Ugly, Tailing 10Y Auction Sees Slumping Foreign Demand

Tyler Durden

Wed, 09/09/2020 – 13:17

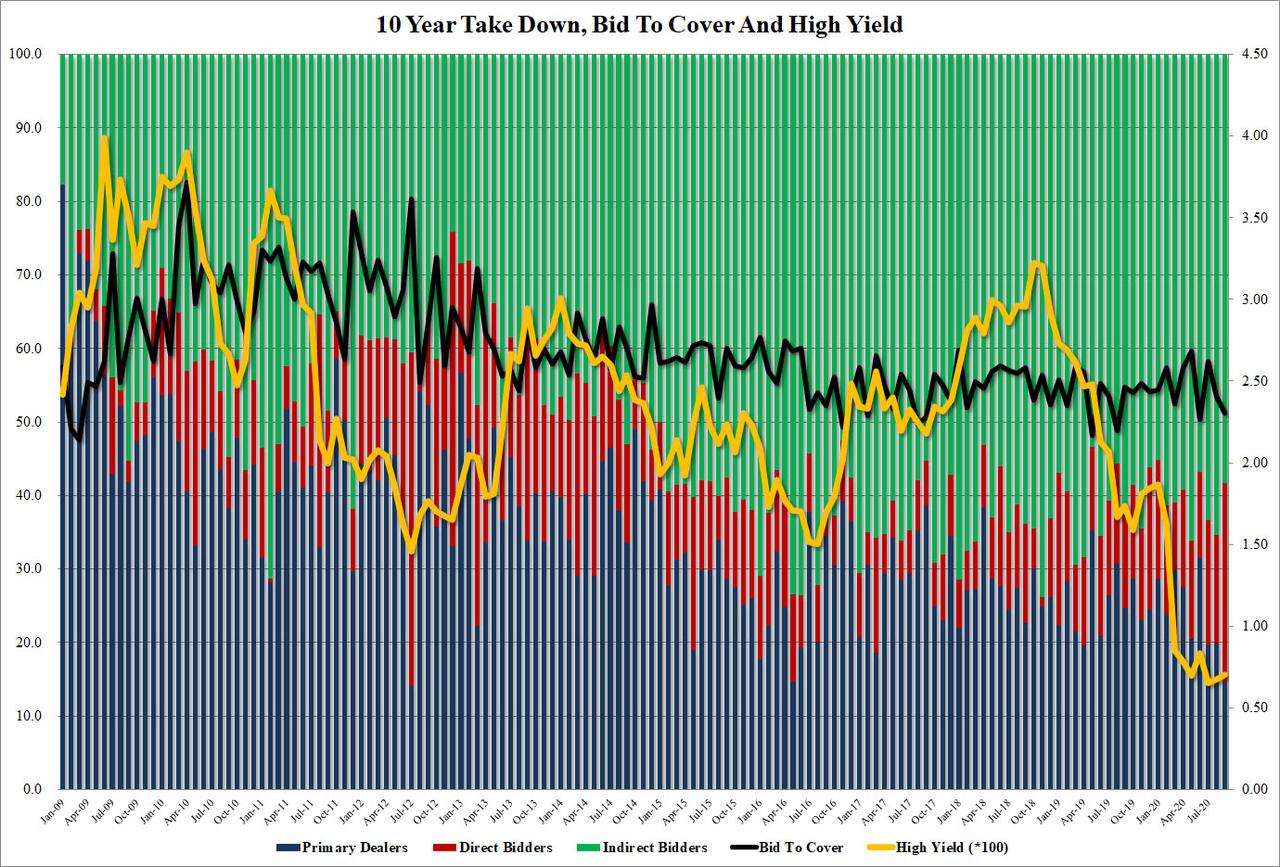

After yesterday’s strong 3Y auction, moments ago the Treasury sold 10 Year paper in a 9-Year 11-Month reopening of Cusip AE1, which unlike most recent sales was not the biggest amount offered on record, and instead at $35 billion was down $3 billion from last month’s $38 billion.

That’s not the only difference from yesterday’s record 3Y auction, because while demand for Tuesday’s sale was superb, today’s auction was mediocre at best. Pricing at a high yield of 0.704%, this was not only well above last month’s 0.677% (and a ways away from the 0.6530% in July), but also tailed the When Issued 0.696% by 0.8bps.

Continuing the ugly metrics, the bid to cover slumped from 2.41 to to 2.30, the lowest since June and below the 6-auction average of 2.41.

The internals were just as ugly, with Indirects sliding from 65.4% to 58.3%, yet Direct demand jumped from 19.8% to 27.1%, the highest since June, leaving Dealers holdings14.6% of the auction, the lowest since June.

Overall, an ugly auction and the bond market clearly agrees, with 10Y yields jumping to session highs in kneejerk response to the auction results.

via ZeroHedge News https://ift.tt/2ZnOa8u Tyler Durden