Why One Bank Thinks The World Is “On The Cusp Of A New Era Characterized By Disorder”

Tyler Durden

Thu, 09/10/2020 – 17:00

Back in July, one of the most respected credit strategists on Wall Street caused stunned gasps across the financial world, when he admitted that he is “a gold bug.” Deutsche Bank’s Jim Reid may have been forever cast out of the ranks of polite, non tinfoil hat/conspiracy theory society when he said that in his opinion, “fiat money will be a passing fad in the long-term history of money”, a shocking admission (if one that many of his peers secretly harbor) for most financial professionals who are expected to tow the Keynesian line and always believe in the primacy of fiat and its reserve currency, the US Dollar.

Of course, for those who have been following Reid’s writings over the past few years (we feature his Daily Morning Reid note in our AM wrap), that admission was hardly a surprise: for much of the past decade, he has been closest to saying what most rational, clear-thinking people on Wall Street – and elsewhere – think and believe, yet are afraid of speaking it for fears of direct and indirect retaliation from an established monetary and financial system which has zero tolerance for anyone casting doubts over its viability (the fact that he works at Deutsche Bank is an added bonus).

For those unfamiliar with his work, some of his more notable recent writings can be found below:

- Jim Reid: “All Of Us Are Reluctant To Fight The Central Banks, But Is This A Trap?”

- Jim Reid: “The Liberal World Order Is In Jeopardy”

- Jim Reid: “This Is Where The Next Financial Crisis Will Come From”

Reid’s natural curiosity and eagerness to ask the right question even if it provokes established financial dogma is why we read his latest must-read long-term asset return study titled appropriately “the Age of Disorder” with great interest, and why we republish the executive summary in its entirety because for better or worse, he gets it right (we will have several follow up posts to follow).

* * *

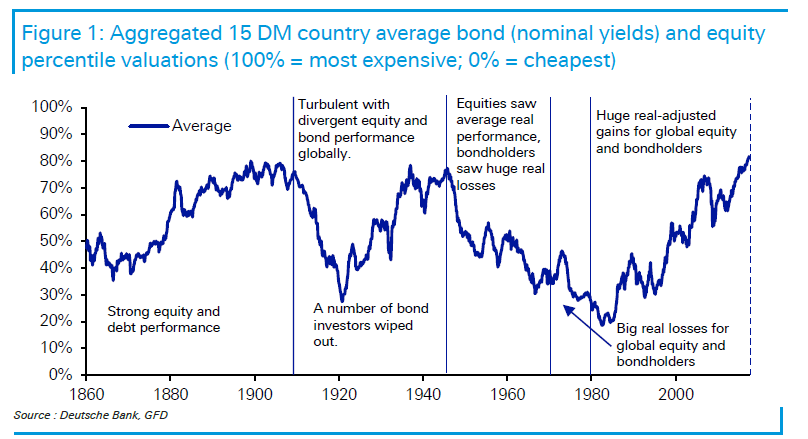

Economic cycles come and go, but sitting above them are the wider structural super-cycles that shape everything from economies to asset prices, politics, and our general way of life. In this note we have identified five such cycles over the last 160 years, and we think the world is on the cusp of a new era – one that will be characterised initially by disorder.

Not all disorder is ‘bad’. Indeed, if the themes of the world economy swing like a pendulum, then it may be that some have swung too far from a ‘sensible centre’ and are due to revert. This can have a cleansing effect. What is worrying, though, is that several themes appear poised to revert at a similar time. This is the point – that simultaneous changes to structural themes will create a level of disorder that will define a new era.

Before we review the key themes of the upcoming “Age of Disorder”, we must note that while some historical super-cycles have begun and ended abruptly, others were slower to evolve and end. The most recent era – the second era of globalisation, during 1980-2020 – is much more like the latter. It started slowly and has been gradually fraying at the edges over the last half-decade. The end of this era has been hastened by Covid-19 and – when, in years to come, we look at the rearview mirror – we may see 2020 as the start of a new era.

By our measure, there have been five distinct eras in modern times, with a sixth likely starting this year:

- The first era of globalisation (1860-1914)

- The Great Wars and the Depression (1914-1945)

- Bretton Woods and the return to a gold-based monetary system (1945-1971)

- The start of fiat money and the high-inflation era of the 1970s (1971-1980)

- The second era of globalisation (1980-2020?)

- The Age of Disorder (2020?-????)

The era of globalisation to we are likely waving goodbye saw the best combined asset price growth of any era in history, with equity and bond returns very strong across the board. The Age of Disorder threatens the current high global valuations, especially in real terms. We believe this coming new era will be marked by at least eight themes, which we will briefly summarise in this executive summary and then expand upon in the full note.

- Deteriorating US/China relations and the reversal of unfettered globalisation.

- A make-or-break decade for Europe, with muddle-through less likely following the economic shock of Covid-19.

- Even higher debt and MMT/helicopter money becoming mainstream.

- Inflation or deflation? As a minimum, it is unlikely it will calibrate as easily as we saw over the last few decades.

- Inequality worsening before a backlash and reversal takes place.

- The intergenerational divide also widening before Millennials and younger voters soon start having the numbers to win elections and, in turn, reverse decades of policy.

- Linked to the above, the climate debate will build, with more voters sympathetic and thus creating disorder to the current world order.

- We’re in the midst of a technology revolution with astonishing equity valuations reflecting expectations for a serious disruption to the status quo. Revolution or Bubble? Also, if WFH becomes more permanent, it will cause major changes to societies and economies. Big cities were huge winners in the previous era, and this could now reverse.

Although some of these themes have been around for some time, it is only recently that they have begun to feed off each other to hasten the demise of the second era of globalisation. Their increased interaction has thus created the conditions to start their own new era of much change.

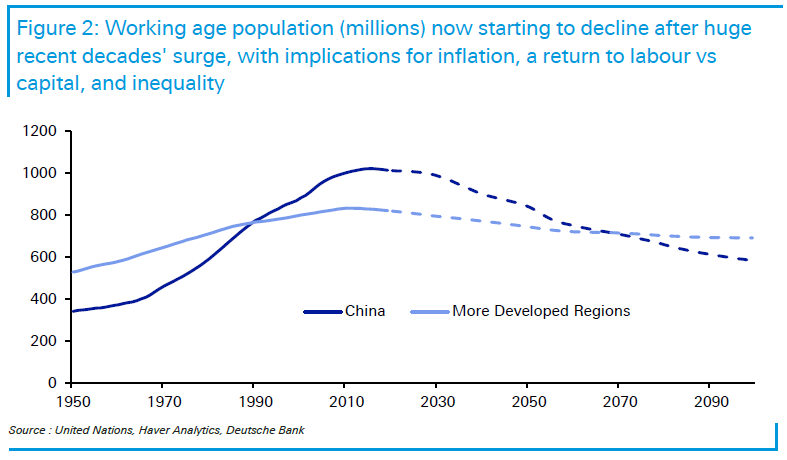

The key to understanding this new age of disorder, then, is to see how its themes emerged during the most recent era of globalisation. This was the era that began around 1980, when the world accelerated the move to abolish regulations and capital controls, which subsequently boosted free trade (and global capital flows) and begat a more liberal world order. Global demographics massively supported this phenomenon and ensured a huge increase in workers, many of them from China and other low-income countries. By the mid-1980s, the second era of globalisation was in full flow.

This era was win-win for most of the globe, and everything fell into place over the next three to four decades. Inflation fell largely due to a huge surge in workers (now behind us), and there was also downward pressure on wage inflation due to global labor market integration. In addition, there was help from direct central bank policy, including increased independence around the world. Lower inflation meant lower bond yields (real and nominal) and lower interest rates, and this all allowed for ever-higher equity valuations and profits. As a result, equities generally performed very well relative to what was slowing developed-market growth.

The cracks in this era began to emerge after the GFC, which revealed that ever-higher leverage had papered over the problems that globalisation had created in many Western countries. Firmly in the spotlight were issues including low real wage growth, the outsourcing of many low-paid jobs, and increased inequality. In response, authorities used heavy intervention (especially monetary) to prop up the existing system (rather than reform it), but populism and resentment built. The Brexit and Trump victories were manifestations of this anger in the UK and US, but populism increased across the globe. It was then that most people realised the era of full-feted globalisation was certainly fraying and the problematic issues it had incubated were about to take centre stage.

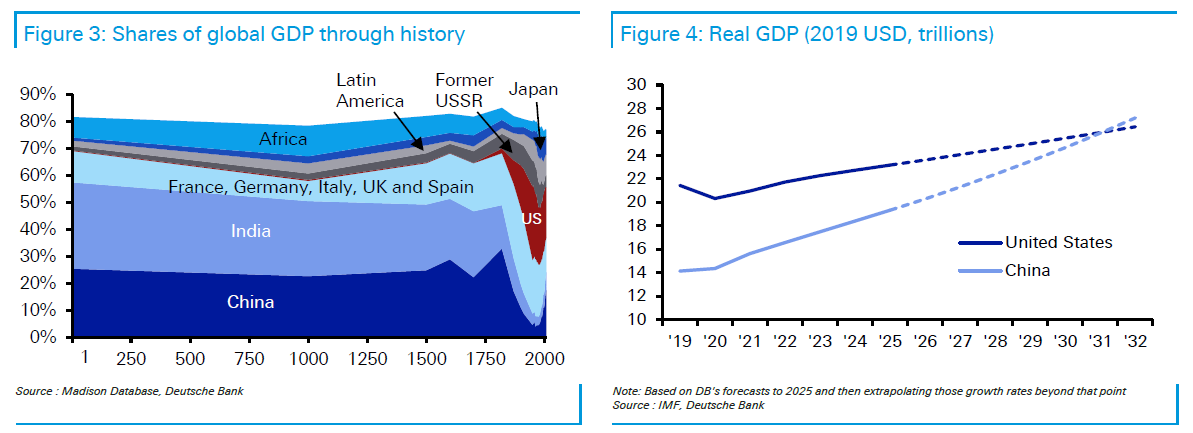

As the Age of Disorder begins, we believe one of the biggest issues will be the political tension between the US and China. Indeed, this should characterise the era of disorder because China has been at the heart of the most recent era – that of globalisation. The future of this relationship can only be forecast by understanding the past. We delve into this in more detail later, but to summarise: China is looking to restore the position it held for much of history as a global economic powerhouse. To illustrate, from two thousand years ago until the early nineteenth century, the country represented around 20-30% of the global economy. It then suffered under colonial powers, particularly in the century before Mao established the modern Chinese state in 1949. By the early 1960s, China’s share of the global economy hit an all-time low of 4%. It is now back to 16%.

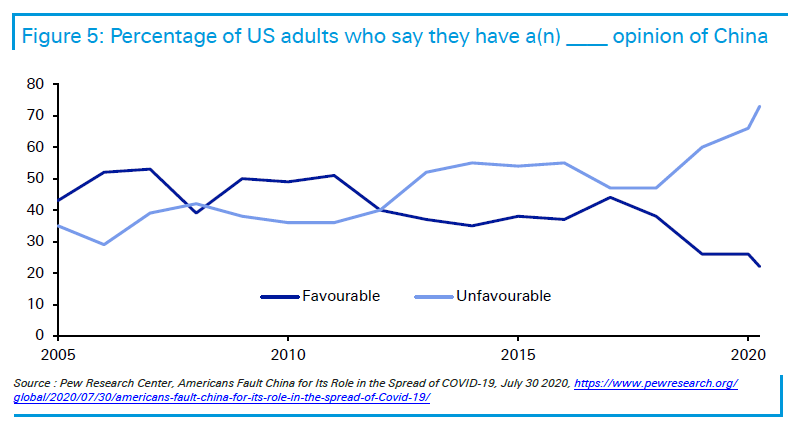

While China’s fortunes rapidly grew during the era of globalisation, so too did tensions with the West. Partly, this came from the incorrect assumption in the West that as China developed it would increasingly become more Western in its outlook and values, and fully integrate into the liberal world order, which contains much American architecture. With hindsight, this was naïve as China has a long, proud and powerful history with its own values.

A clash of cultures and interests therefore beckons, especially as China grows closer to being the largest economy in the world. From the West’s point of view, China would not be in its current position if the West had not accepted China into its economic orbit during the latest era of globalisation. Now, the Covid-19 pandemic will likely speed the symbolic point at which China overtakes the US economy as the largest in the world. China has seen a post-Covid V-shaped recovery already, while it has become obvious that recovery in many Western countries will be a lengthier process. Assuming its current trajectory continues, China could become the world’s largest economy around the end of this decade or soon thereafter. Regardless, the crossover point with the US seems only a matter of time.

As the economic gap between the US and China narrows, many worry about the so-called Thucydides Trap. This refers to the fact that on 16 occasions over the last 500 years, a rising power has challenged the ruling one, and on 12 occasions it ended with war. While a military conflict today seems highly unlikely, an economic battle is likely to ensue, with the benign global trading conditions of the globalisation era likely to be resigned to the history books. The result of the US election in November is unlikely to change the direction of travel. Over the course of this decade, relations will likely deteriorate into a bipolar standoff as both the US and China seek to prevent encirclement by the other. Companies that have embraced globalisation will be stuck in the middle if relations sour as we fear.

The second theme of the Age of Disorder is that the 2020s could be a make-or-break decade for Europe. The strains on the continent were evident prior to Covid-19, but the virus has probably reduced the chance of the 2020s being a muddle-through decade like the 2010s. The economic divergence between countries will likely be even more pronounced and, as such, it feels like the probability of both integration and disintegration has increased over the last six months. On the one hand, the Recovery Fund is a genuine and welcome step in the right direction, but it needed to be. On the other hand, given the economic issues ahead, further measures will probably become necessary in the years ahead to prevent maximum disorder.

Even if further economic stimulus can be negotiated as needed, it is likely to be done against a backdrop of consistent volatility and brinkmanship, particularly if domestic politics across the continent gravitate away from those consistent with further EU integration. With the Covid economic shock, that must be a greater possibility now. So the chances of muddling through for Europe have decreased, while the potential for both further integration or disintegration has increased post-Covid. Even if integration wins out, it may still take an acute threat of disintegration to concentrate political minds.

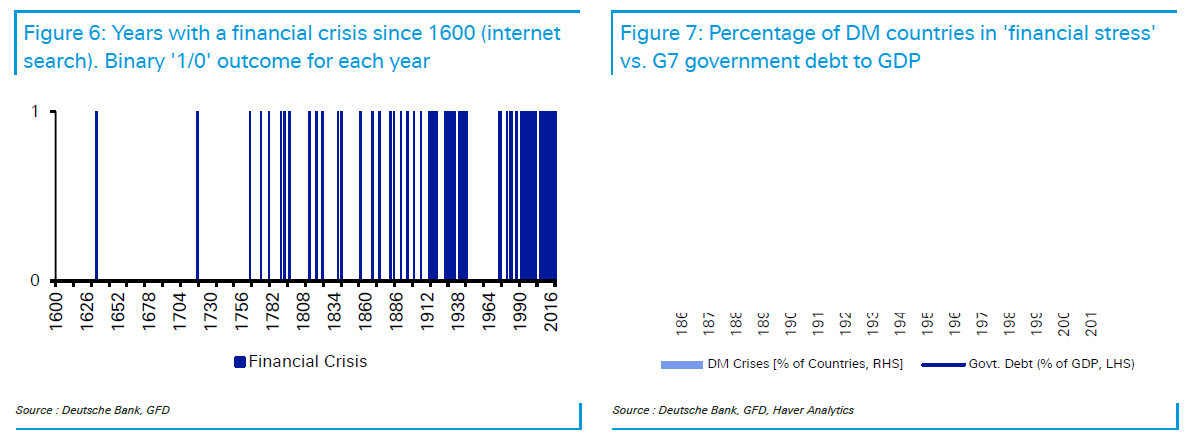

A key problem Europe faces is that many of its countries have too much debt, and this leads straight to our third theme in the Age of Disorder. Far from being just a problem in the European periphery, debt is a global issue – and it is only because central banks have distorted free markets that global borrowing can be financed at a viable interest rate. Given central banks have committed to underwriting the post-Covid recovery, they will have an even more outsized role over the years ahead. Our work in a previous long-term study “The Next Financial Crisis” suggests that periods of higher debt lead to a higher intensity of financial shocks and crises. This trend will be amplified by the Covid-19 crisis and means we will likely see more crises, more disorder and even more money printing in the years ahead. Yes, lower interest rates mean we can run with more debt, but a high-leverage society is always likely to be more shock-prone.

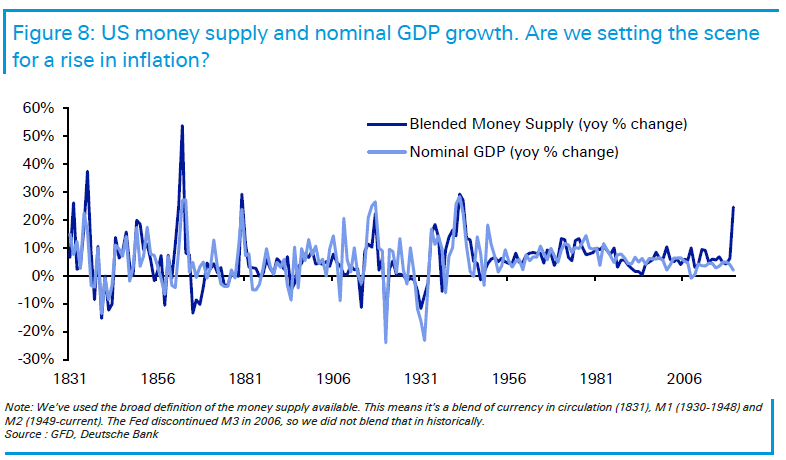

The extent to which we can reduce the huge global debt burden depends heavily upon the fourth theme in the Age of Disorder – inflation. On this topic, DB is still split on whether the debt and Covid-19 crises will be inflationary or disinflationary. Although this team is in the inflationary camp, we acknowledge that the outcome is path-dependent. If we move to a MMT/helicopter-money type world, where both fiscal and monetary policy are expansionary, it is pretty easy to see a jump in inflation. For us, Covid-19 has forced global policy makers to cross the Rubicon with regards to expansionary fiscal policy, and it is unlikely that they’ll go back to the austerity of the early-2010s – and with ultra-loose monetary policy almost guaranteed, this will put us in a completely different world order to that seen previously and create a very different macro environment. However, if we’re wrong and governments prioritise the repair of their balance sheets, then – even if central banks keep printing – we are likely to be stuck with low inflation for a longer period. With so much debt, such a scenario will also almost certainly ensure its own elements of disorder ahead.

Regardless of which outcome materialises, it feels that the ability of policymakers to perfectly calibrate inflation towards target in a post-Covid world will be incredibly difficult given the size of the opposing forces. So we expect a higher probability of more extreme outcomes going forward.

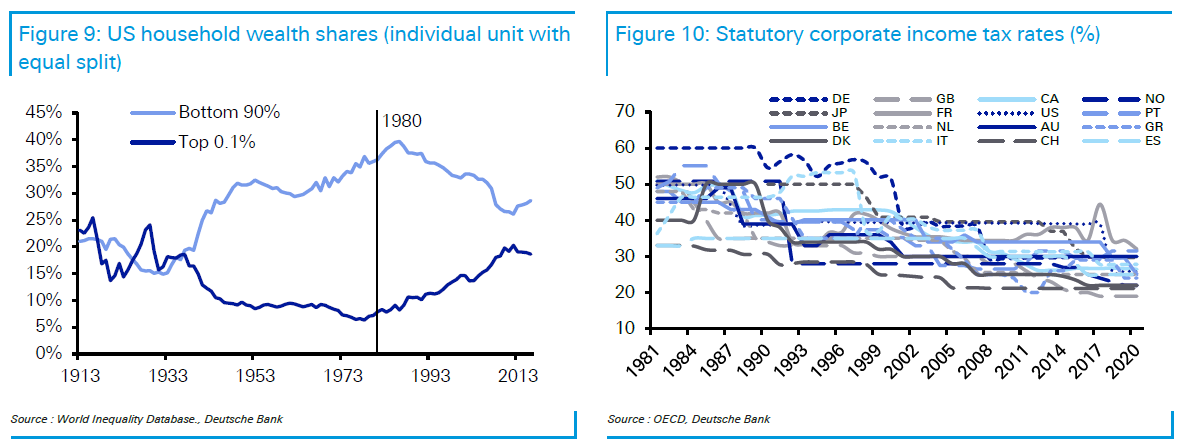

As the outcomes become more extreme, they will heavily influence how progress is made on inequality – our fifth key theme. It may initially worsen, but the need to pay for the Covid shock, and perhaps the reduction of globalisation, may encourage governments to increase taxation on those with deeper pockets. This is likely to be biased towards the highest-paid individuals, but also companies as they have benefited from a race to the bottom in corporate tax in the globalisation era. Technology firms are already attracting greater attention on this front, especially as they have largely benefited from the pandemic.

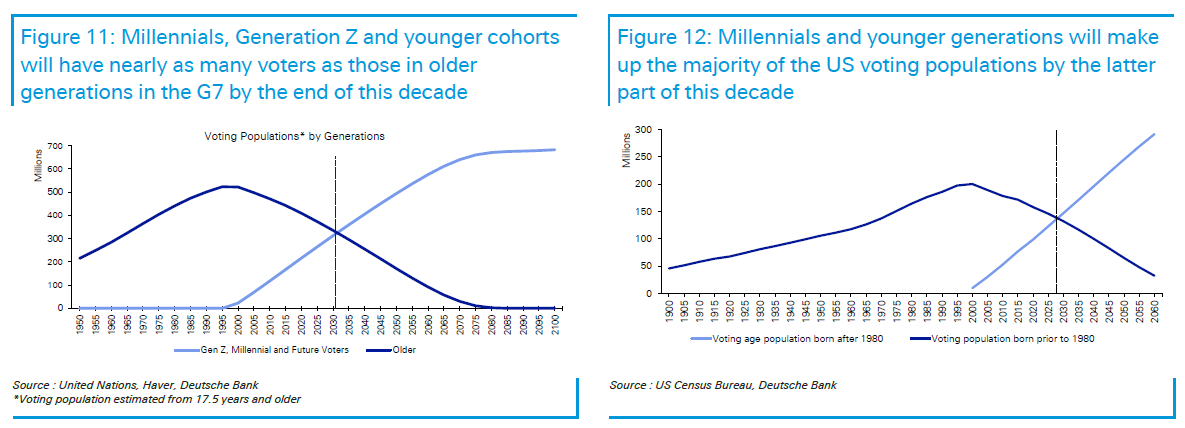

The discussion of inequality within and between countries will not be limited to wealth and income. In fact, an issue that is quickly emerging as a political force is the intergenerational gap. This is our sixth theme in the Age of Disorder. This segment of inequality has been allowed to build and build in the globalisation era. The general assumption is that the divide between the young and old will worsen as the population ages, and the self-interest of the older generation will ensure that the status quo continues. However, this misses the key point: the age at which the intergenerational divide begins is not constant. It is likely that this age will increase over time as those left behind are unable to catch up and thus the average age of discontentment with the status quo continues to increase over time.

The Millennial generation (born in the early 1980s), along with Generation Z and younger voting cohorts, are firmly established as generational ‘have nots’. Yet in G7 countries, the combined size of these groups is fast catching up to that of the generations born prior to the Millennials. The two groups on either side of the divide will be close to neck-and-neck by the end of this decade in aggregate and slightly earlier in the US.

Assuming life does not become more economically favourable for Millennials as they age (many find house prices increasingly out of reach), this could be a potential turning point for society and start to change election results and thus change policy. This is particularly the case when we recognise that the votes for Brexit and Trump in 2016 left many younger people feeling angry and alienated by political decisions that a sizable majority of them were against.

Such a shift in the balance of power could include a harsher inheritance tax regime, less income protection for pensioners, more property taxes, along with greater income and corporates taxes already mentioned, and all-round more redistributive policies. The “new” generation might also be more tolerant of inflation insofar as it will erode the debt burden they are inheriting and put the pain on bond holders, which tend to have an ownership bias towards the pensioner generation and the more wealthy. The older generation may also have to be content with lower (or even negative) asset price growth if the younger generation does not have a sudden income boost.

Whether or not individuals see the above as ‘good’ or ‘bad’ is not necessarily the point. Rather, it seems clear that this will be a big break from the status quo and lead to far more disorder than in the prior era of globalisation.

Amidst the clash between the young and old, an increasingly fraught issue will be climate change – something that increased during and because of the recent globalisation era. This is our seventh key theme and is one where heavily polarised opinions exist – not just about the extent of the problem, but around the various options available to respond. Although the pandemic has displaced climate change from the front pages for now, as the size of the pro-climate younger generation grows, so too will the pressure on leaders to act.

We are likely to see huge pressures for a greener response to the post-pandemic economic rebuild. To move the world to a consumption-driven model of measuring and judging carbon emissions, we believe a carbon border adjustment tax is needed and this will likely be implemented this decade. Given more Millennials will be elected into positions of power over the coming decade, this tax will probably not suffer from the same watering-down as other environmental legislation. As such, a strong carbon border tax will reinforce the disruption to the status quo and create disorder for both companies and countries in terms of the relationships between them that in the era of globalisation were relatively calm.

Most of the trends identified here would likely have occurred without Covid-19, but many are now likely to be accelerated by its arrival. However, the pandemic brings disorder of its own, which leads us to our final point. As we go to print, we’ve now marked six months of working from home with no immediate end in sight for many. It’s reached a stage where much of this trend will have an element of permanence. This has major implications for cities, residential and commercial property, transport, workers and many ancillary sectors and general activities we’ve taken for granted over the last several decades. Big/mega cities have been major winners in the globalisation era. Will this trend reverse post-Covid? If so, this will have a major disorderly impact on society as we currently know it.

On a related theme, this is all occurring alongside record tech valuations in equity markets, with some astonishing valuations. It feels this could go one of two ways, both of which would bring large disruption. Either these valuations are proved to be justified and we’re close to major technological advancements impacting all facets of life, or we run the risk of a repeat of 2000 where a bubble burst even if much of the technology survived and progressively became integrated into our lives in a more normal evolutionary manner. The latter would have major financial market consequences for a period of time, but would be less revolutionary. The answer is perhaps a combination of both: rapid technological change that is both positive and disruptive but with stark winners and losers in both the tech sector and the wider global economy.

So, the Age of Disorder is likely upon us. In the years ahead, simply extrapolating past trends could be the biggest mistake you make.

via ZeroHedge News https://ift.tt/3k3XLJu Tyler Durden