Stocks Bounce Off Critical Support After Fastest ‘Correction’ From Record High In History

Tyler Durden

Wed, 09/09/2020 – 16:00

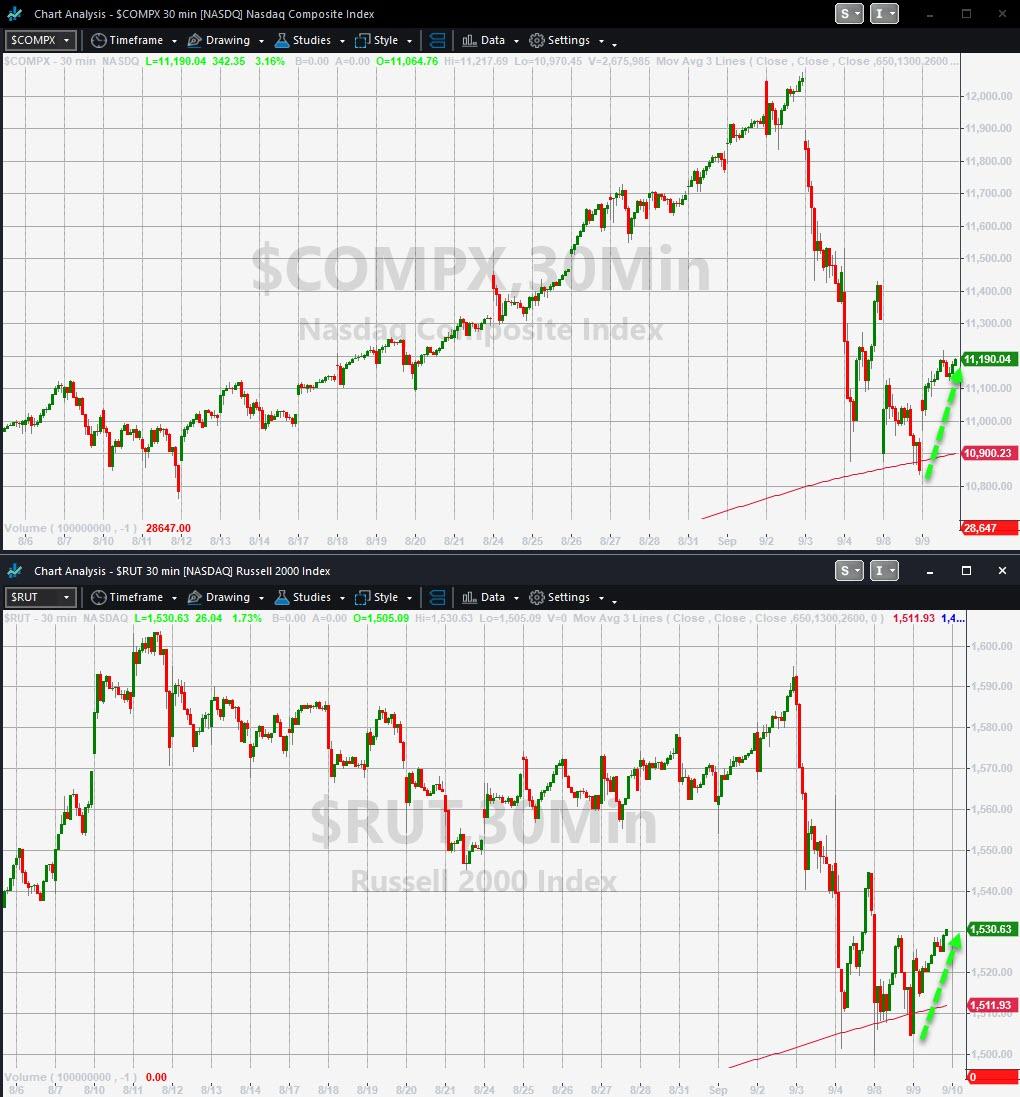

What goes down, must come back with a vengeance in this new normal and so stocks did, but Nasdaq is still down 8% from highs…

After the Nasdaq’s 10% collapse in 3 days (the fastest record high to correction plunge in history)…

The NASDAQ completed a 10% correction just 3 trading days after setting a new all-time high (September 2). This sets a new record for the fastest 10% correction in history.

The old record was 6 trading days from Feb 19 to Feb 27, 2020.

The NASDAQ Index started in 1978. pic.twitter.com/aAut3Hhphq

— Jim Bianco (@biancoresearch) September 9, 2020

Despite bad news on COVD vaccines, everything came roaring back today (best day for Nasdaq since April), with The Dow managing to get back to green from Friday’s close. Note some late day weakness as MSFT/WMT faded on TikTok sale chatter…

After Nasdaq and Small Caps bounced perfectly off their 50DMAs…

Just in case you’re shocked, shocked, at the selloff, Morgan Stanley lays out the key catalysts for weakness…

-

Lack of progress on CARES 2 0 (consensus still sees $1.5-$2T getting passed although even Goldman is becoming more skeptical)

-

Gamma reset in megacap Tech due to the Softbank doxxing (massive upside vol structures should begin to roll off, however)

-

Record equity issuance upcoming ($308BN so far YTD in the US or the 100th %-ile back to 2008)

-

September trading seasonality (see MSZZMOMO SEAG on Bloomberg)

-

Diminishing systematic bid (Morgan Stanley now sees only a few $B of global equities to buy vs prior growth estimates)

-

Diminishing bid from retail (next round of stimulus checks may matter)

-

Elevated HE exposure (nets and gross at the 66th and 89th %-ile per MS PB Cotent)

-

Mutual fund year-end (will we finally see outflows/profit-taking if tax-loss-selling was pulled forward in August?)

-

Election permutations (Senate races should remain in focus for those in fear of new tax proposals)

-

US-China re-escalation (hence focus on SMIC over the weekend)

-

Setbacks in the reopening (second wave?)

“Inconceivable!” we know!!

Of course the momo names ruled the rebound…

TSLA up 10%…

AAPL bounced too…

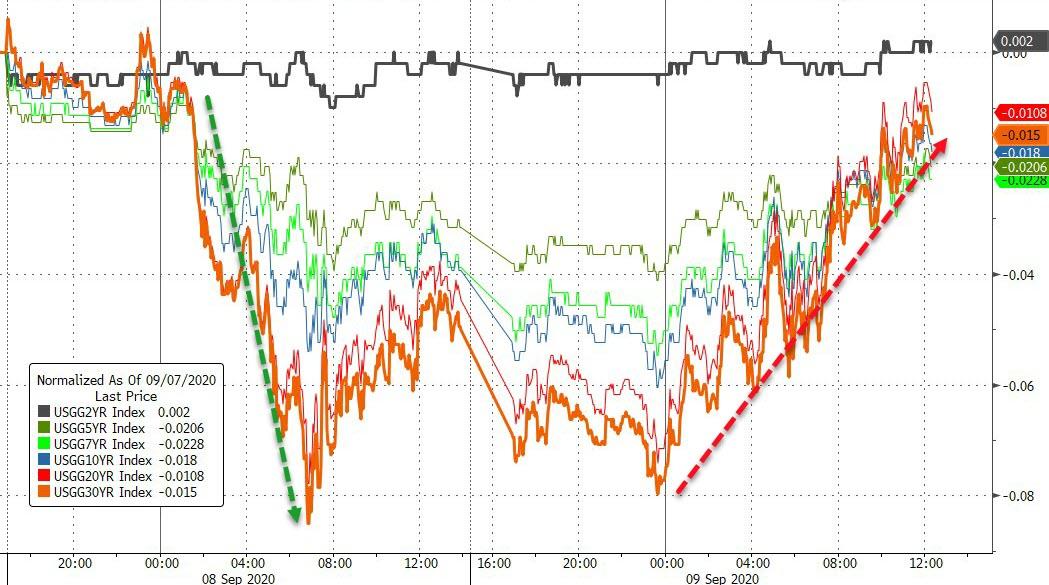

As stocks surged, bonds were dumped with the long-end underperforming…

Source: Bloomberg

10Y Yields reached back up to 70bps after an ugly auction…

Source: Bloomberg

The dollar was monkey-hammered lower (EUR gains)…

Source: Bloomberg

And as the dollar tanked, gold futures rallied back above $1950…

Silver also rebounded with futures back above $27…

Oil rebounded with WTI back above $38 ahead of tonight’s API inventory data…

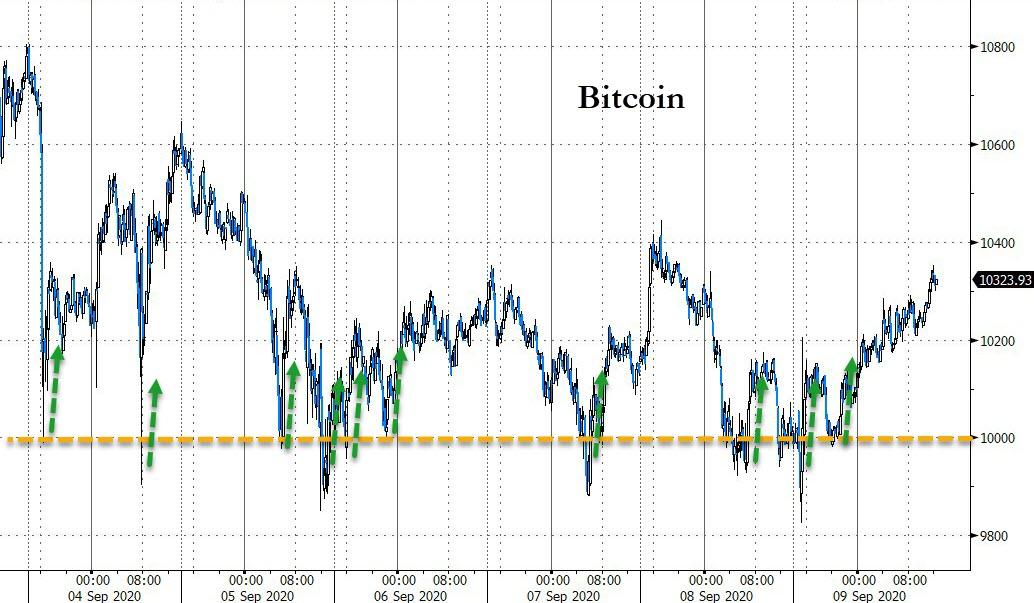

Cryptos also rebounded with Bitcoin finding support at $10,000 once again…

Source: Bloomberg

Finally, it still ain’t cheap!!!

Source: Bloomberg

via ZeroHedge News https://ift.tt/3h8QbLO Tyler Durden