US Consumer Prices Accelerate In August; Used Car & Furniture Prices Spike As Rent Inflation Slows

Tyler Durden

Fri, 09/11/2020 – 08:39

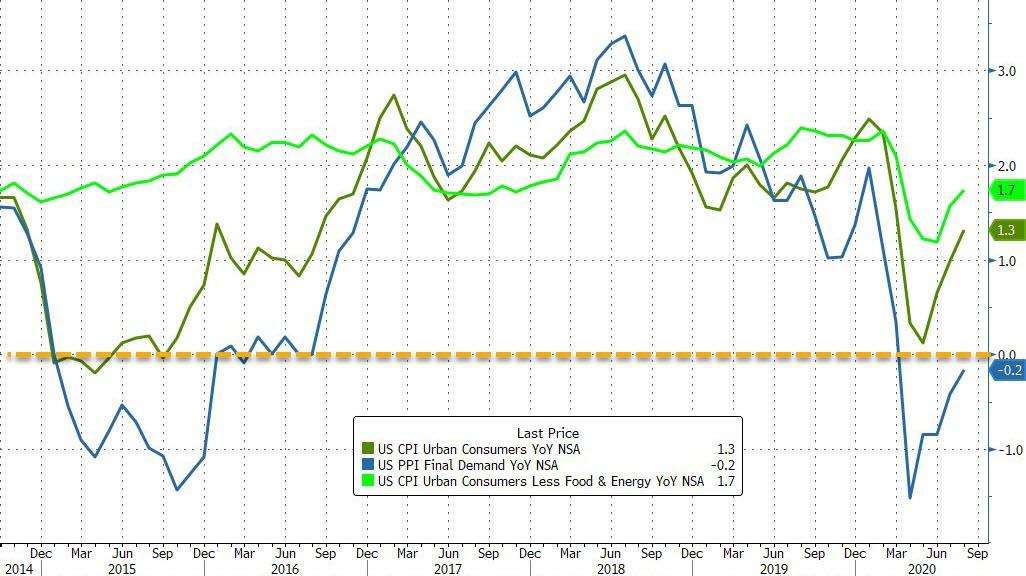

While yesterday’s producer prices continued to show YoY deflation, this morning’s consumer price data pionted hitter than expected with the headline up 1.3% YoY – the fastest since March.

Source: Bloomberg

Core CPI also surged more than expected, rising 1.7% YoY.

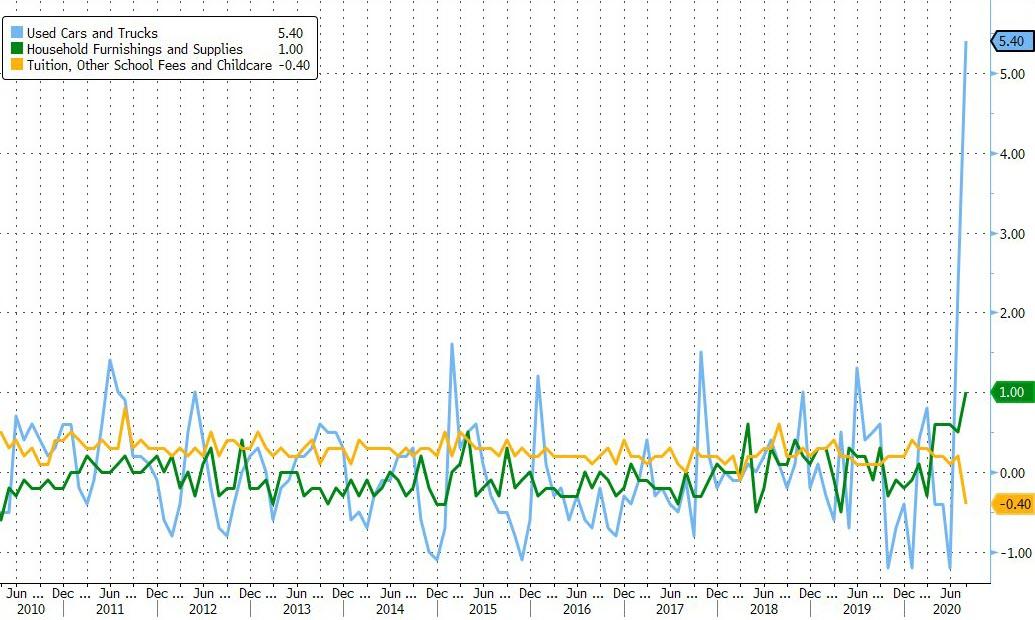

The index for all items less food and energy increased 0.4 percent in August after rising 0.6 percent in July. The index for used cars and trucks increased 5.4 percent in August, its largest monthly increase since March 1969. The shelter index increased in August, rising 0.1 percent, with the indexes for rent and owners’ equivalent rent both rising 0.1 percent.

The recreation index increased 0.7 percent in August after falling in June and July. The index for household furnishings and operations increased 0.9 percent, its largest monthly increase since February 1991, as the index for furniture and bedding rose 1.6 percent and the index for appliances increased 2.0 percent. The apparel index rose 0.6 percent in August, its third consecutive monthly increase. The index for motor vehicle insurance rose 0.5 percent, and the index for airline fares increased 1.2 percent over the month.

The index for medical care rose slightly in August, increasing 0.1 percent. The indexes for hospital services and for physicians’ services both rose 0.1 percent, while the index for prescription drugs declined 0.2 percent. The new vehicles index was unchanged in August after rising in July. The education index decreased 0.3 percent in August, the first decline in the history of the index, which dates to 1993.

Source: Bloomberg

Goods Inflation rebounded to a positive (+0.4% YoY) in August as Services inflation slowed very modestly…

Source: Bloomberg

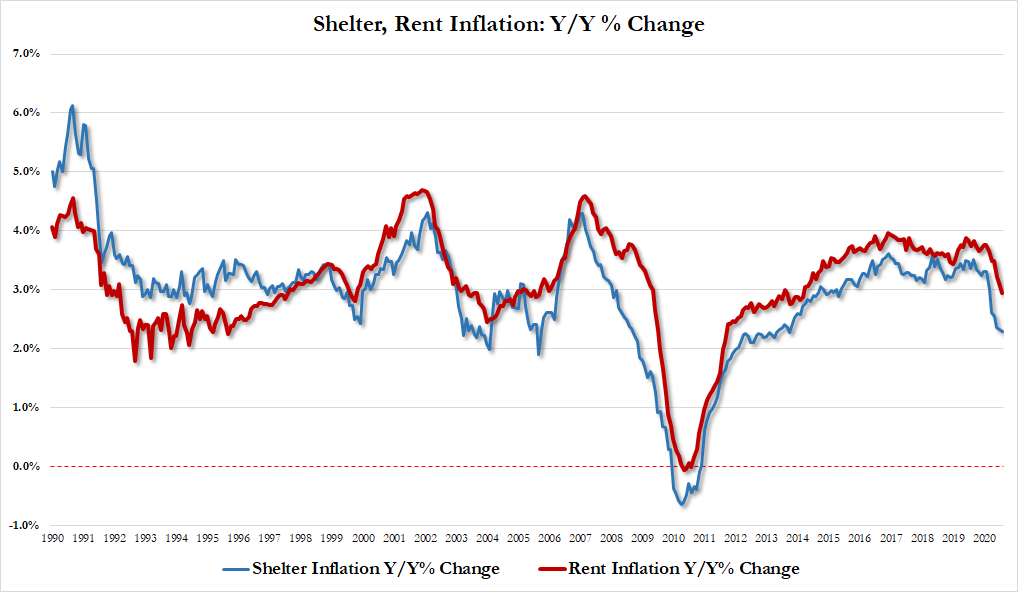

However, there is a silver lining – shelter/rent inflation is slowing (the first rent inflation print below 3.0% since March 2014)

Finally, we note that real average hourly earnings grew at 3.3% YoY (down from 3.7% YoY in July).

via ZeroHedge News https://ift.tt/2GRox9H Tyler Durden