Futures Rebound In Shaky Markets With Stocks On Pace For 2nd Weekly Drop

Tyler Durden

Fri, 09/11/2020 – 08:07

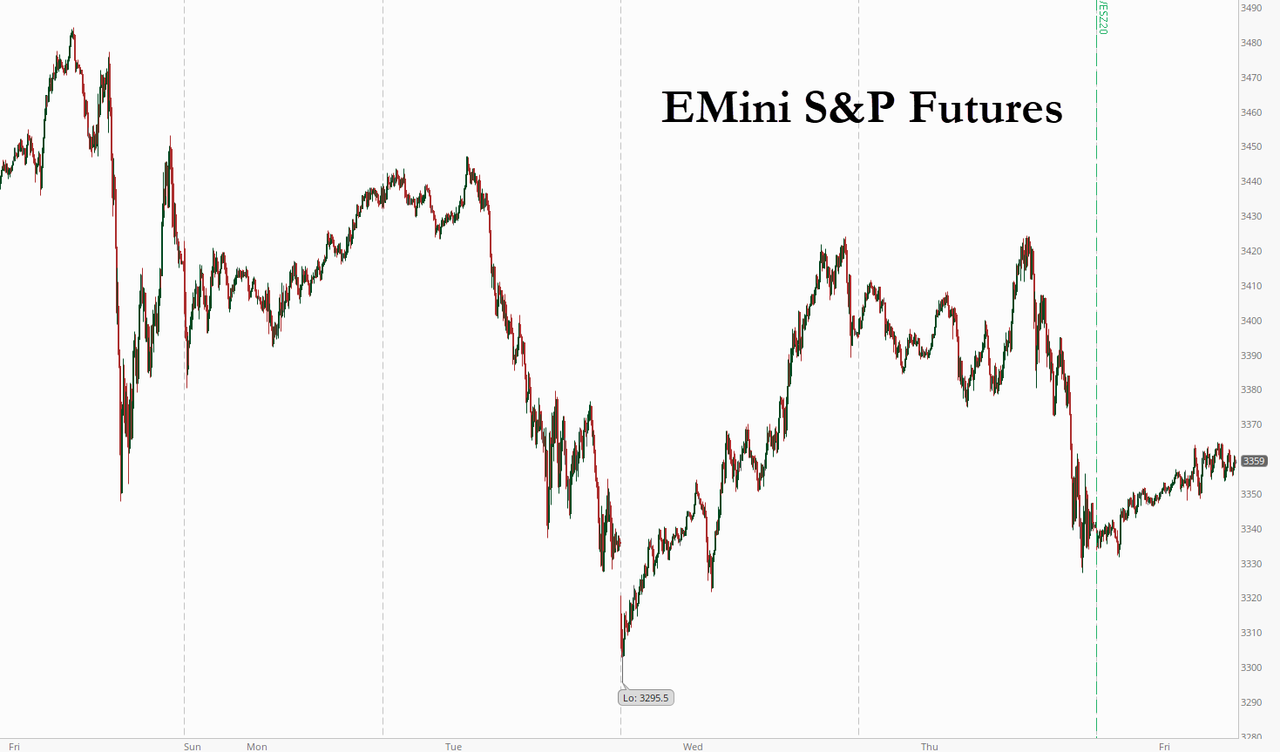

After yesterday’s surprise intraday reversal lower – the third such lurch following last Friday’s and Tuesday’s drubbing – which may or may not have been sparked by a pair of sell programs late in the morning, US equity futures levitated sluggishly in the week’s final session while European shares struggled for momentum on Friday as concerns about extra monetary stimulus and overnight falls in U.S. big tech shares kept investors on edge. The dollar continued its decline while Treasury yields rose.

Despite the modest rebound in U.S. futures, global stocks, the S&P 500 and the Nasdaq Composite were course for a second straight week of losses. On Friday, Nasdaq 100 futures were up 1.3% and S&P 500 futures 0.9% firmer. The NYSE Fang+ index of big 10 tech companies has lost 5.4% so far this week, its biggest weekly loss since the market turmoil in March if sustained by the end of Friday. Menwhile, volatility is rising and as the next chart shows, the Nasdaq has moved more than 1% on every day in September.

“When you see these short-term, sudden moves after a run-up like we’ve had, it doesn’t mean you avoid the sector, but you have to be prepared that it’s the price of admission of being there,” said Charles Day, a managing director and private wealth advisor at UBS Global Wealth Management. “We still think investors should stay invested, we’re still positive on equities.”

Fears over a messy hard Brexit added to the bearish sentiment, putting sterling on track for its worst-week since March after the European Union told Britain it should urgently scrap a plan to break their divorce treaty. In other political clashes, the U.S. Senate killed a Republican bill that would have provided around $300 billion in new coronavirus aid, as Democrats seeking far more funding prevented it from advancing. That followed European Central Bank President Christine Lagarde earlier in the day appearing to rule out measures to weaken the euro, even though the ECB’s chief economist followed up this morning warning that a strong euro is dampening inflation.

“Investors were disappointed,” said Milan Cutkovic, market analyst at AxiCorp. “They were hoping that the central bank will boost the stock market rally by paving the way for further stimulus measures and talking down the euro. “But ECB President Christine Lagarde sounded less dovish, and her remarks about the strong euro left markets unimpressed.”

Europe’s Stoxx 600 was rangebound, opening lower before gaining 0.1%. The bank subgroup index fell as much as 1.4% and travel & leisure index dropped 1.1%, after ECB chief economist Philip Lane used a tougher tone than President Christine Lagarde and warned that the euro’s appreciation this year has dampened the inflation outlook, signaling that more monetary stimulus might be needed. After crashing by a record 20% in the second quarter, Britain’s economy grew by 6.6% in July, slower than June’s monthly rate, the Office for National Statistics said.

The European Union is ramping up preparations for a tumultuous end to the four-year Brexit saga after Britain explicitly said this week that it plans to break international law by breaching parts of the Withdrawal Agreement treaty that is signed in January.

MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.4%, moving away from a one-month trough touched earlier this week. Markets in Asia were mixed, with Jakarta Composite and Shanghai Composite rising, and Australia’s S&P/ASX 200 and Thailand’s SET falling. The Topix gained 0.7%, with Diamond Electric Holdings and Raksul Inc rising the most. The Nikkei rose after Tokyo dropped its coronavirus alert by one notch from the highest level as COVID-19 cases trend down. The Shanghai Composite Index rose 0.8%, with Yechiu Metal Recycling China and Jiangsu Sinojit Wind Energy Technology posting the biggest advances.

With the world’s stocks still trading near the most expensive levels relative to profit outlook since the 2000 tech bubble, some analysts called for caution.

“Global shares had rallied on expectations of economic recovery from lockdowns. But as the autumn begins (in the northern hemisphere), people wonder if the coronavirus infections could worsen,” said Kozo Koide, chief economist at Asset Management One. “You never know if vaccine deployment is that easy nor if banks need to aside more provisions for struggling firms in hospitality sector. Considering all that, investors are likely to question the current valuations can be justified,” he said.

In rates, Treasuries drifted lower led by long end as the curve bear-steepened, with futures near lows of the day in early U.S. trading. 10- and 30-year yields remain below this week’s auction stops, with a 20-year reopening ahead on Tuesday. Yields are cheaper by ~2bp at long end, steepening 5s30s by 1.6bp; 10-year higher by 1.3bp near 0.69%. Government bond yields across the euro area fell after Lane’s comments that inflation will be persistently low in the coming years. Bunds outperformed by ~3.5bp, helped by comments from ECB’s Lane who said the euro’s recent rise dampens the inflation outlook; gilts outperform Treasuries by 2.7bp.

In fx markets, the Bloomberg Dollar Spot Index slipped for a second day as the greenback weakened versus most of its peers as gains in U.S. stock futures dented demand for haven assets. The euro advanced for a third day as investors shrugged off policy makers’ commentary about how the common currency’s strength dims inflation prospects. The EURUSD rose 0.5% to 1.1874 day high, up 0.3% on a weekly basis, after ECB chief economist Philip Lane warned that the euro’s appreciation this year has dampened the inflation outlook, using tougher language than President Christine Lagarde and signaling that more monetary stimulus might be needed. Norway’s krone and antipodean currencies were at the top; the Australian dollar advanced against the greenback to erase a weekly loss after exporters and speculative funds bought spot to cover short term obligations into the weekend. The pound extended this week’s slump and headed for its worst week since March on a deterioration in Brexit negotiations. Dollar-yen stayed in a tight range as investors refrained from taking fresh positions ahead of U.S. inflation data.

In commodities, oil prices were under pressure from a surprise rise in U.S. stockpiles and weak demand due to the coronavirus pandemic. Brent was down 0.4% at $39.91 a barrel after falling nearly 2% on Thursday. U.S. crude dropped 0.2% to $37.23 a barrel, having fallen 2% in the previous session. Despite the continued dollar drop, gold was roughly unchanged at $1,944.75 per ounce after hitting its best level since Sept. 2 on Thursday.

Looking at the day ahead, data highlights include the US CPI reading for August. There are an array of ECB speakers, including chief economist Lane, Schnabel, Mersch, Villeroy and Weidmann. Kroger is reporting earnings.

Market Snapshot

- S&P 500 futures up 0.9% to 3,370.75

- STOXX Europe 600 up 0.07% to 367.74

- MXAP up 0.4% to 170.90

- MXAPJ up 0.3% to 560.25

- Nikkei up 0.7% to 23,406.49

- Topix up 0.7% to 1,636.64

- Hang Seng Index up 0.8% to 24,503.31

- Shanghai Composite up 0.8% to 3,260.35

- Sensex down 0.1% to 38,796.07

- Australia S&P/ASX 200 down 0.8% to 5,859.42

- Kospi up 0.01% to 2,396.69

- Brent futures down 0.2% to $39.97/bbl

- Gold spot down 0.2% to $1,943.19

- U.S. Dollar Index down 0.1% to 93.23

- German 10Y yield fell 3.6 bps to -0.469%

- Euro up 0.3% to $1.1846

- Italian 10Y yield fell 1.2 bps to 0.883%

- Spanish 10Y yield fell 3.0 bps to 0.32%

Top Overnight News from Bloomberg

- The U.K. secured a free-trade agreement with Japan, its first major post-Brexit accord and a boost to Prime Minister Boris Johnson as negotiations deteriorate with the EU

- Britain’s economy expanded 6.6% in July compared to June, when it gained a record 8.7%, with activity being boosted by the reopening of restaurants and bars in early July

- Investors are now paying for the privilege to lend cash to the U.K. government for short periods of time, adding to conviction for rate cuts by the Bank of England

- JPMorgan Chase & Co. is requiring its most senior sales and trading employees to return to their offices by Sept. 21, the strongest move yet by a U.S. bank to restaff its workplaces

- French President Emmanuel Macron will meet with his government Friday to discuss how to curb a surge in coronavirus infections without endangering a tentative economic recovery. France recorded close to 10,000 new cases Thursday, the most since the lockdown ended in May

- Norges Bank will probably raise its main interest rate a good deal earlier than the bank’s own forecasts suggest, according to Norway’s statistics agency

A look at global markets courtesy of NewsSquawk

Asian equity markets trade mixed, but finished mostly positive, as the region partially shrugged-off the weak performance stateside where all major indices declined amid resumed heavy selling in tech and energy, while higher US jobless claims data and the failure to pass the skinny stimulus bill at the Senate added to the downbeat mood. ASX 200 (-0.8%) underperformed with tech and miners leading the broad descent across its sectors, while Rio Tinto shares whipsawed following the announcement of top-level changes with CEO Jacques to exit the Co. when a successor is appointed or by end-March 2021 and iron ore chief Salisbury to step down with immediate effect as a fallout from the destruction of the Aboriginal heritage sites. Nikkei 225 (+0.7%) recovered initial losses with the index helped by mildly favourable currency flows and amid reports Japan is to allocate JPY 1.6tln for coronavirus measures from the reserve fund. Hang Seng (+0.8%) and Shanghai Comp. (+0.8%) were indecisive after this week’s PBoC liquidity efforts resulted to a net weekly injection of CNY 230bln, but with upside restricted after President Trump adamantly dismissed extending the deadline for TikTok and with weakness seen in defense stocks after China and India border tensions eased following a meeting of their foreign ministers in which the sides issued a joint statement that they agreed to honour existing agreements and to not escalate the border situation. Finally, 10yr JGBs were marginally higher as they took their cue from USTs and with the BoJ also present in the market for nearly JPY 1.2tln of JGBs with up to 10yr maturities, although gains were limited by the improvement in risk appetite overnight and with stubborn resistance at the 152.00 level.

Top Asian News

- Credit Suisse Hires 11 for China Research After JV Control

- India Survey Suggests Covid-19 Cases Hit 6.4 Million by May

- Nissan Makes Euro Bond Market Debut After Jumbo Dollar Sale

- Bank Indonesia Intervenes as Planned Social Curbs Hit Rupiah

Directionless trade thus far and relatively contained in early European hours (Euro Stoxx 50 -0.4%) as the region took the lead from a mixed APAC performance and fluctuates between negative and positive territory amidst a lack of fresh catalysts heading into US CPI. Meanwhile, US index futures see more pronounced gains following yesterday’s tech-led slide. European sectors also see a mixed performance with little to be derived in terms of a risk profile. Healthcare leads the gains – propped up by Pharma behemoths Novartis and Roche, with the latter noting that new data further reinforces Co’s Ocrevus as a highly effective treatment for MS. To the downside, banks feel the ill-effects of a slightly lower European yield environment, whilst Oil & Gas and Travel & Leisure react to dwindling demand prospects. In terms of individual movers, Altice (+24%) tops the charts amid news that it is to be acquired by Next Private in an all cash offer of EUR 4.11/shr; expected to completed in Q1-2021. Meanwhile, Banco de Sabadell (-3%) failed to capitalise on further Spanish banking sector consolidation rumors as merger talks reportedly have not been initiated. Sticking with M&A, LSE (+1.8%) shares are supported by reports that Board of directors of Italy’s CDP and CDP equity have resolved to proceed jointly with Euronext (+1.8) to submit non-binding bid for Borsa Italiana.

Top European News

- U.K. Agrees Post-Brexit Trade Deal With Japan, Boosting Johnson; U.K. Economy Surges in July But Clouds Gather Over Brexit

- Sunak Urged to Extend U.K. Job Support, Help Indebted Firms

- LVMH, Hermes Gain as Morgan Stanley Sees Rosier Luxury Outlook

- Euronext Joins Italy State Lender CDP in Borsa Italiana Bid

In FX, sterling remains vulnerable heading into Friday’s round of Brexit trade talks, and with UK PM Johnson facing a Conservative Party revolt against the Internal Market Bill on top of the EU backlash following no reassurances about commitment to comply with the WA from yesterday’s extraordinary joint committee meeting. However, Cable briefly clambered back over 1.2800 after positive reports from Japan about agreement on a trade deal with Britain and Eur/Gbp retreated through 0.9250 before rebounding again after the cross catapulted 2 big figures to 0.9270 on Thursday, albeit with the Euro off its post-ECB highs across the board. For the record, no discernible reaction to a raft of UK data that was mixed on balance, but pretty much as expected in terms of GDP, and from a chart perspective the Pound may find underlying bids around 1.2750 vs the Dollar as the 200 DMA sits not far below at 1.2737, while 0.9300 could offer some sentimental support relative to the Euro.

- AUD/NZD – Broad risk sentiment is still fragile after a resumption of the tech-inspired equity market bull correction on Thursday, but the Aussie and Kiwi have taken comfort from more resilient performances across APAC bourses overnight. Moreover, Aud/Usd and Nzd/Usd will draw encouragement from the fact that their latest pullbacks were shallower, down to around 0.7250 and 0.6650 respectively compared to 0.7200 and 0.6600 on Wednesday, while retesting 0.7300 and 0.6700. Note, however, Aud/Nzd is holding above 1.0900 in wake of softer NZ food prices and the manufacturing PMI only just retaining 50+ status.

- EUR/CHF/CAD – Also rebounding vs the Greenback, as the DXY meanders between 93.356-129 parameters ahead of US CPI, with the single currency near the top of a 1.1869-14 range and keeping tabs on a host of ECB speakers for anything fresh/pertinent to supplement pretty routine and unchanged guidance from September’s policy meeting. Meanwhile, the Franc has reclaimed 0.9100+ status and the Loonie is pivoting 1.3170 without additional impetus from BoC Governor Macklem who basically repeated Wednesday’s post-meeting statement and merely acknowledged that Usd/Cad has not fallen as much as other pairs in the past month.

- JPY – Very little deviation in the Yen just under 106.00 against the Buck awaiting next week’s LDP leadership developments and BoJ policy outcome that is now widely touted to culminate in an upgrade to the economic assessment for Japan.

In commodities, WTI and Brent front month futures are flat within tight ranges in the aftermath of yesterday’s decline, as the complex awaits fresh news flow ahead of US CPI metrics. WTI has been contained within USD 0.5/bbl parameters between 37.00-50/bbl and 39.65-15/bbl respectively, with the only scheduled crude-specific data the weekly Baker Hughes rig count which will be released as usual. Next week is poised to be a relatively busy week for crude markets, with the OPEC and IEA MOMRs alongside the JMMC, which collectively should provide some meat on the bone around what is still an uncertain supply/demand outlook. Elsewhere, spot gold and spot silver are uneventful in caged-trade sub-USD 1950/oz and below USD 27/oz, Meanwhile, Shanghai copper closed lower on the day, weighed on by the losses seen across US stock markets, whilst Dalian iron ore rebounded on demand recovery hopes.

US Event Calendar

- 8:30am: US CPI MoM, est. 0.3%, prior 0.6%; 8:30am: US CPI Ex Food and Energy MoM, est. 0.2%, prior 0.6%

- 8:30am: US CPI YoY, est. 1.2%, prior 1.0%; 8:30am: US CPI Ex Food and Energy YoY, est. 1.6%, prior 1.6%

- 8:30am: Real Avg Hourly Earning YoY, prior 3.7%; Real Avg Weekly Earnings YoY, prior 4.3%

- 2pm: Monthly Budget Statement, est. $235.4b deficit, prior $200.3b deficit

DB’s Jim Reid concludes the overnight wrap

25 years ago today with great trepidation I walked into my graduate training program and started in Investment Banking. My honest plan at that point was to do it for 3-5 years and earn enough money to pursue my dream of becoming a rockstar. I genuinely believed this would happen. The fact that I’m writing this a quarter of a century later suggests my dreams were quashed or alternatively that I’m a very bad analyst. However with Mick Jagger still going strong at 77 maybe there’s hope that I can do this for another 3-5 years and then pursue my dreams of becoming a rockstar! Note that back on this day in 1995, 10yr US, German, UK and Italian yields were 6.22%, 6.61%, 7.89% and 11.51% respectively. I think the first thing I learnt on that training program was that yields and interest rates don’t go negative. So if you’re reading this as a new graduate, ignore the first thing you learn today.

If you really want to look at long-term returns our “The Age of Disorder” (link here) provides you with them spliced and diced numerous ways for global equities, bonds and commodities. This is in addition to our thematic view in the report that we are about to start a new era – the 6th in the last 160 years. The lead topic was one of a likely ongoing deterioration in the US-China relationship. We showed in Figure 3 (and in our CoTD yesterday here) that China is only restoring its historical position that it lost for a century or so post the mid-19th century. That catch up was fine while it was still far behind the size of the US economy but as parity has got closer and as China has resisted conforming to Western ideals, tensions have been and will continue to increase. See the report for a full chapter on this but remember there’s an 8-page executive summary that covers all the report at a high level.

The month of disorder continues in September with yesterday turning into yet another volatile day for investors as a raft of headlines out of Europe coupled with weak labour market data from the US saw swings between gains and losses before the US took a sharp leg lower post the European close led by the tech sector (-2.28%) once again, with the NASDAQ -1.99%. The S&P 500 was flat at noon in New York before finishing -1.76% down on the day. While there was no specific impetus to the selloff, there were a couple of negative headlines that may have reinforced the week-old risk-off sentiment. A slimmed down US stimulus bill failed to pass the Senate (somewhat expectedly), and Microsoft (-2.80%) announced that they had detected new cyberattacks targeting the US elections. With Europe missing the late drop in risk, the STOXX 600 fell a lesser -0.59%. Sovereign bonds diverged as yields on 10yr Treasuries fell (-2.3bps) to 0.677% as investors sought safety in the late risk off. Earlier yields on 10yr bunds (+2.9bps) had moved higher to -0.43%.

One of the bigger FX moves came from sterling, which fell -1.52% against the US Dollar and -1.60% against the euro as Brexit tensions escalated further between the UK and the EU – the biggest daily drops since 18 March during the worst of the pandemic selling. It follows the release on Wednesday of the UK government’s internal market bill, which seeks to override parts of the already-signed Withdrawal Agreement. In terms of the developments in the last 24 hours, an extraordinary meeting of the EU-UK joint committee was held, following which Commission Vice President Šefčovič said that the adoption of the internal market bill by the UK “would constitute an extremely serious violation of the Withdrawal Agreement and of international law.” More notably, the EU called on the UK “to withdraw these measures from the draft Bill in the shortest time possible and in any case by the end of the month”, and that the EU would “not be shy” when it came to using the mechanisms and legal remedies in Withdrawal Agreement to address any violations.

On the UK side however, there was no sign of the government backing down, with their legal defence issued yesterday saying that “Parliament is sovereign as a matter of domestic law and can pass legislation which is in breach of the UK’s Treaty obligations.” Questions have been raised however as to whether the legislation could successfully pass through Parliament, since although the government has an 80-seat majority in the House of Commons (The Times this morning suggest that up to 30 Tory MPs could rebel), they don’t have one in the Lords, where even the former Conservative leader and Brexit supporter Michael Howard expressed disquiet over the fact that the UK could breach its treaty obligations.

In a statement from EU chief Brexit negotiator Barnier, he noted “significant differences remain in areas of essential interest for the EU.” This was almost the exact same wording from U.K. counterpart Frost, who said that “a number of challenging areas remain and the divergences on some are still significant.” The negotiators are due to meet again next week but, as Mr Barnier noted, both sides are in essentially the places they started eight rounds of negotiations ago.

With the Brexit saga dominating, the ECB were somewhat lower down the headlines yesterday, particularly as they left policy on hold with nothing new in the statement. One of the big questions was how they’d react to the recent appreciation in the euro’s exchange rate, which crossed over the $1.20 threshold recently for the first time in over two years. On this President Lagarde said that “to the extent that the appreciation of the euro puts negative pressure on prices, we have to monitor carefully such a matter, and this was extensively discussed”. However, it was a Bloomberg headline rather than comments from Lagarde that saw the euro strengthen during her press conference. It basically said that the ECB was said to agree there was no need to overreact to the Euro’s gains. In response the euro appreciated to $1.19 shortly afterwards, before paring back some of its gains by the close to finish up +0.10% at $1.182.

In terms of their latest economic forecasts, they now see a smaller -8.0% contraction in GDP this year (vs. -8.7% in June), before a +5.0% rebound in 2021 (vs. +5.2% in June). And on the inflation side, the recent weak inflation prints didn’t stop them revising their outlook slightly higher, with this year’s HICP forecast remaining at +0.3%, before next year saw an upgrade to +1.0% (vs. +0.8% in June) while 2022 remained at +1.3%.

With the ECB behind us now, central bank attention is fully on the upcoming Fed meeting next week, which will be the first since the new framework was presented at the virtual Jackson Hole symposium. To that end at 14:30 BST today, Matt Luzzetti, our Chief US economist, will be in conversation with David Wilcox (the former chief economist at the Fed) on the next steps for the Fed ahead of the important FOMC next week. To register for this event, please click here.

Overnight in Asia markets are mixed with the Nikkei (+0.29%) and Hang Seng (+0.42%) both up while the Shanghai Comp (-0.21%), Kospi (-0.67%) and Asx (-0.69%) are all down. The Nikkei is trading higher after reversing earlier declines helped by news that Yoshihide Suga, the leading candidate to become Japan’s next leader, said there’s no need to raise the sales tax again in the next decade. This overnight remark is significant after he had said a day prior that a further increase in the tax is inevitable in the future given Japan’s aging population. In Fx, the British pound and euro are both up +0.20% and +0.17% respectively this morning while the US dollar index is down -0.16%. Futures on the S&P 500 and Nasdaq are trading up +0.59% and +0.64% respectively. In terms of data, Japan’s August PPI came in line with consensus at -0.5% yoy.

On the coronavirus, the CEO of AstraZeneca Pascal Soriot said that a vaccine could still be available by the end of the year after their trial was delayed. Meanwhile, the head of the US FDA has said overnight that drug makers seeking an emergency authorization for a Covid-19 vaccine will have to meet a higher standard of efficacy than normally would be required for such clearance.

Onto the virus numbers now and there were further signs that Europe was becoming a renewed area of concern, with the UK reporting a further 2,935 cases in the past 24 hours, which brought the 7-day average up to its highest since May 25 at 2,532 albeit with higher testing levels now. We have been highlighting the transatlantic shift in new cases over the last month – rising in Europe while falling in the US over the past 6 weeks. Yesterday was the first time since early spring that new daily cases in the European Union and the U.K. surpassed those in the US (c.27k vs c.26k). European leaders continue to advocate for targeted measures over national lockdowns, with French President Macron saying, “we have to continue to be rigorous, realistic, without giving in to any kind of panic” as the country is seeing more weekly cases than ever. Elsewhere, Japan and Singapore are planning to open a reciprocal green lane for travel next week in a bid to revive business between the two countries.

Looking at yesterday’s data, both the initial weekly jobless claims and continuing claims surprised to the upside in the US. The initial claims for the week through September 5th came in at 884k (vs. 850k expected), which is unchanged from the previous week’s level, while the continuing claims covering the previous week increased to 13.385m (vs. 12.904m expected). Notably, the uptick in the insured unemployment rate to 9.2% was the first weekly increase since mid-July, and only the second since May. So that’ll add to concerns that labour market progress is slowing, particularly in the absence of another stimulus package in the US.

Chances for that additional stimulus package fell yesterday, as Senate Democrats voted down a ‘skinny’ bill that some Senate Republicans and the President had been pushing. The bill was estimated at $500-700bn targeted at supplemental unemployment insurance benefits and aid to small businesses. It was a big drop from the Democrats’ most recent salvo of $2.2tr and the Republicans’ opening $1tr bill. With fewer than 60 days to the election it is uncertain what the path forward is here, as some Senate Republicans are still unsure if more stimulus is even needed while Democrats may wait to see if they have a stronger negotiating platform in November.

To the day ahead now, and there are an array of ECB speakers, including chief economist Lane, Schnabel, Mersch, Villeroy and Weidmann. Separately, data highlights include the US CPI reading for August and the UK’s GDP reading for July.

via ZeroHedge News https://ift.tt/2Fio3ZC Tyler Durden