Brexit Butterflies & Bailout Bill Breakdown Crush Cable, Bust Big-Tech Bounce

Tyler Durden

Thu, 09/10/2020 – 16:01

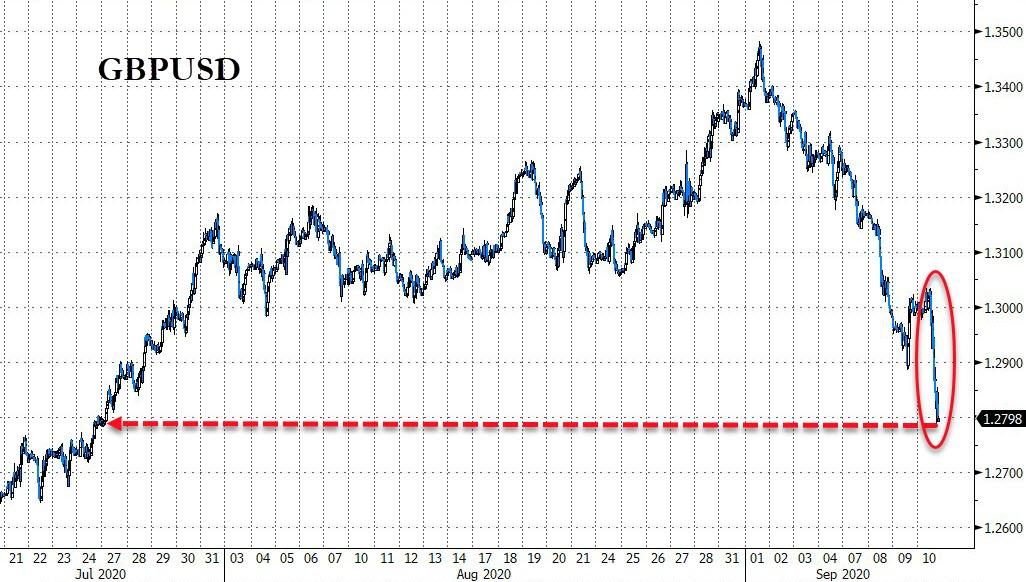

Cable’s collapse made the headlines today on Brexit concerns – its biggest daily drop in six months (6th daily drop in 7 days)…

Source: Bloomberg

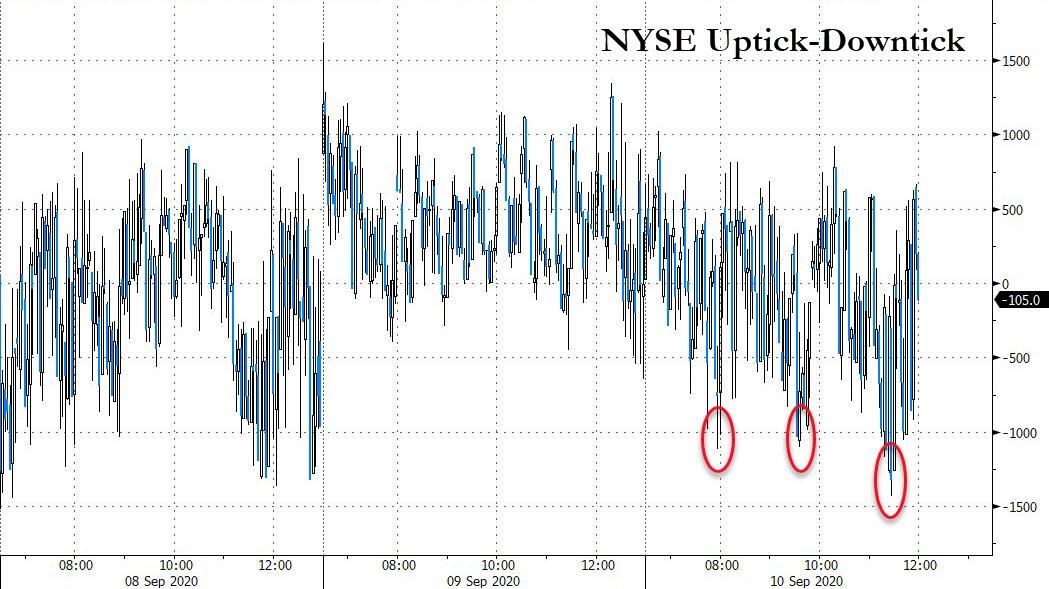

But, as Bloomberg noted, the Brexit breakdown between the EU and the U.K. may have been blamed for the initial down move in stocks, but it happened 10 minutes before the selloff. The trigger actually appears to have been a sell program hit the tape at precisely 1045ET. Then another sell program at 1320ET as DEMOCRATS VOTE TO BLOCK SENATE REPUBLICANS’ STIMULUS BILL.

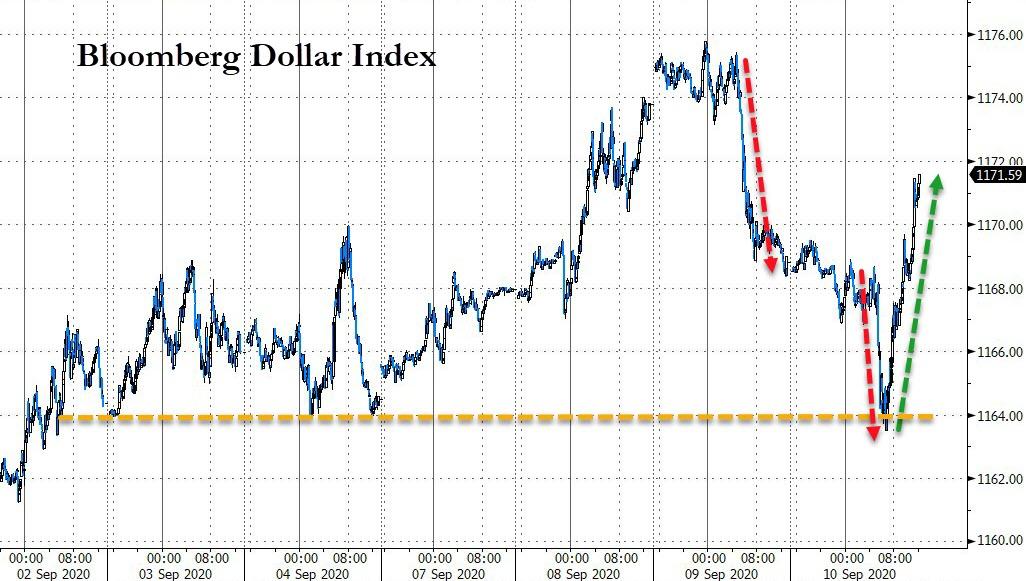

And finally, we note that at around 1430ET (Margin call time), everything tanked (liquidation for dollars) – with bonds, gold, and stocks all diving as the dollar rallied:

Source: Bloomberg

3 things kept the dream alive in the last few weeks…

-

The Fed – hasn’t bought any HY/IG bonds in a while and balance sheet flat

-

Stimulus – fail on any further deal (McConnell Senate comments and skinny bailout bill didn’t pass Senate)

-

Vaccine – the AstraZeneca news did not help

Stocks in a world of their own as corporate bonds were unable to gain without Fed balance sheet juicage…

Source: Bloomberg

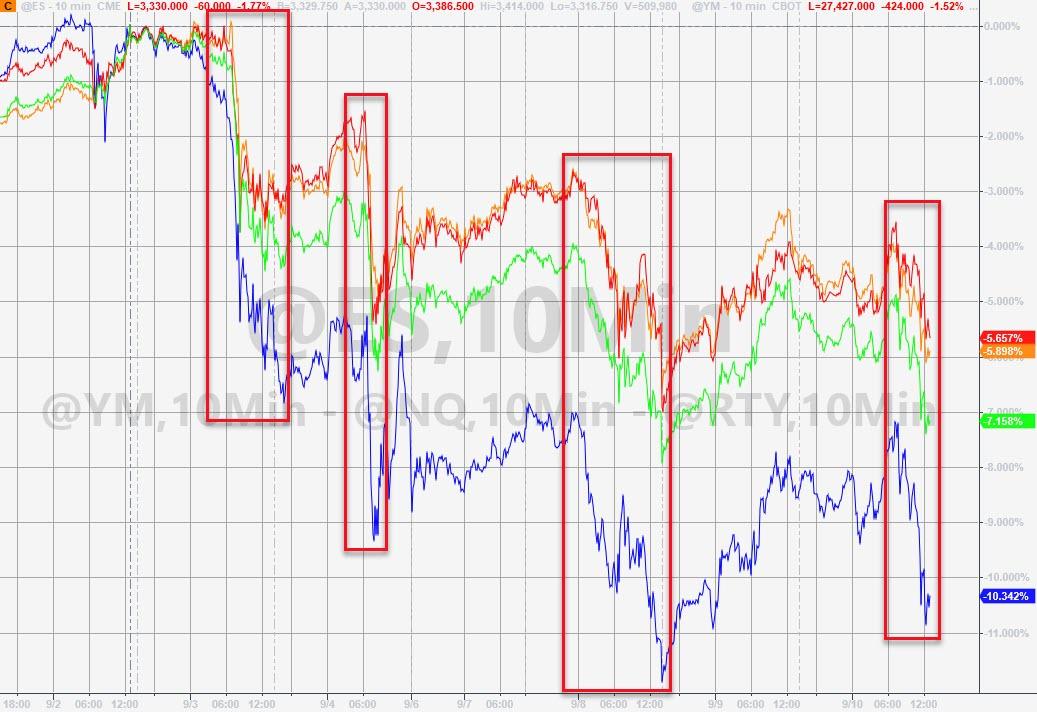

Markets were a chaotic mess today with Nasdaq the highest beta shenanigans, down 1% pre-open, up 1.5% after the bell, to -2% around margin call time

Nasdaq fell back into correction…

Nasdaq and Small Caps tumbled back to their 50DMA…

Of course, this is but a mere fleshwound compared to recent exuberance…

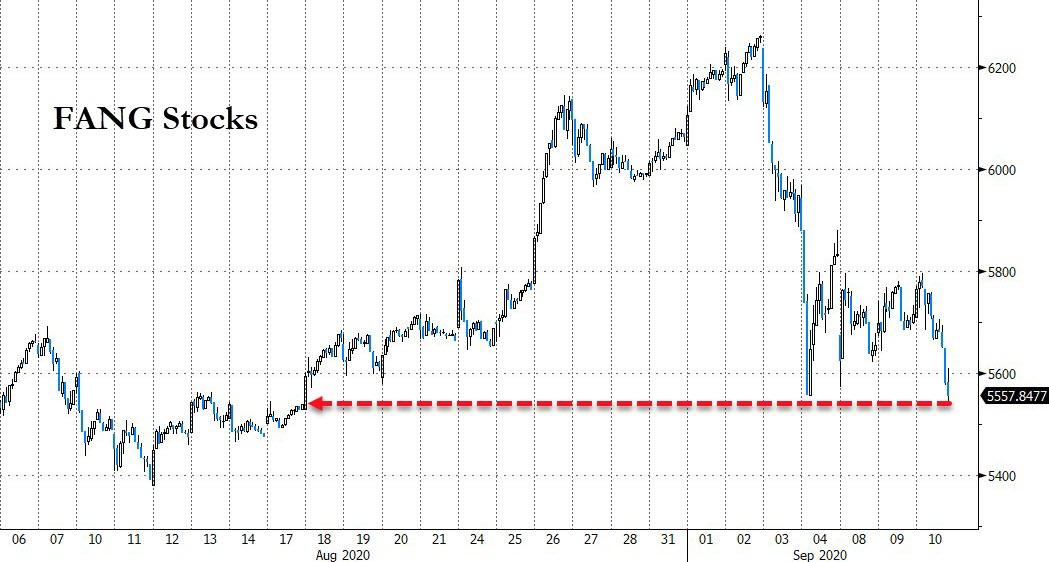

Tech wrecked again as the dead cat bounce died again…

Source: Bloomberg

FANGs faltered to their lowest close since Aug 17th…

Source: Bloomberg

Notably there is no rotation – both value and growth are down (and up together)… i.e. it’s a grossing-down!

Source: Bloomberg

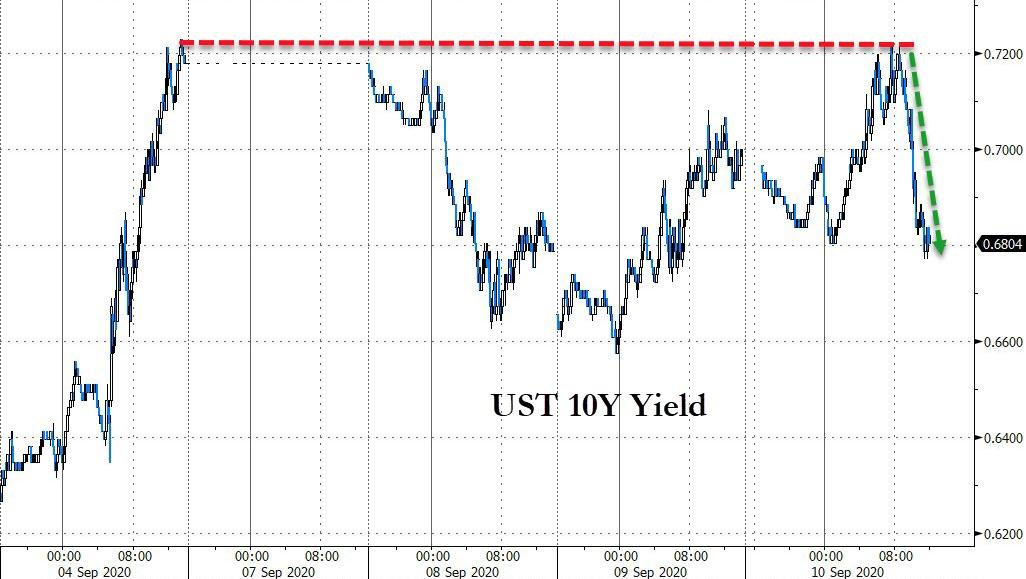

As stocks accelerated lower, Treasuries were bid…

Source: Bloomberg

With 10Y Yields reversing at unchanged on the week, back below 70bps once again…

Source: Bloomberg

The dollar spiked as stocks weakened, after tumbling on EUR strength following ECB comments…

Source: Bloomberg

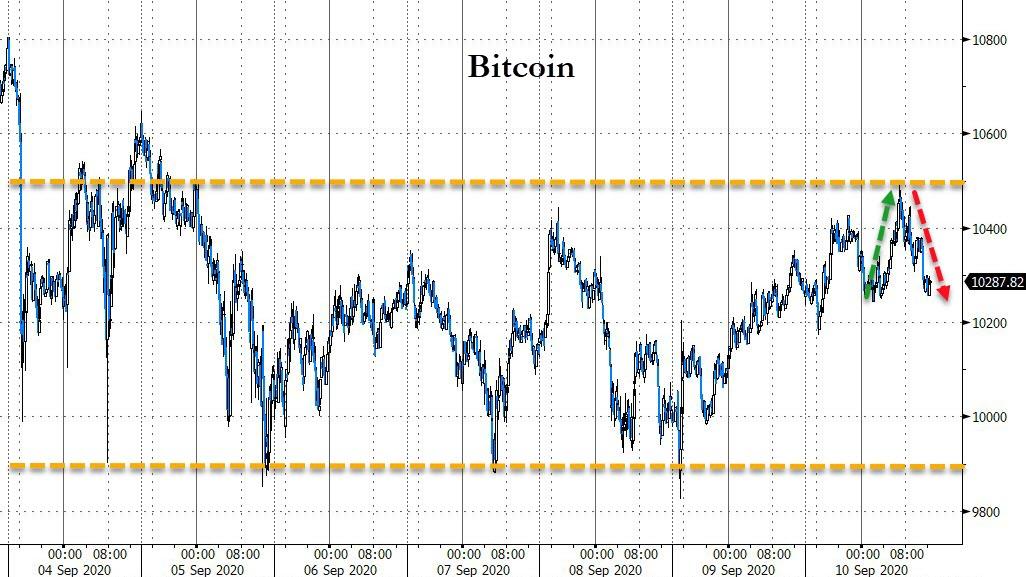

Bitcoin roundtripped to unch after tagging $10,500 at the highs…

Source: Bloomberg

As the dollar rallied, gold was clubbed into the red, as more liquidation-type flows hit around 1430ET…

Silver futures slipped back below $27…

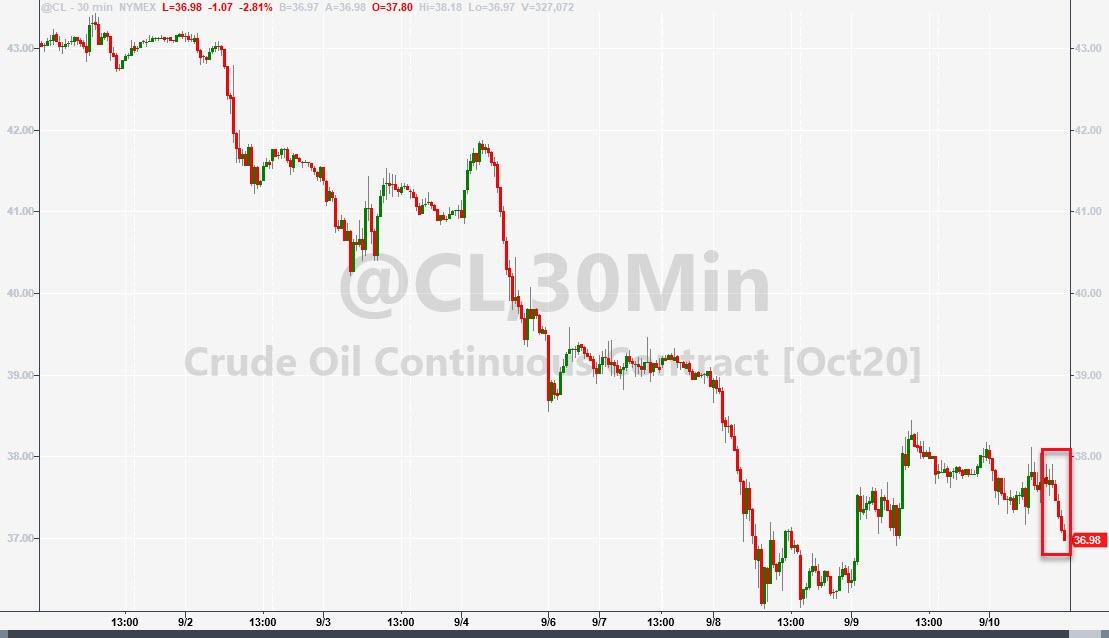

WTI tumbled back to a $36 handle …

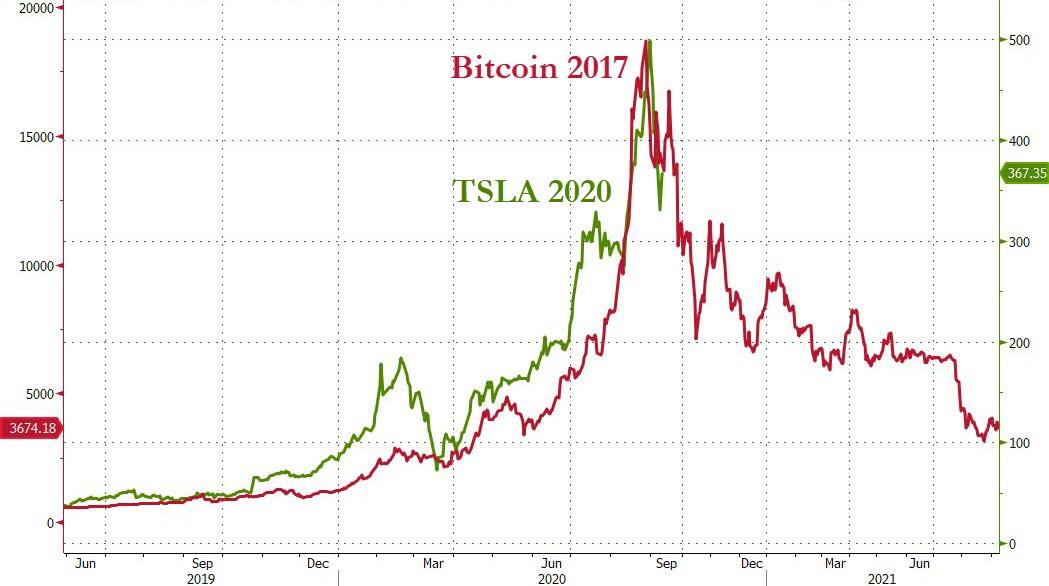

Finally, is it over for Tesla and the Musketeers?

Source: Bloomberg

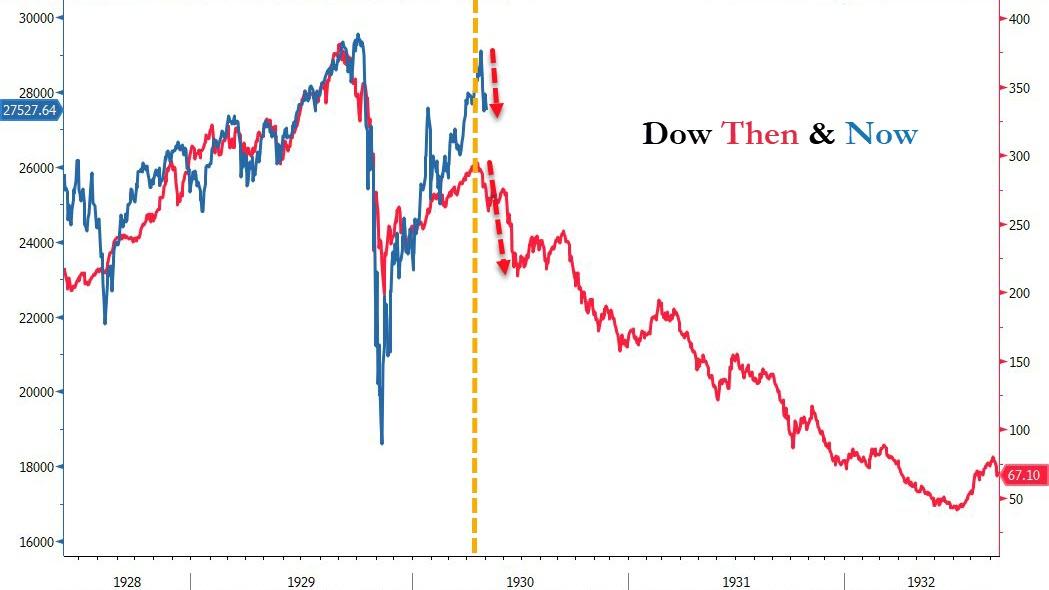

Because we’ve seen this party before, and it didn’t end well…

Source: Bloomberg

via ZeroHedge News https://ift.tt/3ihyqve Tyler Durden