Back in early June, well before we unveiled the SoftBank “gamma gamble” drama, and just as the retail daytrading euphoria peaked manifesting itself in both a record surge in small trader call buying…

… and the stock of bankrupt Hertz soaring so much it prompted the company to try to and issue as much as $1 billion of worthless stock to Robinhood investors and a since-scuttled plan, we pointed out that it wasn’t just retail investors flooding the market, but according to Goldman’s Prime Broker desk, after holding out for months hedge funds finally capitulated and are were also flooding into stocks.

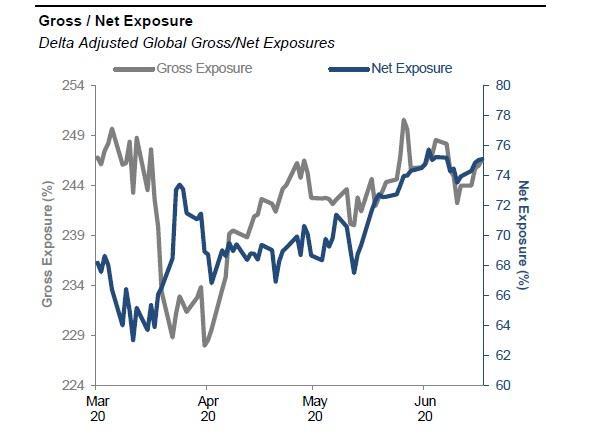

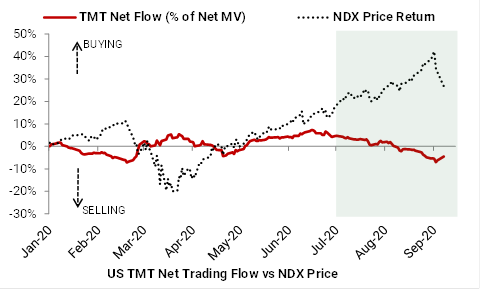

A little later, in one of Goldman’s weekly hedge fund exposure reports, the bank’s prime desk confirmed that this panicked buying across hedge funds had accelerated and gross leverage of the overall book rose another +4.4% to 246.6% (93rd percentile) while Net leverage rose further +1.6 pts to 75.1%, putting it in the 99th percentile, effectively the highest ever as hedge funds went “all in” alongside retail traders (and Japanese VC conglomerates) in chasing beta with leverage.

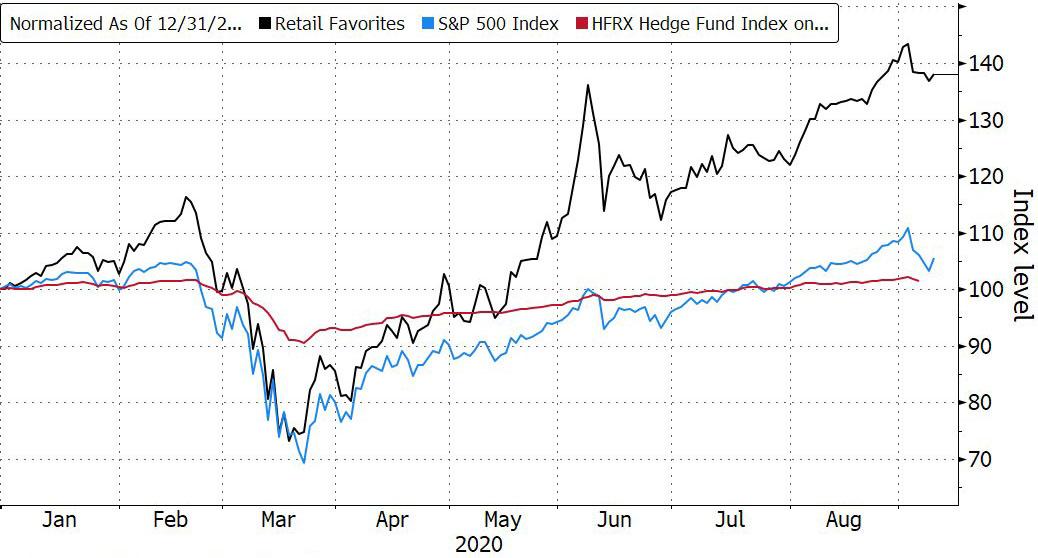

Why this frenzied chase of what was effectively the simplest daytrading strategy popularized by retail day traders on Robinhood (and one which SoftBank ultimately capitalized handsomely on)? Because as the following chart shows, in 2020 the blistering performance by “retail investors crushed both the HFR hedge fund index, and the S&P500.

In short, in their scramble to generate alpha, “sophisticated” hedge funds were forced to use “strategies” popularized by Dave Portnoy and his merry Gen-Z merry men (on Robinhood): buying high beta stocks and doing so with as much leverage as possible.

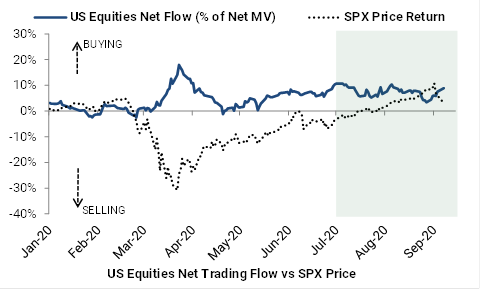

And since the two most popular (and only) “strategies” observed on Robinhood have been to either ball calls on winning momentum stocks (a strategy that was taken to its logical extreme by SoftBank as we explained over the weekend), or Buying The F**king Dip out of losers (such as Hertz), it comes as no surprise at all that as Goldman writes this morning, there has been “no sign of de-risking as hedge funds bought the dip in US equities amid the recent market rout.”

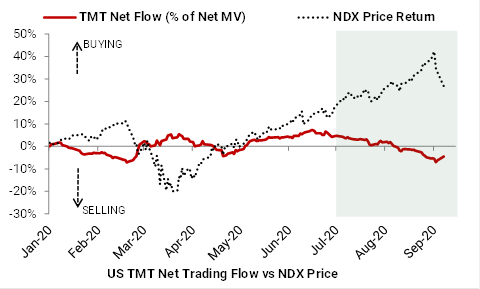

As Goldman details further, hedge funds bought the dip “as the GS Prime book was net bought in each of the past two days (Friday and Tuesday) led by US TMT stocks.

In cumulative $ terms, “the net buying in US TMT stocks over the past two days is the largest in five months.”

This buying was in contrast to recent trends – where US TMT stocks recently saw the largest 5-day net selling on the Prime book in more than four months – and suggests a change in posture amid the sharp price declines.

Goldman Prime also reveals that the recent net buying in US equities was broad-based as both Single Names and Macro Products were net bought led by long buying; in total, 8 of 11 US sectors were net bought over Friday-Tuesday led by Info Tech, Consumer Discretionary, Comm Svcs, and Health Care, while Consumer Staples, Financials, and Materials were the only net sold sectors.

And in a world where hedge funds and retail investors have only one trade left – i.e., BTFD, ideally with lots of leverage – The Big 5 (FAAMG) as a group was net bought for two straight days driven by long buys after being net sold in eight of the previous nine days.

Meanwhile, the near record hedge fund gross and net leverage ratios remained largely unchanged MTD as the effect of price declines was offset by net buying.

As shown in the table below, net leverage and L/S ratio increased MTD for both the overall book and Equity Fundamental LS managers, while gross leverage for the overall book rose +1.8 pts week/week (+3.0 pts ex mark-to-market)…

… “suggesting little to no de-risking seen amid the recent market rout”, according to Goldman.

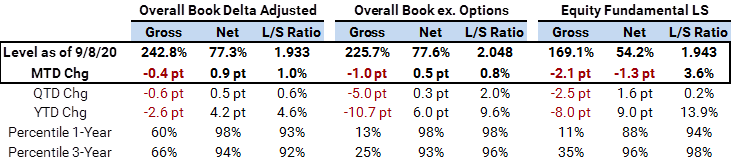

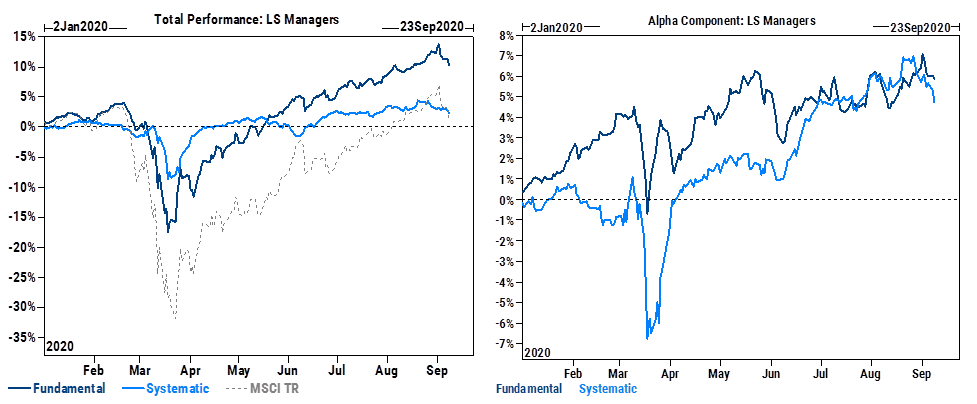

Finally, it will also not come as a surprise that in a world where alpha is dead and everyone is scrambling to lever beta up as much as possible, that “fundamental” hedge fund long/short returns were down 2% MTD driven by negative beta (-1.5%):

- Fundamental LS – down -2.0% MTD driven mainly by negative beta (-1.5%). Negative alpha MTD (-0.5%) driven by losses in momentum factors, Info Tech exposure, and growth. Fundamental LS performance is now up +10.3% YTD due to positive alpha (+5.9%) and to a lesser extent positive beta.

- Systematic LS – down -0.7% MTD driven by negative alpha (-1.0%). Negative alpha MTD driven by losses in crowded shorts, medium-term momentum, growth, and Consumer Discretionary exposure. Systematic LS performance is now up +2.4% YTD due to positive alpha (+4.8%) partially offset by negative beta.

via ZeroHedge News https://ift.tt/2R9uctt Tyler Durden