Loonie Gains After Bank Of Canada Leaves Rates/QE Unch (As Expected)

Tyler Durden

Wed, 09/09/2020 – 10:09

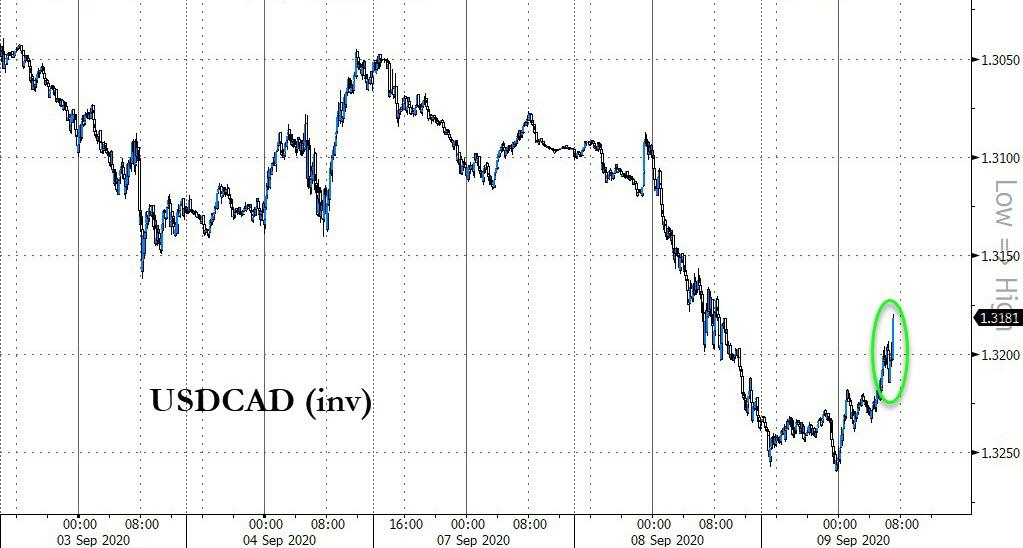

The Bank of Canada left rates unchanged (at 25bps) and left its bond-buying bonanza unchanged at C$5 billion per week – both as expected – and reiterated its forward guidance (as expected), and the Loonie managed to extend its modest gains from a recent drop to three-week lows…

Source: Bloomberg

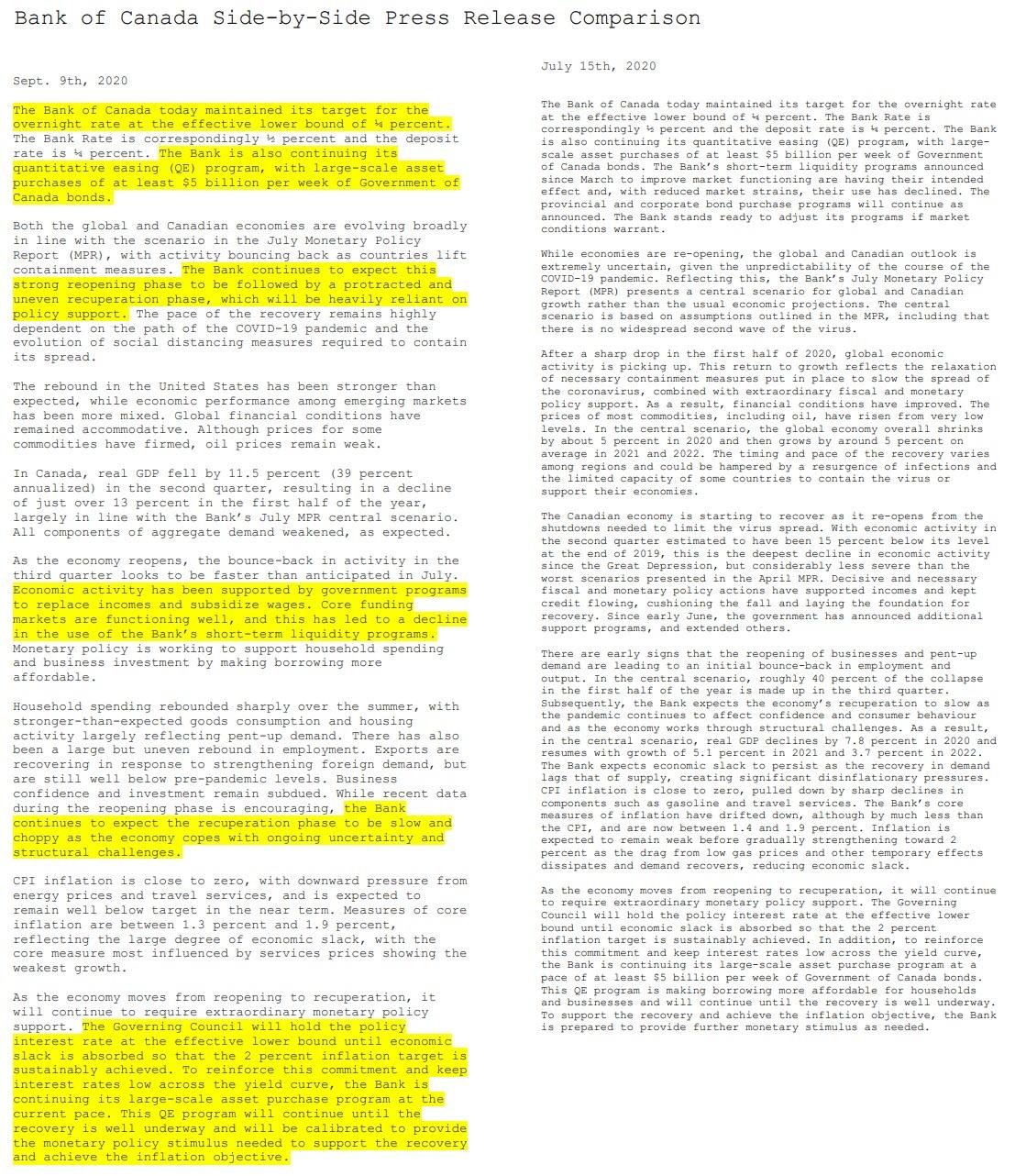

While BoC acknowledges the bounce-back in activity in third quarter has been faster than anticipated and as such “core funding markets are functioning well, and this has led to a decline in the use of the Bank’s short-term liquidity programs,” it is careful not to hint at any hawkishness, noting that the QE program will continue “until the recovery is well underway and will be calibrated to provide the monetary policy stimulus needed to support the recovery and achieve the inflation objective.”

“As the economy moves from reopening to recuperation, it will continue to require extraordinary monetary policy support. The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved.”

Full redline below:

Pledging to keep the policy rate unchanged is “a pretty powerful commitment that they’re likely to reiterate,” Josh Nye, economist at Royal Bank of Canada, said by phone.

via ZeroHedge News https://ift.tt/2Fkwd3z Tyler Durden